Our Rare Earths Portfolio

| Stocks |

Date of Initial Coverage

|

Initial Entry Price

|

Highest Point |

Performance from Initial Entry

|

|---|---|---|---|---|

| MEG | 1676552400 17-Feb-2023 | $0.039 | 151% | -67% |

| LYN | 1668949200 21-Nov-2022 | $0.256 | 127% | -6% |

| LNR | 1644411600 10-Feb-2022 | $0.029 | 134% | -86% |

| Stocks |

Date of Initial Coverage

|

Initial Entry Price

|

Highest Point |

Performance from Initial Entry

|

|---|---|---|---|---|

| MEG | 1676552400 17-Feb-2023 | $0.039 | 151% | -67% |

| LYN | 1668949200 21-Nov-2022 | $0.256 | 127% | -6% |

| LNR | 1644411600 10-Feb-2022 | $0.029 | 134% | -86% |

Macro Outlook Rare Earths - 2023

There are two primary reasons why we like rare earths for 2023, particularly Neodymium (Nd) and Praseodymium (Pr):

- Provides exposure to energy transition - rare earths Nd and Pr, are needed for the manufacture of permanent magnets found in wind turbines and electric vehicles. With electric vehicles to make up a big chunk of future demand:

- Ties in with our localisation of supply chains macro theme - rare earths mining is still currently dominated by China (~63%) and as a result Western and friendly countries are working hard to shore up their rare earths supply chain. In the event of heightened tensions with China or potential conflict, these countries don’t want to be beholden to Chinese rare earths supply - they don’t want a repeat of 2010/2011. As a result, we expect new sources of supply from friendly and aligned countries to attract premium pricing. In 2022, the US rolled out funding initiatives for future Australian rare earth suppliers, something we expect to continue in 2023, further bolstering capital flows to rare earths companies.

Niobium is worth a mention too, as this rare earth is used in a range of high tech applications and can improve the performance of EV batteries - there are only 3 mines in the world that produce it, and it's been showing up on Western governments’ critical minerals lists in the last couple years.

So despite the geopolitical flavour to the rare earths outlook for 2023 - we are long term Investors and believe over the next decade demand from the energy transition will be the primary driver of capital flows into the rare earths industry.

Discover the 5 Battery Materials Stocks we’ve Invested in for 2023

What the analysts say

Macquarie analysts said NdPr accounts “for around a third of global rare earth demand by volume but more than 80 per cent by value at spot prices as the market remains in deficit amid strong EV demand.”

China raised the country’s production quota 20% in 2022, but this wasn’t enough to keep up with supply.

“The rare earth quota for the calendar year 2022 was higher than we had expected, however we still believe the NdPr market remains in deficit despite the increased supply.”

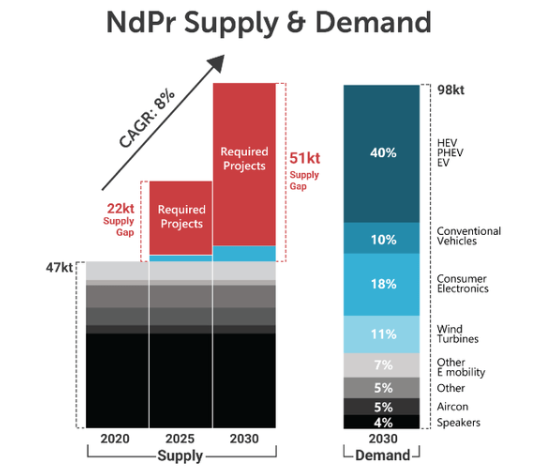

UBS analyst Levi Spry “estimates the NdPr market will grow steadily at 8 per cent a year over the next decade. But there are risks posed by potential substitution by other materials.”

What about the bear case?

China could flood the market, demand could fail to appear or new supply could come into production.

Alternatively, rare earths could face risk from substitution, i.e new materials being used to perform the same function.

In October, Bloomberg noted that, “scientists may have discovered a method for making magnets used in wind turbines and electric cars without the rare-earth metals that are almost exclusively produced in China.” The material is called tetrataenite, an iron-nickel alloy.

Our Rare Earths Investments

Megado Minerals (ASX:MEG)

Read Investment Memo →

Lycaon Resources (ASX:LYN)

Read Investment Memo →

Lanthanein Resources Limited (ASX:LNR)

Read Investment Memo →

Our Commentary on Rare Earths

What happened at RIU Sydney?

Weekender

May 13, 2023

|Next Investors

|15 min

This week we were at the RIU conference in Sydney, meeting our portfolio companies and looking at new investment opportunities. During this time, we saw Latin Resources (ASX:LRS) - our Brazilian Lithium Investment, have a nice little share price run. Let's dive in!

Potential Lithium Comeback, Sydney RIU Conference and more...

Weekender

May 6, 2023

|Next Investors

|12 min

In this weekender, we look at the potential for a lithium price bounce back and the current macro environment surrounding this possibility. We will also be heading to Sydney for the RIU Conference, where we will meet several of our portfolio companies and provide an update.

Why we invest in junior explorers, Critical Minerals and more...

Weekender

Nov 28, 2022

|Next Investors

|13 min

Did you know that almost 100% of new mineral discoveries in Australia are from junior explorers? In today’s newsletter we discuss why, as well as how the ASX is like VC for junior mining companies.

What happened at RIU Sydney?

Next Investors

|May 13, 2023

Potential Lithium Comeback, Sydney RIU Conference and more...

Next Investors

|May 6, 2023

Why we invest in junior explorers, Critical Minerals and more...

Next Investors

|Nov 28, 2022