PMY Drilling For Copper-Zinc Now: Results Due in Weeks

Published 11-SEP-2017 00:14 A.M.

|

7 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The $3.7M capped micro cap stock Pacifico Minerals Limited (ASX:PMY) is in the midst of a diamond drilling campaign in a world class base metal district in the Northern Territory of Australia.

PMY is exploring in an impressive post code, given its neighbours include none other than the £49 billion-capped London-listed Glencore and Teck Australia.

PMY is in a joint venture arrangement with the heavy-hitting, $1 billion-capped Sandfire Resources (ASX: SFR). Importantly, Sandfire is contributing its own share of exploration costs to the tune of 49%.

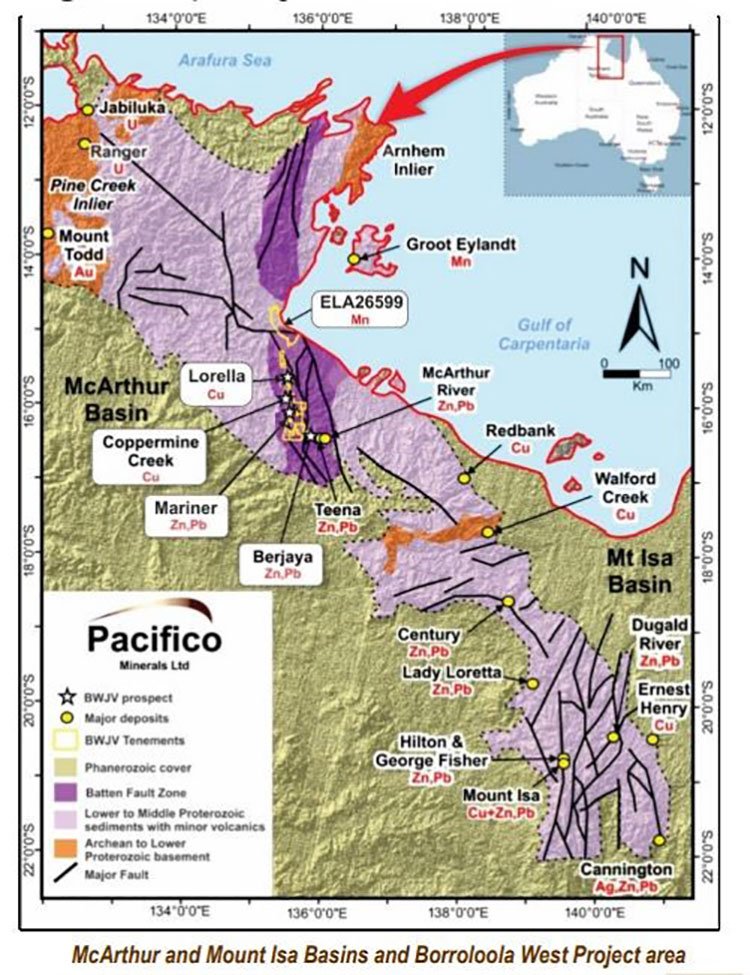

The Northern Territory’s McArthur Basin not only hosts Glencore’s McArthur River Mine, but is also in the vicinity of Teck Australia’s world class Teena zinc-lead deposit where 58Mt of 11.1% Zn and 1.6% Pb was recently discovered.

Parent company Teck is another global powerhouse with a market cap of over $13 billion, so there is certainly something about the region that is attracting the majors.

Whilst PMY has several projects on the go across Australia and as far away as Colombia, its central focus is on progressing the Borroloola West Project in the Northern Territory which is prospective for several base metals.

Borroloola West is the project that PMY has just launched a 1,500m diamond drilling campaign on, hunting for a smorgasbord of metals including cobalt, zinc, copper and silver, across a suite of pinpointed targets.

PMY has operational control and 51% ownership of the the Borroloola West Project and had $1.6 million in cash reserves at June 30, 2017.

Its project has also captured the attention of the Northern Territory government as a worthy recipient of funding to assist with the company’s exploration. Funds delivered by the NT government are contributing to the current diamond drill program.

A significant leadership team is at the helm including Managing Director Simon Noon, who was the Executive Director of ASX listed Groote Resources Ltd, where he managed the company from a market capitalisation of under $5 million to market highs in excess of $100 million.

Whether PMY can repeat this feat remains to be seen, so investors should seek professional financial advice if considering this stock for their portfolio.

The Catalyst: Diamond Drilling Now

PMY has hold of an 1,800km 2 underexplored land package in a highly prospective region of the Northern Territory.

