GGE gets helium offtake BEFORE drilling

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 43,300,000 GGE shares at the time of publication. S3 Consortium Pty Ltd has been engaged by GGE to share our commentary and opinion on the progress of our investment in GGE over time.

Our 2021 Catalyst Hunter Pick of the Year Grand Gulf Energy (ASX:GGE) just announced a helium offtake agreement BEFORE its maiden drilling program scheduled for mid-April.

This doesn't happen very often. Rarely do we see oil and gas companies sign offtake agreements before a discovery is made - but our US helium explorer GGE has managed to do exactly this.

This is a clear indication that urgency is building in the US to secure any domestic helium supply that becomes available.

Helium is the single most critical raw material used to manufacture semiconductors - which is used to produce everything from our mobile phones to the high tech weapons manufactured to supply militaries globally.

It seems that the Russia/Ukraine conflict has now brought to light the potential fragility in the supply chain of yet another critical raw material - this time being helium.

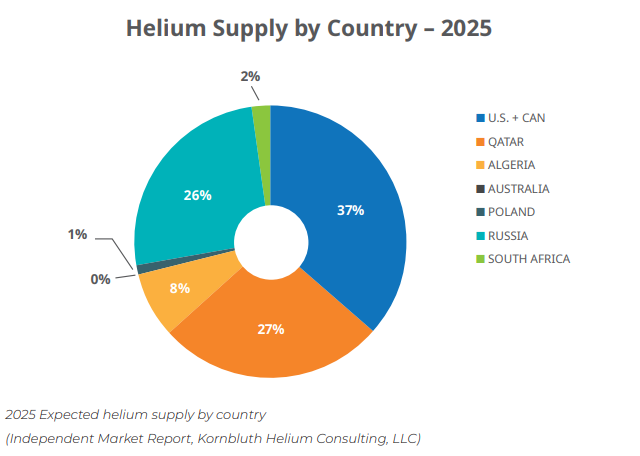

Russia was on track to becoming one of the top 3 producers of helium (expected to supply ~26% of all global supply by 2025) - before it invaded Ukraine and had crippling sanctions placed on it.

It now looks like helium is going to suffer from shortages, and we think this offtake agreement is pre-empting the rush to localise supply chains for the raw materials needed to produce semiconductors.

Key points of GGE’s offtake agreement:

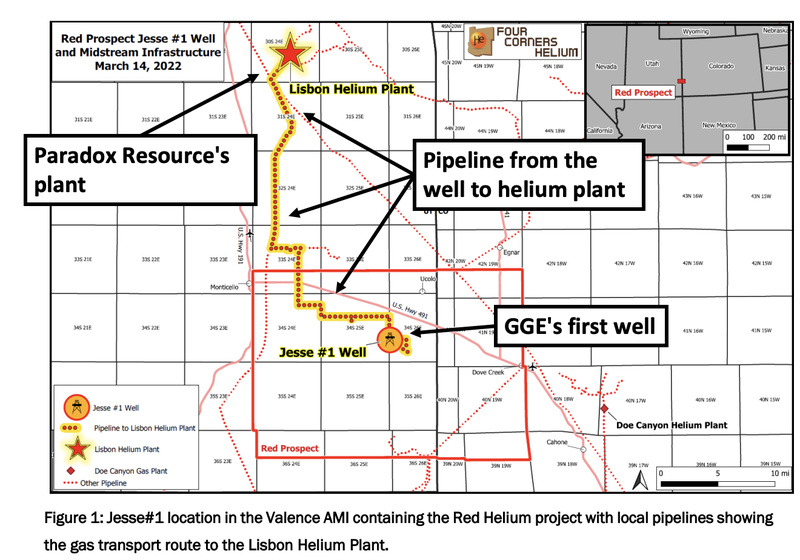

- The owner of the Lisbon helium plant 20 miles (~32km) to the north has signed a “Gas Sales & Processing Agreement” with GGE.

- The Lisbon plant is currently selling helium for up to US$605 per thousand cubic feet

- The agreement is an industry standard 80/20 revenue split in favour of the producer (GGE).

