ASX Stock Confirms 43.2% Zinc Grades on New Project

Published 23-JUL-2017 23:39 P.M.

|

7 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Zinc prices have doubled over the past 18 months to ten year highs.

However, there are only a limited number of ASX listed zinc companies with strong projects vying for investors’ wallets.

One new entry into the zinc realm is Victory Mines, (ASX: VIC) which just last week announced it had entered into an agreement to acquire a promising early-stage, polymetallic asset known as the Bonaparte Project.

The Bonaparte Project spans a large 550km 2 tenement package area, where several high grade prospects have already been defined from early sampling and previous drilling.

The Project is prospective for carbonate-hosted zinc, lead and silver deposits as well as sedimentary-hosted copper and cobalt deposits.

It is already dishing up high grade, independently verified assay results including high-grade zinc of up to 4.1% and 28.2% lead from rock chip sampling. It’s now emerging that several gossans on the project have clearly not been tested by previous drilling – providing potential walk up drill targets once the acquisition is complete.

This all bodes well for VIC as it hopes to turn this project into something quite substantial in the near future.

Of course, this is a speculative stock and if considering for your portfolio, take into account your own personal circumstances and risk profile and seek professional financial advice.

Besides impressive zinc and lead grades, of further note is the high grade cobalt detected of over 4% also occurring in rock chip samples.

Like zinc, cobalt is another market on the rise and one that is cashing in on the growth of the lithium-ion battery market fuelling the electric vehicle and new energy boom.

Given previous drilling did not effectively target potential high grade zones, it opens the door for VIC to not only capitalise on the tenement licences to be acquired, but also leverage the strong position of the zinc market in general.

Importantly for investors, its worth pointing out that VIC currently has a market cap of just $4.1 million, with almost $1.66M cash in the bank – which means VIC currently has a very low enterprise value of $2.4M. This should provide solid funding for proving up additional value on the project.

With that in mind, let’s have a look at the acquisition in more detail.

The Catalyst: Acquiring Bonaparte

VIC is set to acquire the Bonaparte Project, located on the prolific western margin of the Bonaparte Basin in Western Australia.

This Project already contains a non-JORC compliant zinc resource of 150,000t averaging 2.25% zinc.

VIC has entered into a Heads of Agreement to acquire the Bonaparte Project from the vendors under the following terms:

- Cash payment of $50,000 upon execution of the Agreement;

- Cash payment $50,000 plus issue of 10,000,000 shares on receipt of two or more assay results from the recent surface sampling program that confirm zinc mineralisation of at least 10% and cobalt mineralisation of at least 0.5% and;

- Issue of 10,000,000 shares upon satisfaction of the conditions precedent and settlement of the Agreement.

VIC has also agreed to issue the following additional Shares related to exploration goals:

- 5,000,000 Shares upon confirmation of a JORC probable reserve of 10m lbs at 10% copper or zinc or lead equivalent being delineated on the Tenements (Milestone 1); and

- 5,000,000 Shares upon confirmation of a JORC probable reserve of 20m lbs at 10% copper or zinc or lead equivalent being delineated on the Tenements (Milestone 2).

The Project’s minimum combined expenditure on both licences is A$250,000.

The money will allow the work programme to be scaled or held for ~A$150,000 at the election of VIC, which gives the company flexibility to fully explore the project area for all possible deposit types.

“A leader is a dealer in hope” – The Bonaparte Project in Detail

The sub-head above is one of Napoleon Bonaparte’s most famous quotes and is apt as a descriptor for what VIC is attempting to achieve.

No doubt, VIC sees this acquisition as what could be the start of a major zinc asset discovery. And as VIC is coming off a very current low market cap, the hope here is very real for the company (and its shareholders) to build this company into a leading zinc stock.

However at the same time, this stock is speculative and investors should consider all public information not just the information in this article and seek professional financial advice before making an investment decision.

