ASX Stock on Texan Oil Spree: Multiple Transactions Over Coming Weeks

Published 26-SEP-2017 22:50 P.M.

|

7 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

American Patriot (ASX:AOW) is fully focused on value-based acquisitions and a quick entry into oil production.

The company is committing to a tandem strategy of exploration combined with oil project acquisitions throughout the US.

Having recently announced a facility of up to US$40 million from its US Institutional funding partner, AOW has a significant war chest to support a large acquisition programme and dramatically re-rate the value of the company.

AOW is assembling an arsenal of productive oil assets with potentially several price-boosting catalysts on the horizon before the end of 2017.

It is early stages in this strategy and investors should seek professional financial advice if considering this stock for their portfolio.

This $6 million capped company is targeting a string of acquisitions later this year and in 2018, to add verified oil assets to its portfolio and sales revenues to its balance sheet.

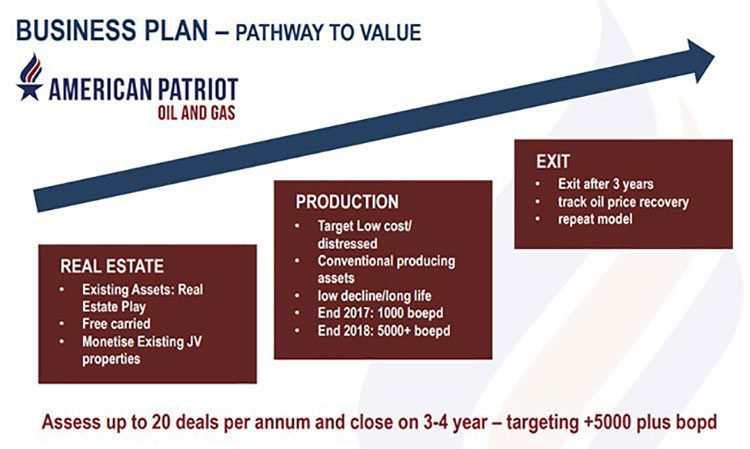

The long-term goal is to build a significant producing business, reaching 5000 BOPD by 2019.

To achieve this feat, AOW has embarked on a frenetic acquisition spree aimed at distressed assets and paying just cents on the dollar for viable oil production resources.

The catalyst

Wading into oil assets currently locked in bankruptcy proceedings is proving to be lucrative for AOW’s peers...

... so why not AOW?

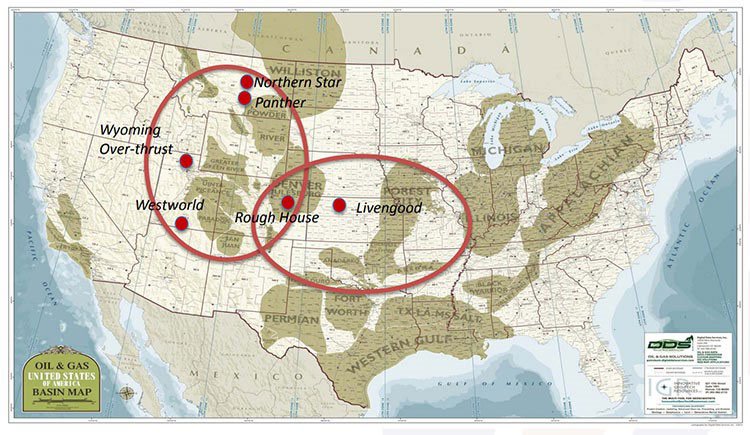

AOW has several US basins in its crosshairs and is selectively acquiring lucrative assets in these regions.

Already this year AOW has made two acquisitions, with more to follow.