- Assuming GGE’s maiden well “Jesse-1” is a success - this is being drilled in a matter of weeks - GGE can monetise it almost immediately, with minimal CAPEX.

- Potential sales volumes will be based on what GGE discovers at the Jesse-1 well

The owner of the Lisbon helium plant is a private US company called Paradox Resources LLC - a proven helium refiner and seller with deep helium processing and marketing experience. Paradox also owns 570 miles of gas gathering lines with four compression stations that feed the Lisbon plant.

For an established operator to come in this early in a project's lifecycle and secure a supply before it even exists is clear external validation of GGE’s project. We also note both GGE and Paradox are in ‘preliminary discussions’ to identify further ‘strategic business opportunities’. Whilst it sounds a bit vague, it does sound interesting, and we will be keeping an eye out for any future deals between the two.

Now that an offtake agreement has been secured, we are looking forward to the drilling of Jesse-1 in mid April.

We also found out today GGE is listing on the US based OTC venture market in the coming weeks as well. We welcome this news as there is a large retail investor base in the US, and we think that GGE’s local helium production potential will spark an interest with them.

When we announced GGE as our 2021 Catalyst Hunter Pick of the Year we highlighted that GGE’s project being in a part of Utah, USA dubbed the “Saudi Arabia of helium” meant that any successful discovery could be quickly monetised because of all of the established infrastructure.

We also liked that with its drilling program less than 6 months away this could mean GGE could potentially go from explorer to producer in a relatively short time frame.

We didn't, however, expect that this would happen before its maiden drilling program.

So today's announcement comes as a pleasant surprise to us and has set up that mid-April drilling program as all that bit more important.

With the deal structured so that GGE receives 80% of revenues and Paradox taking 20% (before all of the costs to process and distribute the helium), and with the helium price on the way up, GGE could be less than 2 months away from becoming North America's latest helium producer.

