CCZ Confirms it Has One of Australia’s Highest Grade Copper Deposits

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Castillo Copper (ASX:CCZ) continues to gain momentum at its Cangai Copper Mine near Grafton in northern NSW.

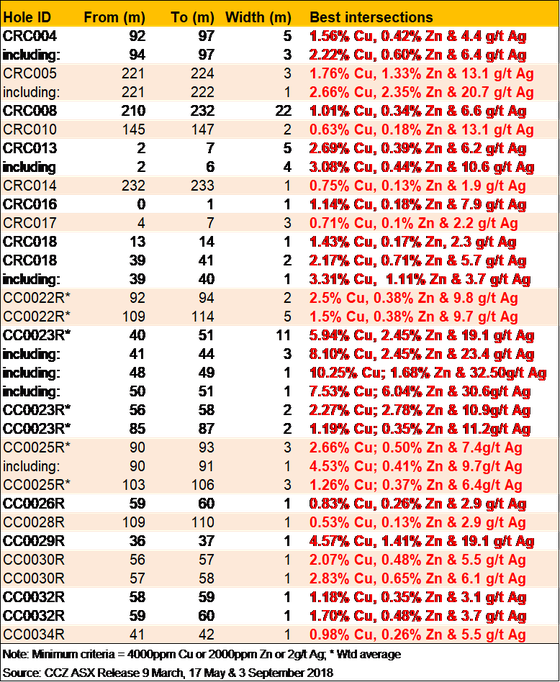

Over the course of two drilling campaigns, CCZ has produced its best results. The best coming via hole CC0023R which delivered 11m @ 5.94% Cu, 2.45% Zn and 19.1 g/t Ag from 40m including: 1m @ 10.25% Cu, 1.68% Zn and 32.5. g/t Ag from 48m.

These results all point to the company potentially being able to re-open the Cangai Copper Mine.

The Cangai Mine is CCZ’s flagship project, comprising a volcanogenic massive sulphide (VMS) ore deposit, with one of Australia’s highest grade Inferred Resources for copper: 3.2Mt at 3.35% copper.

In terms of contained metal, the Inferred Resource is 107,600t copper, 11,900t zinc, 2.1Moz silver and 82,900Moz gold. Notably, supergene ore with up to 35% copper and 10% zinc is present, which is ideal feedstock for direct shipping ore.

If you have followed the CCZ story, you will remember that the Cangai mine shares similarities with the $1.07 billion capped mining giant Sandfire Resources (ASX:SFR). Both miners’ projects carry supergene ore and high-grade copper.

Supergene ore can be shipped directly to key export markets at relatively low cost via excellent infrastructure already in place which could give CCZ a competitive advantage in the long-term.

The latest work done by CCZ, builds on earlier work by the company that not only discovered the Sandfire similarities, but also confirmed that Cangai is arguably one of Australia’s highest grading copper deposits especially with high grade diamond drill core being extracted from shallow depth.

You can read about the earlier work in the following articles:

- Castillo Emerges with Highest Grade Recent Copper Drill Results in Australia

- $31M Capped CCZ Confirms Same Geology as $148M Capped Neighbour COB

- CCZ’s Phase 1 Assay Results Similar to Sandfire’s Mineralisation

Diamond drill core samples are now being assayed, which likely means plenty of news flow to come in the ensuing weeks and months.

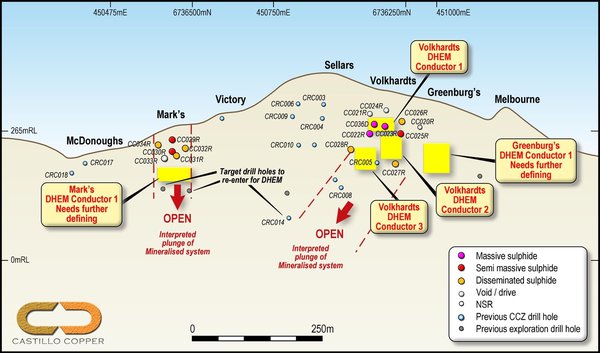

Furthermore, down-hole electromagnetic (DHEM) survey results have been finalised, with several new sizeable massive sulphide target conductors apparent.

Again, these demonstrate the potential scale of Cangai Copper Mine.

With new high-grade targets, the RC drilling program is being optimised and factored into the remainder of current Phase II campaign.

CCZ continues to hit its milestones and could be in for a break out year in 2019, so let’s take a more in-depth look at how it has been progressing.

The Catalyst: Drilling Results... Drilling Continues

CCZ has today provided an update on preliminary diamond drilling results and final assays for drill-holes CC0025-34R and DHEM survey findings.

These diamond drill results underpin Cangai’s status as a high-grade polymetallic deposit.

