Our Top Pick of 2019 Locks in Yet Another Major US Contract

In case you missed it, we put our money where our mouth is earlier this week when we revealed our “Top Pick for 2019”.

The stock has already been up over 46% over the last two days of trading, but from such a small current market cap it’s likely just the very start of a longer run given the momentum of the contracts rolling in, plus the rapidly rising demand for much needed cybersecurity.

As we said in our previous article it might not be long before the company reveals further positive news for its shareholders.

Well, just two days later and that news has dropped.

The company today revealed that it has secured a further US federal government sub-contractor role – its third in six months and its second win this week.

That company is WhiteHawk (ASX:WHK), who today confirmed that it has entered into a US federal government contract supporting a large government department through the Chief Information Officer (CIO).

WHK, along with the primary contractor (an as-of-yet unnamed Virginia, USA based tech giant with over 23,000 employees) will begin work on the $28 million (~A$40M) contract this month.

WHK will provide this department with expert support for cyber risk management, executive technical services (architecture and engineering), and project management, as well as its Cyber Risk Management Framework capabilities.

As cybersecurity risks and awareness grows, WHK continues to rack up important revenue generating contracts with major US customers including:

- A top 10 US financial institution,

- A top 12 US Defense Industrial Base (DIB) company,

- A top US independent insurance agency specialising in cyber liability insurance,

- A major US east coast utility sector company,

- Multiple US federal government departments, and

- A strategic partnership with EZShield, a top financial fraud, identity theft and mobile defense company to service SME customers.

This latest contract win follows Wednesday’s news that the company had won a cyber sub-contractor role under an unnamed, yet “leading global professional services company”, on a five year, $2 billion (~A$2.85B) US federal government contract. WHK expect it to deliver revenues of US$300,000 to US$600,000 (~A$428k-A$855k) in year one, growing to US$1 million to US$3 million (~A$1.4M-A$4.2M) per year in subsequent years.

WHK will provide cloud-based IT services and modernisation, cyber risk management, cyber intelligence and innovation introduction and transition, as well as tailored cyber subject matter expertise — all spanning the department’s operations nationwide.

WhiteHawk secured its first US federal government contract to provide important cybersecurity services in November last year, and the way things are going, we expect to see contracts like these continue to roll in.

While the exact government departments can’t be revealed on these contracts, given the understandably sensitive nature of the business and the players involved, we do know that each of the three contracts is for a separate federal department with WHK’s expertise having a wide reach.

As for the stock, it’s on a run, gaining 40%+ this week alone. Yet it is still only capped at just A$11.4 million, suggesting that plenty of upside remains.

Here’s the latest from,

Share price: A$0.088 (at 2 May)

Market Capitalisation: A$11.4 million

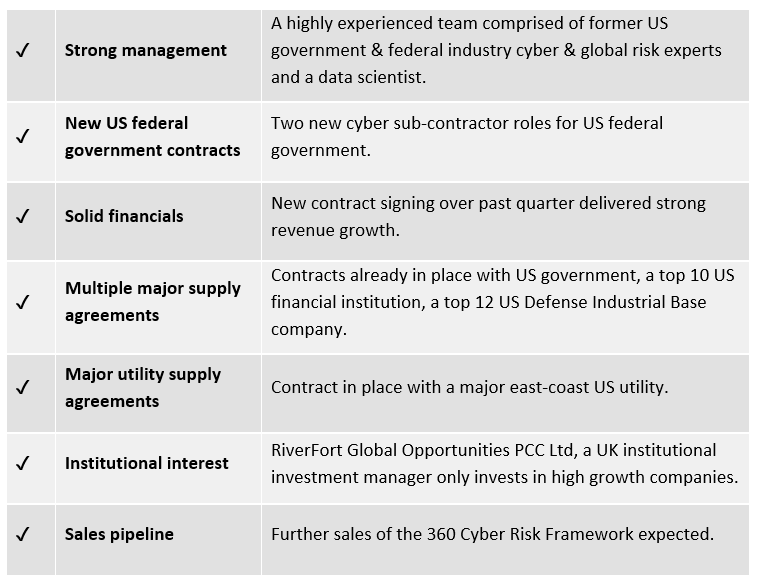

If you didn’t catch our article earlier this week, here’s why we selected WhiteHawk as our Top Pick for 2019:

WHK’s second win in a week

It’s two for two this week for WhiteHawk Limited (ASX:WHK) after it today confirmed it will supply cyber security solutions to another federal government body.

The latest contract is for seven years, including one base year with six option years, and will see WHK act in a cyber sub-contractor role on a US federal government department contract through the Chief Information Officer (CIO).

The contract with the primary contractor is valued at US$28 million (A$40M), and as the sub-contractor, WhiteHawk will provide expert support for cyber risk management, executive technical services (architecture and engineering), and project management, as well as its Cyber Risk Management Framework capabilities.