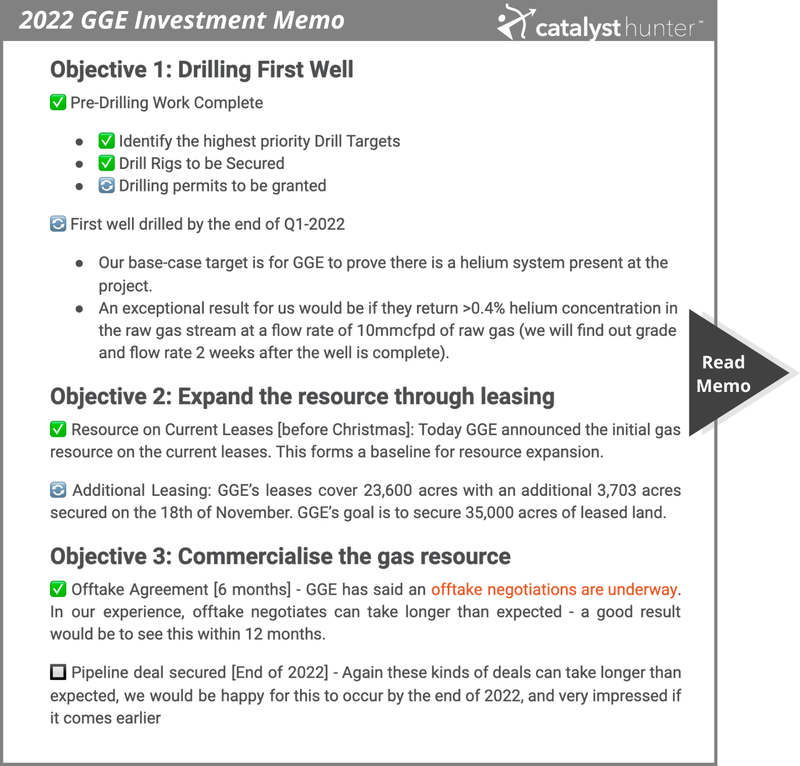

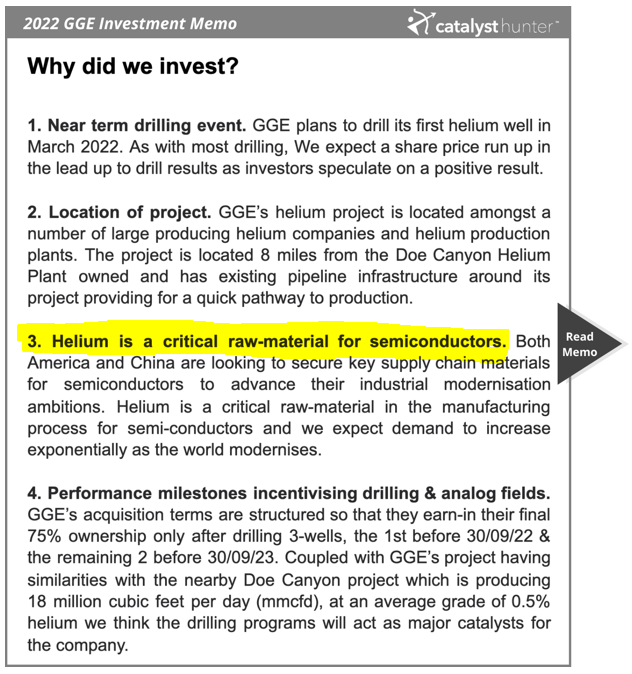

Today’s announcement relates directly to the third objective we set in our 2022 Investment Memo for what we wanted to see GGE achieve in 2022.

With a pipeline running directly past GGE’s well and straight into the Lisbon facility we think GGE has fully accomplished the commercialisation of its helium project and surprisingly done it ahead of actually producing any helium.

More details of the Offtake Agreement:

Today’s offtake agreement now means that in the event of a successful drilling program at the Jesse #1 Well, GGE can put its project into production almost immediately.

But to try and understand how it's important to unpack the details of the offtake agreement.

First, who has agreed to buy GGE’s helium?

GGE has listed in today's announcement the offtake partner as “Paradox Resources LLC ''. This company is the owner of the Lisbon helium processing facility located only 20 miles (~32km) north of GGE’s grounds.

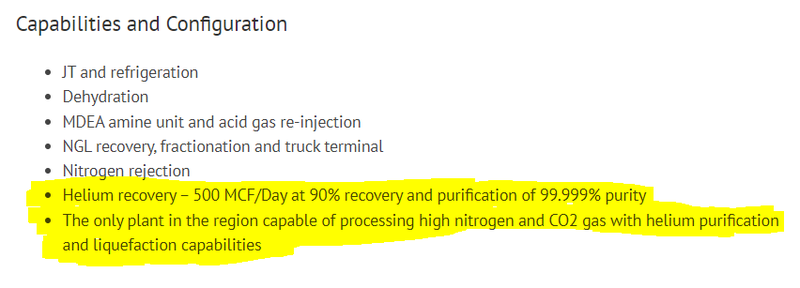

The Lisbon plant has the capacity to treat ~60 million cubic feet per day (mmcfd) of gas, and is capable of producing two different types of helium:

- 0.6 mmcfd of high purity 99.9995% helium (used to produce semiconductors and defence goods) and usually sold at a significant premium to standard helium supply.

- 0.5 mmcfd of purified helium gas which is trucked to end users using specially designed tube trailers. This is the helium that is normally quoted when referring to prices.

99.9995% purity helium is produced via a liquefaction train. The Lisbon plant is one of only 8 helium liquefiers in the US - and it represents 7% of North American helium liquefaction capacity

The significance of all of this is that Paradox is a specialist in processing, refining and selling helium.

Importantly, GGE is only giving up an industry standard 20% of the gross revenues (excluding costs of processing/gathering etc) for Paradox to handle all of this - all GGE has to do is make sure the well is flowing and Paradox handles everything else.

Here are the specs of Lisbon’s helium processing capabilities:

The second is around the distance from GGE’s grounds to the processing plant.