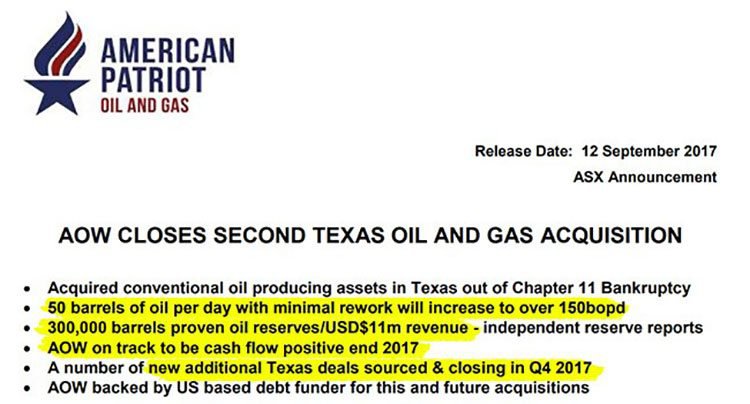

The most recent was a conventional oil producing asset in Texas:

This Texan acquisition alone, brings AOW an immediate increase of 50 barrels per day (bpd), and a likely increase to 150bpd in the near term. The asset also holds 300,000 of proven oil reserves worth $11 million revenue at oil prices of $45pb.

Conventional oil exploration is far cheaper than shale, and can remain profitable despite oil prices languishing below $40pb. This premise underpins AOW’s overarching strategy and could likely see AOW achieve cash-flow positive status as early as this year.

With the deals recently announced AOW is on track to being cash flow positive and achieving production of 300boepd by the end of 2017 with 1 million barrels of proven oil and gas reserves (independently verified). This will generate approximately US$30 million revenue at current oil prices.

Not a bad sight for an ASX-listed oiler, worth a mere A$6 million. Clearly, there is some upside revaluation potential here, especially as the company looks to close out further acquisitions in the coming months.

The conventional play

Given that crude oil prices have remained below US$60 per barrel in recent years, and the fact that non-conventional shale plays are becoming tougher to commercialise (and rationalise), conventional plays are looking increasingly attractive.

As a simple barometer, it costs around $5-10 million for a shale well (even more if it’s on-shore), whereas ‘no-thrills’ conventional wells typically cost less than $300,000n per well.

AOW’s strategy is to aggressively build up a commercially-viable conventional oil & gas portfolio, at the expense of bankrupt oilers desperate to extract something from their locked-up assets.

AOW is actively cherry-picking the best assets across the US, and has already amassed around 3000bpd of active production.

Over the longer-term, AOW intends to raise its production calibre to over 5000bpd, handing this micro-capped oiler with what could be profitable commercial arsenal.

Positive cashflow by the end of 2017

To achieve this eventual aim of securing 5000bpd, AOW is selectively picking up the most amenable oil wells scattered around the US.

From a revenue standpoint, AOW hopes to unlock over $150 million in sales revenue from the oil it already has. But it wants to push things further by improving flow rates and adding more viable assets to its portfolio.

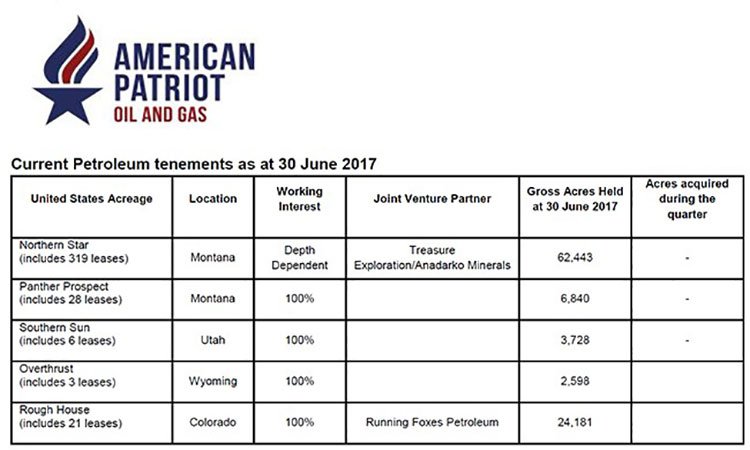

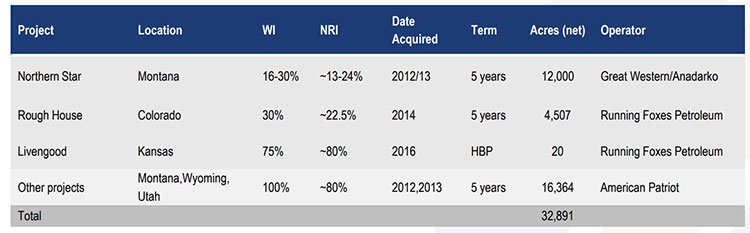

Here is a snapshot of AOW’s assets prior to further acquisitions:

Here they are overlaid onto a map of the US:

Funding

AOW now has some heavy-hitting financing to ensure its cherry-picking strategy pays off. Just recently, it announced an oversubscribed $1.3 million capital raising, which is a great sign at this early stage.

