FNT Rock Chip Samples are in - Peak Grade >8%

Our recent rare earths investment, Frontier Resources (ASX:FNT), just came back with rock chip samples from its WA project, with an impressive peak grade >8%.

The rock chip samples include high grades of neodymium (Nd) and praseodymium (Pr) — two rare earth metals essential for manufacturing the permanent magnets found in EVs and wind turbines.

As a result of today’s news, FNT’s footprint of known Rare Earth Elements (REE) mineralisation is now greater than 2.5km.

We think given the EM targets already found and now high grade rock chips, this strike length is a solid starting point for a maiden drilling campaign, which is expected next quarter.

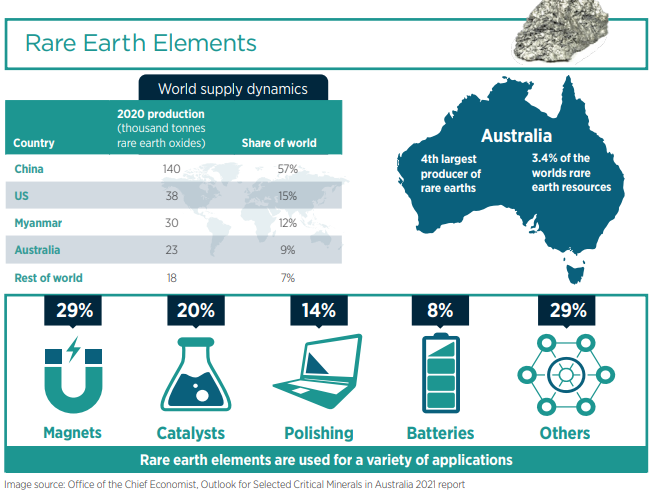

Rare earth metals like neodymium and praseodymium are crucial for the energy transition, and we note that China currently accounts for the majority of rare earths production.

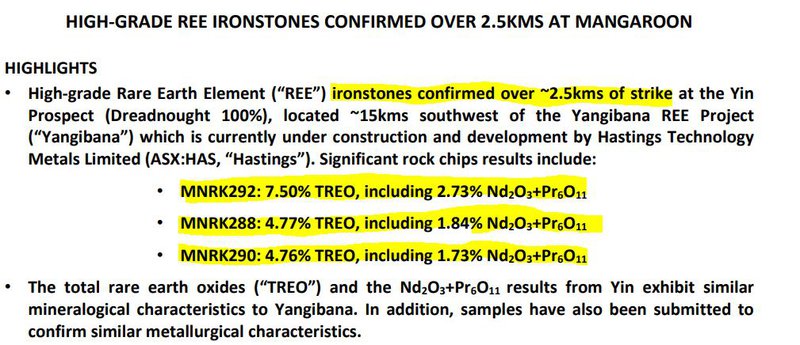

We think the assay results from the rock chip samples announced today compare well with the results that made the neighbouring Dreadnought Resources re-rate back in July 2021.

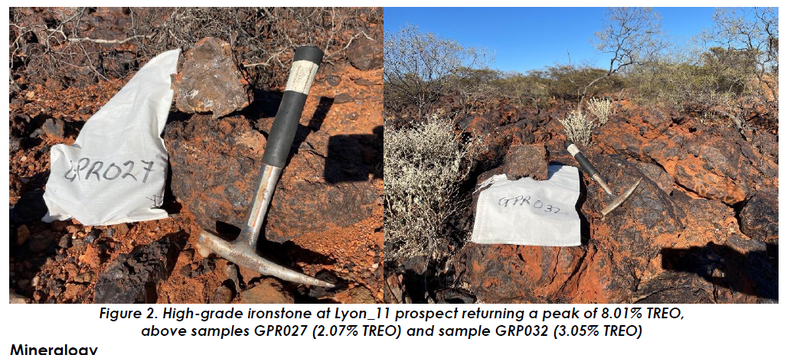

FNT’s results include peak rock chip sample grading 8.01% TREO (Total Rare Earths Oxide).

It’s important to know that those neighbouring Dreadnought rock chip samples came from the same host rock, ironstone, which FNT sampled at their WA rare earths project.

Dreadnought Resources moved from ~2.5c to a high of ~6.2c off the back of its rock chip sampling results, and this move added ~$91M to Dreadnought’s market cap.

Today’s good results from FNT further validates their aggressive exploration strategy in an area of WA that is home to $467M capped Hastings Technology Metals’ Yangibana Rare Earths project.

Hastings’ project is set to become the next major rare earths producing project outside of China at a time when the world is desperate for more rare earths.