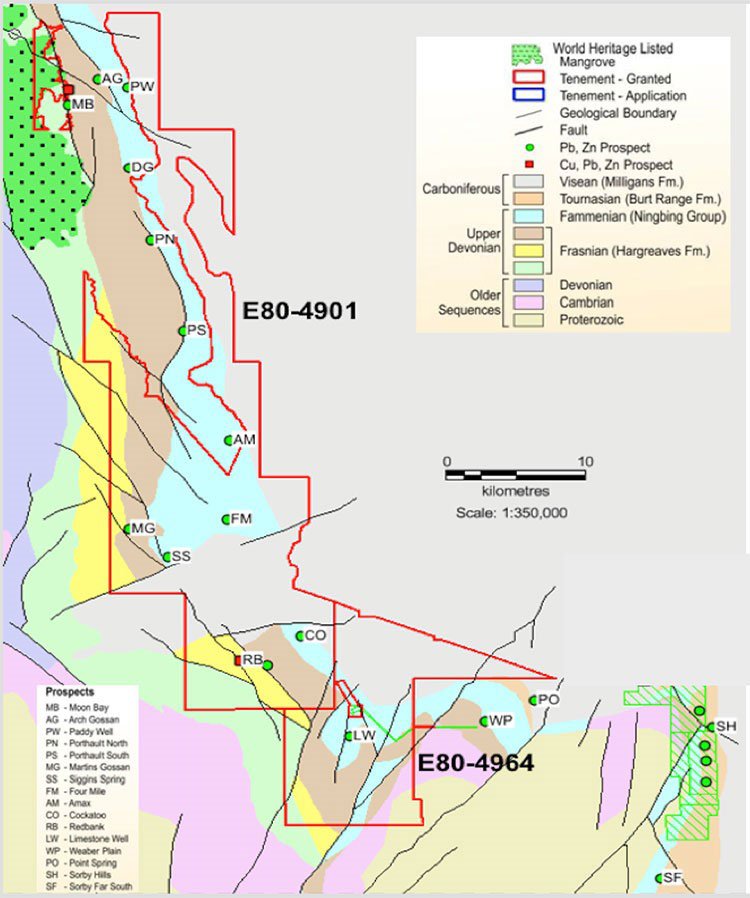

Upon completion of the acquisition, VIC is to secure two exploration licenses covering some 550 km 2 of land at Bonaparte, which are valid for five years.

You can see VIC’s tenements laid out on the map below:

The tenement package has been explored in the past, however most exploration has either involved stratigraphic/pattern drilling or has focused on existing surface gossans. Exploration conducted by Placer Prospecting in 1972 at prospect E80/4091 (see above) resulted in a non-JORC compliant inferred resource of 150,000t averaging 2.25% zinc.

The best results from drilling included:

- 5 g/t Ag over 6.1m from 3m.

- 1 % Cu over 6m from 3m, and 2.3% Cu over 13.7m from 15m.

- 4 % Pb over 6.1m from 0m.

- 1% Zn over 6.1m from 0m and 3.8 % Zn over 3m from 0m.

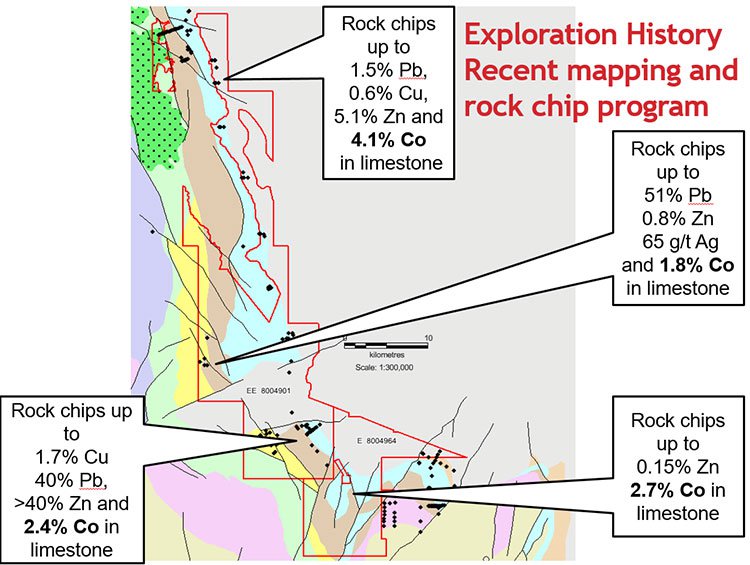

Recent work completed at the Bonaparte Project confirmed high grade mineralisation for cobalt/zinc and copper. Recent rock sampling results are shown in the map below.

