Introducing our new Investment - ASX: REZ

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 18,750,000 REZ shares at the time of publishing this article. The Company has been engaged by REZ to share our commentary on the progress of our Investment in REZ over time.

We are currently on the hunt for new Investments.

We have just made another one.

Our latest Investment shares the same chairman as our best ever Investment Vulcan Energy, and also Kuniko - we are currently looking to back teams that have delivered success for us in the past.

We think that the small cap market weakness during May/June is the perfect time for us to enter some stocks that are trading at near all time lows.

We have been watching this company for over two years now and think that the Enterprise Value is at a level that presents value to us at a bear market entry point.

It is a micro cap nickel exploration stock with a dash of gold, and we do love to roll the dice on mining exploration.

Today, we welcome this company to the Catalyst Hunter Portfolio: Resources & Energy Group (ASX:REZ).

On Friday, REZ was trading at a market cap of under $6M, with around $1.4M in the bank at the end of the last quarter.

REZ is exploring for nickel in Western Australia near Kalgoorlie.

Nickel is a key ingredient in Nickel-Cobalt-Manganese batteries for electric vehicles, and crucial in the production of stainless steel.

REZ’s ground has been explored in the past by the likes of BHP and Rio Tinto who, between 1969 and 1986, kept hitting nickel sulphides grading between 0.1-2.2%.

None of these drill hits were followed up because the demand for nickel discoveries back then just wasn’t as strong AND because no one held large enough ground positions in the area to warrant further drilling.

Now, REZ has consolidated a land position in Menzies (a tiny gold mining town near Kalgoorlie).

This land position is large enough that allows it to apply modern exploration methods across the entire holding to rapidly progress its exploration. Let’s see if they can unlock a discovery that others may have missed.

REZ has just released solid nickel drill results, and we will provide our detailed commentary on these in an upcoming note.

We are Invested in REZ for the nickel exploration (after our success with GAL), but REZ also has a high potential gold exploration project in the same area AND a small gold mining operation that is generating actual cash.

We are bullish on gold in 2023.

We are sticking to the theme of this month, backing companies with teams from previous Investments that have delivered success for us in the past.

Especially companies that are trading at near yearly lows in the recently bearish markets.

Gavin Rezos is the chairman of REZ, he is also the chairman of our best ever Investment Vulcan Energy Resources, which went from 20c to a high of over $16 and is now trading at around $3.70.

Gavin is also the chairman of Kuniko, another battery metals explorer. Kuniko went from 20c to touching as high as $3.60 in a couple of weeks after IPO, and is now trading at around 45c.

We are backing him again here, with a company that is going after a greenfields battery metal discovery.

We also note that early Vulcan investor John Hancock is the 14th largest REZ shareholder according to the 2022 REZ annual report.

We are also looking for companies that we think have been oversold over the last 12-18 months (in our opinion, no one can ever tell this for sure).

We think this is the case for REZ.

On top of the May weakness in the market and June tax loss selling, a fund that invested ~$2M in REZ’s November 2021 capital raise at 4c appears to have run in to some unrelated trouble and we suspect has had to liquidate its REZ holdings (based on disclosures and media in the market).

While we don't have visibility on the shareholder movements at this time, we suspect it may have contributed to REZ's share price fall from 4c to around 1.2c, despite REZ actually making decent progress on their projects in that time (this is just our speculation).

We’ve been following REZ for over a year, having participated in the 4c raise back in November 2021.

We weren't ready to launch the stock in our Catalyst Hunter Portfolio at that time, as our position was small and we wanted to see the company execute on some key milestones before adding it to our Portfolio.

We think that time is now and we have added more to our Investment at ~1.73c

Our average entry price for REZ is now ~2.2c and are now pleased to announce REZ as an addition to our Catalyst Hunter Portfolio.

So the rough markets over the last 12 to 18 months plus May/June weakness have put pressure on a lot of small cap stock prices.

Ultimately we want to see REZ trading well above where the share price sits today on the back of drilling results.

Of course, there is no guarantee of success here. As with all micro cap stocks, this is a risky investment. The company is reliant on capital markets to fund its exploration campaigns and this can cause dilution. It also may find nothing of value on its ground.

Today we have added REZ to our portfolio, and will share our initial Investment Memo for REZ, where you can find:

- Why we Invested in REZ

- Our “Big Bet” - what we think the upside Investment case for REZ is.

