VUL signs third major offtake in 90 days

Our favourite investment and 2020 Small Cap Pick of the Year Vulcan Energy Resources (ASX:VUL) just signed its THIRD offtake agreement in 90 days for its unique, environmentally friendly Zero Carbon lithium - just as the lithium price hits another new high and the global “Net Zero” movement gains pace.

VUL is rapidly closing in on its goal of being the world’s first Zero Carbon lithium company. VUL has the largest lithium resource in Europe - a region where it seems almost everyone is making the switch to electric vehicles.

Europe is the fastest growing lithium market in the world and determined to build its own lithium supply - China currently controls 80-90% of the global lithium market.

So with the lithium price surging, and battery makers unable to keep up with demand, it seems like the perfect storm for VUL.

Today VUL signed ANOTHER offtake agreement - this is the third offtake agreement signed in the last 90 days.

This time it is with leading global cathode manufacturer “Umicore” - for an initial five-year term and the start of commercial delivery is set for 2025.

“Cathodes” are the positive electrodes in lithium-ion battery cells. Cathodes are typically comprised of a multi-metal oxide blend of cobalt, nickel and manganese, to which lithium is added.

Umicore is purchasing 28,000 to 42,000 tonnes of VUL’s battery grade lithium hydroxide over the duration of the agreement, representing approximately 20% of VUL’s current planned output over the period.

Umicore will be the first European cathode producer, doing so at its Polish cathode materials plant - and is sourcing its lithium from VUL.

Umicore plans to achieve Net Zero emissions by 2035 - so VUL’s local Net Zero lithium fits in perfectly with Umicore’s own Net Zero strategy.

VUL has now locked in three offtake agreements in 90 days - battery maker LG Chem in July, car giant Renault in August, and now cathode maker Umicore.

Offtake agreements are signed when a customer commits to buying future output (that doesn't exist yet) from a producer.

These are important because they secure future revenue for the aspiring producer, and make getting funding for capital costs dramatically easier.

All of VUL’s offtake deals will feed into VUL’s bankable study which it is working on now.

A Bankable Feasibility Study will demonstrate the economics of the project and allow VUL to secure financing for the capital costs of its plant.

Umicore is significant because of WHO it sells their product to - Umicore sells their environmentally friendly, green “cathodes” to battery makers, who then can say their batteries are “green” and sustainably sourced.

Battery makers then sell to car makers.

VUL’s unique Zero Carbon Lithium could be a competitive advantage for Umicore as a selling point for their green cathodes into their client base of many different battery makers AND car makers.

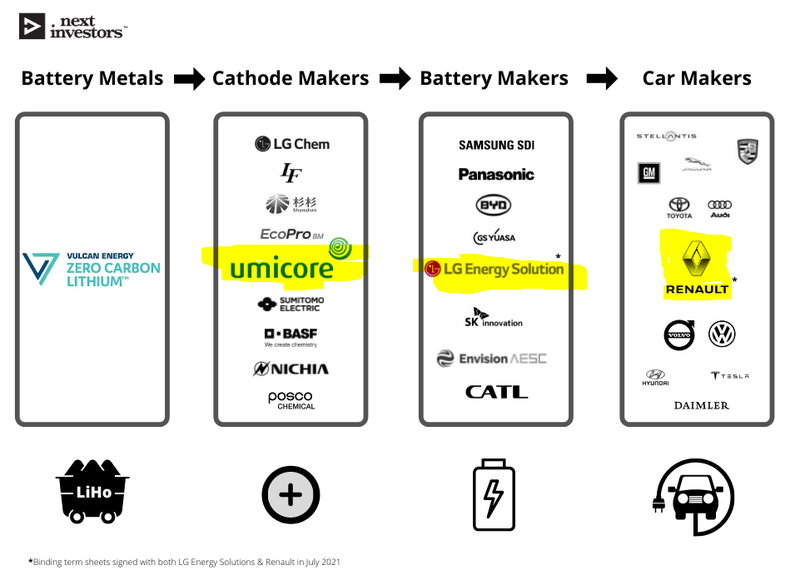

We whipped up this image to explain the supply chain, the yellow highlights show companies where VUL has an offtake, but more importantly it shows that cathode producers have direct sales channels to battery makers, who then sell to car makers:

Importantly, VUL has now proven it can sell their Zero Carbon lithium across the ENTIRE battery value chain - it now has secured offtakes from:

- A cathode maker: Umicore ✅

- A battery maker: LG Chem ✅

- A car maker: Renault ✅

Who is Umicore and why is it interested in VUL?