There is significant zinc, lead and copper geochemical anomalism which has been located by previous exploration, indicating that mineralising fluids have reached these rocks.

The geochemical anomalism found appears to be associated with syn-sedimentary normal faults, similar to the structures controlling the Lennard Shelf MVT-style deposits.

MVT deposits are highly regarded as MVT’s high grades, combined with the soft sedimentary host rock and concentrated structural formation, make them particularly easy to mine.

Recent results

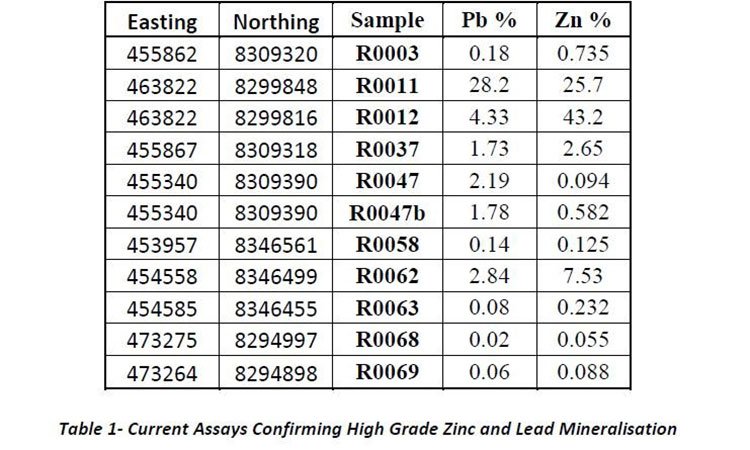

Results released today from independent laboratory analysis of recent XRF rock samples, not only confirm the significance of this acquisition, but have also confirmed VIC’s suspicions about the high-grade prospectivity of the tenements.

These results provide further justification that several gossans on the Bonaparte project have clearly not been tested by previous drilling which provides VIC with several potential walk up drilling targets.

Here are the results:

