$7M junior TG1 is drilling now - with more to come this quarter

After months of preparation, our early stage microcap exploration Investment TechGen Metals (ASX:TG1) is set to drill three projects this quarter.

Each project holds the chance of making a new metals discovery, and has potential to re-rate TG1’s share price.

The first drilling campaign began today.

Importantly, all three of the projects have delivered up impressive drill targets that are yet to be drill tested.

TG1’s near term drilling programs are as follows:

- Gold in NSW - high grade gold in trenches, with chargeability anomaly below - started today (Jackadgery Project)

- Copper in WA - Three distinct EM anomalies sitting adjacent to high grade rock chips grading up to 8.7% copper. (Mt Boggola Project)

- More copper in WA - Cluster of IP anomalies that sit right underneath high grade rock chips which returned 54.8% copper and 249g/t silver (Station Creek).

Today TG1 started a 1,000m RC drilling program at its NSW gold project.

The drilling will be focused on an array of targets set below historic mine shafts where gold was produced in the 1880s, and where only minor surface sampling programs have been run since.

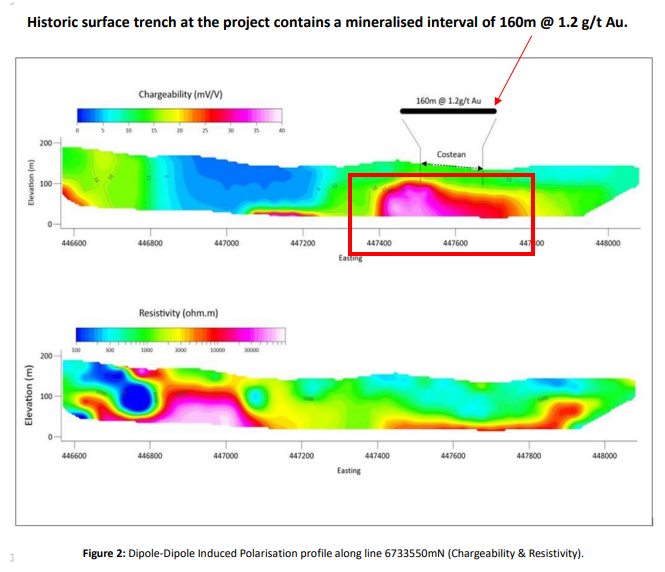

This comes a few weeks after TG1’s IP survey results confirmed chargeability anomalies right beneath 160m of historic surface trenching works that returned average gold grades of 1.2g/t.

Inside that 160m strike zone, two specific high grade assays returned 18g/t and 7.1g/t gold.

Most importantly, this gold mineralisation has never been followed up with any drilling, so TG1 is trying to make an entirely NEW discovery.

We hope any drilling success will translate into a re-rate in the company’s share price from the low base it's starting from.

Given that this is the first ever drilling program at the NSW gold project, we have set the following expectations for the results:

- Bullish case: TG1 intercepts high grade gold mineralisation. Grades >2g/t gold.

- Base case: TG1 finds enough gold mineralisation to warrant follow up drilling.

- Bearish case: TG1 hits nothing - finds no gold.

We hope that as TG1 has such a low enterprise value, any achievement at or above our base case expectation will lead to a re-rate in its share price.

However, as we mentioned above, this isn't the only drilling program TG1 is doing this year. The company will have three independent shots at a new discovery — all being drilled this quarter.

After a quiet start to the year whilst TG1 completed multiple target generation work programs, TG1 has now started drilling the first of its three drilling programs planned for the rest of this year.

TG1 is entering this busy period of back to back drilling programs with $2M in cash in the bank (as of 31 May 2022).

Therefore, like all micro cap explorers relying on sources of funding to make new discoveries, we suspect that TG1 may need to raise capital at some stage over the coming months to shore up its balance sheet.

Whilst the rewards can be significant, drilling programs cost money and junior explorers rarely make big discoveries off the back of maiden drilling programs.

Typically explorers run several rounds of drilling before a discovery is confirmed, hence why a strong cash balance is essential.

If TG1 does, however, make a discovery, we expect the company’s share price to re-rate significantly. This would then allow TG1 to raise capital at multiples of its current valuation.

As with all of our junior exploration Investments, we hope that the latter is the case.

With drilling now underway at TG1’s NSW gold project and two additional programs planned for this quarter, TG1 is making up ground against the key objectives we set in our Investment Memo.

To see the other key objectives we want to see TG1 achieve in 2022, check out our 2022 Investment Memo by clicking on the image below.

More on TG1’s gold drilling in NSW

Our last TG1 note covered the updated IP (geophysical) survey results that TG1 put out over its NSW gold project.

Off the back of these surveys, TG1 put together two high priority drill targets to go after.

Below are the specific targets that TG1 will be drilling in the drilling program that commenced today.

TG1 Gold Target #1

The first target will be in the area immediately below the ~220m long trench that the previous owners of the project (Kennecott and Southern Goldfields) dug in the mid 1980s.

Here the previous owners found a ~160m mineralised zone with an average gold grade of 1.2g/t gold.

Inside that 160m area two higher grade intervals were also picked up, measuring 5m at 18g/t of gold and 5m at 7.1g/t of gold.

The key takeaway from the IP survey results was the chargeability anomaly right underneath this zone.

TG1 will be drilling straight into the guts of this anomaly, where we hope to see a continuation of mineralisation at depths.

Significantly, this target has never been drilled before, so any gold hits could signify a new discovery.

