Drilling Starting in Days: Proven WA Nickel Belt, Targets Chosen by Committee of Elite Nickel Experts

Published 03-SEP-2014 01:30 A.M.

|

10 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

$10M market cap explorer Mining Projects Group (ASX:MPJ) has been working away behind the scenes for almost a year, building up to imminent, deep and comprehensive nickel sulphide drilling in a highly prospective WA Nickel Province.

Whilst it doesn’t happen every day, Sirius has shown how a stock can react to a robust nickel discovery – for one reason or another, nothing excites the market like a big nickel find.

The team of Geologists and Geophysicists steering MPJ were involved in the Sirius Nova discovery and Western Areas’ Spotted Quoll and Flying Fox deposits. In a recent news article they have said they regretted not taking shares as payment in these companies as the share prices rose in the tens of thousands of percent on discovery of Nickel.

These WA Nickel experts say they will not make the same mistake with MPJ, and have taken shares in the company as payment for their services.

With MPJ starting drilling in the next few days aiming for a potentially company defining nickel find, this is the exact kind of stock that catalysthunter.com looks for:

“ CatalystHunter.com provides alerts when an ASX stock is close to a share price catalyst that could potentially initiate a share price movement. “

MPJ: The Upcoming Share Price Catalyst

An Extensive Drilling Campaign – Kilometres worth, starting in days:

- Diamond drilling to test major nickel sulphide targets at Roe Hills Nickel Belt – an established WA Nickel region

- Drilling in and amongst a continuous strike of 40km of fertile ultramafic rocks – an ideal incubator for nickel deposit formation

- Initially 15 holes for 5,000 metres, may extend the campaign to 10,000 metres

- Fully funded drill campaign including geophysics – downhole electromagnetics to be conducted concurrently with drilling

- Kambalda Nickel Region – Proven province surrounded by major operations (BHP and Western Areas)

- Multiple, compelling, large scale nickel targets, with historic intersections of over 6% nickel

There are plenty of explorers rushing to make the next major Nickel find, but we are interested in MPJ because they are set to announce the start of drilling any day now (if they haven’t already).

MPJ: The Timing – Very Soon, in Days

Drilling to commence first week of September 2014:

- A potentially company making exploration campaign right at the “pointy end”

- Other investors have been waiting many months, even years, for this landmark event, with their capital tied up in the interim

- Entry now available at much the same prices with same exposure to the potential upside – this is exact situation we look for at catalysthunter.com

- A few weeks after drilling, results will be released

MPJ: The Team

Drilling targets generated by the best nickel geologist and geophysicists in Australia, both taking some of their payments in MPJ shares – shows supreme confidence.

- Geologist and technical director: Neil Hutchison – Neil is also GM of Geology for Andrew Forrest’s Poseidon Nickel. Responsible for global scale nickel discoveries at Windarra and Cosmos. A leading expert in WA Nickel.

- Neil has re-analysed 50 years’ worth of shallow drilling data on MPJ’s tenements, and concluded that some larger, deeper targets were completely missed by previous explorers. He is in charge of making sure these targets are penetrated directly during the upcoming deep drilling.

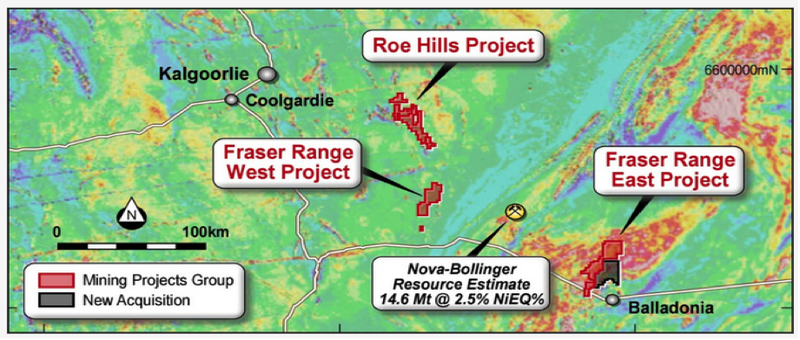

- Geophysicists: Newexco. Arguably the best nickel geophysicists in Australia are overseeing technical aspects of drill target selection for MPJ. Bill Amann and Adrian Black from Newexco helped discovered the Nova-Bollinger deposits, as well as Western Areas’ Spotted Quoll and Flying Fox deposits.

- The Newexco team with Neil Hutchinson form a highly experienced committee to steer MPJ’s drilling campaign to have the highest chance of success.

- Newexco’s have taken part of their fee in MPJ shares – shows their confidence in geology and chances of success.

- Neil Hutchison is also taking MPJ shares as payment for his technical services.

MPJ: The Capital Structure

Micro ~$10m market cap with $1.2m cash and liquid assets – share price is hugely leveraged to discovery – potential for major and ongoing share price rise in case of positive result.

- Dedicated share register – top 20 hold 72%, with MPJ management and vendors of the projects together holding 50%.

MPJ’s Projects

That’s the basic summary of MPJ.

