Days Away From African Graphite Resource Definition

Published 05-NOV-2015 00:28 A.M.

|

8 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Metals of Africa (ASX:MTA) has done exactly what it said on the tin.

This junior explorer has consistently produced high grade graphite drill results, in search of a maiden JORC resource estimate.

Now, this JORC graphite resource estimate is expected to be announced in the coming days at MTA’s Montepuez Central Project.

Once announced, the resource estimate will allow the wider market to fairly judge MTA’s current approximate $10M market cap against its much larger peers who also have a JORC resource in Mozambique.

Direct neighbour Syrah is currently capped at $707M, meanwhile Triton is capped at $70M.

Depending on the resource size, once the JORC resource news breaks, we could see a swift share price movement from MTA. It is likely would-be investors are waiting on this news.

At the same time, success is no guarantee here – this is speculative exploration.

In addition, Mozambique as a country has particular political and social risks which can hinder projects from advancing. With its assets located in Mozambique, MTA remains a high risk stock.

As well as the JORC resource expected to land in the coming days at Montepuez, MTA is drilling continuously at its other Mozambique graphite play – the Balama Central Project.

Keen graphite enthusiasts may recognise ‘Balama’ as it’s the name of the very resource that Syrah holds. This is a 1.15 billion tonne resource at 10.2% graphitic carbon – one of the largest in the world.

MTA’s Balama Central Project is immediately next door to Syrah, and drilling is being undertaken at what may be the extension to Syrah’s already identified monster resource.

12 shallow holes for a total of 1000m will be plunged into this ground over the coming six weeks – adding to the newsflow and potential for uplift for MTA. Strong graphite intersections will only boost interest in this company in the short term.

The company recently confirmed an oversubscribed $3M placement, which will fully fund the work describe above.

For all of these reasons MTA is the exact kind of stock, at the exact kind of time, that catalysthunter.com looks out for:

“CatalystHunter.com provides alerts when an ASX stock is close to a share price catalyst that could potentially initiate a share price movement.”

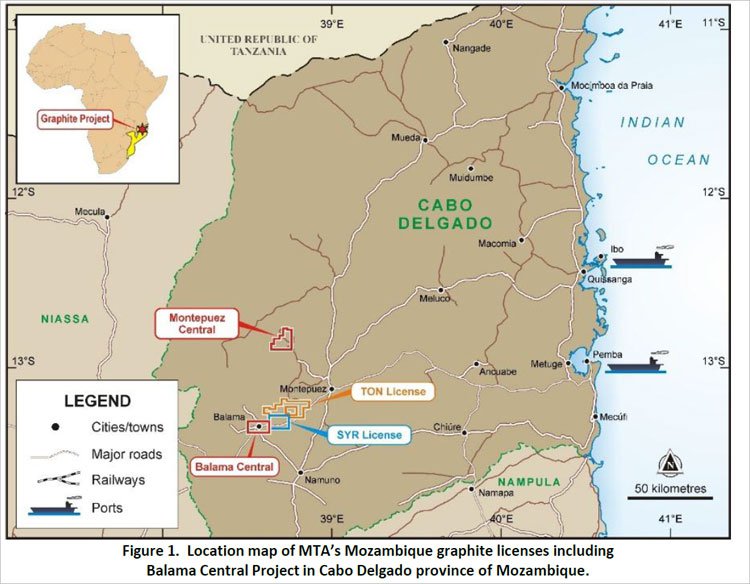

MTA in Mozambique

MTA is exploring for graphite in the most graphite-rich location on the globe – in fact there is more graphite in Mozambique than the rest of the world combined.

MTA is exploring two highly prospective graphite assets in the Cabo Delgado region of the country:

- Montepeuz Central Project – where a JORC resource is due in days;

- Balama Central Project – where MTA is drilling now and over the next six weeks, right next door to Syrah.

Here is where both projects sit on the map:

Location of MTA’s Mozambique graphite licenses including Balama Central Project in Cabo Delgado where the recently discovered Lennox Prospect sits.

Let’s find out a little more about each of them.

