Next Friday: Fraser Range Diamond Drilling

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The $5M market cap explorer Rumble Resources Limited (ASX:RTR) is days away from kicking off its maiden drilling programme.

It’s all happening in Australia’s prime nickel exploration province, the Fraser Range in Western Australia.

On Friday, November 7 th , a drill rig mounted on a high-powered multipurpose truck will begin drilling the first of four holes into their highly prospective Big Red Project.

Two weeks later, the 1,600m RC/diamond drilling campaign will be complete.

The discovery of the world class 13.1Mt nickel deposit known as Nova-Bollinger by Sirius Resources gave that company a $1.3BN market cap and ignited a band of explorers to find the next deposit in the area.

Not just explorers, even the US$55BN mining giant Vale is understood to have entered the region – next door to RTR’s ground.

Western Areas, Sirius, Panoramic – all companies that have electrified the market and been catapulted to new heights with big nickel finds.

But for every successful nickel discovery, there are dozens of explorers that find nothing at all. At least with RTR, investors won’t have long to find out.

With nickel drilling set to begin in days, results due within weeks, and the chance of hitting a potentially company defining nickel target, this is the exact kind of stock catalysthunter.com looks for:

“ CatalystHunter.com provides alerts when an ASX stock is close to a share price catalyst that could potentially initiate a share price movement. “

RTR: The Upcoming Share Price Catalyst

Months of modelling and extensive surveying has led to this critical juncture:

- High impact drilling is planned to commence on the 7 th of November

- 4 holes of RC and diamond drilling, a total of 1,600m

- Geological model similar to Voisey’s Bay in Canada – one of the biggest nickel finds the world has ever seen – 35 Mt at 3.5% nickel

- RTR’s tiny market cap of $5M and tightly wound capital structure has them leveraged to success upon discovery

- Previous nickel discoveries have transformed companies, for example Sirius, Western Areas, and Panoramic.

RTR: The Timing – Drilling in days, results by mid-November

Drilling to commence on the 7 th of November:

- Drilling is expected to take two weeks with assay results released as they come to hand

- RTR will look to complete a geophysical down hole EM survey following completion of the work

- There are plenty of nickel explorers working hard to find the next big discovery in the Fraser Range. But none are drilling on such a scale in the coming weeks – if anyone is going to make a discovery soon – it’s going to be RTR.

RTR: The drill target

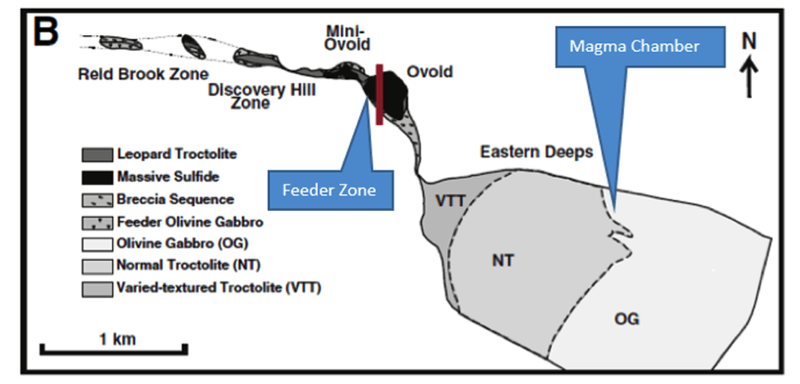

RTR’s modelling and exploration work to date have generated a Voisey’s Bay style drilling target.

The geology at Voisey’s Bay has been extensively studied, the image below shows how that deposit was formed:

Plan of the geology of Voiseys Bay

The “Ovoid” deposit is a feeder zone – a 600m long by 350m and 110m deep body of massive sulphides. It’s full of copper and nickel sulphides, leading to a deeper, richer, magma chamber.

What RTR are looking to do in the coming weeks is prove up their theory that a Feeder Zone exists at Big Red.

Just like at the 35 Mt at 3.5% nickel Voisey’s Bay deposit, RTR have interpreted:

- A feeder zone that is both conductive and magnetic – two big hints that the ground may hold nickel;

- A 2.2 km conductor that coincides with this feeder zone, and;

- This conductor feeds into a large, 6km gravity body – which may well be a large magma chamber.

