We Got Lucky - RAS’ Next Door Neighbour Delivers World Class Drill Intercept

Just last Wednesday we wrote about our long term investment in Ragusa Minerals (ASX:RAS).

So what’s happening with the RAS share price? Why is it moving up?

We thought things had been a bit quiet in recent weeks and were thinking there could be some RAS news soon, and the share price seemed to have established a new base around 8c which was nice to see.

We invested in RAS back in July at 6.5c primarily for its two latest acquisitions - its halloysite project in WA and for its gold project in Alaska.

We were expecting more early activity out of RAS’s WA halloysite than its Alaskan gold project in the near term - but while we waited for halloysite work to begin:

RAS’s Alaskan gold neighbour Nova Minerals just hit a gold intercept that has been regarded as “in the top 40 best high grade gold intercept in the past 10 years”.

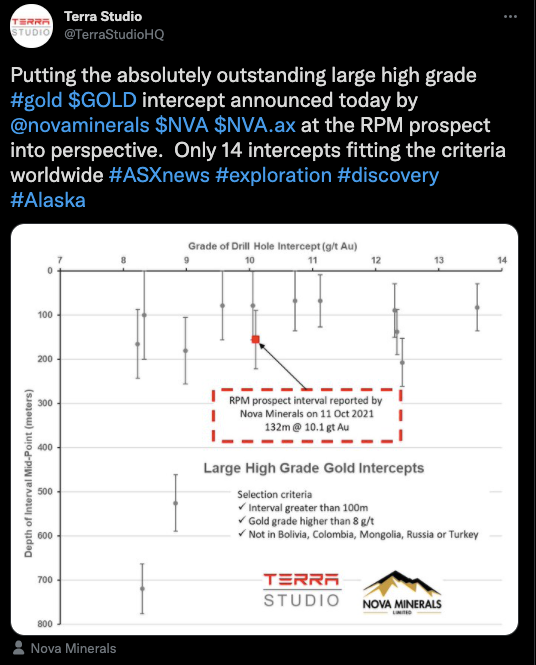

Mining consultants Terra Studio ranked the biggest and highest grade drill intercepts over recent years and put Nova Minerals right up there with the very best:

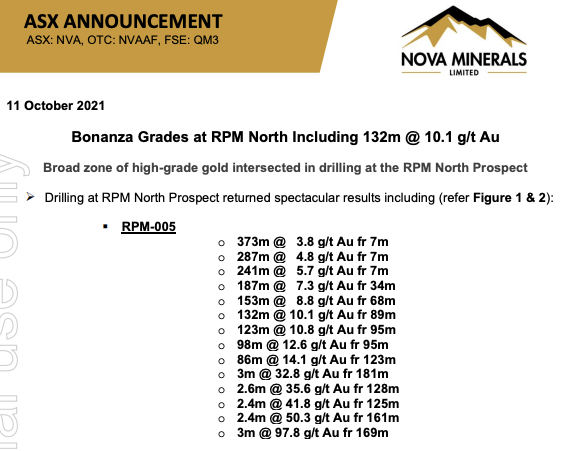

Yesterday Nova Minerals released a batch of drill results from its “RPM North” prospect that included 373m @ 3.8 g/t Au from 7m, including 132m @ 10.8 g/t Au from 95m & 86m @ 14.1 g/t Au from 123m.

Nova is now capped at $340M.

RAS is currently capped at $14M (at 11c) and had over $4M cash last time we checked.

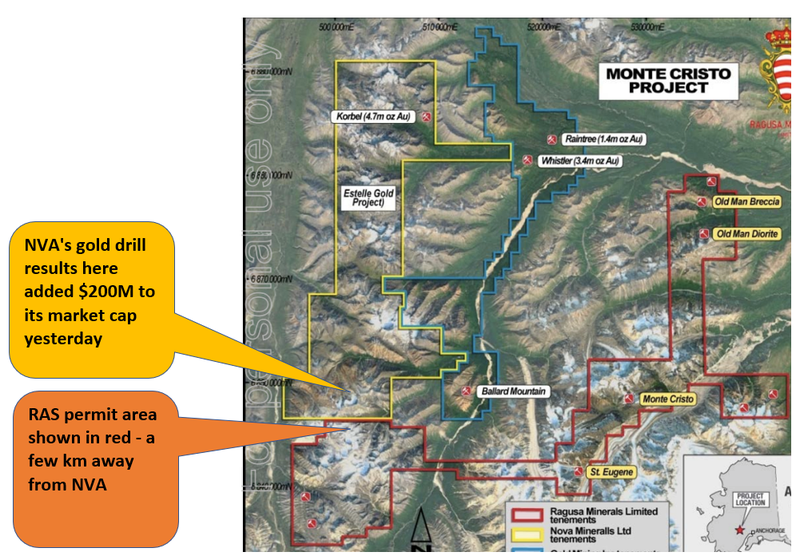

RAS ground is a few kilometers directly south of Nova’s RPM prospect where the huge drill result happened.

