LRS raises $35M to fast track Lithium project

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 6,355,000 LRS shares at the time of publishing this Update Article. The Company has been engaged by LRS to share our commentary on the progress of our Investment in LRS over time.

The macro tailwinds just keep getting stronger for the lithium market.

Lithium carbonate prices are sitting at US$80,000/tonne — up almost 800% in the last 12 months. And now Elon Musk’s Tesla is looking for direct lithium exposure, threatening to make a foray into the lithium mining space.

With that in mind, our exploration investment Latin Resources (ASX:LRS) has now secured what could be a company-making capital raise.

LRS today announced that it has raised $35M to expedite its lithium business.

Just as importantly, the capital raise (at @16c per share) has brought new institutional investors onto LRS’s register.

This includes a cornerstone investment by experienced lithium investors, Canada-based Waratah Capital’s “Electrification and Decarbonization Fund”, which took $15M of the raise.

Waratah Capital manages over CAD$3 billion in assets and is also behind “Lithium Royalty Corp”, which holds royalty investments in lithium explorers including Core Lithium, Sayona Mining and, interestingly, LRS’s Brazilian neighbour Sigma Lithium.

Bringing institutional backing — with the financial firepower to finance drilling programs — onto the company’s register points to LRS having everything in place to accelerate its drilling program.

To that end, LRS confirmed that it is planning on securing an additional two drill rigs, taking its total fleet to four. The drilling will be focused on delivering the following:

- The ultimate aim of proving up a maiden JORC resource estimate at its new discovery by drilling at least 25,000 metres.

- Chasing new discoveries with 5,000 metres of drilling at the newly acquired Monte Alto prospect and Salina South prospect.

This comes just days after LRS reported assay results from drill holes three and four, both of which returned thick high-grade lithium mineralisation of well above economic lithium grades.

These assays demonstrated that LRS’s discovery stacks up both in terms of thickness (of up to 17m) and continuity of grades along strike against its multi-billion-dollar peers.

Heading into this first round of drilling, we wanted confirmation that the project had potential to warrant follow up drilling programs.

We thought that if LRS could show that the lithium project warranted follow up drilling, it could raise some fresh capital and look to delineate a resource from it.

But the drilling program has already surpassed the expectations we set out in our 2022 investment memo.

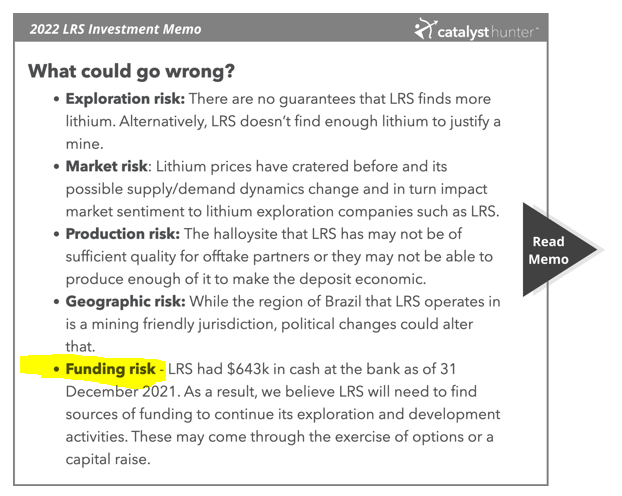

LRS has confirmed a new discovery in just its first round of drilling, at the same time taking care of the “financing risk” that we flagged in our 2022 Investment Memo.

Readers who have been following our previous notes on LRS may remember that whilst there was financing risk, LRS’s decision to delay a capital raise could pay off handsomely if a discovery was made. Then, the eventual raise could be done at a much higher share price.

The LRS share price is now up ~450% from 3.5c before the drilling program to trade at ~19.0c now. This has seen LRS secure funding at multiples of what could have been received back in February.

LRS took the risk and it paid off.

LRS has now significantly de-risked its balance sheet with the $35M in fresh capital. That means it can now deploy that capital to aggressively drill towards Objective #1 of our 2022 Investment Memo — establishing a maiden JORC resource estimate for its lithium project.

More on the capital raise

Today’s capital raise is a milestone moment for our investment in LRS.

Junior explorers rarely see amounts like this raised until after they have made a discovery that warrants the attention of institutional investors.