MPJ certainly fits in with the catalysthunter.com requirements:

“ an ASX stock close to a share price catalyst that could potentially initiate a share price movement. “ Read on for some more in depth information about MPJ and their near term drilling activities.MPJ share price potential

MPJ is massively leveraged with a share price of less than 1c, and a market cap of under $10 million.

The past has shown that the market reacts strongly to a monster nickel find from a penny stock. If you haven’t seen anything like this before, here is what can happen if a discovery is made.

Now of course most hopeful explorers won’t be making any giant nickel discoveries, but here are some that did (which is what MPJ will try to do in the next few weeks).

This is the chart for Sirius Resources – showing this share price rise after targeted drilling discovered Nova, then Bollinger – approximately 100km from where MPJ will be drilling for similar deposits in days.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

It’s easy to spot when the first nickel discovery was made. Same goes for Panoramic Resources, below. A severe and sustained share price move as word spread of a thick, high grade nickel sulphide intersection:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

And again. Western Areas shows the reliable pattern of a stock, post major nickel discovery:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Remember that all 3 of the above discoveries were made by the very same geophysics team (Newexco) that MPJ are now collaborating with.

It’s also important to understand the significance of Newexco accepting a substantial portion of their service fee in MPJ shares. If drilling and electromagnetics turns up nothing, they will have effectively worked at a massive discount.

A recent article in the Australian gives some background on why the experts working for MPJ are so keen to take shares as payment for their services:

Source and full Article: The Australian

Source and full Article: The Australian

Source and full Article: The Australian

Source and full Article: The Australian

Source and full Article: The Australian

Reading between the lines – Newexco likely thinks there is a good chance of success.

5 bags, 10 bags, 20 bags, 100 bags – all possible, depending on the size and nature of the nickel system that MPJ may be about to tap into – but it’s also possible that drilling could yield nothing and the share price will go down. MPJ is that kind of high risk speculative investment. To mitigate this as much as possible, management has taken a strategic view in acquiring multiple core projects to ensure long term exploration upside.

At least it won’t take long to find out what’s in store for MPJ, given that drilling is starting in days.

MPJ is closing in fast on the commencement of a major, deep drilling campaign for a hot commodity, and in the heart of a proven WA Nickel Region.

This drilling campaign will bring multiple price catalysts – not just the possible giant leap on a material discovery.

The official ASX announcement stating that this drilling program is underway will likely attract major market interest. A few weeks later, results will be released.

That’s what we are here for – advance notice of impending price sensitive ASX news flow.

Wouldn’t it have been nice to have been alerted when Sirius first began drilling at Nova?

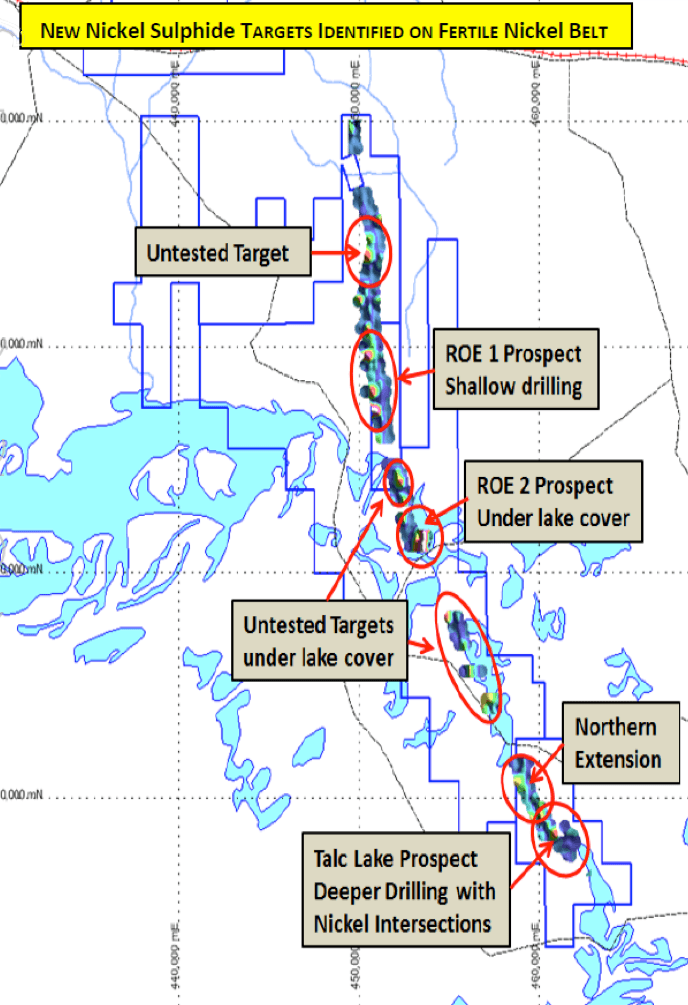

And, MPJ has multiple, high probability targets at Roe Hills, all within a fertile 40km nickel belt, to be drill tested one after the other:

New Nickel Sulphide Targets identified on fertile Nickel Belt

We expect MPJ will be releasing an announcement very shortly – if they haven’t already – that they have commenced drilling at its highest probability nickel sulphide targets.

