$11BN Energy Giant Sets up Shop Near 88E in Alaska: M&A Activity Sparked?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Has the fuse just been lit on the US oil and gas market?

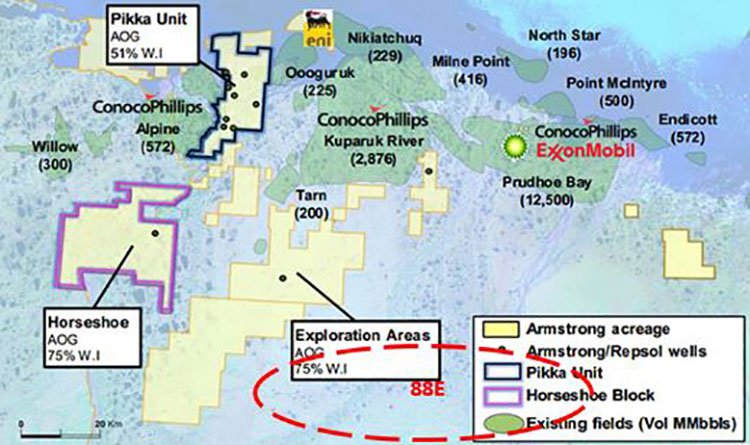

As the oil price increasingly starts to show stronger signs of recovery, $11BN giant Oil Search (ASX: Oil Search) made a significant play this week when it moved to acquire world class oil assets in the prolific Alaskan North Slope – just the region 88 Energy (LON | ASX:88E) has been exploring recently.

Oil Search is paying US$400 million in cash to private company Armstrong Energy LLC for a stake in a Tier 1 oil field under appraisal, along with some exploration upside.

Assets include a 25.5% interest in the Pikka Unit and adjacent exploration acreage and a 37.5% interest in the Horseshoe Block, which gives Oil Search a 37.5% exposure to the Hue shale – a shale layer that may be familiar to 88E investors.

Of course as a speculative stock investors should seek professional financial advice if considering 88E for their portfolio.

This all plays quite nicely for 88E, a company gearing up for significant activity in 2018, including the completion of its Icewine #2 production test (April/May 2018), and 3D seismic acquisition in March 2018 – which should deliver some conventional drilling targets.These leases contain approximately 500 million barrels (gross) in the Nanushuk – one of the largest conventional oil fields discovered in the US in more than 30 years – and satellite oil fields.

Why should 88E investors care about the Oil Search acquisition?

There are a couple of points to note for 88E investors in relation to Oil Search’s acquisition:

- The acquisition price – $US1.3 – US$3.1 per barrel

Given 88E has a target of 1.0 – 2.6 billion barrels (gross mean prospective recoverable) on the HRZ unconventional play, and a further 1.5 billion barrels combined on the conventional leads – the see through value is significant here if 88E can prove up something of magnitude. It also speaks to the level of interest in Alaskan oil opportunities by the majors.

- Armstrong is holding onto its exploration ground in a trend moving south.

When looking at the map and where 88E’s Project Icewine sits, the acreage Armstrong is retaining appears to head toward the western part of Icewine.

Why did Armstrong elect to retain that part of its acreage? Perhaps some upside is in it for them?

- Oil Search has taken 37.5% of the Hue Shale

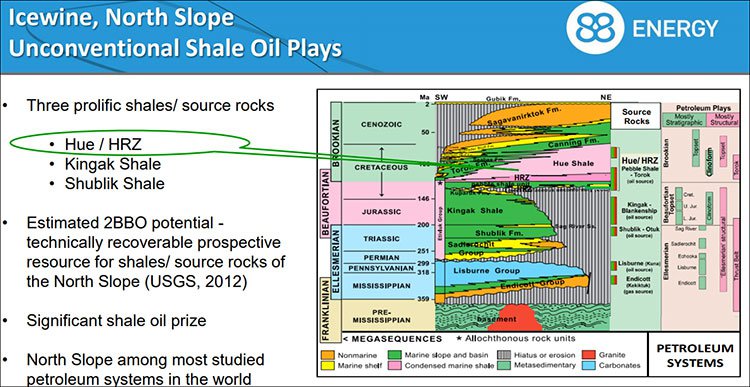

88E’s primary target is the HRZ Liquids Rich play – the HRZ is the lower member of the HUE shale.