- The key objectives we want to see REZ achieve over the next 12 months

- The key risks to our Investment thesis

- Our Investment Plan

REZ’s projects at a glance

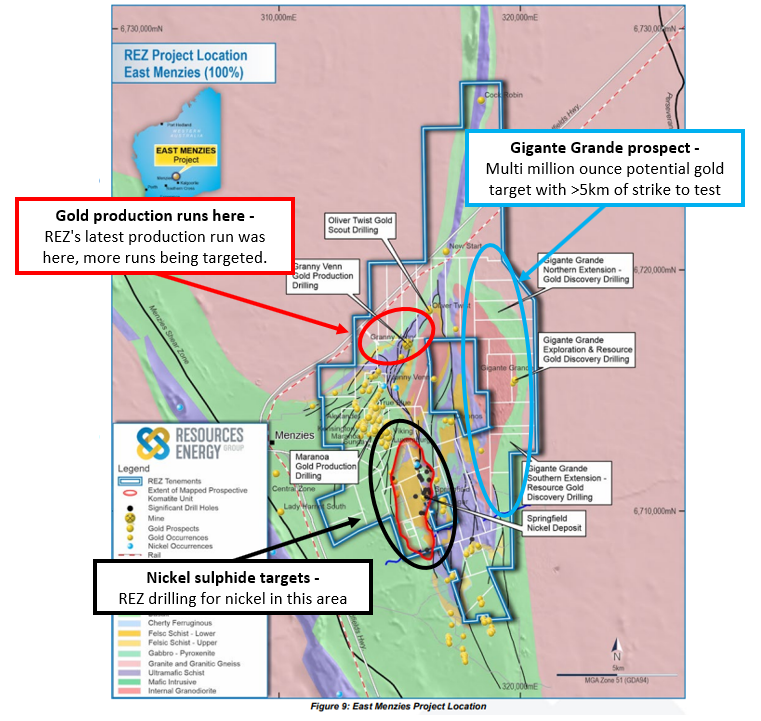

REZ has three key areas of focus sitting inside the company’s East Menzies ground in WA.

Below is an image of the three target areas:

(Source)

Nickel sulphide exploration potential

Here REZ is looking to follow up drill intercepts from RIO/BHP that kept hitting nickel sulphides over REZ’s ground. For over 50 years the nickel sulphide potential of this ground hasn’t been explored extensively. REZ is looking to apply modern exploration techniques to try and find what others may have missed. (this is the main reason we are Invested in REZ).

High grade gold production runs

Here REZ is looking to extend its existing resource base by finding high grade gold structures. The company then mines the small resources for a quick cash injection into the company. Most recent mining run was in Mid-2022 for >$3.5M in cash returned to REZ.

Multi million ounce gold exploration potential

REZ has multiple gold prospects across its ground that warrant drilling. The current focus is on the company’s Gigante Grande prospect where REZ has defined a strike length >5km that is yet to be tested at depth.

The latest from the WA project - today’s nickel results:

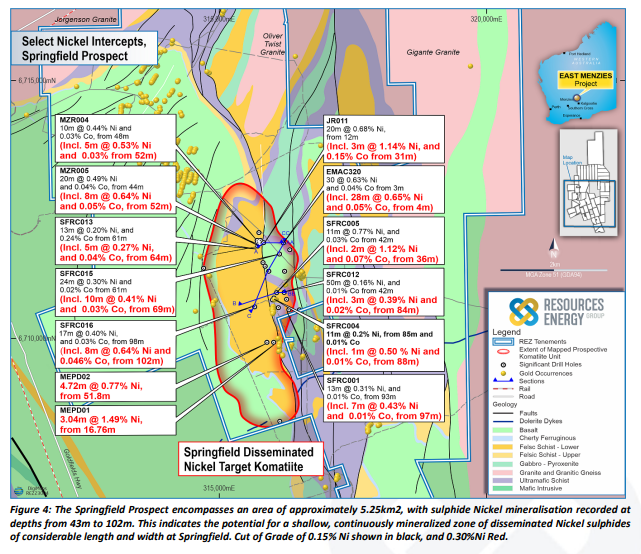

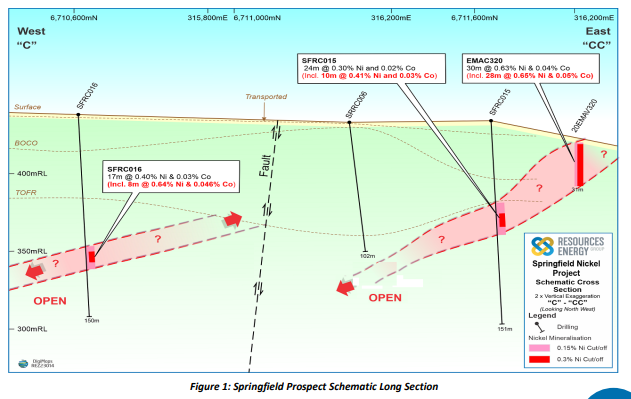

Today REZ delivered ‘economic nickel grades’ from its most recent round of drilling at its East Menzies project in WA.

