Progress at Livingstone complements Kingston’s Misima Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The good news continues to flow at Kingston Resources Limited (ASX:KSN) with the company releasing promising drilling results from its Livingstone Gold Project in Western Australia.

This comes just a week after the company tabled an impressive prefeasibility study in relation to its Misima Gold Project, a development that has provided sustained share price momentum which has seen the group trade at levels not seen since 2017.

We have more news on that which we will touch on later, with some particularly interesting assessments by Canaccord Genuity analysts who have a price target of 80 cents per share on the stock, implying significant upside to Tuesday’s closing price of 29 cents per share - check before publishing.

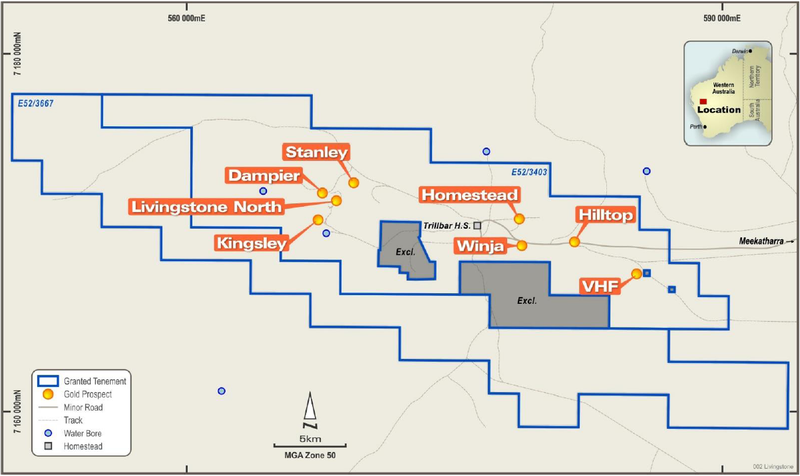

The results released today relate to a reverse circulation (RC) drilling campaign at the group’s 75% owned Livingstone Gold Project, north-west of Meekatharra in Western Australia.

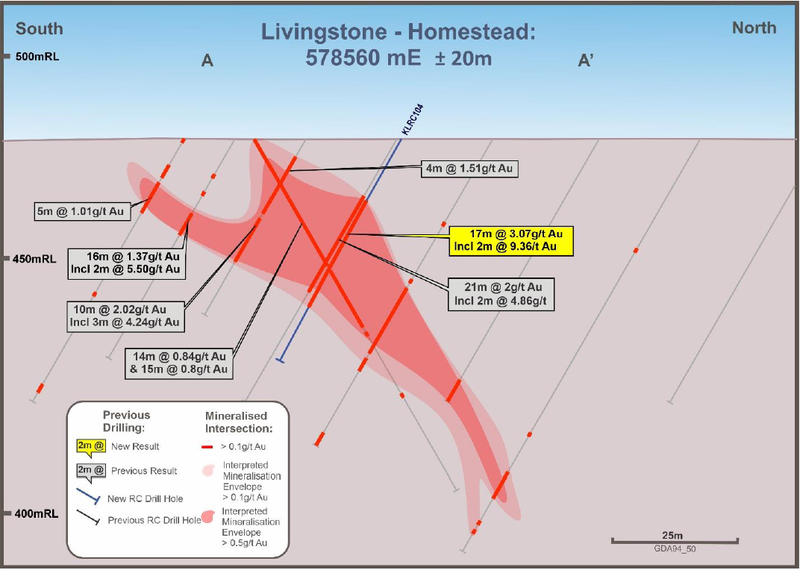

A key takeaway from the results was the consistently high-grade assays from the Homestead prospect.

Drilling confirms historical results and opens up new areas of interest

The five RC holes that were drilled at the Homestead prospect spanned 513 metres and they were designed to expand on and confirm historical results from drilling conducted by Western Mining Corporation, Sons of Gwalia and Talisman Mining.

The drilling was undertaken within the existing JORC 2004 Inferred Resource (990,000t @ 1.6g/t Au for 50,000 ounces) envelope, delivering some impressive intercepts including 17 metres at 3.1 g/t gold from 14 metres and 7 metres at 3.3 g/t gold from 27 metres with the latter including one metre at 9.8 g/t gold from 27 metres.

Kingston opts to frame a project-wide exploration program

Management is currently conducting a project-wide geological study of the Livingstone tenement package that integrates all historical data as well as new information gained during Kingston’s tenure.

The geological study is designed to place the numerous individual prospects in the Livingstone area into a wider geological context, enhancing the understanding of the relationship between mineralisation at the various deposits, incorporating them within a mineral systems model and identifying and ranking areas that are highly prospective at both a deposit and district scale.

Drilling at the Stanley target and the Winja prospect was inconclusive and in part could not be completed.

Consequently, management’s geological study that will position targets at Livingstone within a mineral systems model that can be used to formulate a broader, project-wide exploration program for 2021 will be much-anticipated.

Misima is the main game

Harking back to the Misima PFS, this alone is enough to make for a compelling investment proposition, such that progress at Livingstone in 2021 would be icing on the cake.

Reg Spencer from Canaccord Genuity noted that the PFS was based on an updated resource of 3.6 million ounces at 0.8 g/t and reserves of 1.35 million ounces at 0.9 g/t.

With an anticipated mine life of 17 years and average production of 130,000 ounces per annum at a moderate cost of $1159 per ounce Spencer noted the strong economics that underpin the project.

He said that the PFS metrics exceeded his expectations, particularly in terms of the required upfront capital expenditure, a function of significant infrastructure already being in place.

Interestingly, he also noted promising opportunities for optimisation of the project, including the potential for additional and/or higher grade ‘’starter pit material’’, as well as the possibility of increased production rates/plant expansion in view of the large resource base and the potential for additional resource conversion.

The next key milestone is the definitive feasibility study (DFS) which should be completed in the second half of 2021 with the environmental impact study (EIS) approvals likely to occur in late 2022.

Spencer expects that this will see first production occurring in late-2023/early-2024.

Share price target implies upside of about 175%

However, there are multiple share price catalysts that will come into play during that period, including some of the potential upside opportunities Spencer highlighted, and this could see the company gradually push up towards his price target of 80 cents per share.

In highlighting Misima’s emergence as a quality development proposition Spencer said, ‘’ Aside from robust economics, peer comparisons show Misima screens well against other gold development opportunities on the ASX.

‘’Notwithstanding the PNG location, we see the potential of the project yet to be reflected in KSN's market valuation given some comparable projects/peer companies have between 4-8 times the market capitalisation.’’

Consequently, as peer comparisons are increasingly used to seek out undervalued companies, Kingston is likely to come under the spotlight, leading to a market capitalisation based share price re-rating.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.