Umicore’s history goes back 200 years and today is a global materials technology and recycling group, with three key business streams:

- Key Materials for Rechargeable Batteries: It's a leading supplier of key materials for rechargeable batteries used in electrified transportation and portable electronics. As we mentioned above, Umicore is a leading global cathode manufacturer - and the first in Europe - this is what got Umicore interested in VUL’s lithium.

- Automotive catalysts - Umicore also delivers materials for internal combustion engines, hybrids and fuel powered vehicles.

- Recycler of complex waste streams containing precious and other valuable metals.

Umicore generated €2.1BN of revenue in the first half of 2021, and made €625M in adjusted EBIT.

ESG is a huge focus for Umicore - check out its 2021 Investor Presentation and it is aiming to be Net Zero by 2035 - so sourcing VUL’s lithium fits neatly into Umicore’s strategy.

Lithium price keeps rising.. What are all the VUL offtakes worth now?

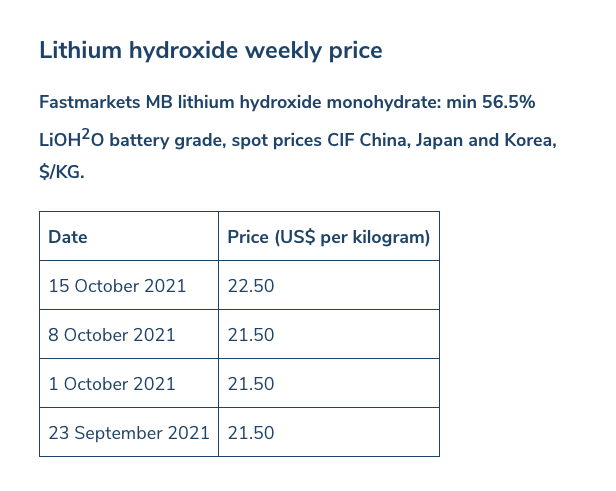

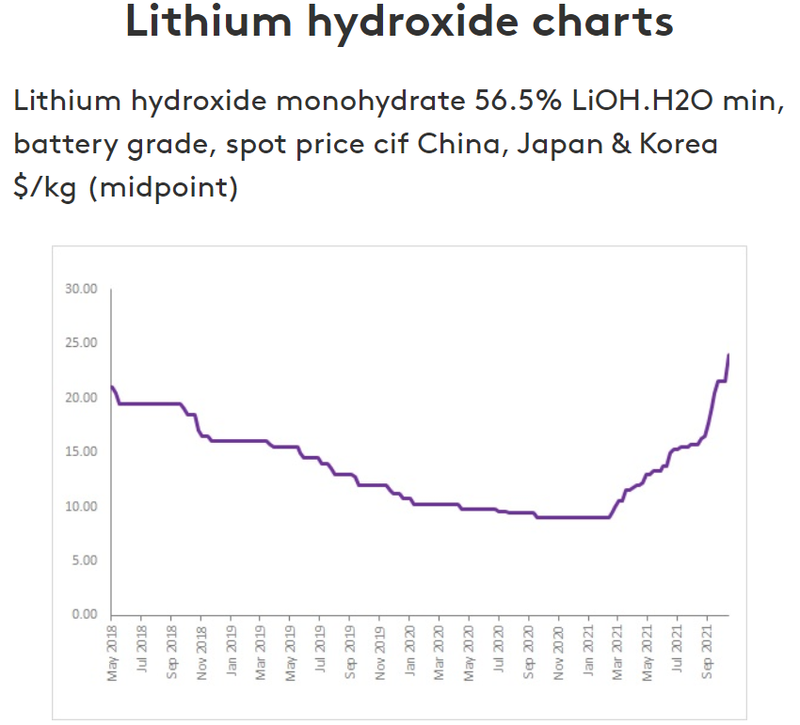

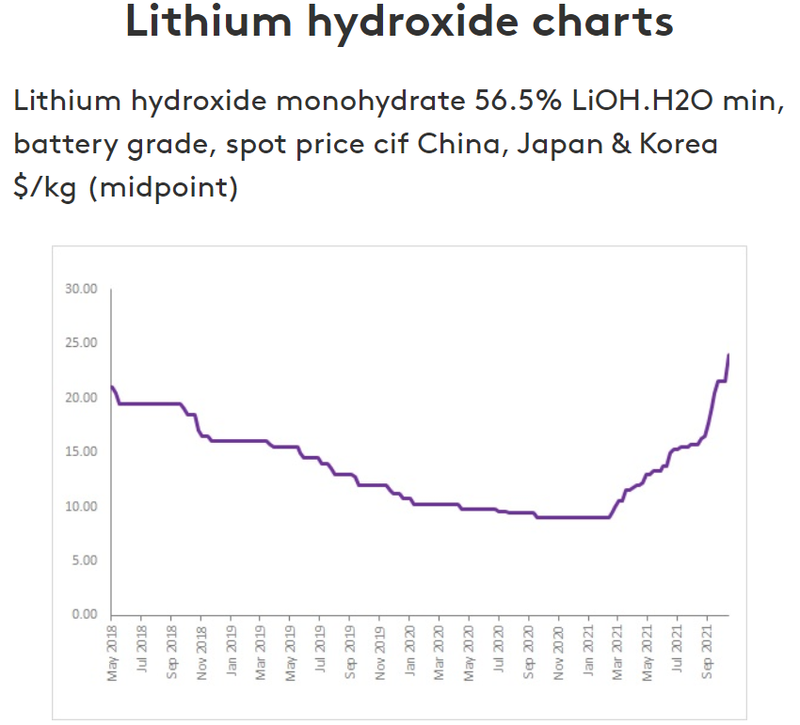

The lithium price hit a new high this week (check out the image below) - so what does this mean for VUL’s offtake values?

And

VUL now has a THIRD offtake for a total of max 42,000 tonnes of its Zero Carbon lithium AND the lithium price is at a new high of US$22,500 per tonne.

Umicore deal: 42,000 tonnes x US$22,500 per tonne = $945,000,000 over the 5 year INITIAL term at the max = US$189M per year to VUL.

(Remember that Umicore sells to many major car and battery makers who are demanding sustainable battery metals - we think this offtake could grow.)

The lithium price was US $15,000 per tonne back when we did the rough calculations for VUL’s last two offtakes, which at the time gave us a combined (rough) total of US$300M per year.

Now if we recalculate the past two offtakes using the CURRENT lithium hydroxide price of US$22,500/t gives us a new rough calc of (click the links in the calculation below to see our original workings and assumption made at US $15,000 per tonne lithium price):

LG Chem 10,000t/y (New: $225M) + Renault 17,000 t/y (New: $382.5M) = US$607.5M per year to VUL.

Add today’s Umicore offtake of US $189M per year, that gives VUL a potential US$796.5M per year of revenue for the first 5 years.