AOW also has access to $40 million in additional funding, made available by institutional investors; thereby fully backing AOW’s aggressive acquisition strategy.

From a fundamental perspective, institutional money seems to be backing AOW and its intentions. This can often be an early sign for future revaluation.

AOW will use the funds from this capital raising to fund further acquisitions of conventional oil and gas projects in the US. Such acquisitions are likely to be value accretive and self-financing, meaning AOW is looking to do as many as it can, as quickly as possible.

AOW’s business plan

With over $1.3 million in the kitty (and a $40 million capital line primed) from a recently oversubscribed capital raising, AOW intends to invest every penny in securing oil productive assets.

Targeting distressed assets as a priority, AOW is seeking quality projects at the low end of the cycle and hopes to see its asset portfolio appreciate, fuelled by efficient production able to cope with low oil prices and further acquisitions in the US Texas and Gulf Coast regionst.

The macro outlook

AOW’s internal operations are now ready for action, but what about the wider oil market? Does AOW have a market to plug into once its acquisition spree has been completed?

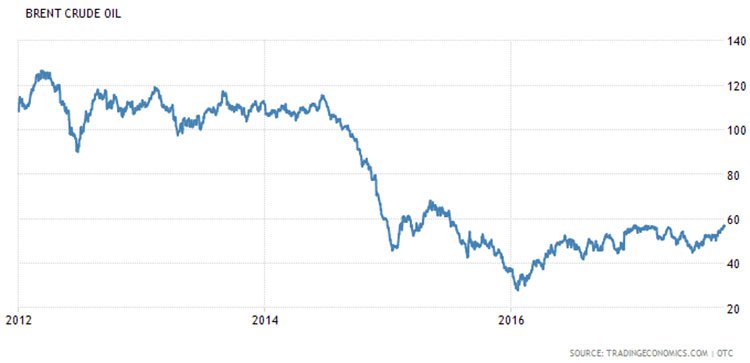

Here’s how oil prices have been tracking over the past few years:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Having taken a swan-dive from their 2014 peaks of more than $100 per barrel, Brent Crude oil prices fell below US$30 in early-2016, before recovering to trade between $40-60 range for the past year. This is a good backdrop to be picking up distressed assets for cents on the dollar.

Of course commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone. Seek professional financial advice before choosing to invest.

If oil prices do make a significant recovery, this bodes well for AOW.

If oil prices remain in their recent range, will mean AOW can sustain its existing strategy.

And worst case, if oil prices suffer again, AOW can remain viable down to as low as $22pb , given its focus on low cost operations.

A back to basics strategy

What the past few years have shown, is that oil production is fraught with obstacles and risks, but a buck can be made in oil regardless of the oil price.

AOW is going back to basics and kick starting a straightforward strategy built on timely acquisitions and pragmatic exploration.

AOW is blessed with 28,256 net mineral acres under lease across five key projects, scatted across the US.

Since its establishment, AOW has assembled a portfolio of prospective oil and gas exploration assets in the US and has completed joint venture agreements on its key projects with US based partners...

...and the good news is, there’s more to come.

AOW is currently reviewing several more acquisitions as part of its spending spree, and therefore, a fistful of catalyst opportunities may be coming down the track.

In the next 12-18 months, AOW intends to expand its reserve/resource base and progress its aggressive acquisition strategy by restarting production at shut wells.

The focus is on cost efficiency, cash flow metrics and tight capital discipline.

AOW is striving to expand its oil market position, but with efficiency as its core principle.

Shale exploration can be highly lucrative, but it’s also highly risky and highly expensive. In today’s oil market, a safer bet is targeting low risk opportunities as companies looking for ‘growth’ are likely to falter at the expense of those with more efficient production.

The implications are that production profiles may decline and companies may get smaller — but returns should improve. This is what AOW is banking on, and is going out there to make it all happen.

This could be a good time to jump on and ride AOW’s coattails, all the way to the pump.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.