With Oil Search prepared to stump up some serious cash for a slice of the HUE Shale, it only gives added weight to the credibility of 88E’s ambitions on the HRZ.

88E expands its leases

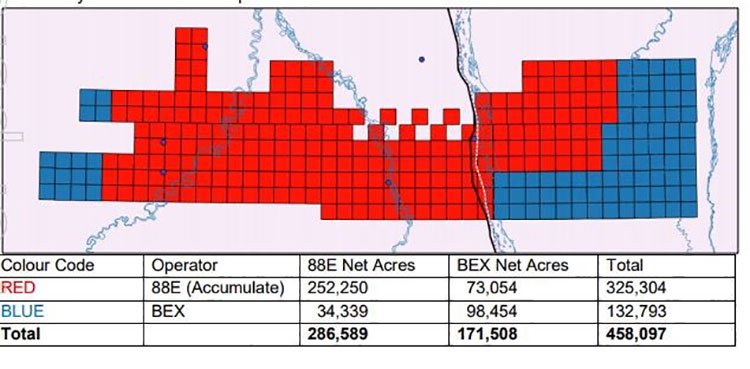

In conjunction with joint venture partner Burgundy Xploration LLC (BEX), 88E recently expanded its gross acreage position from ~350,000 to ~460,000 acres, with its net acreage increasing from ~260,000 to ~286,000 acres.

The following table summarises 88E’s increased acreage on Alaska’s North Slope.

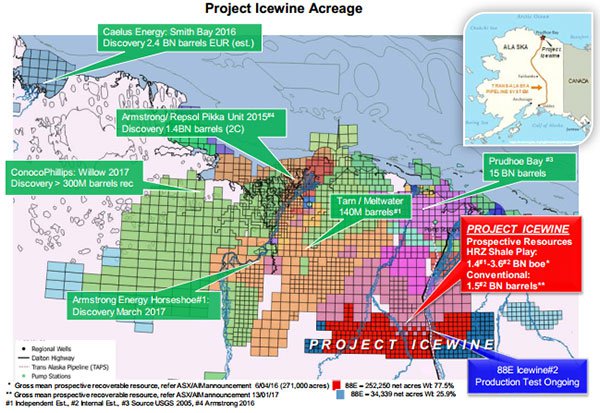

It is worth noting that Project Icewine is strategically located on a year-round operational access road, only 35 miles south of Pump Station 1 where Prudhoe Bay Feeds into the Trans-Alaska Pipeline System.

The recent acreage expansion was carried out on the back of ongoing confidence in the potential of the HRZ shale play in the JV’s possession.

88E and BEX will now work together to fine tune the most prospective HRZ play, with 88E also managing its current cash position versus its planned work program to maximise shareholder value whilst minimising dilution.

In essence, the current leasing strategy undertaken by the JV is designed to act on the confidence 88E has in its assets, whilst striking a balance with available capital required to complete flowback and production testing at Icewine#2 in the first half of 2018.

88E currently has circa US$14.6 million in cash for a planned work program estimated to cost between US$8 million and $US10 million. It also has US$22 million in cash receivable from the State of Alaska vs a debt of US$16.5 million.

Importantly for 88E, internal modelling suggests that Project Icewine’s HRZ target is similar to Tier 1 shale plays including Eagle Ford in Texas.

The Eagle Ford was the most prolific shale play in the US, producing billions of oil – and over 1 million barrels a day at its peak at the end of 2013 – not a bad play to emulate.

The right convention

The Alaskan North Slope has been a happy hunting ground for oil explorers, with Caelus Energy, Armstrong, Repsol and ConocoPhillips all tasting success on conventional plays.

Aside from the exploration of its unconventional play, 88E has not ignored the conventional potential of its acreage to hold large oil resources.

The green labels on the map below indicate significant discoveries of conventional oil, including 15 billion barrels discovered by Prudhoe Bay in the 1960s – the largest conventional oil pool in North America. It also indicates 88E’s positioning relative to Oil Search’s acquisition of Armstrong:

Over 4 billion barrels have been discovered in a new conventional plays on the North Slope in the last two years, the most recent being the discovery of 1.2 billion barrels of recoverable light oil by Armstrong and Repsol, at Horseshoe, just 43 kilometres at its closest point to Project Icewine.