WHK will deliver sensitive risk analytics and mitigation, providing needed added protections to a breadth of office and mission functions.

WHK is expected to reap revenues of US$150,000 to US$300,000 (~A$214k-A$427k) each year, while future (optional) expansions by the US government could increase the scope of WhiteHawk’s services and revenues.

Whitehawk is unable to name the primary contractor (prime) on the contract, but said it is a Reston, Virginia headquartered company with over 23,000 employees. The company provides technology integration services including high-end solutions in systems engineering and integration, enterprise IT, cyber, software, advanced analytics and simulation, and training to US Defense, federal civilian, intelligence community, and space agencies.

A bit of internet sleuthing gives us some idea who may be involved.

A Google search of that description reveals that the US$4.3 billion (A$6.1B) capped SAIC (NYSE:SAIC) could be the company in question.

SAIC is a premier technology integrator solving the US’s most complex modernisation and readiness challenges across the defense, space, federal civilian, and intelligence markets.

Its portfolio of offerings includes high-end solutions in systems engineering and integration; enterprise IT, including cloud services; cyber; software; advanced analytics and simulation; and training.

Work will commence in May, while formal announcements naming the government department and prime contractor are forthcoming, pending approval from the primary contractor, WhiteHawk’s customer.

Terry Roberts, Executive Chair of WhiteHawk said, “We are looking forward to being a part of a forward leaning team of innovators to refine and take to the next level an important U.S. Government CIO resilience strategy and architecture.

“These US Federal Government contract wins highlight the capability of the WhiteHawk team to have further impact across the cyber risk landscape of the US financial, insurance, Defense Industrial Base and utility sectors as well as our sales channels through EZShield, leveraging our CyberPath online decision engine based market place for cyber security software and service solutions.”

Sub-contractor on a 5-year US$2B US federal government contract

Today’s announcement follows confirmation from WhiteHawk on Wednesday (1 May) that it has been awarded a five year cyber sub-contractor role under the primary contractor on another newly awarded US federal government department contract worth US$2 billion.

WhiteHawk will provide an enterprise-wide cyber risk management framework, cyber intelligence and innovation introduction and transition, as well as tailored cyber subject matter expertise as part of the primary contractor’s team — a leading global professional services company.

WhiteHawk’s contract is for five years (one year with four option years). First year revenue to WhiteHawk is expected to be between US$300,000 to US$600,000 (~A$428k-A$855k), and subject to final scoping by the Prime and customer, revenue is expected to grow to between US$1 million to US$3 million (~A$1.4M-A$4.2M) per year in subsequent option years.

Funding & cash position

As for the company’s cash position and its ability to fund continued growth, WHK had access to funds of A$1.5 million, as at March 31. That includes A$650k payable by RiverFort Global Opportunities PCC Ltd in 11 monthly instalments under the equity swap that was part of a share placement made to RiverFort in January. The details of which are summarised here.

Under the Swap, WHK receives 50% of any share sale proceeds made by Riverfort above 7.1 cents. This demonstrates WhiteHawk’s confidence, based on its contract pipeline, that it can achieve a rising share price.

WHK also has a strong pipeline of opportunities across currently operating revenue streams, with contracted revenue for CY2019 at US$898,000 (~A$1.3 million), as of 16 April. Plus the recent contract wins set to bring in over the first year US$150k-US$300k (~A$214k-A$427k) on one, and US$300k to US$600k (~A$428k-A$855k) on the other.

Given that the company has a current cash burn rate of circa A$200k per month things are looking smooth. We also expect further revenues to come in now that WhiteHawk’s Cyberpath Decision Engine is built.

Contracts welcomed by shareholders

While there have been no assurances around who the primary contractors are on either of this week’s contract announcements, WhiteHawk has partnered with two leading businesses with deep US federal government connections.

What’s important to keep in mind is not just the direct revenues that will flow to WhiteHawk, but the validation conferred by these partnerships with the major contractors in question and the (still to be revealed) US federal government departments.

While we like what we’re seeing, it seems that new investors have also been doing their own research.

The company’s share price has been up as much as 48% since Monday’s 6.4 cent close — ignited on the back of the first contract announcement of the week on Wednesday and perhaps the conviction that continued contract announcements were in the works.

A final word... at least for this week

It has been a big week for WhiteHawk and we expect its momentum to continue into the foreseeable future.

That’s why we called it our Top Pick for 2019.

Of course, nothing is a guarantee in the small cap market. So only invest what you can afford to lose when investing in speculative stocks.

So far, noting today’s announcement, there looks to be a pipeline of contracts to come, the share price is rallying after some months in the doldrums, and the company itself seems buoyant about its future.

There’s a lot to like about WhiteHawk, so watch this space as further deals could come through quickly.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.