Montepuez Central Project

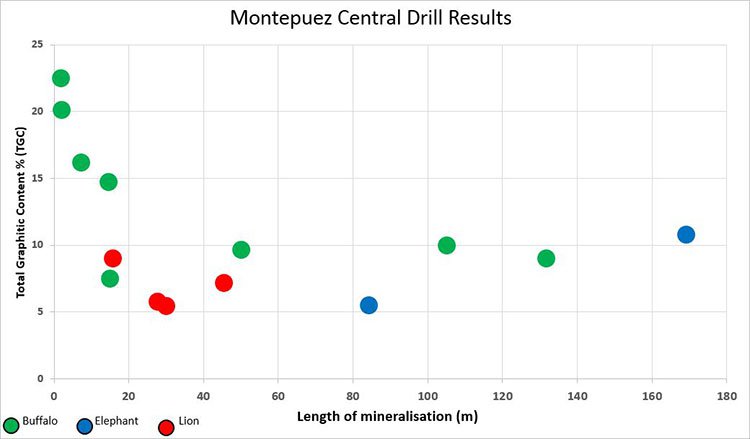

Over the past 12 months, MTA has been busy drilling on the Montepuez Central project, targeting three key prospects: Lion, Elephant, and Buffalo.

In total, MTA has drilled more than 60 diamond holes for 6450m over the past 12 months, with the exploration schedule reaching full capacity between July and October this year.

With excellent flake sizes being encountered, including a large proportion of large and jumbo size, outstanding drill intersections include:

- 15m @ 10.8% TGC (Total Graphitic Carbon) from the Elephant Prospect;

- 1m @ 10.0% TGC from the Buffalo Prospect.

In summary, here are the latest drill results from MTA’s exploration:

Latest MTA drilling results, internally produced

The cores were taken at shallow depths, which ultimately will mean easier and more cost effective mining.

All exploration data gathered will form the basis of MTA’s imminent JORC resource. The working strategy has been to define a near surface, high-grade graphite resource at all three prospects.

Lion is the least drilled of the three prospects, but enough has been done to inform a JORC resource estimate once it has samples independently analysed at a laboratory in Brisbane, Australia.

Buffalo meanwhile, brought up graphite flakes averaging more than 0.1mm, which is classified as large to jumbo.

Overall the TGC ranged from 5% to 15% across MTA’s prospects in Montepuez Central.

Visually, MTA geologists have been impressed with the samples they are seeing on a daily basis:

MTA’s Balama Central Project – Next Door to Syrah

While its Montepuez Central Project is progressing, MTA has kicked off drilling at its Balama Central Project.

This is yet another catalyst for the Company which has the potential to re-rate the stock in the near term.

Bear in mind, however, that this hunt is in its early stages and professional advice should be sought when considering MTA as an investment.

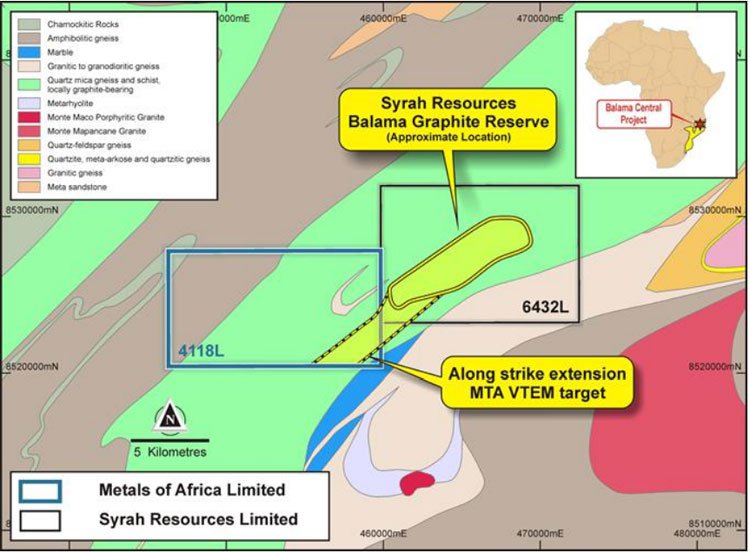

At Balama Central, MTA is on the hunt for an extension of the same graphitic schist defined by Syrah Resources (ASX:SYR). Syrah will start producing from its Balama Project in the first quarter of 2017 – which should bring increased attention to the region.

