White Rock expands its highly prospective landholding

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

White Rock Minerals (ASX:WRM) has made an extremely promising start to the 2020 year with the announcement of the discovery of two significant surface geochemical anomalies at its 100% owned Red Mountain Project, a high-grade zinc and precious metals VMS project in central Alaska.

As a backdrop, there are already two high grade deposits at the Red Mountain Project, with an Inferred Mineral Resource of 9.1 million tonnes at 12.9% zinc equivalent for 1.1 million tonnes of contained zinc equivalent at Dry Creek and WTF (West Tundra Flats).

Providing a further boost to the company’s prospects in 2020, management has secured some 84 square kilometres of new claims at Red Mountain.

This area is identified as being highly prospective territory based on a strong, robust, large (15 square kilometres) gold anomaly that was discovered during the 2019 stream sediment sampling program.

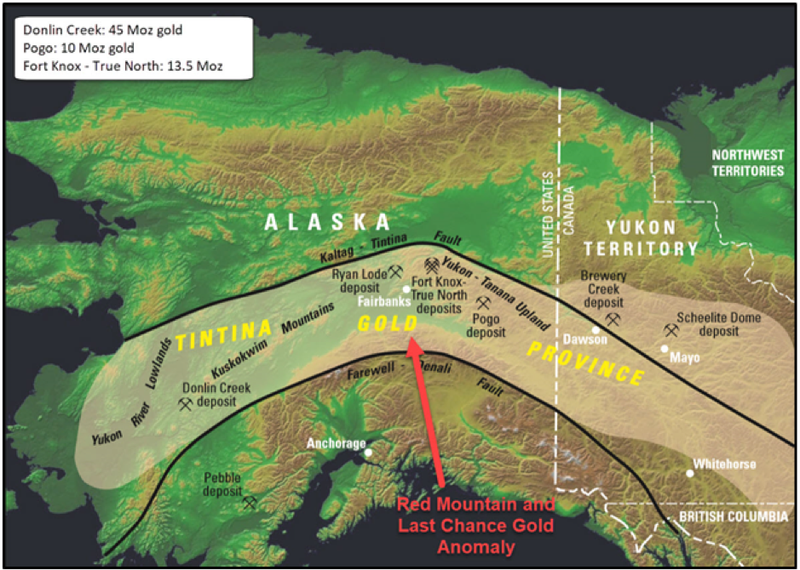

Notably, this gold anomaly sits in the Tintina Belt which hosts Pogo (10 million ounces - Northern Star), Fort Knox (13.5 million ounces - Kinross) and Donlin (45 million ounces - Barrick Gold and NovaGold), amongst others.

Harking back to the two new discoveries, during the 2019 field season White Rock completed a detailed regional stream sediment program over prospective stratigraphy within the Red Mountain project area.

Sampling targeted stratigraphy prospective for additional VMS (Volcanogenic Massive Sulphide) deposits as well as cretaceous gold systems related to the world class Tintina Gold Province.

As previously mentioned and illustrated below, this province is host to gold deposits such as Donlin Creek (45 million ounces gold), Fort Knox (13.5 million ounces gold) and Pogo (10 million ounces gold).

Within this system lies the Last Chance Prospect (red arrow) which is the aforementioned 15 square kilometre gold anomaly referred to.

Defined by 27 stream sediment sample points Last Chance features up to 418 ppb (0.4g/t) gold.

The gold anomaly has a highly anomalous core of more than 100ppb gold in first order stream catchments over 3.5 kilometres of strike east-west, and at more than 75ppb gold extends over 6 kilometres of strike length.

The gold anomaly is located in the headwaters of Last Chance Creek.

Downstream from this prospect, significant placer workings commence 12 kilometres to the north and extend further north downstream through the foothills of the Alaska Range as shown below.

White Rock targeting unexplored territory

The Last Chance gold anomaly is located along a regional gold-arsenic-antimony trend that extends to the east and is spatially associated with a suite of exposed Cretaceous granites, the same age as those associated with the major gold deposits distributed throughout the Tintina Gold Province.

A historic search of the Alaska Department of Natural Resources website indicates that the Last Chance gold anomaly has never had any historic mining claims staked, suggesting that the area is unexplored.

Together with the size and strength of the gold anomaly, White Rock is buoyed by the exploration potential for the Last Chance Prospect to yield a significant new gold discovery.

On this note, managing director Matt Gill said, “White Rock is extremely excited about identifying such a strong and coherent gold anomaly in a part of the world class Tintina Gold Province.

‘’This region is host to over 100 million ounces of gold, that doesn’t appear to have been explored for gold by previous explorers despite the significant placer gold workings downstream only 12 kilometres from the Last Chance gold target.

‘’The detailed sampling gives White Rock an area for immediate focus with the hope that the gold anomalism could lead to a discovery with similar characteristics to world class deposits such as Donlin Creek and Pogo that are also located in the Tintina Gold Province.”

The detailed definition of stream sediment sampling provides a clear area for focused on ground follow-up activities.

White Rock expects to be able to commence geological reconnaissance and detailed surface soil and rock chip geochemistry during June 2020, prior to the possibility of drill testing targets during the September quarter of 2020.