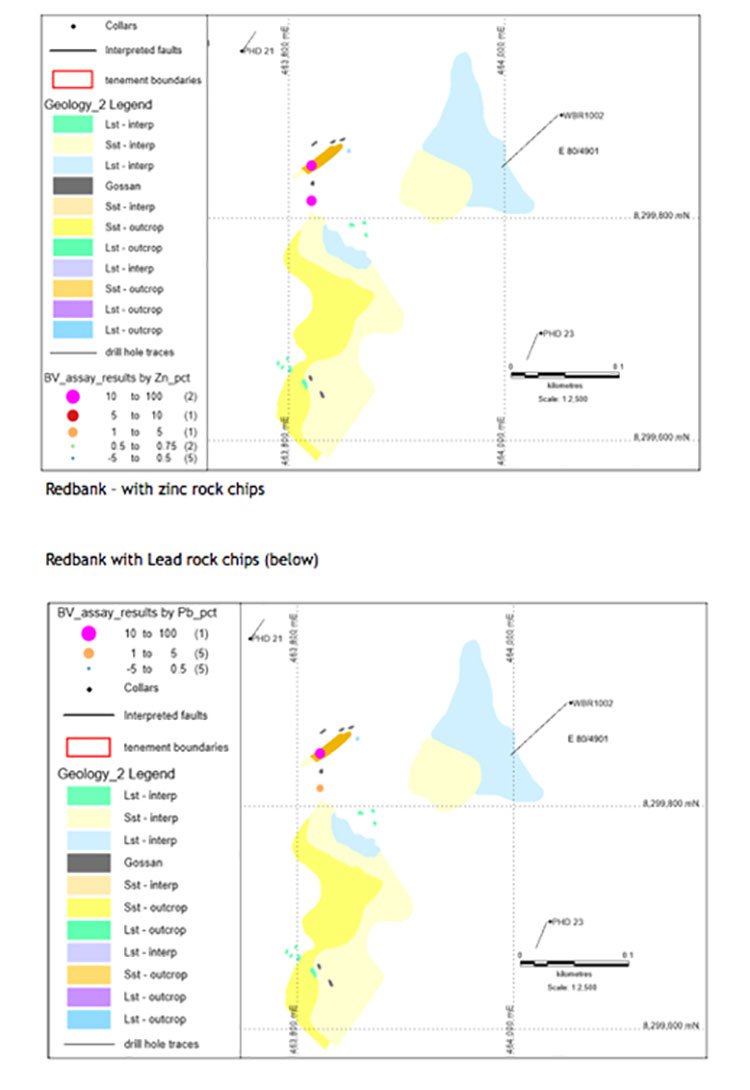

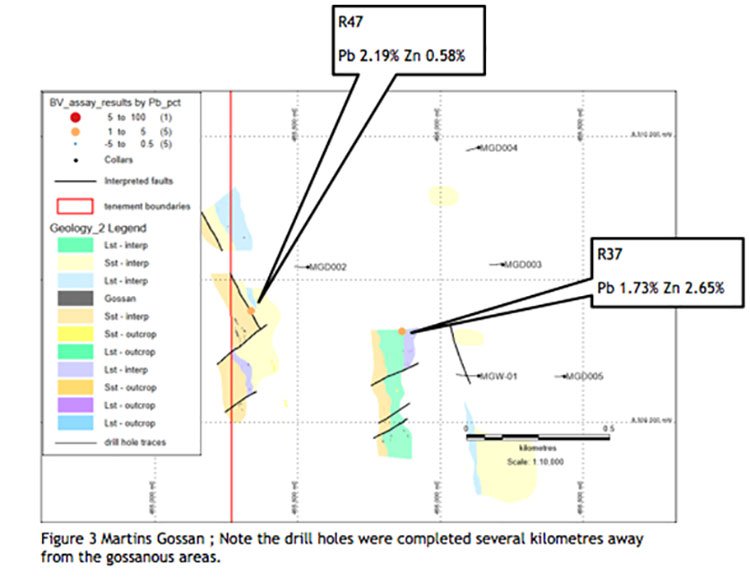

Figures 1, 2 and 3 (below) show an overview of the additional gossans that the company believes are highly prospective on the Redbank and Martins Gossans.

Evidence that previous drilling missed highly prospective gossans is demonstrated from the fact that the previous drilling is quite distant from the areas which returned the high grade lead and zinc results.

Figures 1 and 2 – Redbank Gossan, Rock Chip Results and Previous Drill Hole Locations

Figures 1 and 2 – Redbank Gossan, Rock Chip Results and Previous Drill Hole Locations

VIC will now analyse the data further to decide the best way forward for further potentially aggressive exploration.

Zinc on a high

There is a reason VIC has acquired the Bonaparte Project. It is all to do with the current sentiment towards zinc.

The International Lead and Zinc Study Group (ILZSG) anticipates global demand for refined zinc to be greater than supply in 2017, keeping zinc markets in a deficit for a second consecutive year.

The ILZSG further predicts a deficit of 226,000 tonnes, similar to last year.

So with demand increasing and higher prices forecast, a significant, high-grade zinc project may just be what the zinc doctor ordered.

However, commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone. Seek professional financial advice before choosing to invest.

Headlines like this tell the story:

And this:

So, VIC’s acquisition is of serious strategic importance as it looks to evolve this early stage project into something that could have an impact moving forward.

And that’s just zinc. Remember cobalt is in the mix here too, with the cobalt market experiencing similar growth.

The wash up

VIC’s acquisition is a strategic play to make the most of the current sentiment towards the zinc market.

Whilst an early stage play, The Bonaparte Project is already highly prospective for zinc, lead and cobalt and independent assay results have already produced encouraging numbers.

With a low enterprise value of $2.4 million, VIC is well placed to increase in value should its impending aggressive exploration campaign bear fruit.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.