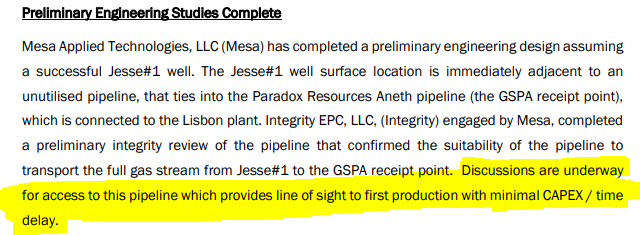

Paradox’s Lisbon plant is only ~20 miles (~32km) to the north of GGE’s grounds and most importantly there are already established pipelines that run from the location of the Jesse #1 well straight into the Lisbon plant.

The significance of this being that should GGE make a successful discovery, it would not need to outlay large amounts of CAPEX to get the project into production.

GGE has gone a step further and in today’s announcement confirmed that the unused portion of pipelines that sit adjacent to the Jesse #1 well operated by Paradox (that runs directly to the Lisbon plant) is also in good enough condition to be used straight off the back of a successful drilling program.

After completing some preliminary engineering studies, the EPC contractor Mesa Applied Technologies confirmed that the unused portion of the pipeline was ready for production - contingent on a successful drilling program.

With oil & gas (and in GGE’s case helium) projects, infrastructure can sometimes make or break a discovery no matter how large it is. If there is no infrastructure in place then the resources can sit dormant - classified as “Contingent resources”.

We mentioned in a previous note that GGE’s unique position in an infrastructure rich region could mean that the company skips the contingent step and converts its gross P50 10.6BCF prospective resource straight into a reserve figure.

With the offtake signed, all GGE has to do is confirm commercial flow rates and it will convert that prospective resource straight into a reserve figure, but more importantly, will be able to start making money from selling the production.

🧑🎓 To learn more about how oil & gas companies define resources, read our educational note here.

To summarise:

- GGE has managed to secure an offtake agreement with a proven helium refiner and seller with deep helium processing and marketing experience in the USA. With a revenue split - 80/20 in favour of GGE.

- With all of the infrastructure in place, GGE can monetise a successful discovery with minimal Capex, giving it a capital light pathway to revenue generation.

All GGE has to do now is to get the potentially company making well drilled and with a bit of luck prove that the project has commercial helium flow rates.

How much cash does GGE have? Can it afford to drill this well?

GGE has flagged that Jesse-1 well is expected to cost ~US$1.6M ($2.2M AUD), including all of the drilling, evaluation and flow testing that will be done. This is relatively cheap for what could be a cash generating helium discovery.

At December 31st 2021, GGE had $3.05M AUD in the bank account.

We note that during the December quarter, GGE produced ~4,997 barrels of oil equivalent generating ~$0.5M in revenues - translating to ~AU$102/barrel.

With the oil price surging of late and the oil price trading at ~AU$140/barrel, we will be looking forward to seeing how much those producing assets bring in this quarter.

In any event, we think the cash on hand may be getting a little tight walking into drilling.

We think that if the GGE share price runs in the lead up to the Jesse-1 well - as Australian and those new US OTC investors speculate on a helium discovery in anticipation of a helium discovery - it would be prudent for GGE management to shore up the balance sheet and secure some additional funding prior to the Jesse-1 well results.

This is only our opinion though - GGE may want to wait until drilling is completed before raising any new funds.

It remains to be seen as to how GGE will manage its balance sheet over the coming months.

What we want to see from GGE in 2022 and what’s next?

Permitting to be completed 🔄

In today’s announcement, GGE confirmed that permitting was ongoing and ahead of schedule with the drilling contract signed for a firm mid-April spudding.

This means we are likely to see the final permitting completed within the next 2-3 weeks.

Pipeline deal 🔄

With an offtake agreement secured the final step towards commercialising the Jesse #1 well will be to sign a pipeline deal that means GGE can tie in the well straight into Paradox Resource’s Lisbon plant.

Drilling of the maiden helium well 🔄

After the permitting is done, all GGE has to do is get the Jesse #1 well drilled.