Which means that Hastings, Dreadnought and now FNT, are making a strong case for the area becoming a significant rare earths district.

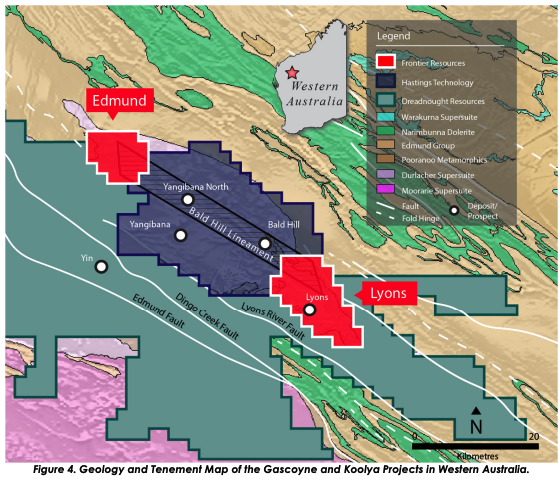

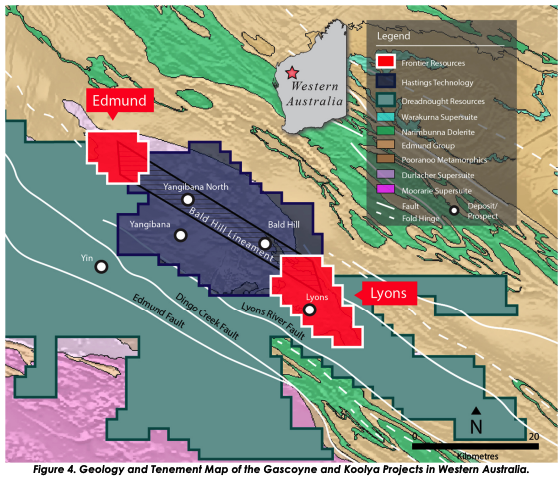

The map below shows the emerging rare earths district, with FNT in red ($21M market cap), Hastings Technology in dark blue ($476M market cap) and Dreadnought ($113M market cap) in teal below.

FNT is at the earliest stage of exploration, and we are hoping it can deliver value over the coming months and catch up to its bigger neighbours in valuation. Drilling next quarter will be crucial to this.

Interest in this district is increasing, especially in light of recent government initiatives around rare earths.

Australia has recently recognised the importance of rare earths and Prime Minister Scott Morrison announced last week (16 March) that the Federal Government is committing $243M in grant funding for the processing and refinement of critical minerals, as part of the Critical Minerals Accelerator Initiative.

This resulted in a $30M grant for NT-based Arafura Resources for its rare earths (NdPr) project. The company plans to construct a “first of its kind” rare earth separation plant - only the second of such plants outside of China.

While FNT may be too early stage to receive grant funding of this kind, the Australian Critical Minerals Accelerator Initiative shows that the government is serious about pushing rare earths projects in Australia forward.

We’re invested in FNT to see the results from their maiden drill campaign at their WA rare earths project, which we now know is slated for the later half of Q2 2022.

On Friday, FNT also announced the sale of their PNG gold project for a sum of A$2M, comprised of A$500,000 cash and a further A$1.5M either in cash or shares in a new company called Lole.

FNT will also get a further $1M if Lole can turn up a JORC resource of 500,000 oz of gold in the next 5 years.

We think this is good news for FNT as it means the company can now pour more cash into what we see as their highest priority project - the WA rare earths drilling campaign.

In this note we’ll also share the significance of rare earths for the energy transition - which we think underlines the growing importance of FNT’s rare earths project.

Frontier Resources

ASX:FNT

Below are the reasons we invested in FNT in 2022, drawn from our Investment Memo:

More on today’s announcement

With the announcement today, FNT has managed to overlay another critical bit of information as it moves forward towards its maiden drilling program at its rare earths project.

With ~134 rock chip samples collected from outcropping ironstone formations across its project, FNT has managed to return a peak rock chip sample grading 8.01% TREO (Total Rare Earths Oxide).

The good news for FNT is that they are finding a good ratio of Nd and Pr in their rock chip samples - in one sample’s case - it was as high as 58.8% of the total rare earth oxide (TREO) contained.

While these are just rock chip samples and the drilling will likely have lower grades, Hastings’ project has 27.42Mt @ 0.97% TREO with 0.33% Nd+Pr.

Across the entire batch of samples FNT returned 54 samples of potentially economic rare earth grades >0.1% TREO and 31 high grade samples >1% TREO - a positive early sign for FNT.

Armed with the sample results today, FNT’s footprint of known REE mineralisation is now >2.5km.

