$2BN Patriot - Can Jody Dahrouge do it again?

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 9,740,545 MEG shares and 350,000 MEG options at the time of publishing this article. The Company has been engaged by MEG to share our commentary on the progress of our Investment in MEG over time.

Patriot Battery Metals more than tripled its market cap in the space of six months off the back of drilling at its James Bay lithium project.

The company listed on the ASX in December 2022 at a valuation of ~$553M and now trades with a market cap of ~$2.2Bn.

Patriot's success in James Bay Canada was no fluke - the region has some of the most prospective geology for lithium in the world.

This success has led to a rush into the region by junior explorers. Whilst there are a lot out there, we think it's important to back the explorers with the people who have been there and done it all before.

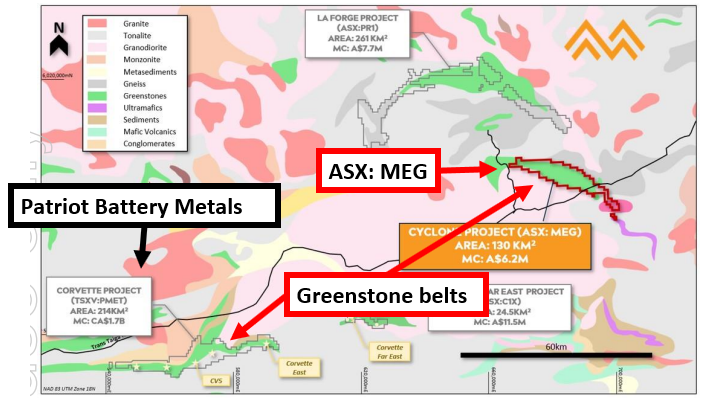

Sitting on almost identical geology in James Bay, our micro cap exploration Investment Megado Minerals (ASX:MEG) biggest shareholders are the Dahrouge Family, Canada based geos and proven lithium project finders, led by principal Jody Dahrouge.

The Dahrouges were one of the vendors of Patriot’s Corvette Project in James Bay & are exploration consultants to the $2.2Bn company.

The Dahroughes have the playbook for a $2.2Bn James Bay lithium discovery.

With ~18% of MEG’s shares controlled by the group, we think they have all the motivation necessary to deliver exploration success for MEG.

MEG’s current market cap is ~$11M and the company just raised $2.7M at 4.5c per share

MEG is currently trading around the placement, vend-in and the Dahrouge’s entry price of 4.5c per share.

MEG has been trading near our entry price of 3.9c - we also participated in the 4.5c placement in April.

MEG holds ~130km^2 of ground on a greenstone belt along strike from Patriot and where the Canadian government has previously found outcropping pegmatites - some ~1km in length just outside of MEG’s ground.

On top of all of this, the ground has never before been explored for lithium.

Typically, the best time to invest in a region is before a major discovery is made. This is because the ground held gets an uplift in valuation from the work being done by other companies.

With MEG, we took a slightly different approach.

We specifically looked for an early stage company in the James Bay Region that would give us exposure to a high-risk but also high reward exploration project that can be built from the ground up.

We like Investing in exploration projects because it gives us the upside exposure if the company makes a substantial discovery.

At the time of our Investment, MEG’s ground had never been explored for lithium before.

This is the type of greenfield exploration project that we like.

During our due diligence process, MEG’s projects stood out from the pack because:

1) MEG’s major shareholder helped discover Patriot’s Corvette project

The project vendors (Dahrouge Resource Management) are a related party of the team that helped Patriot make its Corvette discovery.

Dahrouges and associates control ~18% of MEG, meaning they have a very large exposure to the success and upside of a lithium discovery.

