Rumble snaps up two promising polymetallic Canadian projects

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

ASX junior, Rumble Resources (ASX:RTR), has penned a binding option agreement to acquire up to 100% of the Long Lake and Panache Projects in Canada from well-known local (Sudbury) prospector, Gordon Salo. Both are considered highly prospective high-grade nickel-copper deposits.

This plays nicely into RTR’s strategy to proactively generate a pipeline of quality high-grade base and precious metal projects, critically review them against exacting criteria, and to action low-cost systematic exploration to drill-test for high-grade world-class discoveries.

RTR is at a promising stage for shareholders, having recently drilled the Munarra Gully high-grade copper-gold project (currently awaiting assays) and the Nemesis high-grade gold project (assays awaiting) in WA. The company is also scheduled to drill its flagship high-grade Braeside zinc-lead-copper-silver project in August and the Earaheedy high-grade zinc project in September (also in WA).

With $3.8 million cash in the bank, moreover, RTR is in well-funded for this busy series of upcoming works.

With that in mind, the Long Lake and Panache projects have met RTR’s stringent criteria and will provide shareholders with another near-term opportunity to find a world-class base and precious metal deposit.

However, success is not guaranteed and any investment decision should be made with caution and professional financial advice should be sought.

The Sudbury Mining Camp, the Copper Cliff Offset Dyke System, and some promising geology

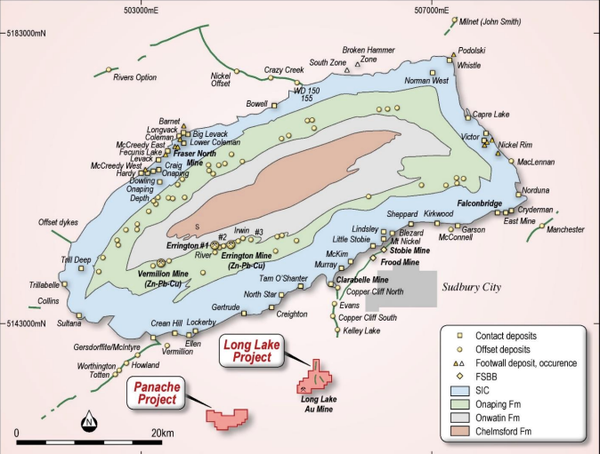

Since 1883, the Sudbury mining field has been globally significant with the Sudbury Basin, the second-largest supplier of nickel ore in the world — and new discoveries continue to be made.

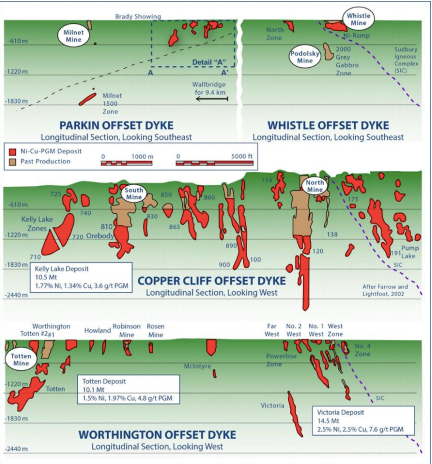

It is one of the most productive nickel-mining fields in the world with over 1.7 billion tonnes of past production, reserves and resources. Nickel-copper and platinum group metals (PGM) bearing sulphide minerals occur in a 60 kilometre by 27 kilometre elliptical igneous body called the Sudbury Igneous Complex (SIC). Nearly half of the nickel ore at Sudbury occurs in breccias and Offset Dykes in the footwall rocks of the SIC.

The Copper Cliff South and the Copper Cliff North mine have yielded some 200 million tonnes of ore along the north-south trending Offset Dyke System. Vale Limited’s Clarabelle mill, Copper Cliff smelter and Copper Cliff nickel refinery are all located near the Copper Cliff Offset Dyke.