When looking at rock chip sample results it's important to look at them with some context. In isolation they could mean very little, but if it is a small piece to a larger puzzle, then the information gathered can be really important.

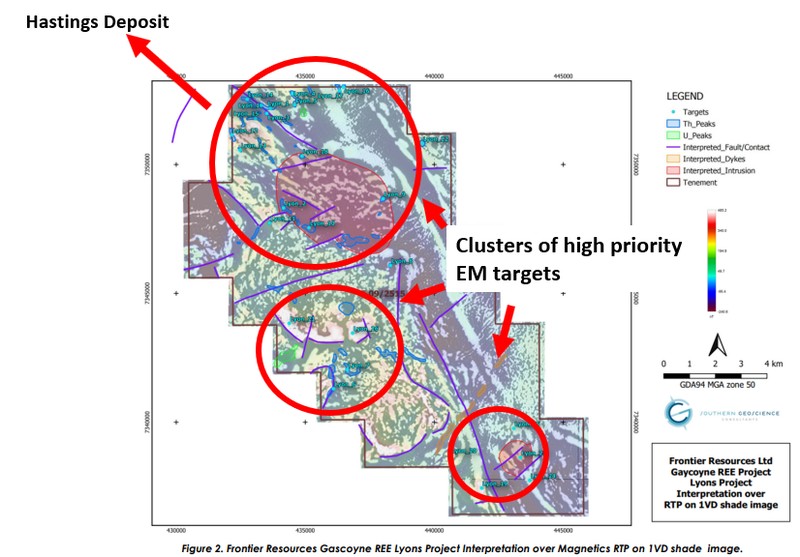

To do this, we need to go back to our last note on FNT where we covered the results from EM surveys.

These EM surveys generated 12 “high priority” drill targets that warranted follow up drilling.

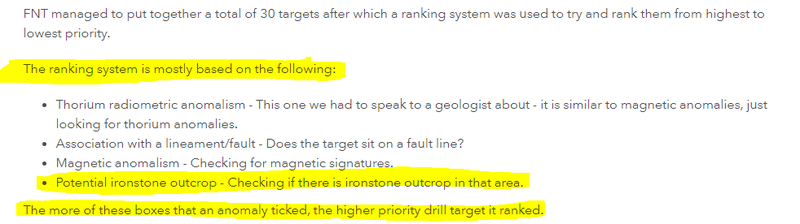

With over 30 EM targets detected, FNT used a ranking system to determine the 12 which were considered highest priority.

FNT wisely used the same ranking methods next door neighbour Hastings Technology Metals had used when they made there Yangibana discovery. Below is that ranking system:

Of particular note is the last of the dot points “Potential ironstone outcroppings”. The first stage of target generation works was to see if there were any ironstone outcroppings present in areas where the EM surveys were indicating FNT should be looking.

In our last note we also mentioned that FNT had sent out its team to do some “ground truthing” - this is where today’s rock chip sampling fits in.

Today’s sampling results are just another part of the whole target generation works that goes into preparing a drilling program. FNT identified the 12 high priority EM targets and then went looking at outcroppings in those areas to pinpoint which of these 12 should be drilled first and where FNT would invest the most amount of exploration effort and cash.

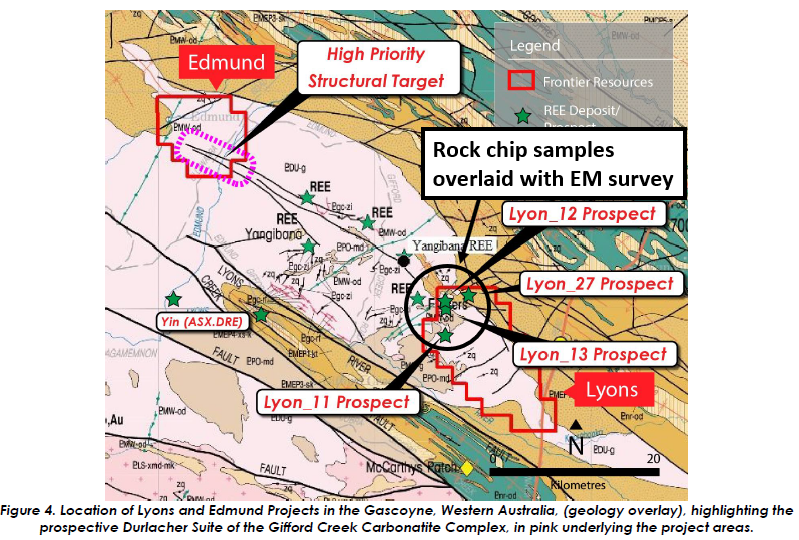

The image below shows in light blue where the cluster of EM targets were located, we are most interested in those adjacent Hastings tenements.