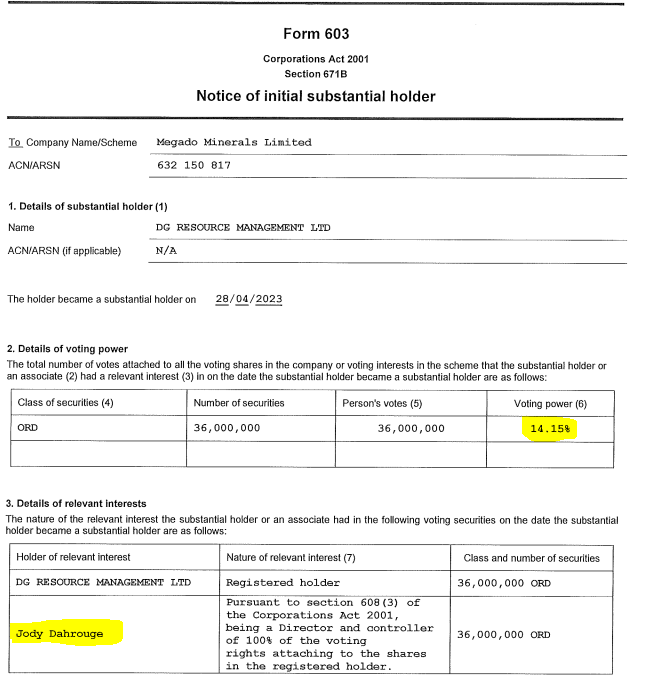

Jody Dahrouge (the principal) just lodged his substantial shareholding notice, and he alone holds ~14.15% of MEG.

2) Similar geology to larger market cap neighbour

MEG sits on top of the same type of rock structures that host Patriot Battery Metals Corvette discovery.

At a very high level, we are Invested in MEG to see the Dahrouge’s repeat the success they had with Patriot Battery Metals (at the $2.2Bn Corvette discovery) with MEG.

What is MEG up to now?

MEG is in the process of firming up drill targets and the next major piece of news will likely be centred on where the company intends to drill.

A lot of work has gone into getting MEG to this stage, and there are some strong early signs that MEG’s ground in James Bay will throw up good targets.

Here’s what we’ve seen so far.

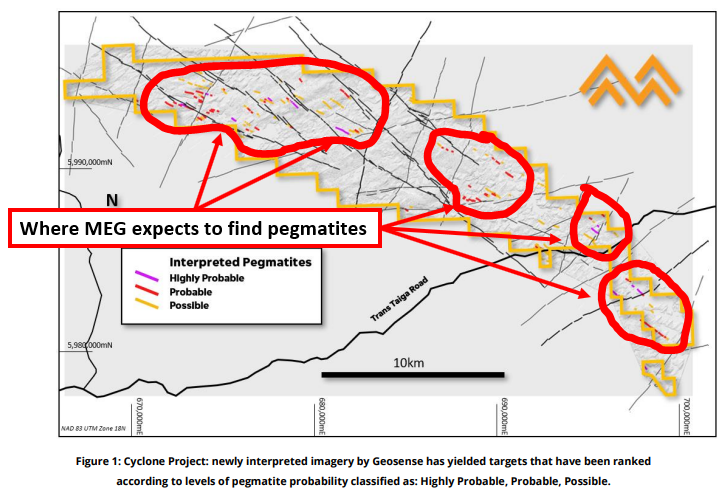

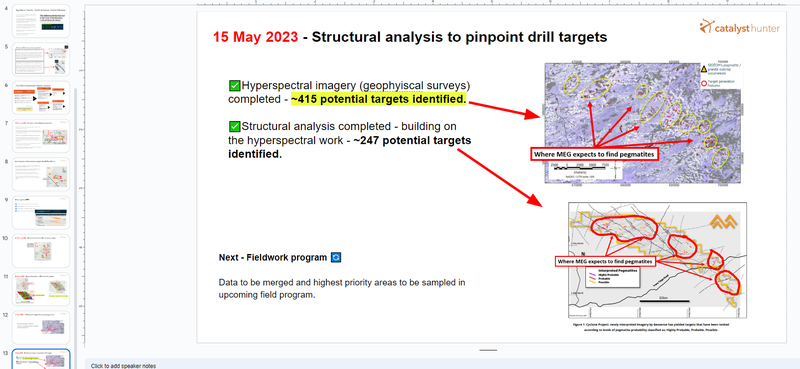

MEG’s first step in the lead up to drilling was structural and hyperspectral analysis.

