High Grade Gold Hits Struck 350m South of 118koz Gold Deposit

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Kairos Minerals (ASX:KAI) has been riding a newsflow wave recently, particularly in relation to its highly prospective Roe Hills Project in Western Australia.

At a glance, this project shows considerable promise.

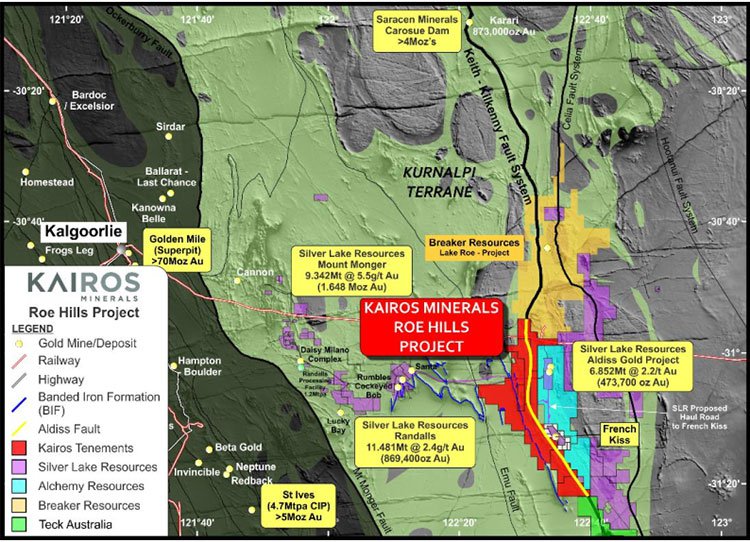

Located 120km east-south-east of Kalgoorlie in WA’s globally renowned Eastern Goldfield region, the project is situated next door to and over the same geology along strike to the south of Breaker Resources’ (ASX: BRB) Lake Roe gold discoveries.

Bear in mind that BRB’s Lake Roe gold discovery was responsible for pushing the company to a $90 million market cap in a very short space of time.

Importantly, BRB is just eight months ahead of KAI in terms of progress, but the $7.7 million capped KAI has already exceeded BRB’s current drilled depth and mineralisation.

Could KAI produce a similar find and produce its own significant new goldfield?

Time will tell – and that would be a catalyst in itself – but the numbers at this stage are highly encouraging.

Of course, if considering this stock for your portfolio, you should take into account your own personal circumstances and risk profile and seek professional financial advice.

Highly positive results were determined in early July this year.

On July 12, an aircore (AC) drilling program testing for cobalt and gold returned impressive assay results: high-grade, shallow cobalt mineralisation of up to 1.36% cobalt int ersected. The cobalt grades intersected were extremely high compared to other Australian cobalt projects and other nickel-cobalt oxide deposits globally.

Now just weeks after this high-grade cobalt discovery, KAI has announced that new high-grade primary gold zones have been discovered at Roe Hills.

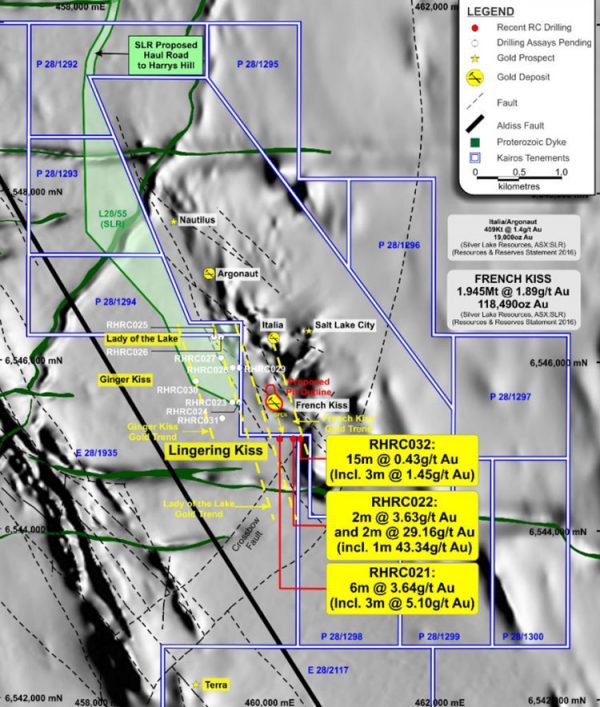

Broad spaced maiden reconnaissance Reverse Circulation (RC) drilling at KAI’s newly identified ‘Lingering Kiss’ prospect at Roe Hills intersected strong mineralisation in multiple stacked lodes, including up to 43.3g/t gold.

Lingering Kiss is located just 350 metres south of the $229.1 million capped Silver Lake Resources’ (ASX:SLR) 118,490oz French Kiss gold deposit, where Silver Lake has commenced preparations for mining.