(Source)

Here REZ is following up on previous work done by BHP and Rio Tinto.

Between 1969 and 1986, BHP and RIO kept hitting nickel sulphides grading between 0.1-2.2% in the region.

For decades, the nickel potential wasn't followed up primarily because the demand for new nickel discoveries was just not as strong back then.

Now with nickel’s importance in the Electric Vehicle (EV) battery supply chain, nickel exploration is back in favour.

While there's no massive discovery hole here yet, we think REZ has started putting holes in the right zones and the company may be getting closer to a nickel deposit.

Nickel discoveries are hard to make, but once discovered, they become highly valuable.

For REZ to get its “discovery moment”, we need to see the company hit either thin intercepts with high nickel grades OR large intercepts with grades similar to those announced today.

So far, REZ’s intercepts are showing relatively good thickness’:

(Source)

High grade, thin intercepts make up Mincor’s Cassini deposit (now purchased by Twiggy for $700M+).

Large intercepts with grades similar (or lower) than REZ’s make up the ones found at Western Mines Group’s discovery - which has since taken its share price from 10c per share in March 2023 to a peak of ~$1 per share only a few weeks later.

Ultimately we are hoping REZ can achieve a similar re-rate off the back of successful exploration results.

Our REZ Investment Memo

As part of our new Investment launch, we have also released our REZ Investment Memo, where you can find:

- Why we Invested in REZ

- Our long term bet - what we think the upside Investment case for REZ is.

- The key objectives we want to see REZ achieve over the next 12 months

- The key risks to our Investment thesis

Memo Opened: 5-June-2023

Shares Held: 18,750,000

What does this company do?

Resources & Energy Group (ASX:REZ) is a junior explorer focused on making a metals discovery in Western Australia.

REZ is exploring for gold, nickel, cobalt, copper and PGEs.

What is the macro theme?

Nickel, cobalt, copper, PGEs are critical raw materials for the decarbonisation theme.

Gold and silver (precious metals) tend to perform well in times of market volatility.

These commodities are used in applications ranging from electric vehicle batteries, electrical infrastructure and catalytic converters to reduce emissions in internal combustion engines.

Our REZ Big Bet:

“REZ’s share price re-rates by over 1,000% off the back of a new discovery and the definition of a deposit significant enough to move into development studies”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our REZ Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true

Why did we invest in REZ?

1- Nickel, cobalt, copper and PGE potential

WA gold project underexplored for nickel, cobalt, copper and PGEs.

Between 1969 and 1986, BHP/RIO kept hitting nickel sulphides grading between 0.1-2.2% in the region. Chalice Mining’s PGE discovery in WA was made after decades of gold focussed exploration.

2- WA nickel discoveries are in demand

Nickel discoveries are hard to make, but once discovered, they become highly valuable.

IGO purchased Sirius Resources' nickel discovery for $1.8Bn, Chalice Mining’s discovery is now worth ~$2.7BN, and Mincor Resources was recently scooped up for $760M.

3- REZ Chairman is also Chairman of Vulcan and Kuniko - A team that has delivered success for us in the past

REZ’s Chairman Gavin Rezos is also the chair at Vulcan Energy Resources and Kuniko.

Vulcan is our best ever Investment, it went from 20c to a high of over $16 and is now trading at around $3.70.

Kuniko went from 20c to touching as high as $3.60 in a couple of weeks after IPO, and is now trading at around 45c.

We also note that early Vulcan investor and WA mining billionaire John Hancock is the 14th largest REZ shareholder according to the 2022 REZ annual report.

4- Low Enterprise Value leveraged to exploration success

REZ has a market cap of just $6M and had $1.4M in cash in the bank at the end of last quarter, which equates to a low Enterprise Value of just $4.6M. Any exploration success could re-rate the company to multiples of where it is trading now.

5- Bear market entry point

Most small cap stocks (including REZ) have been beaten down over the last financial year, especially during periods of market weakness like in May and June (from tax loss selling).

In addition to this, we think that REZ may have been oversold due to a large fund being a forced REZ seller over the last 6 months (Magnolia fund in liquidation) - if this was the case we hope that most of this selling is now finished.

6- Revenue from small gold project

REZ has produced gold from its WA gold project before. The most recent production run brought in $3.35M in the June quarter 2022.

With some additional drilling, REZ could look to do the same again in the future.