Moose represents a new zinc-copper VMS target

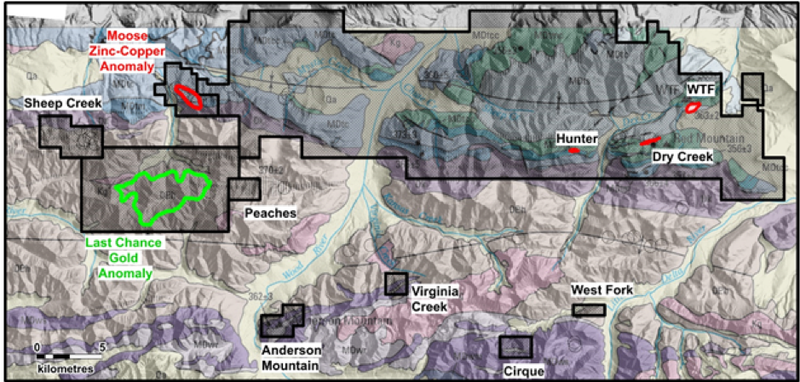

It is also worth noting the Moose Prospect which as indicated on the above map lies to the north of Last Chance.

It is a 1.5km2 zinc-copper anomaly defined by four stream sediment sample points of more than 5000 ppm (0.5%) zinc and more than 750 ppm copper, with two of these assaying greater than 1% zinc.

The anomaly is located in the lower section of the Totatlanika Schist on the southern limb of the regional synform.

This is along strike and to the west of White Rock’s high-grade zinc and precious metals Dry Creek VMS deposit.

The Moose zinc-copper target will also be prioritised for initial ground activities at the start of the 2020 field season.

Starting on front foot after strong finish to 2019

While these new opportunities are important in terms of providing White Rock with new opportunities in 2020, one needs to also bear in mind that the company finished its 2019 exploration season on a high.

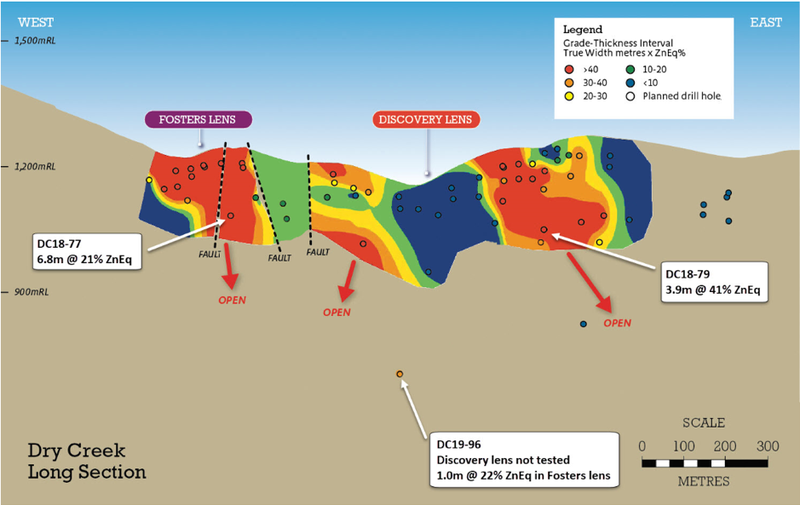

Assay results for the final drill hole (DC19-96) of the 2019 season at Dry Creek which tested an aggressive 200 metre plus down-dip step out from the known high-grade zinc-silver-lead-gold mineralisation of both the Fosters and Discovery lenses returned extremely high grades.

Mineralisation was successfully intersected with 1.4 metres including massive sulphide containing abundant zinc sulphide located within stratigraphy equivalent to the Fosters lens.

Assay results for this intersection as illustrated below returned 1.4 metres at 13.9% zinc, 4.4% lead, 115 g/t silver, 0.8 g/t gold and 0.3% copper for 21.6% zinc equivalent.

This deepest intersection in the Dry Creek deposit indicates a possible steeper dip to mineralisation than first interpreted, suggesting the deposit could be wide open down dip along its entire 1,200 metre strike length.

This leaves considerable additional potential to the down dip position in the deposit, especially when considering the Resource footprint extends for 1,200 metres of strike.

A targeted drill program early in the 2020 field season could unlock just how significant the Resource expansion potential could be.

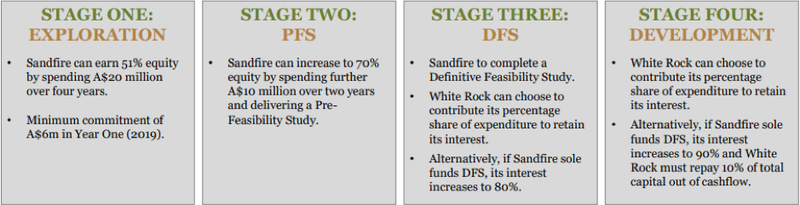

With this in mind it is extremely valuable for White Rock to have Sandfire Resources (ASX:SFR) as a strategic partner and major shareholder that has signed an earn-in joint venture that could see $30 million spent on the Red Mountain Project for a 70% interest in this high-grade asset.

This is how Sandfire’s contributions will assist White Rock in the near to medium-term as it contributes towards financing of exploration and studies, as well as a possible proportion of development costs depending on decisions taken by the parties following the DFS.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.