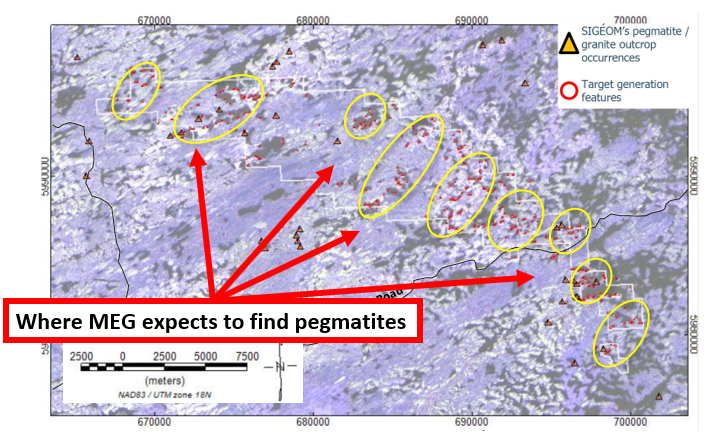

The hyperspectral analysis is the same type of work that ~$20M Loyal Lithium recently finished where it found ~247 potential lithium bearing pegmatites. MEG on the other hand found ~415.

At a very high level - MEG took satellite imagery data, ran some complex algorithms over it to try and locate where, on MEG’s ground, the highest probability of hosting lithium bearing pegmatites exist.

The result - the red spots all over the ground are where MEG expects to find those pegmatites.

The alternative to this work would be to just go and walk over the entire ground with a team of geologists but this would take months/years and a whole lot more cash.

MEG then overlaid structural analysis and now has ~272 areas where the company expects to find pegmatites.

We like that MEG is instead choosing to start from the air and work its way onto the ground.

When it comes time to walk the ground and look for the pegmatites, the company will at least know where to start looking.

MEG will be following the same tried and tested playbook that has led to the discoveries of some of the world's biggest lithium deposits that have become company making projects, creating hundreds of millions of dollars in value.

The lithium exploration process playbook is fairly simple:

- Company maps outcropping pegmatite structures which are likely to host lithium mineralisation - MEG is currently working towards doing this. MEG should be ready to get on the ground in the coming months. 🔄

- Company samples these outcrops to confirm if there is lithium mineralisation. 🔲

- Company confirms spodumene hosted mineralisation - spodumene is the source rock for the majority of the world’s lithium supply. 🔲

- Company drills into the outcropping pegmatites to prove out a large lithium bearing structure. 🔲

MEG is currently at the first stage and is capped at ~$11M.

Its much larger capped neighbour Patriot has made its discovery and is capped at ~$2.2Bn.

As the company systematically works through the exploration process, we expect to see the company’s share price move higher (assuming of course the company is able to make a discovery).

Ultimately, a discovery forms the basis for our MEG Big Bet which is as follows:

Our MEG Big Bet:

“MEG returns 10x by making a North American critical minerals discovery significant enough to move into development studies, or attract a takeover offer”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our MEG Investment Memo.

To monitor MEG’s progress since we first Invested and how the company is performing relative to our “Big Bet”, we maintain the following MEG Progress Tracker:

More on the the Dahrouge/Patriot connection

MEG’s James Bay lithium project was acquired from Dahrouge Resource Management (DRM).

DRM is a related part of “Dahrouge Geological Consulting”.

The Dahrouges vended part of the projects that now make up Patriot Battery Metals ground & have been Patriots’s exploration consultants from discovery through to today.

This is the same process MEG is following - purchase ground from the Dahrouges, and retain them for on the ground exploration work and other consulting.

So, the Dahroughes have the playbook for a $2.2Bn James Bay lithium discovery, and we think they will be just as motivated to deliver exploration success with MEG, given they hold ~18% of MEG shares on issue.