Raising $35M @16c per share, and being cornerstoned by a highly experienced lithium investor such as Waratah Capital, is a sign of external validation for LRS’s new discovery.

The placement also came with 2-for-1 free unlisted options with a five-year expiry, exercisable @22c per share.

All up, this means LRS will be issuing the following:

- 218,750,000 in new shares

- 98,375,000 in unlisted options

Who is Waratah Capital and why are they interested in LRS?

Waratah Capital manages over CAD$3 billion in assets and is behind the “Waratah Electrification and Decarbonization (E&D) Fund”, which took $15M of the capital raise today.

This is the same group behind “Lithium Royalty Corp” which has royalty investments in lithium explorers Core Lithium, Sayona Mining and, interestingly, LRS’s CAD$1.2 billion capped neighbour Sigma Lithium.

It is this investment in LRS’s neighbour in Brazil, Sigma Lithium, that is the most interesting to us. The Waratah team know the area well, having been active in the space before.

Any discovery by a billion-dollar explorer will always attract some level of institutional investor interest as they look to get involved and pour capital into growing a new discovery.

We suspect the strong interest seen in the capital raise was due to the potential for leverage. LRS was capped at $313M (before the @19c per share capital raise), meaning that Waratah can add value by funding additional drilling for LRS to prove out its discovery, establish a JORC resource, and re-rate in line with its larger peers.

The Waratah E&D Fund’s investment mandate is largely focused on ESG principles, with a goal to “achieve attractive risk-adjusted returns through investments in battery material, decarbonisation, and electric vehicle related opportunities”.

We also note from this press release by Waratah and Lithium Royalty Corp:

We suspect that LRS’s commitment to best in class ESG reporting made LRS that much more attractive as an investment proposition.

Long time readers will know that we like seeing our portfolio companies adopt best in class ESG reporting in order to attract this type of capital. Today’s news for LRS is a sign of validation for what is a core part of our investment criteria.

LRS’s ESG disclosures progress summary can be seen here:

LRS’s full ESG report report can be viewed by clicking the image below:

Off the back of today’s announcement, LRS has addressed a significant risk that we flagged in our 2022 Investment Memo — “funding risk”.

LRS went into the drilling program with around $604k in cash, and most of its funding coming through options conversions and a $2.5M funding facility from Lind Asset Management.

LRS has now significantly de-risked the company and has added $35M in fresh capital to the balance sheet.

Off the back of this, we have adjusted our 2022 Investment Memo, removing “funding risk”, as we now believe that funding is unlikely to be an obstacle for the remainder of the year.