Here’s a look at the region in which PMY is playing:

PMY has hold of the Borroloola West Project consisting of Coppermine Creek, Mariner, Berjaya, which is just 20km east of Teck Resources’ Teena Deposit and Lorella prospects.

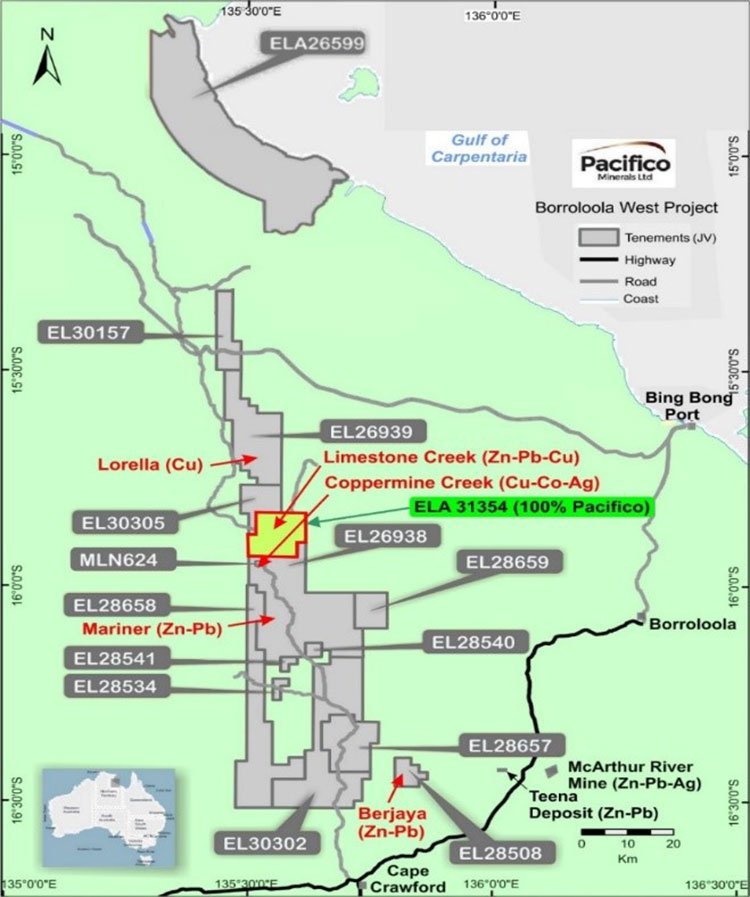

The following map gives you an indication of the Borroloola West tenements (in grey) and the location of its prospects, the 12 exploration licences and the mining licence:

The company recently began a drilling programme at Borroloola across 5 drill holes for 1500m at three of the company’s prospects where copper and zinc targets have been established.

The zinc target occurs in the same stratigraphic rock sequence (Barney Creek Formation) as the world-class McArthur river zinc-lead-silver deposit, and lies 30km along strike to the west.

Significant stratabound copper mineralisation intersected by PMY at Coppermine Creek has given the potential for a major copper discovery.

Drilling is expected to be completed in the next month with assay results expected to flow shortly after.

Following the diamond drilling program, an aircore drilling program is planned to commence this field season to test for primary and additional oxide copper mineralisation at the company’s Lorella prospect.

That means plenty of newsflow to grab the market’s attention.

Borroloola in further detail

As we highlighted above, the Borroloola West Joint Venture between PMY (51%) and Sandfire Resources (49%) consists of 12 exploration licences and one mining licence over 1,817 square kilometres.

The project lies west and northwest of Teck Australia’s zinc-lead resource at the world class Teena deposit, in close proximity to Glencore’s world class McArthur River zinc-lead mine.

PMY mobilised a diamond drill rig in early August at the Coppermine Creek, Mariner and Berjaya prospects.

Coppermine Creek is situated 100km north-west of the McArthur River zinc-lead-silver mine where the target is a Mount Isa Copper style deposit.

