ASX Explorer Days Away From Completing European Cobalt Drill

Published 14-NOV-2017 00:45 A.M.

|

7 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Auroch Minerals (ASX:AOU) has been making lightning-fast work of its four hole, 1,500m drilling program at its Tisová Cobalt-Copper-Gold Project in the Czech Republic, completing its first two holes in late October and its third hole just last week.

Completion of these holes has brought AOU to 75% of its focused drilling campaign.

As predicted in its 3D model , all holes have intersected the sulphide blanket.

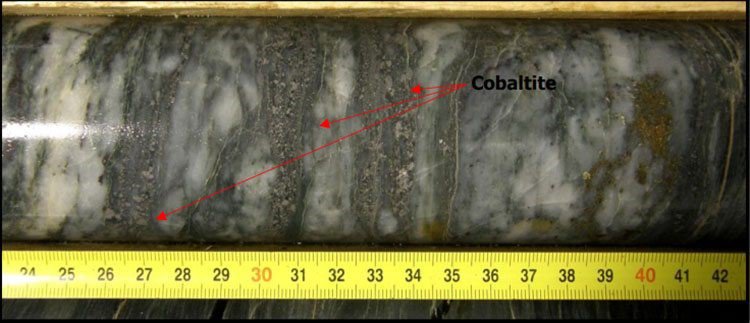

One hole intersected multiple zones of massive to semi-massive sulphide mineralisation with a disseminated sulphide halo over 100 metres thick between 333 metres and 462 metres, including visible cobaltite.

The other intersected multiple lenses of vein and disseminated sulphides between 370 metres and 400 metres.

Results released for the third hole show that AOU has identified more cobaltite, intersecting multiple zones of semi-massive, disseminated and vein hosted sulphide mineralisation above the target zone.

Samples for these holes were dispatched to the assay laboratory, with results expected in a matter of weeks.

The campaign itself is set for completion by the end of-November – just days from now – and represents a sizeable milestone for the $20 million-capped AOU.

Of course, as a speculative stock investors should seek professional financial advice if considering AOU for their portfolio.

Central Europe is growing rapidly as a favoured destination for ASX listed stocks exploring for renewable energy metals such as cobalt and lithium.

Two stocks further along than AOU, European Cobalt (ASX: EUC), currently capped at almost 10 times AOU ($188M market cap) and European Metals (ASX:EMH) — capped at $100 million have both done particularly well over recent years, and provide the pathway to value appreciation for AOU.

Strong leverage to European Cobalt

Results thus far are especially interesting in light of the similarities between AOU’s Tisová project in the Czech Republic and the Slovakian projects of a larger explorer: European Cobalt (ASX:EUC).

This cobalt peer has a high-grade cobalt, copper and nickel mine in Dobsina, central Slovakia — not all that far from Tisová.

Over the last 18 months, EUC has been in an ascendant position. Chaired by the resources entrepreneur, Tolga Kumova, the company’s share price is up more than 500% since May last year, currently trading at $0.285.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

EUC’s market cap is $188 million. AOU is capped at a mere $20 million, and is drilling right now. Given the early stage of its progress, there could be strong upside in the long-term for AOU.

The catalyst: Drilling campaign to be completed in coming days

With the completion of the first three holes of its drilling program at the Tisová cobalt-copper-gold project, AOU is now more than halfway through its campaign.

AOU recently released results from its third hole , which was found to intersect visible cobalt and copper minerals with a 130 kilometre thick zone containing 1-5% disseminated sulphides.