If we take the POTENTIAL LIFETIME CONTRACT VALUE of all the offtakes VUL have secured using this weeks lithium price of US $22,500/t assuming high points and contract extension options are exercised, our rough calcs give us:

(Umicore $0.945 Billion) + (LG Chem $1.5 Billion) + (Renault $1.275 Billion)

= US $3.72 Billion of total potential revenue to VUL from current offtakes based on current lithium prices

this is AUD ~$5 Billion dollars of potential revenue from current signed offtakes .

But please remember these are just our fast, rough calcs where we make a few assumptions. There are no guarantees that lithium prices will stay the same.

The current lithium price of US$22,500/t price is well above the US$14,925/t price used in January’s Pre-Feasibility Study (PFS) to arrive at an after tax net present value for the VUL project valuation of A$3.55B - here is our commentary on the VUL Pre-Feasibility study (PFS) from when it first came out in January this year and VUL’s share price rocket from $4 to $14.

Big estimated revenue numbers look great, but how much will it cost to build the plant? What are the risks?

Ok, time to take a cold shower... according to the PFS, the capex to build the full project will be ~US$2B (converted to USD at today’s exchange rate from the January 2021 PFS capex of €1.738B).

Now that VUL has proven it can sell its Zero Carbon Lithium with three offtakes secured, this will contribute to the Definitive Feasibility Study (DFS), which will be used to deliver a Bankable Feasibility Study (BFS) to secure finance to build the project, VUL is currently working on both.

VUL has appointed BNP Paribas to help them secure this project financing. BNP Paribas is the biggest bank in Europe, and has had success with raising large amounts of financing for other green projects - see our commentary on the BNP Paribas project financing appointment here.

What are the risks? Everything is sounding very exciting for VUL at the moment, with a lot of things going right, but there is still a few years ahead and a couple of risks that investors need to note, including:

- successful completion of DFS and BFS,

- lithium price continuing to remain strong in the years to come,

- Securing project finance,

- ...and then all the risks that come with building a large capital project.

