ASX Battery Metals Developer Days Away from Pilot Plant Results

Published 19-JAN-2021 11:47 A.M.

|

11 minute read

Battery metals stocks are currently enjoying a massive boom thanks to the anticipated groundswell of demand for Electric Cars.

Most investors would be aware of lithium and its requirement in lithium ion batteries, but there are a number of other crucial metals that go into a battery, that are looking at drastic supply shortages as the world makes the switch from petrol cars to electric.

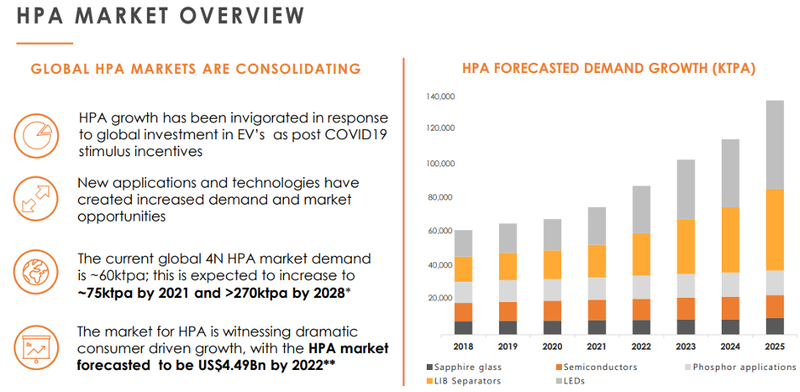

One of those materials is High Purity Alumina – HPA – defined as alumina having a grade equal or greater than 99.99% Al2O3. The HPA a market is currently witnessing dramatic growth, forecast to grow to a $4.5BN market by 2022.

FYI Resources (ASX: FYI) is a $100M capped stock positioning itself to be a world class producer of High Purity Alumina (HPA).

FYI possesses a high-quality aluminous clay (kaolin) resource in Western Australia with a 25 year plus mine life, a state-of-the-art processing technology to convert the clay into HPA, and robust economics to bring its project into reality.

FYI has a number of Tier 1 industry participants very interested in what the company is developing. The world’s biggest aluminium company Alcoa has signed an MOU and is progressing towards a JV as a project partner, and the company has an $80M financing package secured.

What’s the upside in FYI?

We have seen a number of other battery metals stocks run on the ASX. Could FYI be next?

In the lithium space, Vulcan Energy Resources (ASX: VUL) has been the runaway standout performer on the ASX, delivering long term investors over 8,000% since the start of the year. VUL is now capped at $880M.

Meanwhile manganese stock Euromanganese (ASX: EMN) has also performed strongly, delivering over 520% gains over the last 12 months. EMN is currently capped at over $280M.

FYI Resources (ASX: FYI) is rapidly developing a HPA production plant, and given the product’s requirement in battery metals, it could be one of the next battery metals stocks to run, especially given imminent news from its pilot plant results.

Why is FYI different from other HPA producers?

Traditionally HPA is sourced from expensive feedstock, such as refined aluminium metal, sourced from bauxite using antiquated processing.

FYI plans to produce low-cost HPA from kaolin (its 100% owned Cadoux Kaolin Project is located 220 kilometres north-east of Perth) using innovative processing methods.

Key to the company’s success is a pilot plant that will be essential in determining project success and economics as FYI’s HPA strategy moves towards commercialisation.

In relation to its Pilot Plant strategy it has a four pronged approach:

The Cadoux Kaolin Project boasts excellent quality resource and project infrastructure. The project boasts a reserve of 2.89 million tonnes grading 24.4% Al2O3, which supports a mine life of 25+ years.

In essence, FYI has a proven resource, solid operational and financial metrics and proof of concept in terms of being able to bring a premium product to market.

FYI is already in advanced discussions with a number of Tier 1 industry groups, apart from Alcoa, across the Lithium-ion battery separator, sapphire glass and other specialty markets regarding HPA marketing and off-take arrangements.

Late last year, FYI concluded a detailed HPA production trial at its pilot plant in Welshpool, Western Australia.

This week, it is expected to release its final pilot plant analysis results, which could provide a major catalyst for the company in a year where sustained newsflow could really have a positive impact for investors.