History: How MPJ arrived at this critical juncture

MPJ commenced its transition into a WA based Nickel play in 2013 when it acquired three core projects known as Roe Hills, Fraser Range and Dingo Range.

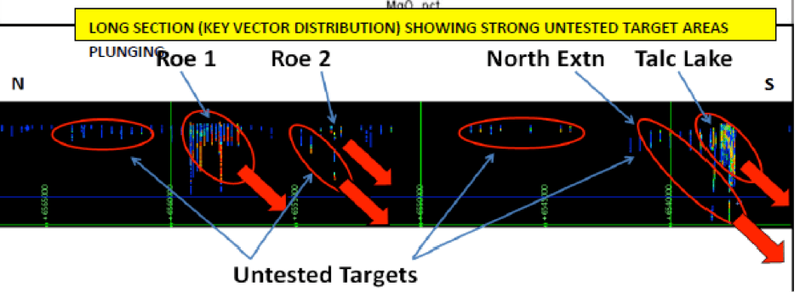

MPJ has multiple targets across at Roe Hills extending the entire length of strike of the ultramafic rocks, which will be the focus imminent drilling campaign:

Untested Target Areas

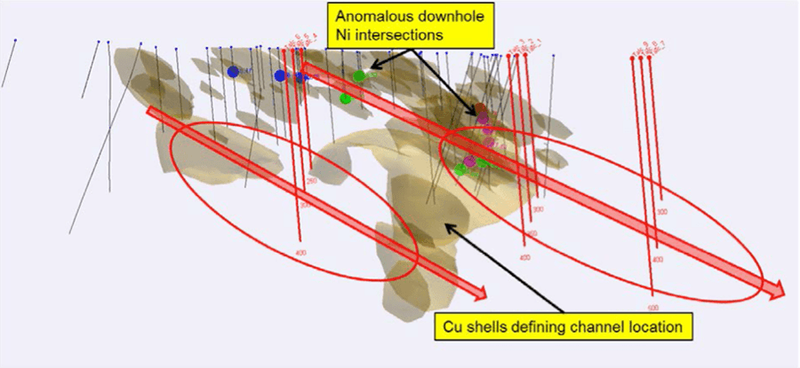

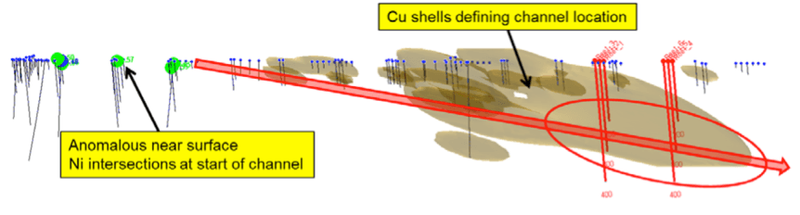

The following cross sections show the extent of the planned drilling – planned holes are marked in red:

9 diamond drill holes planned for 3200m at Talc Lake 1 Prospect

6 diamond drill holes planned for 1,800m at Roe 1 Prospect

MPJ went on to team with Bill Amann and Adrian Black from Newexco – the discoverers of Nova, Bollinger and multiple other economic nickel discoveries in W.A.

MPJ also added another W.A. nickel genius – Neil Hutchison – to its nickel hunting arsenal.

Neil discovered the world class Windarra and Cosmos nickel deposits, also in W.A.

All three men have a substantial vested interest and belief in finding more big nickel deposits in WA with MPJ, as evidenced by the large shareholdings they acquired in MPJ as part of their remuneration packages.

Source and full Article: The Australian

Last month MPJ raised just shy of $1.4 million to sophisticated investors at $0.006 – that’s only one tick below MPJ’s current on market share price.

MPJ shares on market are at much the same price as placement takers over a month ago, and now just days before a major nickel drilling campaign gets started at Roe Hills.

MPJ have spent many months preparing under the guidance of Neil Hutchinson, using advanced exploration techniques including the latest 3D modelling software, to utilise the extensive dataset accumulated over several decades of previous exploration.

Soil sampling, geophysics, and rock chip assaying have also been used to hone in on the biggest and best nickel sulphide targets.

And all indications are that the nickel sulphide targets MPJ has are some of the biggest and best in the entire region.

Now it has come to crunch time.

Newexco, Neil Hutchison, MPJ management and the original project vendors have all seen the exploration data first hand, and have all placed their bets:

Committed Major Shareholders

Breaking new ground

When MPJ and Newexco start intersecting fresh rock and assays as anticipated, investors jockeying for position and high volume trading is likely.

Every new nickel sulphide target drilled in this campaign will be a new and separate price catalyst in itself.

Then, with a market cap of just ~ $10 million, and a share price of under a cent, any high grade nickel assays could positively impact the MPJ share price.

The efforts of nickel expert Neil Hutchison and Newexco have made drill targeting as refined and as accurate as possible, so the ultimate assays hold the best possible chance of revealing an economic discovery.

With any luck this drilling campaign could deliver Australia’s next big nickel find, and potentially the ASX’s newest market darling.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.