The drilling contract GGE has in place is scheduled for a mid-April spudding putting the company less than 1 month away from a potentially company making drilling program.

We anticipate drilling and all of the production testing to take at least 4-6 weeks so expect to get a better understanding of how much revenues will flow back to GGE by the end of the June quarter/early in the September quarter.

What do we want to see from the Jesse #1 well?

With ~190km of 2D seismic already acquired and reprocessed, GGE’s project is considered analogous to the already producing Doe Canyon helium field ~8 miles (~13km) to the west of GGE’s project.

The Doe Canyon field is producing at ~18mmcf/day of raw gas with average helium grades of 0.5%, which sets a benchmark for what is considered commercially viable.

Generally, helium grades above ~0.4% are considered economic but it all depends on the raw gas flow rate, if there is more gas flowing then the helium grade can be lower, if the gas flow rate is low then there needs to be a higher helium grade for the project to be considered economically viable.

Importantly, GGE has some historic data from wells drilled within or nearby its project area which has shown 0.4% helium grades. The caveat is that most of these flow tests were done in the 1950s and 1960s when most of the focus was on oil and gas and not so much on helium which is considered not flammable.

With testing technologies improved and a market for helium now far more developed we expect GGE to prove out helium grades higher than that 0.4% figure, the more important question will be how high the raw gas flow rate is.

At this stage, an exceptional result from the drilling program would be:

- A raw gas flow rate of ~10mmcf per day.

- A helium grade of at least 0.4%.

Offtake before production - why we think this happened

We mentioned earlier in the article that it's rare to see gas projects with no proven reserve or producing wells to have offtake agreements in place.

It's perfectly normal when we look at large scale mining projects where a resource is already well defined but for GGE with a prospective resource, we think the urgency to get an offtake done before drilling shows just how important securing domestic helium supplies in the USA is becoming.

The helium price is also confirming all of this, having recently increased as a function of supply issues in the US after the Bureau of Land Management’s Cliffside helium facility in Texas was shut down and as a result of all of the geopolitical issues impacting supply chains.

Only last week we mentioned in our last note that helium prices were ranging between US$300-500/mcf. GGE today confirmed that Paradox had been signing contracts with recent customers at ~US$605/mcf.

The situation in Ukraine and the sanctions being levied on Russian exports has just added fuel to the fire of the rush to secure domestic supplies. The image below shows how the world WAS on track to have almost ~26% of global helium supply come out of Russia by 2025. It remains to be seen how the world responds to Russia over the coming years as the fallout from its Ukraine invasion plays out.

The rush to secure domestic supplies has become all that bit more important because without helium, you cannot make semiconductors and without semiconductors, you are limited in producing almost everything high tech ranging from MRI imaging technologies all the way down to military equipment.

We suspect the rush to secure domestic helium supplies is more so related to the US wanting to shore up the raw materials that fuel its military industrial complex.

The following article titled “How Taiwan underwrites the US Defence industrial complex” sheds light on the urgency around the USA to onshore both semiconductor manufacturing and to secure the raw materials needed to produce them.

Read the article here: How Taiwan Underwrites the US Defense Industrial Complex

With Taiwan Semiconductor Manufacturing Company (TSMC), one of the world’s top 10 companies building a US$12 billion semiconductor manufacturing plant which is due to open in 2024, we think US domestic supply will become that bit more important going forward.

It seems that the Russia/Ukraine situation may have been the trigger for swift action from producers, and we suspect that the price rises are unlikely to slow down in the short term.

All of this is a key reason why we initially invested in GGE and why we continue to hold GGE in 2022.

To see all four of the key reasons why we continue to hold GGE in 2022, check out our 2022 Investment Memo below:

Our 2022 GGE Investment Memo:

Below is our 2022 investment memo for GGE where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to track the progress of our portfolio companies using our Investment Memo as a benchmark, throughout 2022.

In our GGE Investment Memo you’ll find:

- Key objectives for GGE in 2022

- Why we continue to hold GGE (Shown above)

- What the key risks to our investment thesis are

- Our investment plan

To access the GGE Investment Memo simply click on the button below:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.