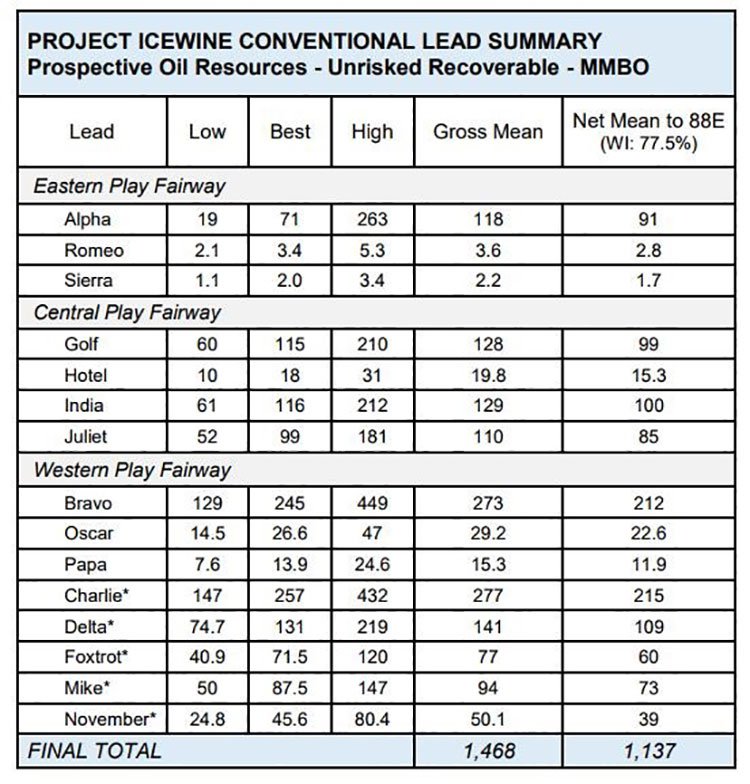

The following table shows a summary of 88E’s conventional oil leads:

The numbers are solid and if 88E can prove up its assets, it could join its neighbours in harbouring one of the most prolific discoveries in the region.

88E has identified five key leads that have been prioritised for early maturation from which future likely drilling candidates will be selected.

3D seismic acquisition in March 2018 will seek to sharpen up these leads into fully fledged drill targets.

The macro outlook

Activity in the region looks to be occurring just as the oil price has picked up.

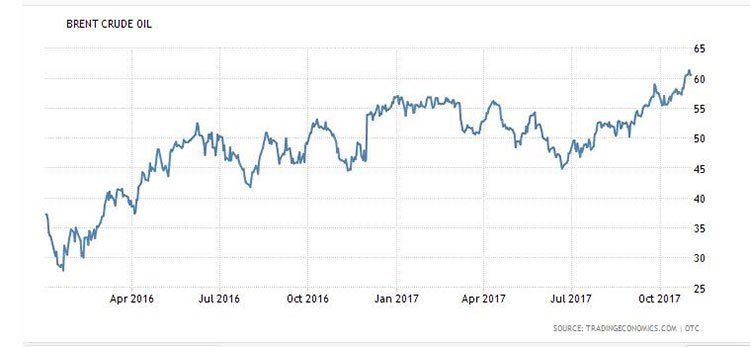

Here’s how oil prices have been tracking since early 2016:

The graph above shows oil recovering to trade between $40-60 for the past year. Recently, the price of Brent Crude hit a two year high. Sentiment suggests this will remain steady through 2018.

Of course commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone. Seek professional financial advice before choosing to invest.

This cautious positivity provides a good backdrop for oil companies and investors to start looking at the market again.

But where should investors start looking for oil?

Given the numerous discoveries over recent years, the North Slope of Alaska must come into consideration.

Recent big conventional oil discoveries have been made by Armstrong and Caelus, with Oil Search potentially sparking a flurry of M&A activity on the back of those discoveries.

Where else in the world is presenting numerous oil discoveries of this magnitude?

Given the region it is exploring in, it seems like 88E could well be in the right place at the right time here.

With plenty of cash in the bank and a clear exploration schedule ahead of it, it’s shaping up to be a big 2018 for 88E.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.