Now lets overlay a map of the rock chip sampling program:

The rock chip samples were taken at the north western corner of FNT’s grounds, right next door to Hastings and importantly right above where there was a cluster of high priority EM targets.

The significance of this?

Now FNT knows that the EM targets are correlated with ironstone outcroppings that are full of high grade rare earths - grading as high as 8.01% TREO (Total Rare Earths Oxide).

This isn't the last round of sampling FNT will be doing though. In today’s announcement FNT also flagged that they would be doing more rock chip sampling across the remaining EM targets and importantly over the high priority structural target to the north west of Hastings deposit.

Today’s announcement, coupled with the previous EM survey data, is laying the foundations for what we hope will be a strong maiden drilling program in Q2 this year.

With the ironstone outcroppings indicative of high grade rare earths in this part of FNT’s grounds, we think that the drilling program just got that much more interesting.

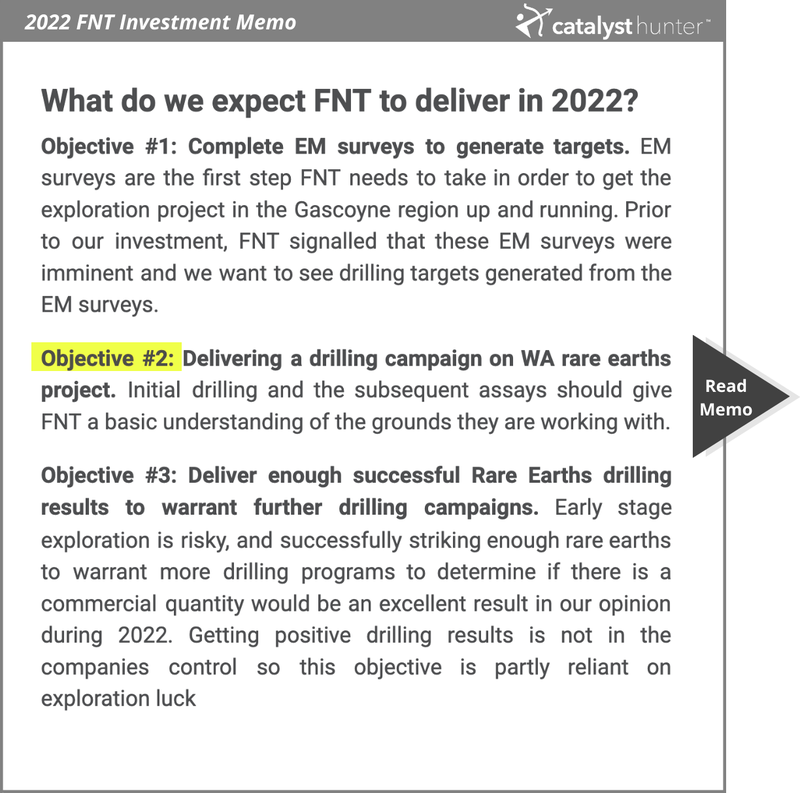

FNT’s maiden drilling program is Key Objective #2 in our FNT Investment Memo which you can view by clicking the image below:

FNT’s results compare favourably with Dreadnought’s

FNT has two direct neighbours in the Gascoyne region of WA, the established Hastings Technology Metals and the emerging rare earths player, Dreadnought Resources.

Like FNT, Dreadnought borders Hastings’ tenements and below is a map of the various tenements that these companies own.

Red is FNT, dark blue is Hastings, and that aqua area is Dreadnought’s position:

With a current market cap of ~$21M, FNT’s results stack up well against Dreadnought’s rock chip sampling program in July 2021.

That program helped tack on ~$91M to Dreadnaught’s market cap in the space of two and half weeks.

The rock chip samples came from the red section on the right of this map.

And Dreadnought to the south of FNT’s tenements, previously re-rated on finding similar rare earth grades in their rock chip sampling program.

This is what Dreadnought Resources (ASX: DRE) returned in July:

As a result of this, this is what happened to the Dreadnought share price after that 19 July 2021 announcement:

Not only did it push the Dreadnought share price as high as 6.2 cents, it also effectively put a floor under the share price when it retraced.

We’re optimistic that a similar thing could play out for FNT because their results are on par with Dreadnought’s and have the added bonus of running straight into Hastings’ tenements.

Adding further significance to today’s results, is the fact that powerful macro tailwinds from the energy transition are driving forward a slew of Australian rare earths projects like FNT’s.

