GGE helium drilling: Approaching the “gas pay zone”

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 25,011,058 GGE shares at the time of publishing this article. The Company has been engaged by GGE to share our commentary on the progress of our Investment in GGE over time.

We are about to go into four long days of no trading on the ASX.

This comes as a few companies in our Portfolio reach the pointy end of their drilling campaigns.

We expect material updates on progress once the market re-opens early next week.

One of those is helium explorer and our 2021 Catalyst Hunter Pick of the Year, Grand Gulf Energy (ASX:GGE 🇦🇺 | OTC: GRGUF 🇺🇸).

GGE is one to watch next week with long awaited drill results expected.

GGE is currently drilling its Jesse-2 helium well in Utah, which is aiming to determine commercial helium flow rates, building on last year’s discovery.

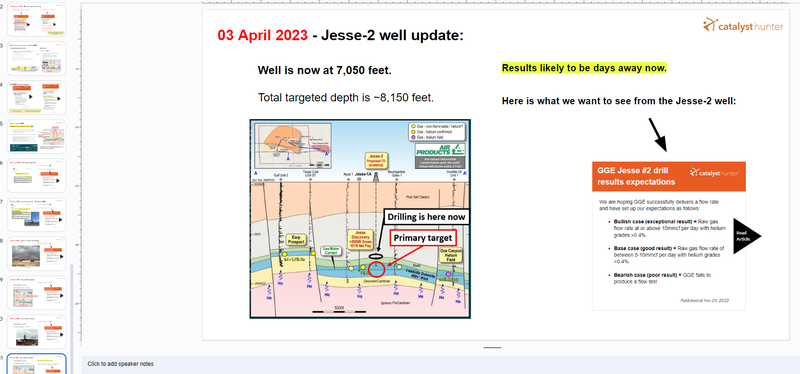

On Monday the drill bit was 7,050 feet down, heading toward its target total depth of 8,150 feet.

Today, GGE said it would be drilling into the primary reservoir target next week.

Given it is so close to target depth, and that GGE has flagged it will move straight into production testing once target depth is reached, we anticipate more material news for the company next week.

Today, GGE announced that drilling had so far hit multiple helium shows and grades ~71x background levels OUTSIDE of its primary target.

So we know GGE is getting high concentrations of helium before it even reaches its target reservoir.

High helium concentrations is a good sign that GGE is drilling toward a working helium system.

🏹 GGE expects to drill into the main reservoir section next week - this could mean a major catalyst materialises straight after the Easter break.

Below is a video update from GGE’s Managing Director Dane Lance on the latest at the Jesse-2 well:

GGE declared a helium discovery at its Jesse-1 well last year, with helium grades of ~1% helium and a net pay of ~31 metres.

The goal of the current drilling is to confirm helium flow rates, and then move swiftly into development and production.

GGE’s project sits inside the “Saudi Arabia” of helium.

The project is on trend with the Doe Canyon helium field (responsible for ~50% of North America’s helium supply).

GGE has all of the necessary pipeline infrastructure in place and an offtake agreement with the owner of the nearby Lisbon Helium processing plant.

If GGE flows commercial rates of helium it could get the project into production exponentially quicker than a more greenfields discovery which has major CAPEX hurdles.

The good news so far is that GGE hasn't had any operational issues, drilling is going as planned.

With the well about to go through into its primary target, here is the context on GGE’s drill program and what we think success would look like.

What GGE is doing & what success looks like

GGE’s helium project has the following going for it:

1) Neighbour’s helium fields produce ~50% of North America's helium - GGE is drilling just ~24km away from the Doe Canyon helium field owned by $94BN US listed Air Products.

2) Sits near idle pipeline & processing infrastructure - GGE can tie its project into existing pipeline infrastructure in the region.

3) Offtake with nearby helium plant owner - GGE already has an offtake agreement in place for its helium with the owner of the nearby Lisbon helium processing plant.

Last year GGE first made its helium discovery, however it couldn’t produce a flow rate. The issue was that GGE drilled into the “water contact zone” which prevented it from producing a flow rate.

This time around, GGE will drill just above the (now known) water contact zone (~16m above the previous drilling) and expects to produce a flow rate.

Below is a visual of the well design:

Here is what we now know about GGE’s target

✅ A proven helium structure - A >61m gross gas column (with ~31m of independently audited net pay).

✅ Commercial helium grades - Helium grades of up to 1% returned to surface (higher than our 0.4% expectation)

Here is what GGE is trying to achieve

🔄 Commercially viable flow rate - GGE’s Jesse-2 well is being drilled with this goal in mind.

The commercially viable flow rate is the final hurdle for GGE to take its helium project from the exploration stage directly into the production stage.

GGE will be able to skip the development stage of a new discovery (which can take years) and significant capital expenditure (potentially hundreds of millions of dollars for a greenfield discovery) thanks to the region’s existing infrastructure.

Instead, GGE can put production infrastructure in place at the well site and tie it into existing pipelines that run directly to its offtake partner Paradox Resources’ Lisbon helium processing plant.

GGE is therefore largely de-risked from a development perspective.

This is contrasted with new discoveries that can sit stranded due to the high costs of constructing processing plants, roads, pipelines, and even ports).