The catalyst

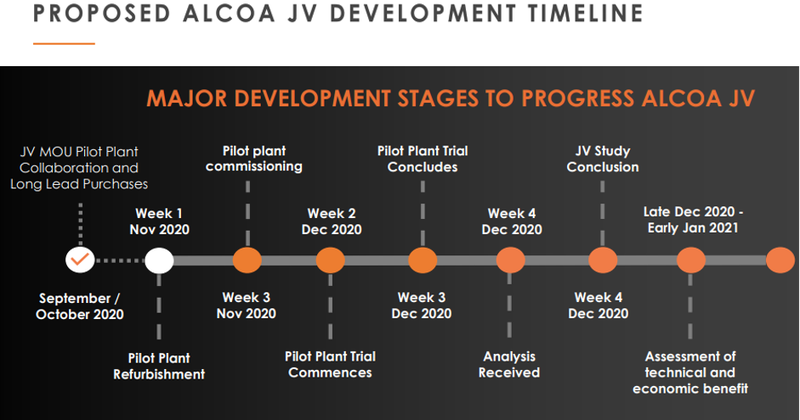

In late October 2020, FYI commenced trials at its Pilot Plant to produce a stipulated end product tailored to targeted customers.

FYI worked hand-in-hand with Alcoa Australia Ltd, one of the world’s leaders in the production of bauxite, alumina and aluminium during the testing period.

The HPA pilot plant trial concluded successfully in December, achieving expected operational performances and demonstrating the potential for commercial production of HPA via FYI’s innovative flowsheet design.

The HPA product from the trial was submitted for high level Glow Discharge Mass Spectrometry (GDMS) analysis to EAG Laboratories in New York, USA for independent, high accuracy, confirmation of HPA grades.

The results of those trials are due in a matter of days.

Here is FYI Managing Director discussing the company’s expectations for the plant, as well as the current market demand, potential offtake agreements and the overall project including its strong DFS with Proactive Investors’ Andrew Scott.

The interview followed a strongly supported $6M capital raise which was completed at 20c. The funds will go towards advancing its HPA project and progressing its JV with Alcoa.

Prior observations of the HPA trial material has already indicated excellent quality end product, so the next batch of results are highly anticipated.

“The trial was a culmination of process improvements noted from previous piloting and the objective of targeting the HPA end product to specifications stipulated by several prospective off-take groups,” FYI Managing Director, Roland Hill said.

“This exercise bodes well with our continuing discussions with potential off-take parties and other project stakeholders including financiers.”

FYI has successfully completed three plant trials to date which all operated continuously for seven consecutive days on a 24 hours a day basis to demonstrate the end-to-end fully integrated operational efficiency of FYI’s innovative HPA refining process.

The objective of the latest collaborative pilot plant operation with Alcoa was to demonstrate the complete metallurgical process using the best scale up practices to replicate commercial production.

This is a condition precedent to the Memorandum of Understanding (MOU) with Alcoa, which was entered into on 8 September 2020 for the potential joint development of FYI’s innovative, fully integrated, high quality HPA project.

Importantly, the project is not reliant on the MOU being consummated, however formalisation is progressing and will assist in off-take discussions.

The HPA produced will be checked for quality control and assurance jointly prior to being forwarded by FYI to targeted end-user and customer groups for on-going product qualification.

Offtake potential

As discussed, previous production trials have resulted in outstanding quality HPA. This is currently being assessed by potential off-take parties.

Current discussions with parties other than Alcoa could result in material agreements and the potential for FYI to undergo a significant share price increase.

