Thomson builds position in gold prospective Lachlan Fold Belt

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

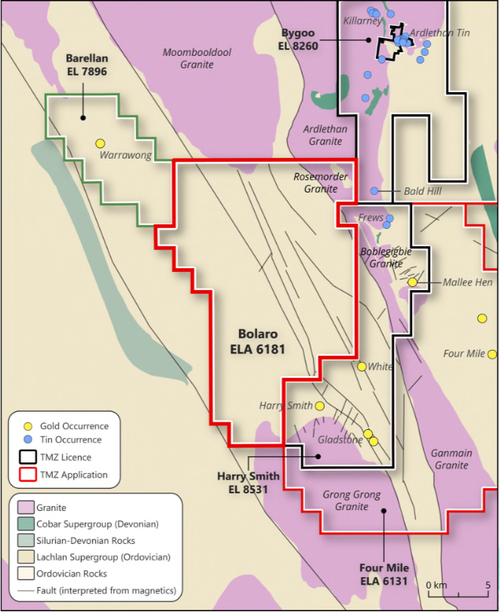

Thomson Resources (ASX:TMZ) has announced its entry into a Binding Terms Sheet which would expand its land package at the Harry Smith gold project by more than 70 square kilometres.

The agreement is to acquire EL7896 (Barellan tenement), located in the Lachlan Fold Belt in NSW, strategically situated approximately 20 kiolmetres north-west of the Harry Smith Gold Project.

Along with this, TMZ has also lodged an Exploration Licence Application for ELA6181 (Bolaro), the land between the Barellan tenement and the Harry Smith gold project.

These two EL acquisitions when added to existing EL’s and ELA’s held by Thomson in the Lachlan Fold Belt will increase Thomson’s landholding to an aggregate of just over 2,360 square kilometres.

Importantly, management believes that its improved understanding of the broader area that has been enhanced by drilling at Harry Smith will assist in guiding the group's intended exploration initiatives across the new landholdings.

Thomson Tenements in Lachlan Fold Belt in vicinity of the Harry Smith gold project including the Barellan tenement

Barellan Tenement Gold Acquisition

Barellan is currently held by private company Cape Clear (Lachlan) Pty Ltd and ASX listed Carpentaria Resources Ltd (ASX:CAP).

The Barellan target has similar host rocks to the Harry Smith gold project.

Recent phase 3 drilling confirmed that Harry Smith possesses a large gold system, enhancing Thomson’s understanding of the mineralisation and controls within that project which can be leveraged for future exploration activities at Barellan and Bolaro.

Within Barellan is the Warrawong Prospect; one which has been the focus of exploration by the vendors. It contains a one km long anomaly with subtle gold levels in the soil and basement interfaces.

The ‘discovery’ of the Warrawong Prospect dates back to the 1980’s.

An initial surface rock-chip sample traverse along the channel (across strike) defined a zone averaging 18 metres at 2.5 g/t Au and 1.0% Sb, which included 10 metres at 3.65 g/t Au and 1.79% Sb.

The other indication of gold mineralisation in the immediate district is the small hand-excavated mine 600 metres to the north, which presumably produced a small quantity of gold and is now backfilled.

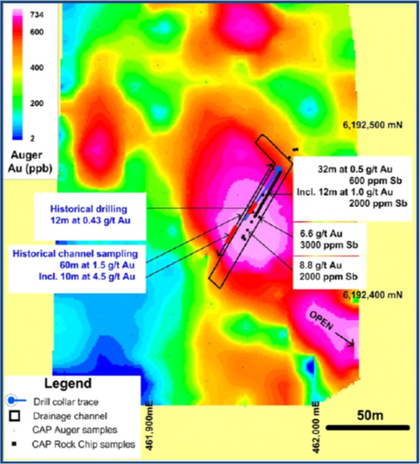

A channel rock chip sampling program and shallow auger drilling program was conducted by Carpentaria Resources in 2014. The survey defined a 200m x 30m plus 50 ppb bedrock gold (plus arsenic and antimony) anomaly open to the south-east.

At the centre of this anomaly is a contour drain that returned 60 metres at 1.5 g/t gold (including 10 metres at 4.5 g/t gold) in historical work that was resampled where possible and returned 32m at 0.5g/t gold.

A maximum result of 1 metre at 8.8 g/t gold in an area overlapping the historical high-grade result was returned confirming the presence of high-grade mineralisation.

Warrawong Prospect diagram displaying drainage channel with CAP rock chip sample assays (black squares) and historical rock chip and drill assays (red), along with the extent of the auger drilling gold geochemical anomaly.

In 2017, Cape Clear (Lachlan Pty Ltd) drilled two angled diamond core holes for a total of 268 metres and undertook a program of geochemical soil auger sampling at Warrawong.

However, Thomson believes the tenement is still very much underexplored and intends to apply its learnings from exploration work on the Harry Smith Gold Project to better understand the opportunity here.

Details of the Transaction

Thomson will acquire 100% legal and beneficial interest in the Barellan tenement and the associated information and agreements from the Vendors.

Completion will be subject to a number of conditions precedent:

- any approvals required by the ASX;

- Ministerial consent, if required, to be obtained in relation to transfer of effective control of the Tenement; and

- other conditions precedent usual for this type of transaction.

The conditions must be satisfied or waived on or before 30 June 2021, or such other date as the parties agree.

Bolaro Exploration Licence Application (ELA)

Given the successes of the recent results from the follow-up drilling at Harry Smith gold project and the Barellan acquisition agreement, Thomson has submitted an application for a new EL for ELA 6181 (Bolaro).

The Bolaro ELA covers 295 square kilometres and connects Thomson’s Frying Pan EL, which incorporates the Harry Smith gold project, and the Barellan EL.

The ELA covers the northern margin and southern margin of these granites respectively.

Management believes that the eastern bounding fault is probably the largest, running up the western margins of four known granite features.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.