Macro theme: More on why the world needs rare earths

The market is starting to catch on to the fact that the world desperately needs rare earths. Rare earths are essential for manufacturing the permanent magnets used extensively in low-emissions technologies like wind turbines and electric vehicles - our macro theme behind our investment in FNT.

With increasing geopolitical tensions all across the world and the current crisis in Ukraine causing friction between the US and China, we note that ~10% of the world’s rare earth reserves are located in Russia and China accounted for ~57% of rare earth production in 2021.

Not only does China dominate the rare earths mining space, but it also accounts for ~85% of refined output.

This is why rare earths have been listed as a “critical mineral” in the Australian Federal Government’s updated “2022 Critical Minerals Strategy”.

Last week, the Australian Federal Government announced $243M in funding across four different projects that have exposure to the list of critical minerals from its updated “2022 Critical Minerals Strategy”.

$30M of this was given to Arafura Resources Limited, to construct a Rare Earth Separation Plant in the Northern Territory.

This plant will be the first of its kind in Australia and only the second plant outside of China.

With the Australian government now throwing capital behind the sector and really trying to focus on building out a processing industry domestically, we think that rare earths projects locally like FNT’s will become increasingly more important.

Especially if FNT can go on and make a successful discovery.

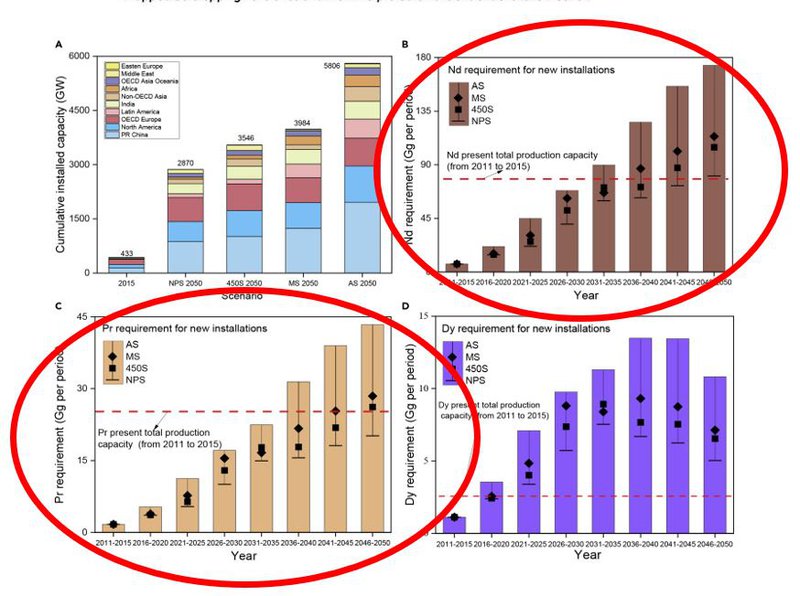

While the demand for Nd and Pr from EVs is relatively well documented, we dug up some more information on the demand for rare earths, specifically Nd and Pr from an academic paper published in 2020.

That paper argues that if the world is to meet its ambitious energy transition goals an “11- to 26-fold expansion of RE supply is needed for meeting global wind-power targets.”

Below is what this looks like in terms of demand through to 2050 with the Nd and Pr charts circled in red:

There’s also significant demand from defence applications as well.

A U.S. F-35 fighter jet needs 427 kg of rare earths while a Virginia-class nuclear submarine uses nearly 4.2 tonnes of rare earths.

These are the very same fighter jets and submarines that Australia is procuring or may procure from the United States.

Combine the EVs, the wind turbines and the defence applications and we think that after today’s results there is a very compelling story playing out for FNT right now - which makes the Q2 drilling one of the more exciting drilling campaigns in our portfolio.

We’re looking forward to that, and will put out more updates as that crucial period for FNT approaches.

This drilling period is not without risk though, and we’ve identified the following risks for FNT as it progresses its project:

New to FNT? Read this

Below is a list of our previous coverage of FNT:

- 10-Feb-2022 - Our Latest Investment: Rare Earths Exploration

- 15-Feb-2022 - EM targets identified - rare earths drilling event next quarter

Another great way to get a handle on FNT is to read our FNT Investment Memo.

Our 2022 FNT Investment Memo

Below is our 2022 Investment Memo for FNT where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to track the progress of our portfolio companies using our Investment Memo as a benchmark, throughout 2022.

In our FNT Investment Memo you’ll find:

- Key objectives for FNT in 2022

- Why we continue to hold FNT

- What the key risks to our investment thesis are

- Our investment plan

To access the FNT Investment Memo simply click below:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.