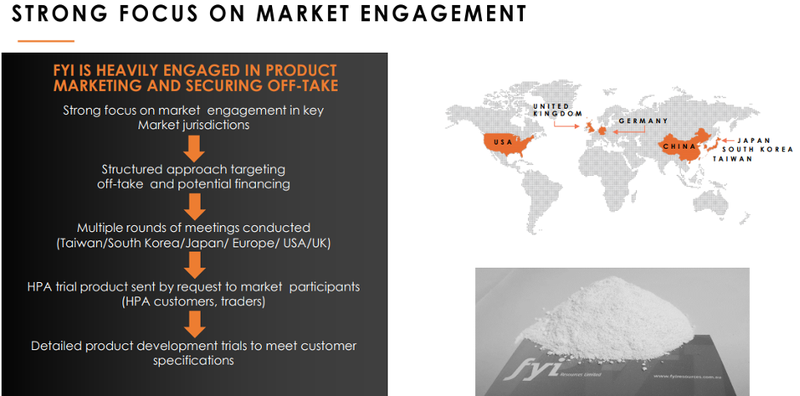

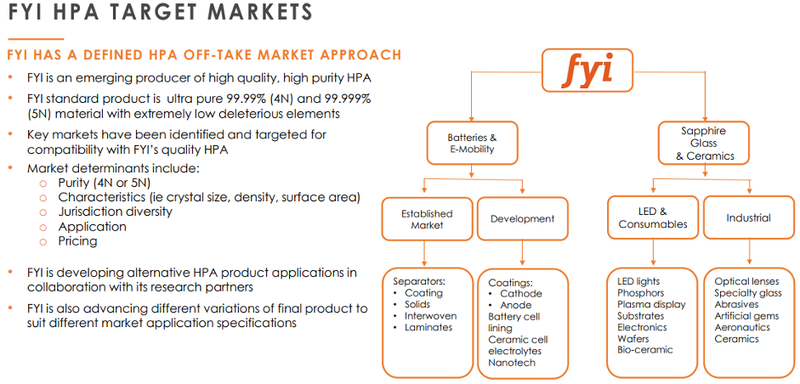

As you can see by the graphic below, FYI is committed to securing offtake agreements.

FYI could also establish itself as a leading player with a point of difference given its potential to control the full supply chain from mining to refining and through to distribution.

There are myriad advantages in doing this:

- quality control

- efficient distribution capabilities

- production of a range of products

- creating multiple revenue streams and

- reducing its reliance on a small client base.

FYI’s end to end strategy allows it to target a broad range of markets, providing scale, client diversification and leverage to multiple price points, including a proportion of top-tier product segments that fetch in the order of US$50,000 per tonne.

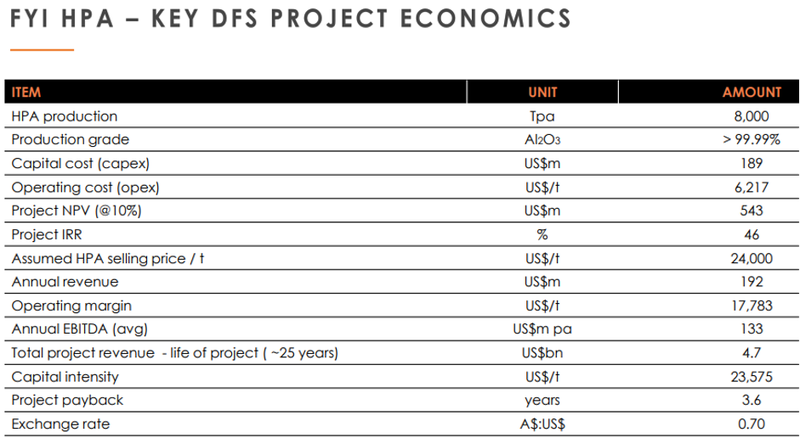

It should be noted that FYI has been conservative with its definitive feasibility study (DFS), assuming a sale price of US$24,000 per tonne, more in line with what is referred to as 4N HPA (99.99%).

While hard and fast numbers are yet to be determined, there is already evidence that FYI will be able to produce a proportion of ultra-pure 5N HPA (99.999%) which based on independent projections should sell for about US$50,000 per tonne.

This highlights the importance of getting the technology right, and with management confident that it will release data in 2021 that will provide a strong insight into the product mix there is the potential for a significant revaluing of the company based on upgraded revenue generation and significantly increased profit margins.

DFS stacks up

The following DFS project economics feature a robust Net Present Value of US$543 million and a strong Internal Rate of Return (IRR) of 46%. Project payback should only take 3.6 years.

The Proven and Probable Ore Reserve for the project totals 3.2 million tonnes at 24.8% Al2O3, all contained within the area of the company-owned Mining Lease (M70/1388) and Mining Proposal.

This represents an increase to the total Probable Ore Reserve of 2.9 million tonnes at 24.5% Al2O3 reported at 30 June 2019.

Glancing across the DFS numbers, a combination of a high valuation, as well as a sizeable IRR isn’t a common attribute among mining projects as robust valuations are often offset by less compelling rates of return and vice versa.

Given the possible outperformance compared with the DFS due to conservative assumptions, FYI could emerge with very attractive investment merits, providing both news driven share price accretion and the potential for an enterprise value/earnings driven rerating.