Let’s look at this latest drilling in more detail:

The Catalyst: Positive assay results and more due in coming weeks

Significant high-grade primary gold mineralisation has been intersected in maiden reconnaissance RC drilling at KAI’s recently identified Lingering Kiss prospect.

Assay results included six metres grading 3.6 grams per tonne gold from 102 metres and two metres grading 29.1 grams per tonne gold from 120 metres.

Three wide-spaced reconnaissance RC drill holes were completed at Lingering Kiss as KAI expands its gold-focused drilling program at Roe Hills.

They each intersected multiple zones of significant primary gold mineralisation, including very high grade intervals (greater that 1 oz/t gold) within broader low-grade mineralised envelopes. The wide-spaced drilling was completed along a single section, circa 250 metres in width, with the mineralisation remaining open in all directions.

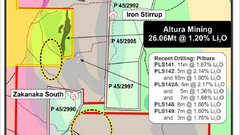

You can see the drilling locations laid out in the map below:

Preliminary indications are that the gold mineralisation intersected at Lingering Kiss represents the southern extension or repetition of the French Kiss deposit.

These results follow earlier significant results from gold drilling at Roe Hills’ Terra, Lady of the Lake, and Talc Lake prospects.

Assay results from the balance of the recently completed 2,800m gold drilling program at Roe Hills are expected in the coming weeks, where a number of high-priority gold targets have been investigated.

Lingering Kiss: an extension of French Kiss

The Roe Hills project is situated within the Southern Kurnalpi Terrane of the Eastern Goldfields in WA — a rapidly emerging and highly prospective gold province. The region is currently enjoying significant investor interest and exploration activity, with a cluster of important gold discoveries by Silver Lake Resources and Breaker Resources.

KAI’s new prospect, Lingering Kiss, is located just 350 metres south of Silver Lake’s French Kiss Gold Deposit, which hosts a total Indicated and Inferred Resource of nearly 2 million tonnes, grading 1.89 grams per tonne gold for 118,490 ounces. The French Kiss deposit is a key component of Silver Lake’s Aldiss project, which it plans to bring into production in 2019.

KAI’s Lingering Kiss prospect is a highly ranked structural target identified from detailed airborne magnetic and ground gravity survey data. It is situated proximal to an east-west trending Proterozoic Dolerite Dyke, at the confluence of the interpreted north-south trending French Kiss Shear Zone and a major regionally recognisable north-east trending structure now described as the ‘Crossbow Fault’.

The Lingering Kiss results add to the known extensive gold endowment within the project, which is not only in close proximity to the French Kiss deposit, but also just south of Breaker Resources’ (ASX: BRB) emerging Lake Roe/Bombora discovery.

And, as we alluded to earlier, KAI is already in a better position than BRB was at the same of exploration.

BRB went from a sub-$10 million market to over $90 million today.

Can KAI do the same? Time will tell.

However at the same time, this stock is speculative and investors should consider all public information not just the information in this article and seek professional financial advice before making an investment decision.

The project’s location — and intriguing proximity to the two key Silver Lake and BRB discoveries — is made clear in the map below:

Bearing all this in mind, this area can certainly be considered highly prospective.

Lingering Kiss also represents an essential new addition to the growing pipeline of abundantly mineralised zones recently identified by KAI at Roe Hills, all of which offer strong potential for the near-term definition of significant gold resources.

Multiple zones of significant primary gold mineralisation intersected

The result is a valuable milestone for KAI at Roe Hills and has a number of things going for it:

- The broad lateral extent and quality of the mineralisation (assays grading up to 43.34 grams per tonne gold);

- Its proximity to the French Kiss gold deposit;

- The favourable geological setting; and

- The fact that the mineralisation remains open in all directions.

Coming up with strong primary mineralisation of significant grade over multiple stacked lodes is a confidence-boosting achievement. It also provides an immediate focus for KAI’s team as a near-term resource development opportunity.

Also of potential advantage for KAI is the fact that the Roe Hills project has experienced little exploration activity, despite having widespread mineral endowment.

Given these results and the excellent progress made by Breaker Resources and Silver Lake Resources in the same region, the pending results expected in the coming weeks are decidedly anticipation-worthy, and these should assist the company in shaping the next phase of exploration.

Looking forward

KAI controls a continuous 40 kilometre strike length of the same prospective package which hosts Breaker Resources’ discovery to the north, with the company now aiming to target areas that will provide the most optimal chance of making a world-class discovery.

Whether this happens or not is speculative at this stage, so investors should approach any investment decision with caution.

Plenty of news flow has also come out of KAI’s other projects that span gold, lithium, cobalt and nickel, making for a pleasingly diversified portfolio.

Yet, the immediate potential catalyst is the current assays and further results to come out of Roe Hills — results that could translate to a share price rerating for KAI.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.