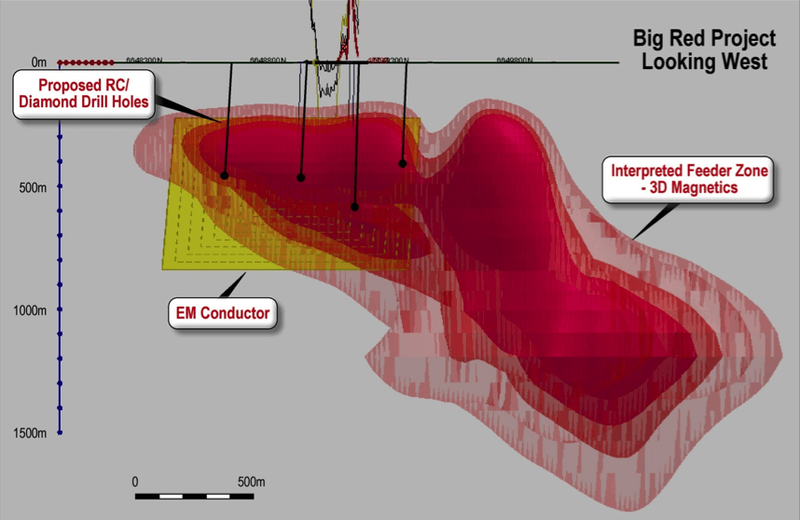

The below image displays RTR’s model looking west – the upcoming drill holes are in black. With these holes, RTR are targeting an identified electro-magnetic plate within the interpreted feeder structure:

Big Red Project – Looking West

The geologic model RTR have developed bears a striking resemblance to Voisey’s Bay – but it will become a whole lot clearer over the coming weeks as the company starts their drilling.

RTR: The Capital Structure

RTR has a micro $5M market cap with just 120M shares on issue with board and management owning 16.4% and the top 20 shareholders controlling 35.8%.

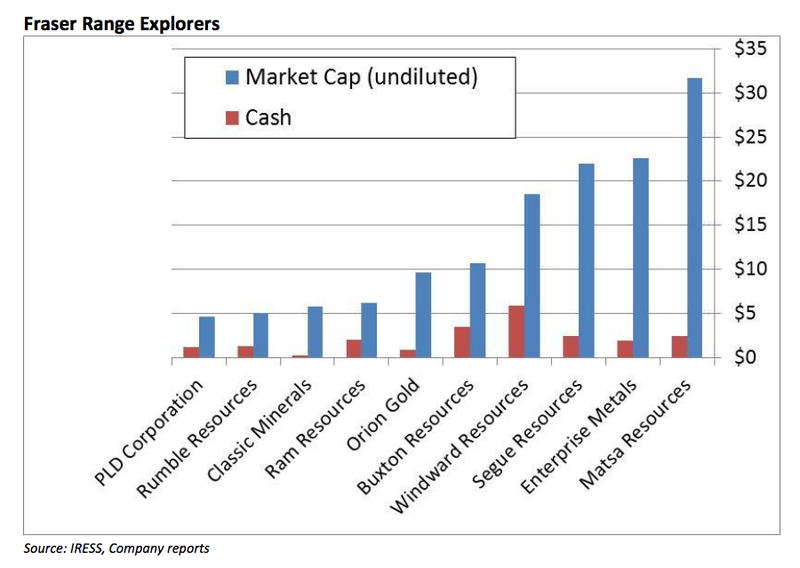

Looking at RTR’s market cap, it is clear that RTR is much more leveraged to success when compared to other Fraser Range nickel explorers:

Fraser Range Explorers

Any strong assay results in the coming weeks have the potential to ignite RTR’s share price, especially from such a low base.

RTR Share Price Potential

We have seen in the past that the markets react positively when a penny stock finds a massive nickel deposit.

With a maiden drilling programme kicking off at Big Red on November 7 th , there is a chance that RTR could be the next one.

All Fraser Range explorers are dreaming of a Sirius like discovery. That explorer, once struggling with a market cap of $6M, went to $1.3BN almost overnight when it discovered Nova-Bollinger.

Here is that famous chart:

Sirius Resources Stock Chart

The past performance of these products are not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

You can clearly see the moment when Nova-Bollinger was discovered – in the same region as RTR’s drilling site.

RTR investors could know very soon what they have in the ground at Big Red – and if it’s a big nickel deposit – then RTR could enjoy a Sirius style run. However a share price rise for RTR is of course no certainty.

Drilling is now days away

On November 7 th , a drill rig mounted on a high-powered multipurpose truck with 2500m depth capacity will begin sinking the first of four holes into RTR’s prospect.

Four holes totalling 1600m will be drilled down into an interpreted feeder zone above a large EM target – a geophysical structure very similar to the one found at the 35Mt Voiseys Bay nickel resource in Canada’s Thompsons Bay nickel province.

When the work’s finished, around two weeks after the November 7 th start date, assays should follow.

RTR will also look to schedule a down-hole EM survey to provide a diagnostic test of the bedrock conductor.

With a market cap of just $5M and an imminent drilling event, RTR could possibly uncover the next Nova-Bollinger and take them from scrappy junior status to major player.

This is high risk exploration but it won’t be long until RTR investors find out the result, one way or another.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.