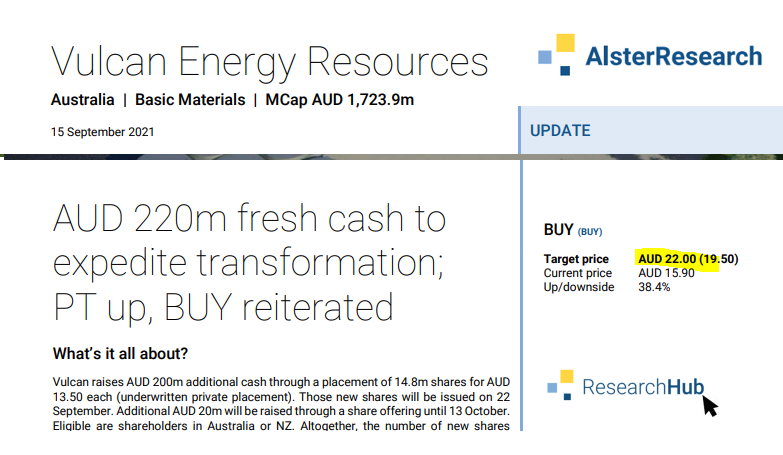

A great summary of the risks and capital expenditure required for VUL to deliver their project can be found in the latest research report released by German research house Alster, who currently have a buy recommendation and price target or AUD $22.00 for VUL:

While it’s always wise to take analyst predictions with a grain of salt, VUL does have a track record of eventually breaking through Alster’s previous price targets.

Since we have been invested in VUL, the share price has gone on to exceed most of Alster’s previous price targets so far (although it has pulled back after last $13.50 cap raise):

- March 2020: $2.45 ✅

- January 2021: $12.95 ✅

- February 2021: $13.30 ✅

- May 2021: $16.00 ✅

- June 2021: $16.50 ✅

- August 2021: $19.50

- Current Alster target price: $22.00

Given the pace of VUL’s progress as it works towards its goal of producing commercial quantities of battery quality lithium in 2024, we think there remains plenty of upside potential — something that Alster also recognises.

The VUL share price has been on a great upward trajectory over the last year, but remember that there will be bumps in the next few years and no great project is ever delivered without a couple of hiccups along the way.

Like after VUL’s $6.5 cap raise, it took a while for the share price to work back above the cap raise price. We hope that some near term newsflow from VUL (fast tracked by their $300M in the back) will get the price back up and past its previous highs.

VUL’s secret sauce is that it is in the hottest sector (clean, green lithium, for battery metals, in Europe) AND it has built the best geothermal team to deliver their projects AND it has $300M in the bank to acquire new projects and expand.

VUL remains our largest holding. Here is a quick summary of what it has achieved in the last 3 months that caused the share price to move from $9 to $16 (it’s now trading at around $12.50 on open) and what we are watching for next that will take the price to the next level:

Key things VUL has achieved in the last ~90 days:

Offtake #1 Offtake agreement with Renault - read our in depth commentary here

Offtake #2 Offtake agreement with LG chem read our in depth commentary here

VUL raised $200M, now over $300M in bank: according to the VUL September equity raise presentation, VUL still had $111M in the bank from their $120M raise at $6.50 in February this year. Now having raised a further $200M at $13.50, VUL has over $300M in bank, which in our opinion underpins VUL’s current valuation and allows them to fast track current initiatives AND explore some new opportunities - we expect plenty of news over the next 6 months.

VUL produced first battery grade lithium sample: VUL produced a battery-grade lithium hydroxide monohydrate (LHM) sample that grades better than the current best-on-the-market battery grade specifications required by offtake customers. Production of this battery quality lithium in a pilot plant in the Upper Rhine Valley is a major step on VUL’s path to producing commercial battery-grade lithium and is another step towards successful completion of the company’s Definitive Feasibility Study (DFS) that is now being conducted - read our in depth commentary here.

Announced Listing on MAIN Frankfurt stock exchange: VUL just announced that Berenberg, a 430 year old investment bank is going to list VUL on the main German stock exchange, opening them up to huge amounts of new capital by providing access to German and European institutional investors. VUL’s recently appointed chief communications office in Germany will get the world out to investors - read our in depth commentary here.

Appointed BNP Paribas to help with BFS and to secure project financing: appointed Europe’s biggest bank by assets, BNP Paribas, to help with its Bankable Feasibility Study and structuring project finance to build its Zero Carbon Lithium project. BNPP helped Sweden’s Northvolt secure a US $1.6B debt facility to build the biggest battery factory in Europe and also helped secure £5.5bn to fund construction of the 2.4 GW Dogger Bank wind farm in the UK..read our in depth commentary here.

Added to ASX 300 and key communication hires appointed: Read our commentary here.

Secured site for its lithium plant: Our other portfolio Wise-Owl covered this news - read here.