More on the assays from earlier in the week

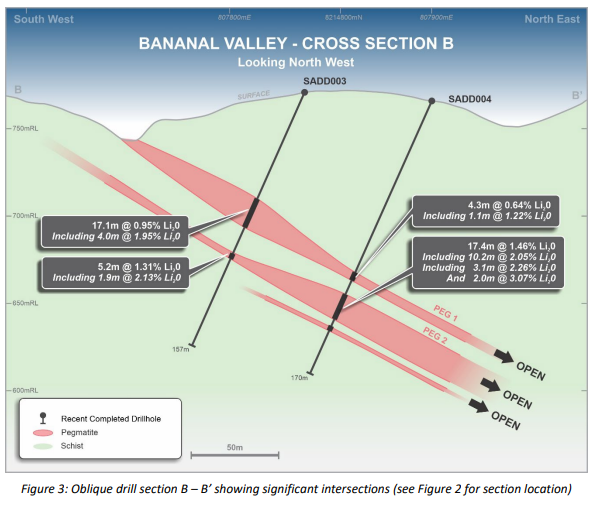

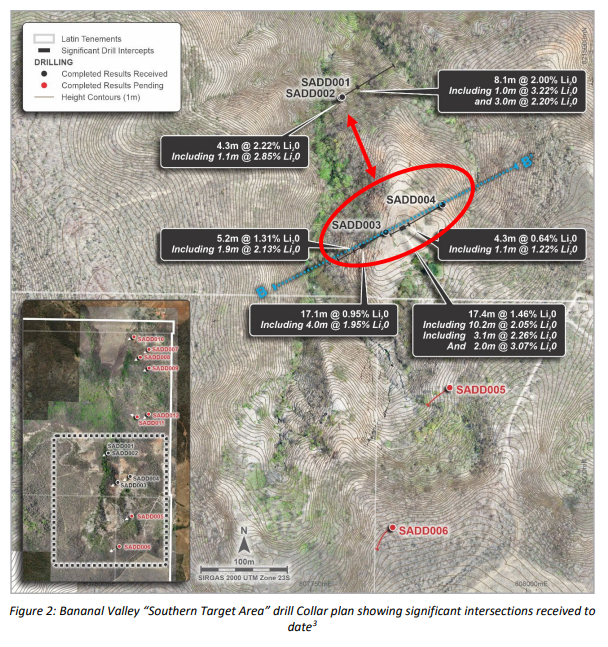

The most recent assay results are from drill holes three and four – labelled SADD003 and SADD004, which were very well received by the market, included:

- SADD004: 17.38m @ 1.46% Li2O from 119.80m

- SADD003: 17.05m @ 0.95% Li2O from 65.65m

Across the two holes, the intercepts also contained lithium grades as high as 3.07% Li20 over 2m.

The main takeaway from these assays is that they both came from intercepts of more than 17m in thickness and are well above economic lithium grades.

These two holes were drilled ~100m to the south of the last batch of assays that, as we wrote about in our last note, confirm that the lithium discovery is getting bigger both in terms of length and thickness towards the south.

LRS’s discovery indicates that the deposit likely extends down towards the south, while also proving that the deposit gets thicker along strike.

Having confirmed that the intercepts are still mineralised well above an economic cut-off of ~1% lithium hydroxide, the more significant takeaway is the fact that these assays are almost 2.5x the thickness of the first two assays.

The first two assays measured 4.3m and 8.1m.

The latest assays range from 4.3m all the way up to 17.4m, with the two highlight assays being 17.1m and 17.4m.

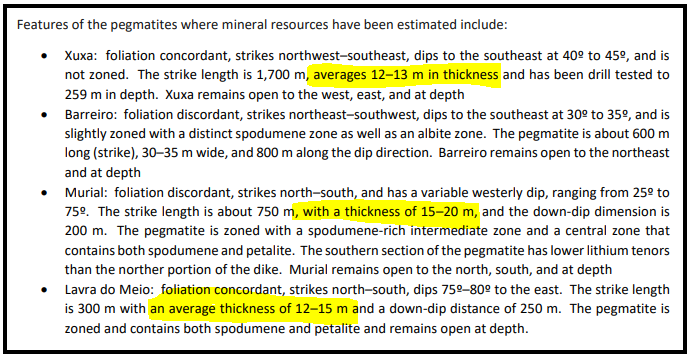

Putting this into context, LRS’s neighbour CAD$2 billion capped Sigma’s ~46mt @ 1.38% lithium esource sits across ~4 deposits with pegmatite intercepts starting from a few metres up to ~20m.

Below is an extract from the technical report showing the main orebodies are averaging 12-20m.

LRS’s first two assays showed really high grade lithium, but the caveat was always going to be that the intercepts were only 4m and 8m respectively.

LRS has since shown the market that its discovery stacks up both in terms of thickness (of up to 17m) and continuity of grades along strike against its multi-billion-dollar peers.

Previously, LRS’s discovery seemed to be concentrated in the southern section of its project across a ~500m strike.

But now that LRS has hit ~8m of spodumene bearing pegmatites ~350m to the north, the potential strike length has doubled to ~1km.

Putting all of this together, what do we know about LRS’s discovery so far?

- The potential strike length is ~1km from drillhole 11 and extending down to drillhole 6 ✅

- Assays have come back with intercepts ranging from ~4m to ~17.4m and with lithium grades as high 3.07% ✅

- The discovery is extending along strike to the south and is open down dip to be tested for potential extensions with deeper drilling ✅

What do we want to see LRS do with the discovery?

LRS had already hinted at bringing in additional drill rigs to accelerate its drilling program.

We will now be watching to see what comes of the remaining assays.

If grades continue at or above ~1% and LRS can keep drilling out extensions in both strike length and width, it will be a step closer to putting out that JORC resource estimate.

Junior explorers often see a real re-rate once a JORC resource is defined, as it gives the market a better understanding of what a company has on its hands as a base in-ground resource.

In our last note, we put together a peer comparison between LRS and some of the hard rock spodumene explorers/producers that have market caps in the billions of dollars.

To see that comparison check out our previous note here.

What’s next for LRS?