This is a new discovery for Nova Minerals - it is in addition to Nova’s existing Korbel 4.7 million ounce resource - and the best part for RAS’ holders is that it's so much closer to RAS’ ground.

The RPM prospect is Nova’s latest discovery within its Estelle project.

Here is where Nova’s project (in yellow) sits - directly to the north of RAS (marked in red):

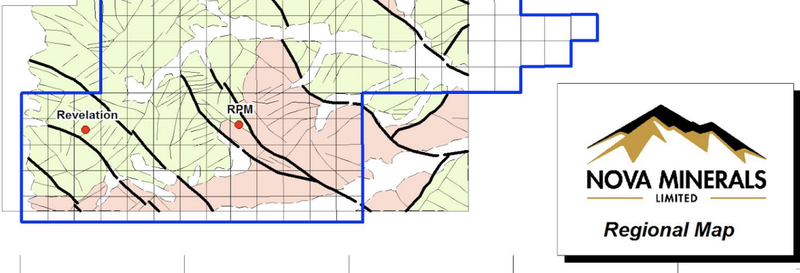

Here’s a close up shot of Nova’s “RPM project” that sits right at the bottom of its project - directly north of RAS’ ground - this is where yesterday’s drill hits were recorded.

Note - there is also GoldMining's 4.78m ounce Oz Whistler resource in the same region as RAS’ project - so it's a pretty well endowed region to be exploring for gold.

Our Quick Guide to Nearology - what does Nova’s results actually mean for RAS?

Just because a stock has some ground nearby some much more valuable ground, does not always mean your stock is also similarly valuable, OR that your nearby ground will yield any similar results.

We spoke to an independent geologist to get his take, and this is what we learnt about the different levels “nearology”:

“Entry level” nearology - almost irrelevant:

If two projects are geographically close - but there is different geology - it's almost irrelevant.

“Better” nearology

Two projects have the same geology and structures, but no supporting data - or drilling that downgrades it.

“Even Better” Nearology

Two projects have the same geology and structures WITH supporting drilling / geochemistry.

“Best” Nearology

There is an extension of the same deposit.

How does the “RAS nearology to Nova” concept actually stack up?

We would rate RAS comparison to Nova fairly highly on the scale.

✅ “Entry level” nearology - yes RAS is next door to Nova

RAS is very close to Nova’s new “RPM” gold discovery.

RAS’ gold project is also located very close to two large gold deposits which include Nova Minerals' 4.7 million once Korbel deposit & GoldMining's 4.78m Oz Whistler and Raintree gold deposits.

✅ “Better” nearology - RAS and Nova has same geology and geophysical features

RAS’s gold project has several similarities to Nova’s 4.7 million ounce Korbel deposit, including several valleys in a similar topographic setting, similar local geology and geophysical features - which comes from resistivity and magnetic survey information.

What’s next for Nova?

Nova released results from just one hole from RPM North yesterday - there are still three more holes to go.

Early next year Nova will move the drill rig to “RPM South” - which is even closer to RAS’ grond. We are looking forward to that drilling event early next year.

What’s next for RAS?

We are going to wait for the rest of the Nova drill holes to come in, and we expect RAS to now fast track a drilling campaign and all the prep work that comes with it NEAR the Nova drill stie.

We expect any drilling campaign by RAS will take a few months to kick off and will be patiently waiting.

We don't know if the Nova geology extends into RAS’ ground yet - RAS is going to do some drilling of its own - and realistically that won't happen until 2022.

Right now we like RAS as a $14 market cap “bet” that might emulate Nova’s gold strike when in early 2022.

Alaskan Gold Project

⚔️ Nova (ASX:NVA) Gold Results

🔲 Sampling program (Monte Cristo)

🔲 Sampling Assays (Monte Cristo)

🔲 Drill Targets Defined (Monte Cristo)

🔲 New Project of Works near Nova Project

RAS Investment Milestones

✅ Initial Investment @ 6.5¢ (before key drilling event)

🔲 Increase Investment

🔲 Price increases 250% from initial entry

🔲 Price increases 500% from initial entry

🔲 Price increases 1,000% from initial entry

🔲 Free Carry

🔲 Take Some Profit

🔲 Hold position for key drilling event

🔲 Decide New Investment Plan after results of key drilling event

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.