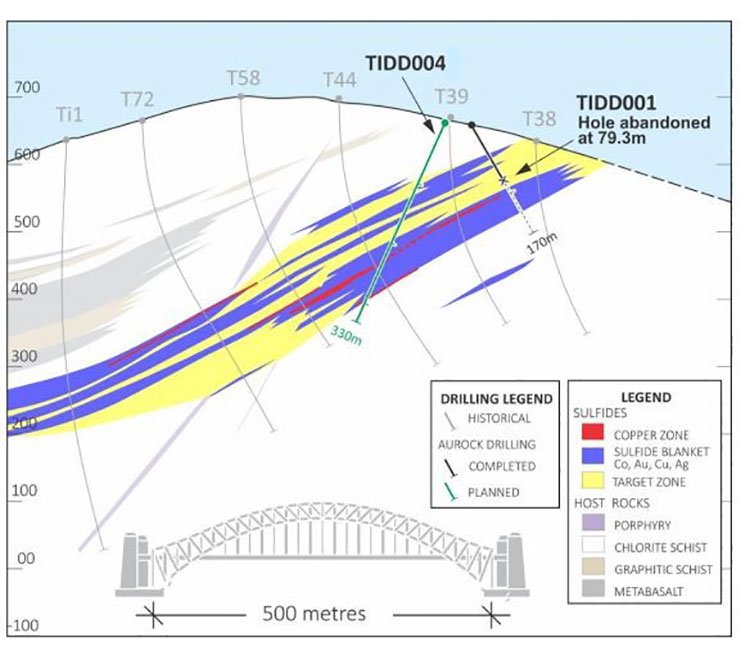

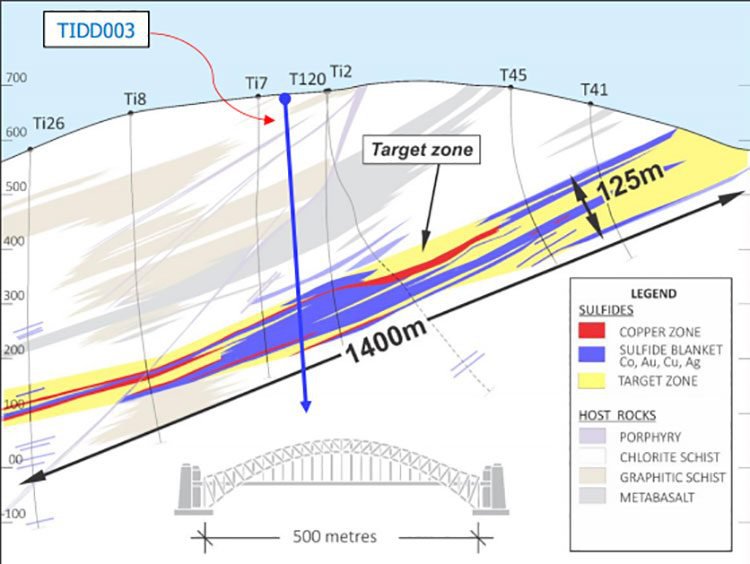

Below, you can see the geographical section highlighting sulphide halo and historic drilling.

These results have followed quickly after the first completion of the first two holes:

AOU’s pleasing drilling outcome has confirmed the positive results from its recently completed 3D model based on historical drilling and other records of the old copper mine.

AOU’s best results for Tisová have come in at: 0.69% cobalt, 17.1% copper, 3.7 grams per tonne of gold, and 178 grams per tonne of silver.

Encouragingly, the second hole, TIDD003, intersected multiple zones of massive to semi-massive sulphide mineralisation with a disseminated sulphide halo over 100 metres thick between 333 metres and 462 metres, including visible cobaltite.

Further to that, the first hole (TIDD002), intersected multiple bands of pyrrhotite, pyrite, and chalcopyrite mineralisation between 370 metres and 400 metres.

Previous rock chip samples by AOU suggest that the highest cobalt grades occur away from the copper (chalcopyrite) rich zones.

Situated in the Czech Republic, Tisová itself is a very old underground mine that was first constructed in the 12 th century, and produced 560,000 tonnes of ore (at 0.68% copper) between 1959 and 1973.