We went and dug through old Patriot Battery Metals documents to see what else we could find.

Below is the reference to the “initial Corvette block” which was acquired from “DG Resource Management” - DG Resource Management is 100% owned by Jody Dahrouge (14.15% shareholder of MEG).

(Source)

AND here are the references to the exploration programs the Dahrouges ran for Patriot:

(Source)

(Source)

As part of the deal the Dahrouges and its associates were issued ~45M shares in MEG (~18% of the company).

The 45 million MEG shares that the Dahrouges hold (at 4.5c per share) also have the following escrow conditions:

- 4.5 million with no escrow.

- 20.25 million with a 6-month escrow.

- 20.25 million with a 12-month escrow.

In a market like the one we have today, where James Bay lithium prospects are a hot commodity, the team could easily have sold the project for cash and walked away.

The Dahrouges have instead retained a large MEG shareholding and are staying on as exploration consultants for ~3 years, leveraging themselves to the success of the project.

We are hoping the Dahrouge team leads MEG to a Patriot style discovery of its own.

We like that the Dahrouges (as MEG’s biggest shareholder) are aligned with other shareholders and would likely be motivated to make a discovery happen.

What about MEG’s Rare Earths project?

We are also looking forward to seeing what comes from exploration at the company’s US based rare earths project.

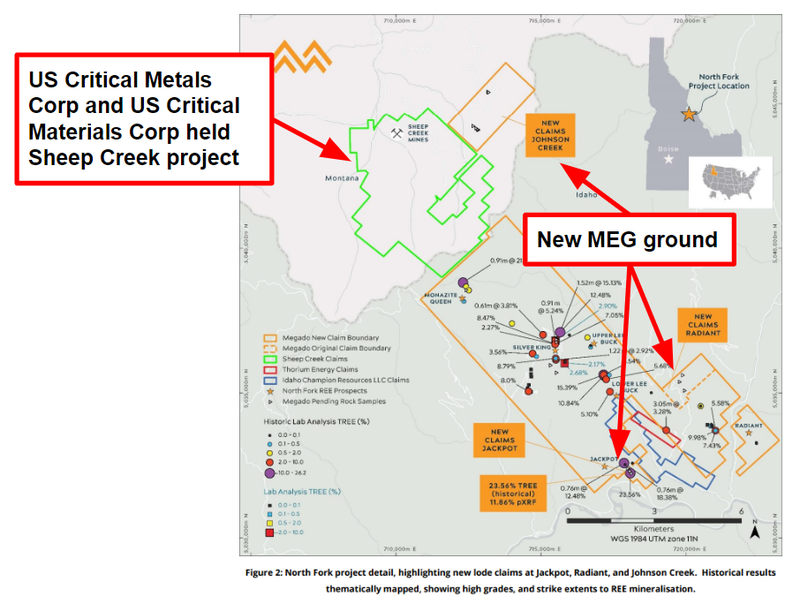

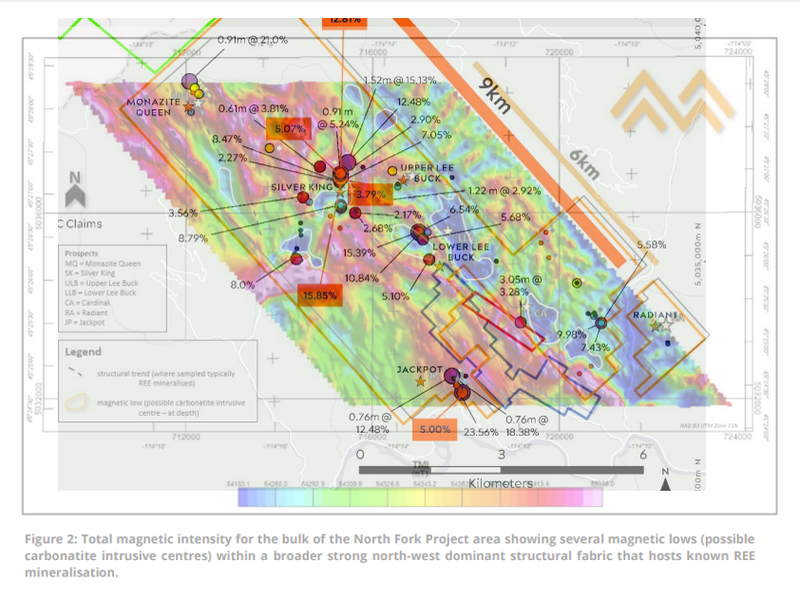

MEG holds ground in Idaho that is prospective for a carbonatite hosted rare earths discovery.

Carbonatites are the same rock structures that host Lynas Rare Earths Mt Weld project.

Mt Weld is the highest grade, already producing, rare earths mine in the world with average total rare earth oxide (TREO) grade measuring ~5.4%.

MEG’s project is still at the pre-drilling stage BUT has already returned rock chip samples with total rare earth oxide (TREO) grades as high as 17.7%.

While rock chips don't always lead to discoveries, they are generally a good indicator of whether or not there are mineralised rocks in an area AND whether or not a company should spend capital drill testing those rocks.

MEG’s project also benefits from being located in a mining-friendly part of the USA.

Earlier in the year we mentioned that US based commodities (especially critical materials) is a space where we expect to see large capital inflows.

(Source)

Central to our macro outlook on US based commodities is all of the capital pouring into local supply chains, for the supply chains to be secured the US needs more local minerals discoveries.

Our view is that if major discoveries of critical raw materials are made inside the USA they will be valued at premiums to other discoveries outside of the USA.