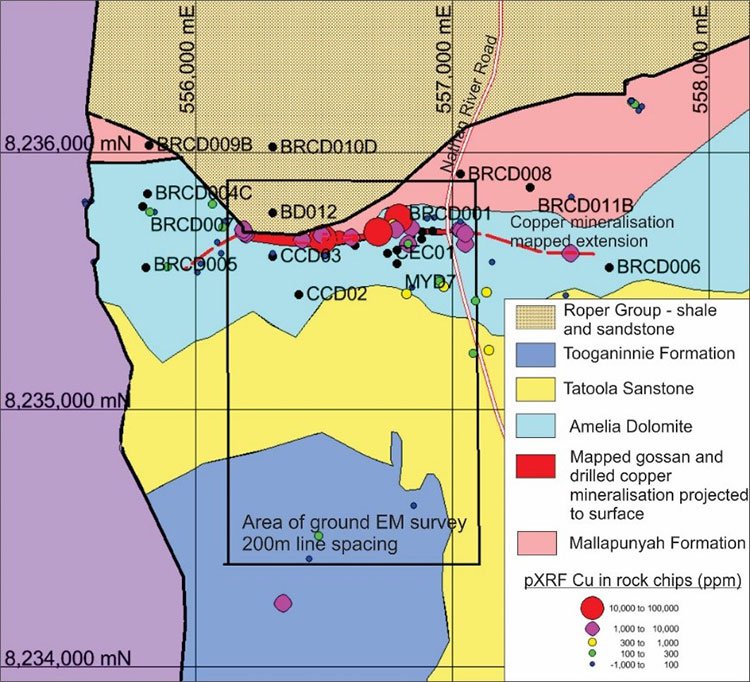

Copper mineralisation can be observed at surface as outcropping gossans with malachite staining over a strike length of at least 1.5 kilometres based on drilling, recent geological mapping and sampling.

RC and diamond drilling by PMY and previous explorers, has produced results including 30m @ 1.1% Cu in RC hole GPR07 and 34m @ 0.5% Cu in RC hole GPR09.

Massive sulphide veins with high copper grades have been intersected by previous drilling in a thick horizon within the Amelia Dolomite of intense fracturing, brecciation and alteration.

A ground electromagnetic (EM) survey has been recently completed over part of the prospect.

Conductivity profiles confirm the 3D geological model, built up from projecting previous drilling information of gently dipping, bedding replacement, and stratabound copper mineralisation beneath 100-250 metres of flat lying dolomitic siltstones.

Below is a map of Coppermine Creek, showing just part of the area underlain by the target mineralised horizon:

Here’s a quick look at PMY’s other prospects within Borroloola West.

Mariner

Previous drilling in 2016, led to PMY intersecting lead-zinc mineralisation at the Mariner Prospect, where zinc rich Sediment Hosted Massive Sulphide (SHMS) drill targets were established.

The latest round of drilling is now being conducted, following the company establishing diamond drill targets to test for McArthur River style stratiform zinc mineralisation (i.e. 200 million tonnes of >12% Zn + Pb).

Two diamond drill holes are being targeted to test for both zinc mineralisation and favourable stratigraphy.

Berjaya

The Berjaya Prospect lies west and northwest of the McArthur River zinc-lead mine.

PMY is targeting a zinc-lead SHMS deposit within the Barney Creek stratigraphic package and like Mariner and Coppermine Creek is currently being drilled

One diamond drill hole is planned to test a Versatile Time Domain Electromagnetic conductive horizon that appears to correspond to the position of gently dipping Barney Creek Formation beneath Hot Springs Formation.

Lorella

Lorella has been the subject of vigorous historical drilling. There is potential for significant primary and oxide copper mineralisation here and acid leach testwork is currently being carried out on oxide copper mineralisation.

A planned aircore drilling programme (40 holes for 2000m) to get underway during September.

As you can, PMY has a lot on its plate over the coming weeks and as it continues its drilling programme, we should see results flow in thick and fast over the coming weeks.

Limestone Creek

Limestone Creek is PMY’s 100% owned prospect and is covered by an exploration licence application. Once the licence is granted RC drilling to test strike extensive gossanous breccias containing high lead and zinc geochemistry, is planned.

What’s to come

A diamond drilling program has begun at PMY’s Northern Territory operations, specifically at Coppermine Creek, Mariner and Berjaya – assay results will be released in the weeks to come.

Following that, aircore drilling is planned to commence at Lorella should PMY see positive results from metallurgical testwork.

An update assessing the potential copper oxide ore resources with metallurgical testwork on Lorella Copper oxide material is due in the third quarter.

That’s a significant amount of news expected just out of PMY’s Borroloola West Project.

Borroloola West has been the primary focus of this article, but PMY has several other irons in the fire in Australia and overseas in Colombia that could also create potential catalysts in the near future.

Of course it is early days for PMY and investors should seek professional financial advice if considering this stock for their portfolio.

All up, there is a huge volume of news due to flow over the coming twelve months... including plenty of catalysts to draw investors’ attention.

How long will PMY maintain a market cap of just $3.7 million...?

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.