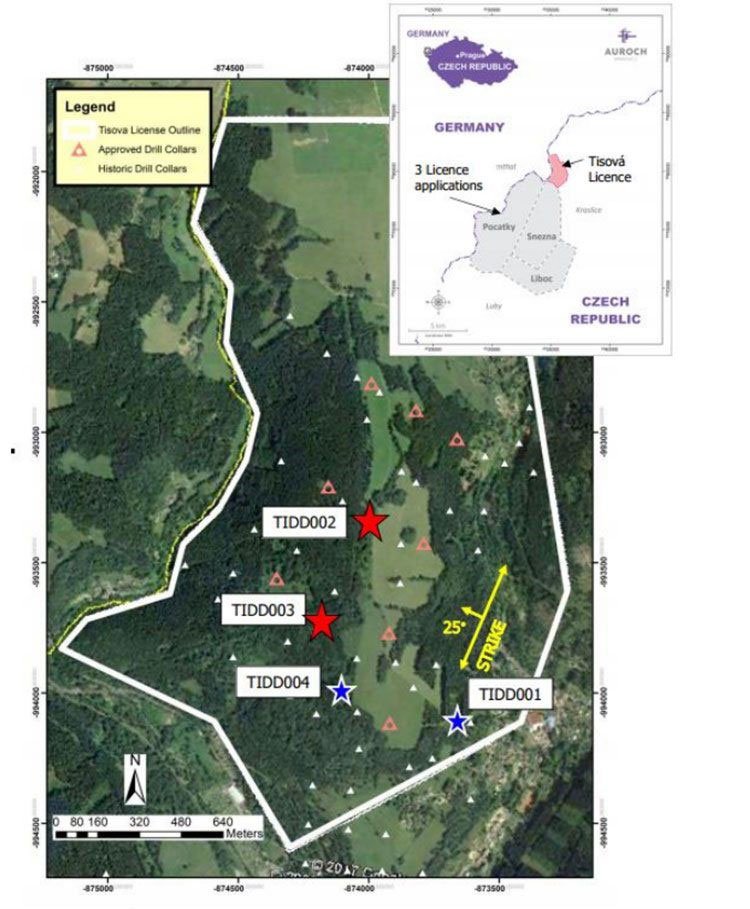

Below, you can see outline of the Tisová licence, alongside the drill hole location plan:

Using its 3D model to target the thickest parts of the sulphide-rich ore body, AOU’s prediction that the second hole would intersect multiple sulphide zones was proven correct.

The 3D model also confirmed sulphide halos of more than 100 metres in true thickness, multiple lenses of massive semi-massive sulphides within the target halo, and 30 kilometres plus of underground development, including a 400 metre shaft down to 9 level (400 metres below surface).

The target zones are highlighted below:

When it comes to TIDD003, AOU believes that a visual inspection of the drill core suggests a significant cobalt tenor in the mineralisation at Tisová.

A noteworthy highlight here is a 20 centimetre band of semi-massive cobalt mineral, displaying almost mono-mineralic cobalt mineralisation, followed by 30 centimetres of pyrrhotite and 10 centimetres of chalcopyrite mineralisation, as below:

Furthermore, other geological features now tend to suggest that the mineralisation has a strong structural control, which had not previously been recognised. Importantly, the new model opens significant exploration potential.

As with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

AOU has now begun drilling the fourth hole, which is expected to be completed by late-November – not long away now.

Assay samples are being prepared for analysis, and are also expected back in a matter of weeks, which could mean some compelling news for AOU shareholders.

Overall, this is a big step and some very encouraging results for the proactive AOU.

Cobalt and electric cars – the status quo in Europe

With Tisová, AOU has within its reach a particularly promising corner of the renewables market: the significant projected growth in EV manufacturing within Europe.

A recent report by Dutch bank, ING, has predicted that EVs will account for all new vehicle sales in Europe by 2035, as reflected by brands like Jaguar, BMW and Mercedes.

As the article above explains, driven by falling battery costs, government support, and economies of scale, all new cars sold in Europe will be electric within less than two decades.

Eventually, by the end of the next decade, car manufacturers will begin focusing solely on electric models.

Swedish car manufacturer Volvo has said that all new cars will be fully electric or hybrid from 2019 onwards, with plans to have sold a total of 1 million electrified cars by 2025.

The German Volkswagen is even attempting (though not successfully , it would seem) to secure at least five years’ supply of cobalt, hinging on the important question of supply.

Bearing all this in mind, and taken alongside the lack of stable, conflict-free cobalt sources to satisfy this growing demand, this is a ripe market that AOU stands to tap – and where better to do that than from the heart of industrial Europe?

Looking forward...

AOU has a lot to look forward to, and is only weeks away from completion its high-impact drilling program at large at Tisová.

That’s not the full extent of AOU’s battery-focused repertoire, either.

The company is also rapidly progressing its highly prospective copper-zinc Alcoutim Project in Portugal – the other half of the renewable puzzle. Alcoutim is situated immediately along strike from the super-giant Neves Corvo mine in the western half of the globally renowned Iberian Pyrite Belt (IPB).

Before the year is out, a number of major signposts pave the way for this budding explorer, including assay results and completion of the fourth hole at Tisová. This will very likely translate to a flood of news flow in the coming weeks.

These are still early days, but with serious leverage to European Cobalt and promising recent drilling results, AOU is quickly emerging as a serious contender in the ASX cobalt exploration corridor.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.