Think of this as a geographic premium applied to discoveries inside the USA.

At this stage MEG’s project is pre-discovery BUT we think at MEG’s current market cap of ~$11M, the risk/reward is exactly what we look for in our Catalyst Hunter portfolio.

In the event MEG makes a rare earths discovery we think it could significantly re-rate MEG’s market cap.

A recent timeline on MEG’s US rare earths project:

27th February - MEG increased its landholding at the project. See our Quick Take on the news here: Megado gets new rare earths ground in USA

14th March - MEG put out more high grade rare earths rock chip sampling results (up to 15.85%). See our Quick Take on the news here: More rare earths at Idaho rare earths project; 15.85% TREE

29th March - MEG put out some geophysics results highlighting two distinct new carbonatite targets. See our Quick Take on the news here: MEG finds more carbonatites at Idaho Rare Earths Project

Below is an image overlaying the rock chip samples with the geophysics:

What’s next for MEG?

Fieldwork at James Bay lithium project 🔲

The next step for MEG will be to pick out the best parts of its project to go and sample.

Ultimately all of the work done to date will help define where the company focuses when it gets on the ground and starts looking for lithium bearing pegmatites.

MEG expects to be on the ground in Canada after the snow season is finished with drilling planned for after this.

Typically the Canadian winters run through to the end of March/early April so we shouldn't have to wait too long for on-ground exploration to start.

Fieldwork at US rare earths project 🔲

Similar to its Canadian project, MEG is waiting for the US winter months to end so that on ground exploration can start.

Similar to Canada, we expect MEG to be active over the next ~6-9 months, noting that the US/Canadian winters tend to start towards the end of every year.

MEG also noted in its most recent announcement that it is currently working toward permitting for a maiden drill program - hopefully this means MEG will get out and drill the project this year.

MEG has previously guided for a drill program on its rare earths project in mid to late 2023.

What are the risks?

As with all early stage explorers that are risks to consider with MEG - click on the image below to see more detail about the potential risks:

Our MEG Investment Memo:

Below is MEG Investment Memo, where you can find a short, high level summary of our reasons for Investing.

In our MEG Investment Memo, you’ll find:

- Key objectives for MEG for the coming year.

- Why we are Invested in MEG

- The key risks to our investment thesis

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.