What we are watching out for VUL to do next - how will it hit Alster’s $22.50 price target?

Lots of news - We expect with over $300M in the bank VUL is going to be delivering news at a pretty good rate. We want to see some near term surprises from VUL with that amount of cash in the bank.

Access to European investors - We want to see progress announced on the Frankfurt main bourse listing - we think this listing will have a big impact on VUL particularly due to last month’s appointment of new German based chief communications officer, Beate Holzwarth, who has over 20 years experience in various communication and marketing roles within Mercedes-Benz Cars and Daimler Trucks.

We are excited for VUL to list on the main German stock exchange and for the new chief comms officer to start banging the drum about VUL to the deep pools of German capital seeking to invest in local companies.

Continued Lithium price strength - Bigger lithium price = better project economics for VUL. Here is the lithium price chart. Look at it again:

Macro news out of Europe - We are always watching for more news from the Electric Vehicle scene, the battery metals sector or any evidence that countries start stockpiling battery metals to secure supply. Recently we had a deep dive read from this Financial Times series on the “Electric Vehicle Revolution” - definitely worth a read if you are a VUL investor.

As always we will continue to provide our commentary on all the above as VUL continues to execute their business plan. We expect a large amount of rapid progress given the heat in the sector and $300M in the bank.

Here are our project milestones for VUL’s Zero Carbon Lithium project in Germany

✅ Acquisition of disruptive EU focussed Zero Carbon Lithium Project

✅ Commencement of Scoping Study

✅ Reports Lithium Grades above expectation

✅ Maiden Indicated Resource Reported

✅ Test Work Shows Excellent Lithium Recoveries

✅ Taro Licence Granted

✅ Positive Pre-Feasibility Study (1), (2)

✅ Bankable feasibility advisor appointed - BNP Paribas

🔲 Ramp up of DLE pilot plant

✅ Offtake Agreement 1: EV battery Maker LG

✅ Offtake Agreement 2: Renault

✅ Offtake Agreement 3: Umicore

✅ First Production of Battery Grade Lithium

🔄 Definitive Feasibility Study

🔲 Bankable Feasibility Study Complete

🔲 Project Financing Secured

Here are the company milestones we are watching out for (and what has been achieved since we invested)

✅ Next Investors Portfolio Initiation & Small Cap Pick of the Year

✅ EU Backed Investment (EIT InnoEnergy)

🌎 EU Regulations: Sustainability in the Supply Chain for EVs

✅ Key Board Appointment (Vincent Ledoux-Pedailles)

✅ Key Board Appointment (Former Tesla Director Jochen Rudat)

✅ Key Board Appointment (Annie Liu)

⚔️Controlled Thermal Resources Lithium Brine Offtake (US)

🌎 EU Regulations: Reduce Carbon Emission 55% by 2030

✅ [UPA] Proposed listing on main German Stock Exchange

✅ $200M Capital Raise @ $13.50 (Insto)

✅ $3M Capital Raise @ $13.50 (SPP)

🔄 Commence Trading on Main German Stock Exchange

🔲 More brine/land acquired 1

🔲 More brine/land acquired 2

🔲 More experts hired/acquired

🔲 Acquisition of existing project 1

🔲 Acquisition of existing project 2

Our Investment Milestones for VUL

VUL has been our best investment so far, as our plan played out perfectly (which is extremely rare in small cap investing). We’ve made three investments in the company as it continued to prove it could deliver. We’re free carried and have taken a bit of profit, but we continue to hold onto a significant portion of our original investment.

Do we regret free carrying and taking some profit?

No. Our strategy in small cap investing is to free carry and take some profit as a share price rises over time as a company delivers key milestones. This protects our capital in case it comes back down again, but also leaves a significant position invested for when we hit a winner that just won’t stop rising ... just like what VUL has done.

(But we are only human and deep down inside we can’t help occasionally calculating what our free carry and take profit sales would have been worth today if we had held all of them!)

A lot of unpredictable events happen in the small cap market. The only thing you can control as an investor is making a plan that works for you before you invest and sticking to it. Our plan protects against the downside but, most importantly, allows for unlimited upside too.

Remember to create a plan that works for your financial situation and risk profile.

Here is the progress of our VUL investment plan:

✅ Initial Investment: @ 20c

✅ Increase Investment: @ 40c

✅ Increase Investment: @ $6.50

✅ Price increases 500% from initial entry

✅ Price increases 1000% from initial entry

✅ Price increases 2000% from initial entry

✅ 12 Month Capital Gain Discount

✅ Free Carry

✅ Take Profit

🔲 Hold remaining Position for next 2+ years

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.