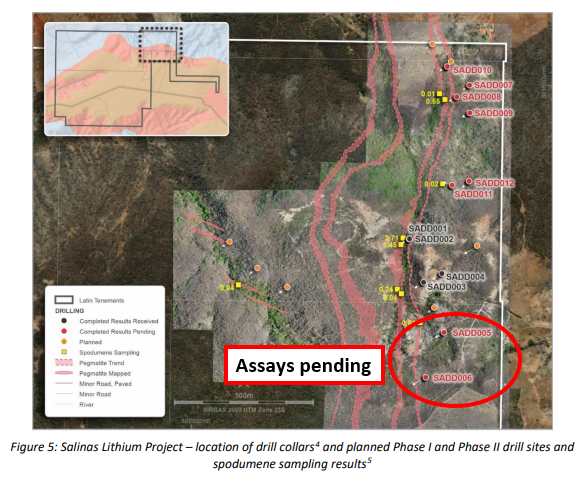

Assays pending from other drill holes 🔄

LRS is now up to the 12th drillhole of its current drilling program.

Holes five and six both intercepted between 10m and 32m of spodumene bearing pegmatites so we will be watching to see the assays from both those holes.

LRS expects to receive these in the “coming weeks” and we will be hoping that the assays are indicative of more high grade lithium mineralisation.

Below is an image of the spodumene crystals from drillhole 6 (assays pending).

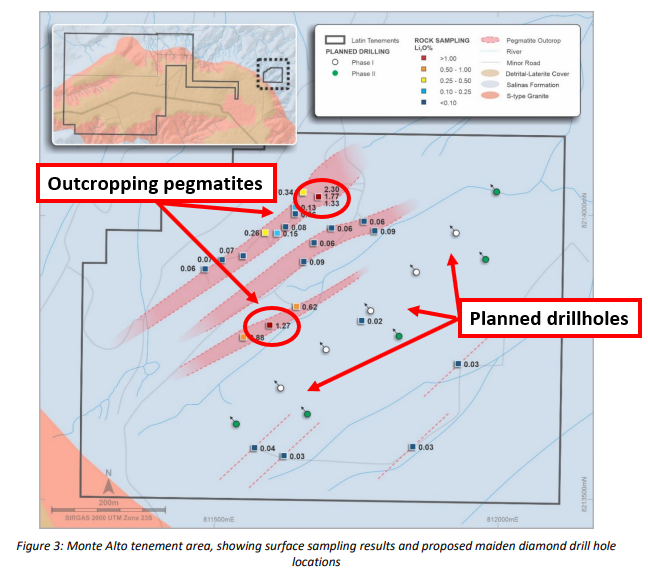

Drilling at the newly acquired Monte Alto and Salinas South prospects 🔄

LRS has committed to doing up to 5,000m drilling across the newly acquired Monte Alto prospect and the Salinas South prospect.

The Monte Alto prospect which was picked up a few weeks ago, has outcropping spodumene bearing pegmatite grading up to 2.30% lithium.

Below is an image of the rock chip samples and LRS’ planned drill holes to test these structures.

25,000m of drilling to define a maiden JORC resource estimate 🔄

LRS wants to add two new drill rigs to its fleet and do 25,000m of additional drilling to prove out a maiden JORC resource estimate.

This will mean LRS has two drill rigs running in the southern part of its project and can quickly get the data together to be able to build out a JORC resource estimate.

Most of this drilling will be “infill drilling”, meaning it will target areas where LRS is looking to extend the known mineralised structures.

Our investment plan:

LRS has now risen over 1,000% (exceeding our expectations for 2022) and in accordance with our investing strategy we have sold enough to be free carried, taken some profit and are holding the majority of our position into the next phase of the company's growth as they deploy the $35M they have just raised.

It’s not often that an investment plan in small cap investing comes together so well, and we are very happy with our Investment in LRS and look forward to the next phase over the next couple of years and beyond.

Given the material change in the company's cash position we will release an updated LRS investment memo in the coming weeks where we will adjust our expectations with regards to what the company can deliver in 2022 with an increased cash position.

Our 2022 LRS Investment Memo

Below is our 2022 Investment Memo for LRS where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to track the progress of our portfolio companies using our Investment Memo as a benchmark, throughout 2022.

In our LRS Investment Memo you’ll find:

- Key objectives for LRS in 2022

- Why we continue to hold LRS

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.