GGE doesn't have this problem.

Given the existing offtake agreement and the partnership with Paradox Resources, GGE could be in a position where it starts selling its helium having only outlayed very minor expenses (CAPEX).

All that is needed now is a commercially viable flow rate which is exactly what GGE will be targeting with its drilling of the Jesse-2 well.

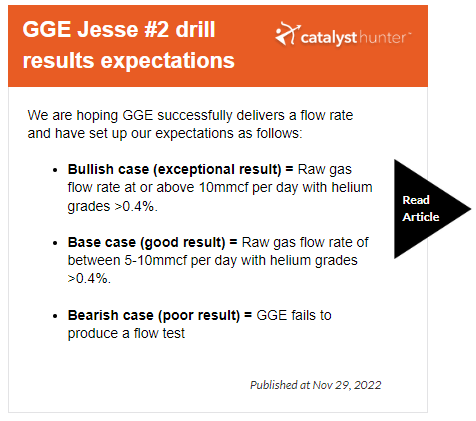

With drilling results due in the coming weeks our Bull/Base/Bear case expectations for the drill program are as follows:

Our expectations are based on the flow rates being achieved at the Doe Canyon helium field ~24km east of GGE’s project.

The average flow rate across the Doe Canyon wells is ~20mmcf per day with helium grades of ~0.4%.

Update on our Investment Plan

At this stage in GGE’s drill program, a lot of the drilling outcome will depend on luck.

Either GGE produces a commercially viable flow rate, or it doesn't. The market is largely expecting some sort of a flow rate, and so any outcome to the contrary will likely lead to a re-rate down in GGE’s share price.

If GGE does produce a commercially viable flow rate (or exceeds it), we think that will significantly de-risk the project and the market may re-rate GGE higher with the view of it being a potential helium producer.

In line with the binary outcome (versus market expectations), we have followed our Investment Plan as per our GGE Investment Memo.

Since we first Invested in late 2021, we have achieved Free Carry by gradually de-risking into the lead up of the last two wells (~50% of Total Holding) - our standard oil & gas explorer strategy.

Our plan now is to hold our position into this upcoming result next week, and hopefully into production

We hope GGE can go from helium developer to producer and drill out future helium wells from cash flow generated from the Jesse prospect.

This brings us to our “Big Bet” for GGE:

Our ‘Big Bet’

“GGE makes a commercial helium discovery, ties it into the existing local processing infrastructure, and becomes a USA helium producer - or gets taken over.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our GGE Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor the progress GGE has made since we first Invested and how the company is doing relative to our “Big Bet”, we maintain the following GGE “Progress Tracker”:

More on GGE’s recent capital raise

Just last week GGE raised $2.5M, adding to its $4.9M cash balance (at 31 December 2022).

The raise was done at 2.2 cents per share.

The placement also came with 1 free option for every 2 shares purchased in the raise. The options have an exercise price of 5 cents per share, expiring in three years time.

This means an additional ~113 million new shares came onto the market on 31 March 2023.

Since the placement shares came to market we have been watching to see some churn as short term traders sell out at, or close to, the placement price.

Typically with placements, there will be a small proportion of investors who sell down some of their positions relatively quickly.

In the short term this isn't great for the share price, but in the long run it creates a higher base for the share price that the company can re-rate off of.

We note that the raise was done to “accelerate the completion and development of Jesse-2 including long lead production equipment, subject to the success of Jesse-2” which we see as a sign of confidence from the company in the potential of the well.

The placement means that GGE is well funded in the event the drill program is a success so there shouldn't be any immediate need for a large capital raise to fund development.

Ultimately, the move in GGE’s share price will depend on drill program results, independent of the capital raise recently issued shares.

What’s next for GGE?

Drilling of the Jesse-2 well

- ✅Drilling commenced - Drilling started around 15 March 2023.

- 🔄 Drilling to 8,150 feet Total Depth (TD) - Drilling is currently at a depth of ~7,050 feet.

- 🔲 Flow rate results - We expect to see this news a few weeks after drilling is completed.

✅ Permitting for a third helium well

GGE confirmed today that it had just permitted its third Jesse well.

Interestingly, the permit is for another well at the company’s Jesse prospect and is approved to allow for a follow up development well (conditional on the Jesse-2 well being a success).

GGE had multiple other prospects it could have prioritised a permit for but has instead decided to go ahead and permit a third Jesse well.

We see this as a sign that the management team are confident the Jesse-2 well will come in and warrant a follow up development well.

For some context on what GGE is looking to emulate, the Doe Canyon helium field next door is producing helium from over 20 wells, GGE would be producing from just one (IF the Jesse-2 well is a success).

Overall we think the decision to permit a Jesse well is a good move.

What are the risks?

GGE already has a working helium system in place, Jesse-2 is about testing for a flow rate.

As a result the primary risk for GGE’s Jesse-2 well is “commercialisation risk”, which we detailed as part of our GGE Investment Memo:

Our GGE Investment Memo

Below is our GGE Investment Memo where you’ll find:

- Key objectives we want to see GGE achieve

- Why we Invested in GGE

- The key risks to our Investment thesis

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.