It’s very unusual for a small cap explorer to have any revenue, we like this because it reduces the need over time for capital raises, which dilute existing shareholders and can weigh on the share price.

7- Blue sky, greenfield gold project (this is a side bet for us)

We are Invested in REZ for the Nickel exploration, but we are also bullish on gold in general in 2023.

In addition to its small gold projects that sporadically produce revenue, REZ says it has “significant greenfield gold exploration project at Gigante Grande” and will be “pursuing a million plus ounce resource and bulk mining project”.

8- REZ’s nickel sulphide peers at higher market caps:

Nickel discoveries are hard to make, but once discovered, they become highly valuable.

WA nickel discoveries have produced major winners in the past...

- $1.8BN Nova nickel discovery - Sirius Resources’ Nova nickel discovery was purchased by IGO for $1.8Bn in 2015.

- ~$2.7BN Julimar nickel/copper/PGE discovery - Chalice Mining was looking for gold (similar to REZ) and made the Julimar nickel/copper/PGE discovery - now Chalice trades with a market cap of ~$2.7Bn.

- $760M take over of Nickel player Mincor - Australia’s richest man Andrew Forrest just completed its takeover of Mincor Resources for $760M. Mincor is one of the nickel players in the region where REZ is exploring.

Given the company’s current valuation, we think the upside on a discovery here is multiples of where the company currently trades.

9- First time someone has consolidated this landholding and done modern exploration

REZ is following up on previous work done by BHP and Rio Tinto.

Between 1969 and 1986, BHP and Rio Tinto kept hitting nickel sulphides grading between 0.1-2.2% in the region.

For decades, the nickel potential wasn't followed up primarily because the land position was owned and explored by different companies at different periods of time.

AND because the demand for new nickel discoveries was just not as strong back then.

Now with nickel’s importance in the Electric Vehicle (EV) battery supply chain, nickel exploration is back in favour.

While the nickel price has sold off since a 2022 peak, we remain confident that new nickel discoveries will be well received by the market.

After almost ~55 years REZ holds a 100% interest in a land package big enough that it thinks it could host a new discovery.

What do we expect the company to deliver in 2023?

Objective #1: More drilling at WA project focused on nickel/cobalt/copper/PGEs

We want to see REZ follow up on its recent nickel results across its East Menzies project and continue drilling out the nickel/cobalt/copper/PGE potential of the project.

Milestones

✅ Fieldwork (Geophysical/Geochem)

🔲 Drilling

🔲 Downhole EM surveys (following up the best drill results)

🔲 Assays

Ultimately we will judge the drill results based on a combination of grade and thickness, if the intercepts are thick, then the grades can be lower and vice versa.

To begin with our bull/base/bear case expectations for the drilling results are:

- Bull case = Nickel grades greater than 1%

- Base case = Nickel grades between 0.5-1%

- Bear case = Nickel grades <0.5%.

Objective #2: Extensional drilling across gold targets at WA gold project

We want to see REZ drill out its gold targets in the region, chasing both NEW discoveries and looking to extend the company’s existing discoveries.

Milestones

🔲 Drilling commenced

🔲 Assays

Objective #3: Progress developments studies at QLD gold project

We want to see REZ progress development studies across its QLD gold project including metallurgical testing, mine studies and environmental permitting.

Milestones

🔲 Metallurgical testwork

🔲 Environmental Permitting (Water supply issues to be resolved)

🔲 Land access agreements

🔲 Development study completed

What could go wrong?

Exploration risk

A large part of our Investment thesis for REZ is to see it go and make a new nickel/cobalt/copper/PGE discovery on a project that has historically been focused on gold exploration.

This will mean a whole new approach to exploration, and there is no guarantee that this leads to a discovery.

Funding risk

REZ is a junior exploration company that is heavily reliant on access to capital markets to finance exploration programs. Whilst it has made sporadic revenue in the past, to fund meaningful exploration, REZ will be reliant on capital markets for additional funding.

Market risk

Given REZ’s reliance on access to capital with high risk tolerance, there is a risk that negative market sentiment makes it difficult to raise funds.

REZ is reliant on a market that is open to financing high risk exploration and could see its share price de-rate in times when the markets are less willing to finance exploration companies.

Investment Plan

REZ is a new portfolio addition, our average entry price is ~2.2¢.

As with all our new investments, we hold 100% of our position for 90 days. After 90 days we may look to sell a maximum of 20% of our total position, which we may do if the REZ share price has risen from a positive drilling campaign or other material news.

This is our standard plan across all early stage exploration investments.

The rest of the investment will be held long term into the drilling results over the next few drill campaigns, and hopefully over several further delineation drill campaigns if the initial drill campaign delivers encouraging results.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.