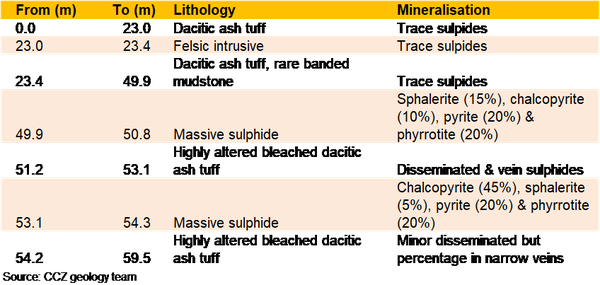

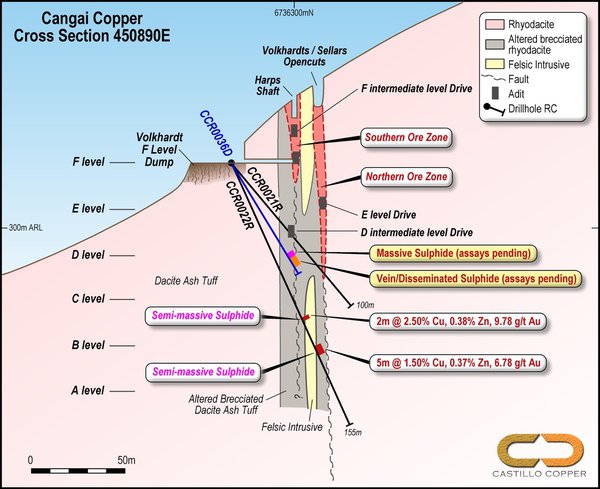

A 9.6m mineralised diamond drill core intersection was extracted (CC0036D - see below) from a shallow 50m. This included two sub-intersections exhibiting mineralisation up to 45% chalcopyrite and 15% sphalerite, which are now being assayed.

Now, here is a look at the 36D cross section.

CCZ’s diamond drill team targeted a known quantity near Volkhardts’ lode that hosts massive sulphides but from a different position to the previously drilled hole CC0023R.

ASSAY RESULTS

Assays for drill-holes CC0026-to-34R delivered consistent, high-grade mineralisation up to 4.57% Cu, 1.41% Zn and 19.1 g/t Ag, with all holes intersecting mineralisation. Furthermore, over the course of the two drilling campaigns this year, the assay results have confirmed considerable high-grade mineralisation:

Drill-hole CC0023R, the standout, delivering excellent results from shallow depth including: 11m @ 5.94% Cu, 2.45% Zn & 19.1 g/t Ag including 1m @ 10.25% Cu, 1.68% Zn & 32.5 g/t Ag from 48m.

Here's a look at the best intersections over the two drilling campaigns.

This is diamond drill core sample from hole CC0036D:

Those results alone are extremely encouraging.

Now add in two massive sulphide intercepts from 49.9m to 51.2m and 53.6m to 54.2m. These intercepts comprise chalcopyrite, pyrite, pyrrhrotite and sphalerite that are hosted within heavily bleached dacitic ash tuff's of the Siluro Devonian Willowie Creek Beds.

All collected samples have been sent to the laboratory to be assayed which should confirm the high-grade polymetallic system prevalent at Cangai Copper Mine.

These earlier findings continue to place the Cangai Copper Mine deposit as one of the highest grading in Australia.

DHEM RESULTS HIGHLIGHT SCALE

Undertaking DHEM surveys has been key to identifying several sizeable high-grade massive sulphide conductors under the Greenberg, Volkhardts and Mark lodes. Encouragingly, after analysing the data, the geophysicist consultant determined the mineralised system below these conductors is open at depth – clearly highlighting the potential scale of the ore body at Cangai Copper Mine.

CCZ’s geology team now has several new, high priority massive sulphide targets to optimise and factor into the balance of the current Phase II drilling program. Moreover, further DHEM work will accompany the remainder of the drilling campaign to garner a broader understanding of potential extensions to the known mineralisation.

We can expect further results to come shortly, with the RC drilling team expected to head back to the site to complete CCZ’s Phase II campaign.

More results to come

We alluded earlier to the fact that Noble Group is currently conducting metallurgical test work.

CCZ has an arrangement with Noble Group to progress metallurgical test-work on all legacy stockpiles at the Cangai Copper Mine.

CCZ’s geology team collected samples from the stockpiles (seen below) around the Mine and the old smelter and sent them to Noble for third party verification and optimisation.

Metallurgical test-work undertaken to date on samples from McDonoughs’ stockpile demonstrated copper concentrate recoveries of >80%, with grades up to 22%.

CCZ hope to improve on these results and aim to complete a binding off-take agreement with Noble Group to distribute up to 200,000t of copper concentrate.

This agreement would be pivotal for CCZ as it will validate the high-grade polymetallic nature of the ore body at Cangai Copper Mine and provide early-stage cashflow.

The road ahead

More results. More drilling. That’s what we can expect from CCZ as it closes in on finalising its Phase 2 drilling campaign.

We already know that the company has uncovered high-grade mineralisation that takes it one step close to re-opening the Cangai Copper Mine.

These are significant achievements at a time when the global EV battery market is set to grow at a compound annual growth rate (CAGR) of 42% to 2021.

Remember, copper is a key component in electric vehicle batteries and power electronics.

CCZ is currently capped at $23 million and is a long way from the billion dollar Sandfire, but should it continue to release highly encouraging results that lead to the reopening of the Cangai mine, it could very well rise in value very quickly.

With drilling to be completed in the coming weeks and months and further results due imminently, CCZ is in a strong position to capitalise on the hard work it has done so far.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.