ARN Days Away From Nickel Drilling

Aldoro Resources (ASX:ARN) is now just days away from diamond drilling at its flagship Ni-Cu-PGE project.

ARN is targeting two drill holes to kick off its drilling campaign.

We invested in ARN in March this year for the long term for a large nickel discovery and made the company one of our biggest holdings.

We increased our position when internationally renowned geologist Dr Minlu Fu invested $2M into ARN, making his entity one of ARN’s largest shareholders.

Dr Fu’s previous successes and enviable track record involve a number of nickel, copper and gold discoveries and it is the potential to make a large nickel discovery that attracted him to make a strategic investment in ARN.

We also like ARN’s low number of shares on issue and battery metal thematic.

In fact, after its lithium acquisition last month, ARN has almost all the materials needed to make an electric vehicle battery, all in one location, all in Western Australia.

However, this week is all about nickel for ARN.

ARN is about to start 5,000m of nickel drilling on a number of high confidence targets - holes have been pegged and drill pads prepared.

The drill rig is now mobilising after a slight delay in getting the rig to site and drilling will start in the coming days.

The catalyst: Drilling in days

ARN will start drilling at the Narndee Igneous Complex in the coming days, with the drilling operator now mobilising to site.

Two targets VC1 and VC11 will be drilled first, with ARN planning 550m of drilling and up to 800m if results go its way.

A MLTEM survey designed to refine the highest priority exploration targets is now completed. Results of this survey will also be reported in the coming days.

Drilling isn’t the only catalyst that’s days away

Field reconnaissance by ARN in July identified two nickel-copper gossans requiring follow-up at the Narndee project.

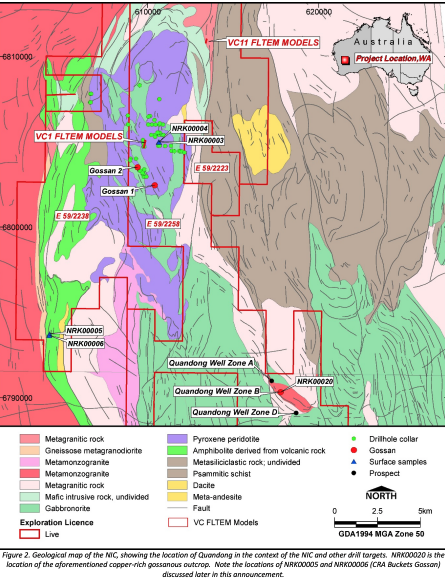

Below, you can see the location of the drill holes and gossans:

We expect to see results of the field reconnaissance and sampling work at Narndee soon. It has already confirmed a copper-rich gossanous outcrop at Quandong Well Zone B (see above).

The historical copper and nickel-copper gossans had been confirmed and sampled at Quandong Well Zone B and CRA Buckets Gossan, respectively.

Gossans are found at the surface of the rock and are essentially the signposts that point to what lies beneath.

We’ll know more about the rock chip samples and what is contained in them when assays from the drilling come in.

It’s interesting to note here that the Quandong Well area was explored by Dampier Mining Co ltd in the early 1970s and several copper gossans were discovered.

Thirty-one holes for 1731m were drilled, with significant copper, zinc, and gold results reported in oxide phases close to the surface, grading into a sulphide assemblage of pyrrhotite and chalcopyrite at depth.

This represents a significant exploration opportunity for ARN, given the modern electromagnetic technology available now compared to the 1970s.

ARN interprets copper and gold-rich Volcanogenic Massive Sulphide (VMS) style targets in this area. The datasets for Quandong will be compiled, QAQC checked, validated, and interpreted. Once this is completed, significant historical results will be reported, and follow-up programs planned.

In other words, there’s a lot of news expected as results from various programs are made available.

We continue to anticipate sustained share price growth in ARN in the lead up to good news including ongoing drilling and subsequent results in the coming weeks and months.

Why we like ARN:

- Tightly held share register, including renowned geologist Dr Minlu Fu

- Exposure to upside of a large nickel discovery

- Nickel drilling - 5,000m targeting three high confidence targets

- Spin out of gold assets allows ARN to focus on existing assets but retain exposure to gold exploration success.

- New lithium acquisition gives it even more exposure to the battery metals revolution.

ARN Investment Strategy:

We expect ARN to deliver the following key milestones over the next 3 to 6 months and the share price to appreciate as the market speculates on a drilling outcome:

- Key Team additions (✅ Dr Minlu Fu, internationally renowned geo)

- Permits and Land rights (✅ all land rights and permits secured)

- Drill targets identified ( ✅ some already found, potentially more to come)

- Geological surveys and prep work (ongoing)

- Drill rig secured (✅)

- Drill rig mobilising to site (✅ Rig moving to site and drilling to begin in late July)

- Key Catalyst: 5,000m of drilling begins (Coming days)

- Divest Gold Assets: Gold spin out IPO goes live (Q3 2021)

- Gold Spin out: ASX listing of new co (Q3 2021)

- Completion of lithium acquisition: Completion of sales agreement between Meridian and ARN for the the acquisition of the adjacent Wyemandoo Project.

Note we plan to retain a significant position into the nickel drilling results which are hopefully positive.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.