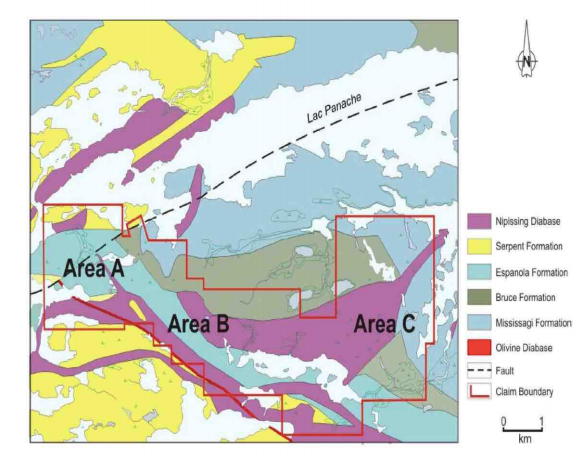

The location of the Long Lake and Panache Projects, including the deposit types of the Sudbury Basin:

Very significant high value deposits occur as clusters along Offset Dykes and are often blind. The Kelly Lake Deposit was found below a smaller near surface deposit by downhole TEM, and was defined in 2006.

Long Lake Project — Gold-Copper-Nickel-PGM, Sudbury, Canada

The Long Lake Project shows potential for nickel-copper-PGM mineralisation and deposits associated with Sudbury Basin-style Offset Dyke ore systems.

Intriguingly, the project area lies some 10 kilometres southwest of the Kelly Lake nickel-copper-PGM (10.5Mt at 1.77% nickel, 1.34% copper, 3.6 g/t PGM reserve), which lies at the southern end of the major Copper Cliff Mine Sequence.

Fieldwork (including a single shallow diamond drill-hole) has highlighted Sudbury Breccia and quartz diorite (a known host for Sudbury Basin deposits) occurrences over several kilometres of strike. The occurrence is inferred to be the faulted southern extension of the Copper Cliff Offset Dyke.

So far, no deep penetrating ground TEM surveys have been conducted to test for nickel-copper-PGM massive sulphide mineralisation — something RTR will explore in the not-so-distant future.

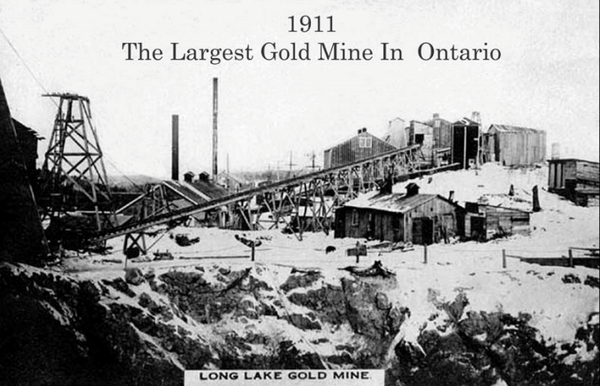

The Long Lake Project also hosts the historic Lake Gold Mine, which produced 57,000 ounces of gold from over 200,000 tonnes of ore mined in the periods 1910-1916 and 1932-1939, with an average recovered mill grade of 9 g/t gold.

Historically, the Long Lake Gold Mine was the largest gold mine in Ontario:

The Panache Project is located 40 kilometres southwest of the city of Sudbury, Ontario. The project hosts a large portion of the Panache gabbro intrusion, which is part of the regional extensive Nipissing Gabbro Suite (some 2215 million years old).

Here, potential mineralised feeder dykes associated with layered gabbroic intrusions have been identified by mapping and surface geochemistry. No ground TEM has been completed.

Rock chip assays of up to 1.1% cobalt, 6.01% copper, 1.47%, nickel, 3.5 g/t PGMm and 524 g/t gold have been collected from surface sampling.

Moving forward: Rumble’s exploration strategy

At the Long Lake Project, RTR will target blind Sudbury Offset Dyke-style massive nickel/copper/PGM type deposits by using high power ground TEM to generate potential conductors.

In regard to the Panache Project, RTR plans to target high order base metal with PGM surface anomalism inferred to be potential feeders to gabbroic intrusions, using high power ground TEM to generate potential conductors.

RTR will embark on diamond drilling to test conductors that may represent massive nickel-copper-PGM sulphide mineralisation.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.