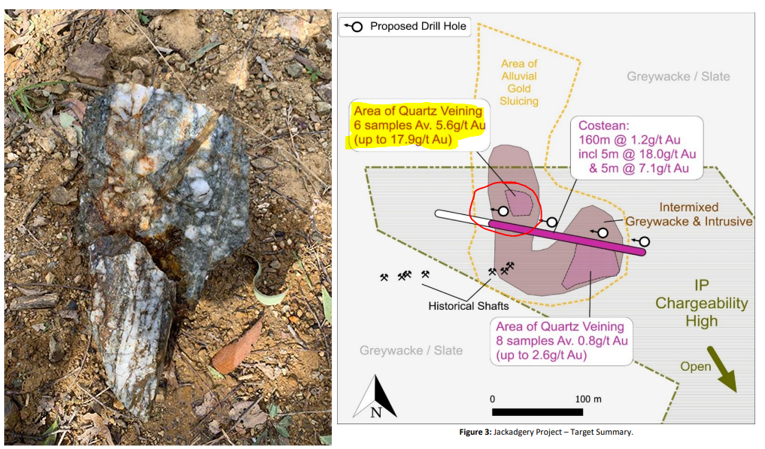

TG1 Gold Target #2

Drilling of the second target is based on previous rock chip sampling programs, which returned gold grades as high as 17.9g/t gold.

Below is an image of those rock chips and the area they were found in.

Again, these targets have never been drilled.

Any gold hits here could bring market interest to what has the potential to be a new gold discovery.

The obvious caveat here is that even if TG1 hits a gold structure with this round of drilling, we expect it will need to come back and do several more rounds of exploration before it can confirm a commercially viable discovery. This is typical for junior explorers, as major discoveries are rarely made during the first drilling campaign.

This is where the exploration risk inherent for all junior explorers comes into play.

But if a new discovery is made, TG1’s share price would likely re-rate to a level where the company can raise a lot more capital at a higher valuation.

What’s next?

TG1 put out the following timetable recently in its investor presentation, and below that is specifically what we are looking out for.

Drilling results from TG1’s NSW gold project 🔄

With drilling commenced, we now await the results. In today’s note, we set the following expectations for the drill results:

- Bullish case = TG1 intercepts high grade gold mineralisation. Grades >2g/t gold.

- Base case = TG1 finds enough gold mineralisation to warrant follow up drilling.

- Bearish case = TG1 finds no gold.

In the meantime, we’re watching to see if TG1 intercepts any visible gold, which would be a good indicator that they could be onto something.

Target generation works across WA copper/gold projects to be completed 🔄

TG1 spent most of the first half of 2022 running geophysical surveys across its portfolio of copper/gold projects in WA.

At the end of the March quarter, the company was still planning to do more work across the Ashburton Basin and Paterson Province.

We expect to see some more results from the ongoing target generation works in the lead up to a drilling program later in the year.

Drilling Program at TG1’s copper/gold projects in WA 🔲

TG1 previously said it is preparing drill targets for maiden drilling programs across its WA copper/gold project portfolio.

In our 2022 TG1 Investment Memo, we listed drilling programs across these projects as things we want to see TG1 achieve in 2022.

We expect to see the following projects drilled during this quarter.

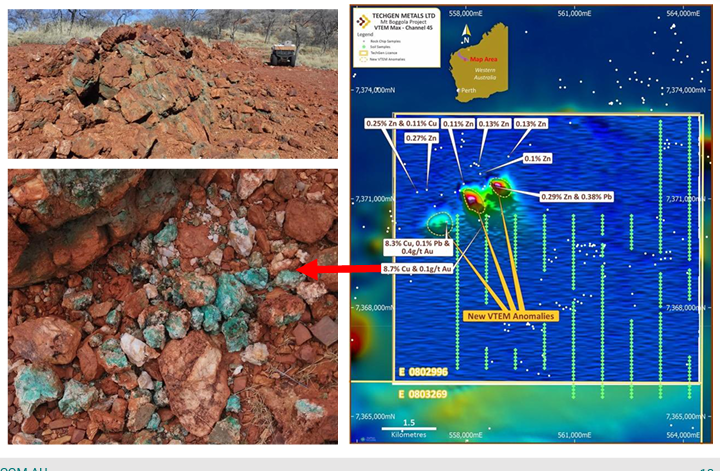

1) Mt Boggola Project - Here, we want to see TG1 drill a group of three EM targets found during target generation work over the project area. The image below shows rock chips from those EM targets, grading as high as 8.7% copper at surface.

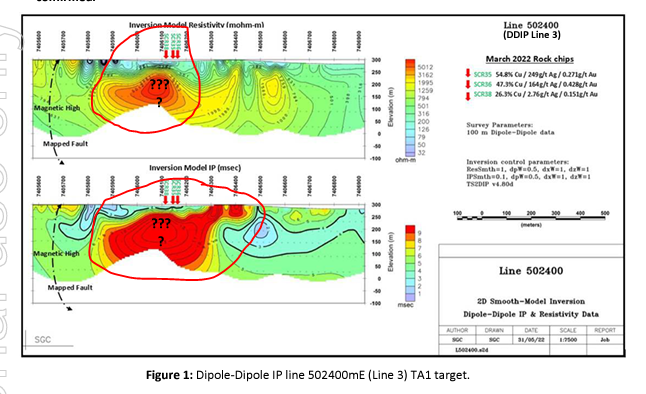

2) Station Creek Project - Here, we want to see TG1 drill a cluster of IP chargeability anomalies that sit right underneath high grade rock chips, which returned 54.8% copper and 249g/t silver.Below is an image of the rock chips and the massive IP anomalies from the recent surveying work completed on site.

Our TG1 Investment Memo for 2022

Below is our 2022 Investment Memo for TG1, where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company's performance against our expectations 12 months from now.

In our TG1 Investment Memo, you’ll find:

- Key objectives for TG1 in 2022

- Why we invested in TG1

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.