The highly impressive valuation metrics haven’t been lost on the investment community with FYI securing an A$80 million equity financing facility to progress the company’s HPA development strategy, very much an endorsement of the project’s worth, as well as management’s credibility.

The following pilot plant timeline was impressively short, highlighting FYI’s ability to successfully complete the trial in collaboration with Alcoa.

FYI is now positioned to benefit from its proven ability to quickly and efficiently bring a premium product and a sound business case to market that should generate strong returns over a 25 year mine life.

Meanwhile, the $80M equity will provide critical funding for the substantive development stages leading up to, and including, construction through to operation.

The funding is a key catalyst for the company’s development objectives and significantly de-risks the project.

Target markets

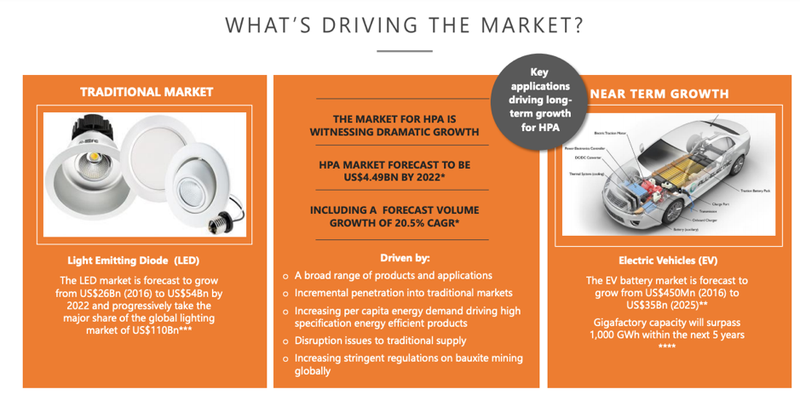

HPA has emerged as one of the hottest commodities for investors aiming to tap into new age industries such as electric vehicles and energy storage.

Fast growing high-tech sectors such as those that involve semiconductors and LED screens are also on the radar.

There is high demand for HPA as it is a specialised product used in a multitude of high-tech applications, including lithium-ion batteries and LED lights.

Interestingly, the HPA market is currently responding well to the current global post-COVID-19 stimulus into the electric vehicle (EV) sector.

The amount of HPA in lithium-ion batteries is considerable with up to ~5kg of HPA in every EV.

According to Benchmark Mineral Intelligence principal James Clark the multiplier effect of EV growth “means high purity alumina demand in five and 10 years will be very significant”.

Note, the electric vehicle market is forecast to grow to US$35BN (2025).

At the same time, the HPA market is forecast to be US$4.8BN BY 2026, including a volume growth of 20.7% CAGR from 2020 to 2026.

The growth of these sectors has led to substantial development in products that require HPA, which means premium grade HPA is being increasingly sought after.

As Finfeed’s Trevor Hoey states, “The quality of the product can be a game changer, and as a result commodity quality/price differentials have come down to margins as low as .001% where such a degree of difference can equate to an incremental price increase of around US$10-20,000 per tonne.

“It could be argued that the burgeoning EV industry has only just scratched the surface given expectations that enhanced electric engines will be increasingly used in much larger vehicles such as trucks, trains and planes.”

A wide range of markets are available to FYI based on its HPA quality.

FYI is positioned to be a dominant participant in high growth market applications such as LED’s, sapphire glass, semiconductors, as well as the rapidly emerging electric vehicle and static power storage.

Its diversification of product could also potentially cover additional industries.

The following industry breakdown highlights the anticipated high growth forecast to occur in the LIB separator and LED market segments where FYI’s HPA product specifications meet the necessary requirements.

FYI is one to watch

With results from its pilot test due at any time now and with several milestones to come, 2021 is already shaping as a milestone year for FYI.

The aforementioned potential signing of a formal joint venture with Alcoa in February/March could provide a potentially significant share price catalyst.

Potential offtake clients could come as early as this quarter, along with a revised project economics study. Add all of this up and it is easy to see the potential for the company to deliver for its shareholders.

The delivery of a final engineering report in the June quarter should position the company to confirm its decision to proceed to construction - another highly material trigger point.

FYI has developed a robust HPA strategy that is significantly de-risked. Its economics demonstrate lowest quartile capex and opex and it is operating with positive long-term market fundamentals working in its favour.

With all that in mind, FYI may very well provide a ground floor entry for investors looking for growth with imminent and large upside.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.