MTA’s ground is directly next door to Syrah’s, with both likely sharing the same type/grade of mineralisation below the ground. In fact, MTA believes that a 3km extension of SYR’s deposit may well run into its own permit.

MTA’s geologists made the call based on an airborne VTEM survey which has been backed up by high grade mineralisation at the surface, with all the technical hallmarks of Syrah’s deposit.

That VTEM survey also provided clues about where exactly to drill – which MTA has commenced with the aim of defining yet another JORC resource next year.

You can see what we mean by ‘next door’ in the map below:

Based on MTA’s initial observations and pitting, Balama has so far produced encouraging graphite and vanadium samples that warrant a dedicated full-scale drilling programme similar to the one just completed at Montepuez Central.

Samples indicate up to 17% TGC graphite at the surface following a 400m x 200m, 12 exploration pit pitting programme.

Graphing the Graphene Market

Just as a reminder of what MTA is playing for, the global market for graphite is roughly $15.06 billion according to a P&S Market Research report on the subject .

The market is tipped to grow by 4% until 2020, with a global supply/demand imbalance thought to be about 1500 tonnes in favour of suppliers.

The market demand for the material is being driven by a number of factors, but is thought to be down to an increasing appetite for lithium-ion batteries. Already, around 80% of graphite used in batteries was for the lithium-ion variety .

The batteries power a number of consumer good electronics such as cameras and phones, but also electric cars.

The end-user market is looking rather alluring from MTA’s perspective, given the recent graphene test results received by MTA .

According to independent testing, MTA’s graphite from Montepuez can be processed into graphene and is comparable to synthetic graphene from a quality perspective.

Globally, it is estimated that hundreds of millions of dollars are already being spent on graphene research and development, with patent applications mushrooming over the past few years , according to the ‘Intellectual Property Office’, based in the UK.

MTA’s Zinc & Ruby Options

Funding for metallurgical work and the impending Pre-Feasibility Study has been secured through an oversubscribed placement raising $3M, which welcomed two new significant shareholders.

Of particular interest to MTA investors, is the investment made my Mr. Navin Sidhu, Group CEO of Allgreentech International Plc., (AGT) a major international resource investment company based in London, UK. One of AGT’s major subsidiaries is Malaysian Mega Galvaniser (MMG), a large galvanising company based in Malaysia which is also an end-user of zinc.

At the same time as a zinc end user invests in MTA, MTA’s zinc project in Gabon is also progressing and could add another value layer here.

Last but not least, MTA’s commercial potential has been further scoped up to include rubies. A tidy JV deal with ‘Mozambican Ruby Lda’ (MRL), sees MTA cede 75% of its non-core ruby project, in exchange for handing over exploration to MRL.

The deal could open up early cash flow for MTA and is a factor that shouldn’t be ruled when looking at the value in MTA.

MTA: Significant catalyst within days

MTA is hastily advancing its prime project in Mozambique (Montepuez Central) with a keen eye on a second, not too far behind – Balama Central.

A JORC resource is already highly anticipated at Montepuez in the coming days, which may well lead to an immediate re-rating of MTA’s valuation.

Of course, like all small minerals explorers in Africa, investing in MTA is not without risk – MTA may not uncover commercial quantities of graphite.

Meanwhile at Balama Central, MTA is drilling to much shallower depths compared to SYR and TON which may put a ceiling to the size of JORC resource expected to be announced later this year...

But on the other hand, with drilling results indicating grades up to 33.8% TGC and jumbo flake size, MTA could outshine its larger peers via a more premium product, one which may be cheaper to extract due to its shallow depth.

Regardless of the size of resource MTA manages to secure, exploration is ongoing and a Pre-Feasibility Study will soon be initiated at Montepuez, and potentially the Company may look to go straight to a pilot plant capable of generating early cash flow here.

Once a maiden JORC resource is confirmed in the coming days, MTA has strong potential to close the valuation gap with its peers and competitors, Syrah and Triton.

Remember, Syrah is currently capped at $707M while Triton is capped at $70M.

There’s plenty of catch-up room for MTA who are valued at only $10M, and yet, are playing in the same ball park as much larger companies at a further stage of development compared to MTA.

Happy hunting...

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.