Strategic Energy Resources and Fortescue JV at Myall Creek

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

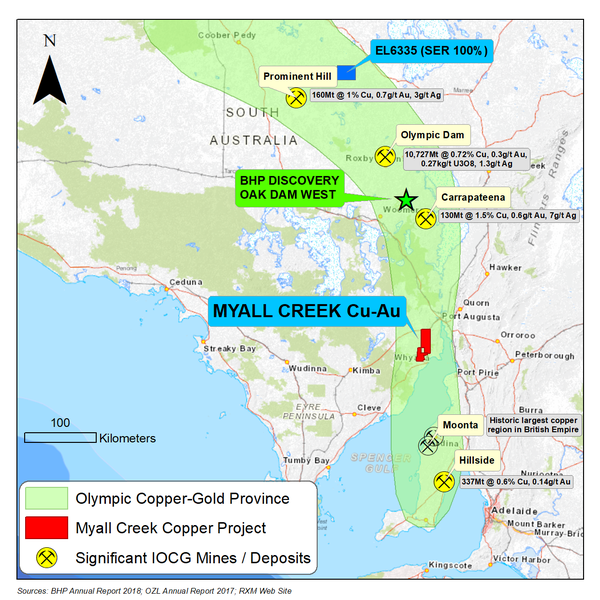

In a financially valuable and strategically important development, Strategic Energy Resources (ASX:SER) has executed a farm-in and joint venture agreement with FMG Resources Pty Ltd, a subsidiary of Fortescue Metals Group Ltd (ASX:FMG) to explore the group’s Myall Creek Copper-Gold Project in the renowned Olympic Dam IOCG (iron ore copper-gold) corridor of South Australia.

Fortescue is one of Australia’s largest iron ore producers with a market capitalisation of nearly $25 billion.

However, FMG has recently flagged its intention to diversified into copper-gold exploration, targeting projects prospective for these metals in Western Australia, South Australia and Ecuador.

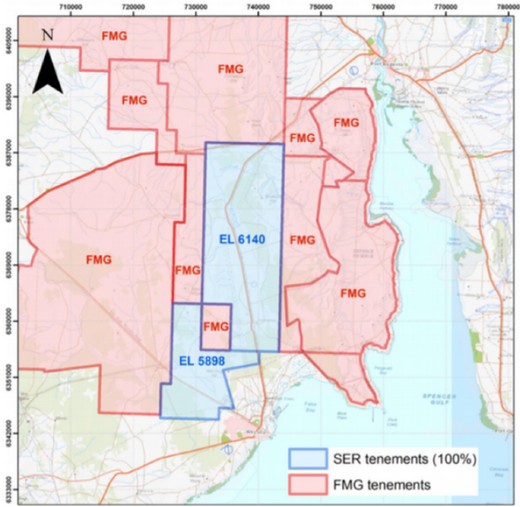

Fortescue will spend $1.5 million on exploration over five years, including a minimum of 1500 metres of drilling at Myall Creek (EL6140 and EL5898) to earn an 80% interest in the project.

As the map indicates below, much of SER’s tenements are already abutted by Fortescue, which obviously sees the broader region as highly prospective.

FinFeed suggested in November that there appeared to be a strong likelihood of an approach by Fortescue given the strategic benefits offered by the location of SER’s territory.

The area around Myall Creek came under the microscope in August 2018, being the focus of a substantial body of work by the Geological Survey of South Australia (GSSA).

In August, the GSSA published a report — Roopena Basin: Sedimentary basin formation associated with Mesoproterozoic mineralising event in the Gawler Craton.

It notes that both Olympic Dam and Prominent Hill are spatially associated with sedimentary rocks deposited synchronous with volcanism, which suggests an active sedimentary basin may be significant in the formation of IOCG mineralisation.

Further demonstrating the extent of the IOCG system, the Prominent Hill Copper-Gold Project lies to the north of Olympic Dam, while the $3 billion Oz Minerals’ (ASX:OZL) Carrapateena copper-gold project is much closer to Myall Creek, as it is situated south of Olympic Dam.

This adds weight to the proximal location of Myall Creek as Carrapateena is a 4.2 million tonnes per annum project with an estimated mine life of 20 years.

Also positive for SER’s EL6335 licence

Providing further proof that this region is still one of the prime exploration targets in Australia, it was only late last year that BHP made the Oak Dam West discovery which lies between Olympic Dam and Carapateena.

It could be argued that Fortescue’s move is just as significant for SER’s EL6335 licence, which was just awarded in April, prompting a surge of 30% in the company’s share price.

The following 12 months share price chart demonstrates the impact that regular promising newsflow has had over the last six months or so, triggering strong share price support.

However, being a tangible financial commitment by a world-class iron ore producer, the joint venture agreement could be the most significant share price catalyst that has emerged in the last 12 months.

Fortescue to manage exploration

Under the agreement Fortescue will manage exploration, satisfy all expenditure requirements and keep the tenements in good standing.

After Fortescue has earned-in, a joint venture will be formed under which each party will contribute pro-rata (FMG 80%, SER 20%) to further exploration and development or be diluted in accordance with industry standard formula.

At Myall Creek, SER and Fortescue are targeting Iron Oxide Copper-Gold (IOCG) mineralisation in the Proterozoic basement and sediment-hosted mineralisation in the overlying sediments.

Key IOCG host rocks are present within the project area and overlying sediments include a 15 kilometre zone with anomalous copper in historic drilling.

Exploration results the next share price catalysts

Underlining the significance of having a world-class partner, SER executive chairman, Stuart Rechner said, “SER welcomes Fortescue joining the Myall Creek Copper-Gold Project, bringing its substantial exploration and technical capability having discovered and developed some of the most significant mines in the world.”

Not only is Fortescue’s involvement strategically and financially beneficial, but it is also an endorsement of the quality of SER’s landholding.

While this development could well trigger significant share price momentum, there is also the prospect that other catalysts will come into play as exploration results come to hand.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.