Victory Mines propels Husky and Malamute cobalt-scandium drilling campaigns

Published 10-MAY-2018 11:48 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Victory Mines (ASX:VIC) has now received preliminary drilling programs for its NSW assets — the highly prospective Husky and Malamute projects.

VIC’s geological team has designed comprehensive drilling campaigns for both projects that target key areas prospective for cobalt-scandium mineralisation. These campaigns will be dynamically refined once the company receives final geochemical assay results — expected within two to three weeks — and will then be submitted to the NSW mining regulator for approval.

VIC’s underlying strategy here remains fast-tracking its understanding of the geology apparent within both the Malamute and Husky projects, and to determine if modelling can deliver an inaugural JORC (2012) compliant Resource for cobalt, scandium and nickel.

VIC is now progressing steps to implement these campaigns, with drilling set to kick off first at the Malamute project.

Landholder access for all key target areas has been secured, and the geology team is currently reviewing potential third-party drilling contractors that will be ready to deploy once regulatory approval is granted.

Further to that, the geology team is also progressing work on VIC’s newly acquired WA assets, Galah Well and Peperill Hill, and is reviewing options for the Bonaparte and Laverton projects.

Non-executive chairman, Dr James Ellingford, said: “The Board is delighted the drilling campaigns for the Malamute and Husky projects are largely mapped out and can be readily finalised once the geochemical results are received. The remaining steps are finalising the application for submission to the NSW mining regulator and selecting a reliable third-party drilling contractor.

“Holistically, the Board’s current primary focus is to ascertain the extent of cobalt and scandium mineralisation within the NSW assets as quickly as possible, then progress gaining a greater understanding the WA cobalt projects,” added Ellingford.

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

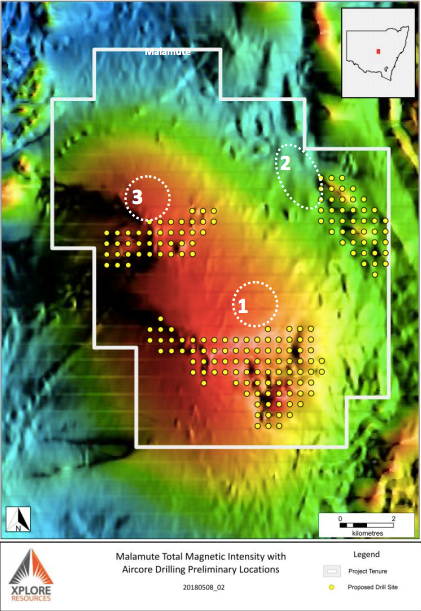

The Malamute campaign

The drilling strategy for the Malamute project is to confirm the prospectivity of known ultramafics that have the potential to form prospective laterite profiles for cobalt, scandium and nickel mineralisation.

To recap, legacy drilling records from 1993-1994 only targeted porphyry related copper/gold mineralisation. However, drilling confirmed the presence of ultramafics and lateritic units overlying a large geophysical signature within the southern part of the Malamute project.

Given that, VIC’s proposed drilling target areas assess several prominent magnetic features associated with the wider intrusive complex which it believes hosts cobalt, scandium and nickel mineralisation.

Drilling campaign for Malamute

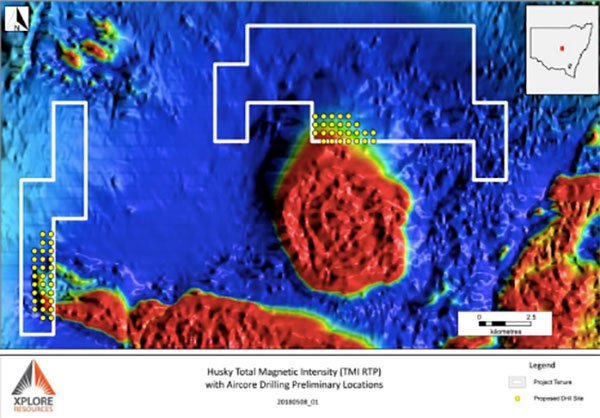

The Husky plan

The exploration strategy for the Husky tenure is to execute an air-core drilling program with an initial circa 70 holes on 400 square metre spaced grids. Notably, these grids will cover magnetic anomalies which are deemed prospective for laterite hosted cobalt, nickel and scandium mineralisation.

The VIC geology team expects the drilling campaign to capture the entire lateritic profile, with drill-holes 30-40 metres deep terminating in the ultramafic (specifically the Tout Intrusive Complex). Interestingly, the ultramafic geological unit that hosts the prospective cobalt-scandium-nickel mineralisation has been confirmed as open to the east by VIC’s peer, Australian Mines (ASX:AUZ).

The targeted magnetic anomalies are located in the southern sectors of each portion of the Husky split exploration tenement: Husky West and Husky East. Moreover, Husky East is contiguous to Platina Resources’ (ASX:PGM) Owendale project — Husky West is also contiguous to AUZ’s Flemington project.

Encouragingly, PGM’s Owendale project has reported high-grade intersections — 9m at 685ppm scandium, including 3m at 880 ppm scandium and 3m at 0.45% cobalt, including 1m at 0.90% cobalt.

As the Husky East project covers the same magnetic anomaly, VIC believes it hosts similar cobalt-scandium-nickel lateritic mineralisation over both ultramafic and intermediate intrusive rock, which suggests at material exploration upside.

Furthermore, there is also significant exploration upside for the Husky West project. Importantly, AUZ has reported cobalt intercepts of 5m at 3,152ppm cobalt from 4m and 16m at 556ppm scandium from surface at its contiguous Flemington project.

Drilling campaign for Husky

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.