Our New Portfolio Addition is Here

It’s finally here.

Introducing our third Next Investors portfolio addition for 2021:

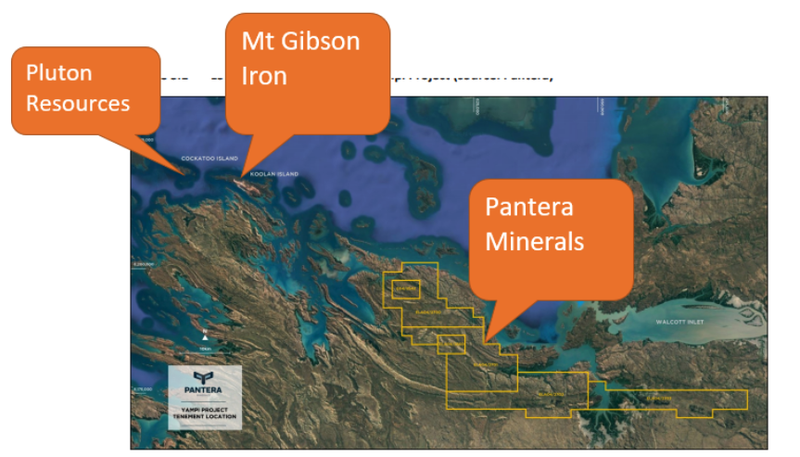

Pantera Minerals (ASX:PFE) is an early stage explorer about to drill for high grade iron ore right next to billion dollar iron ore producer Mt Gibson Iron (and all their infrastructure).

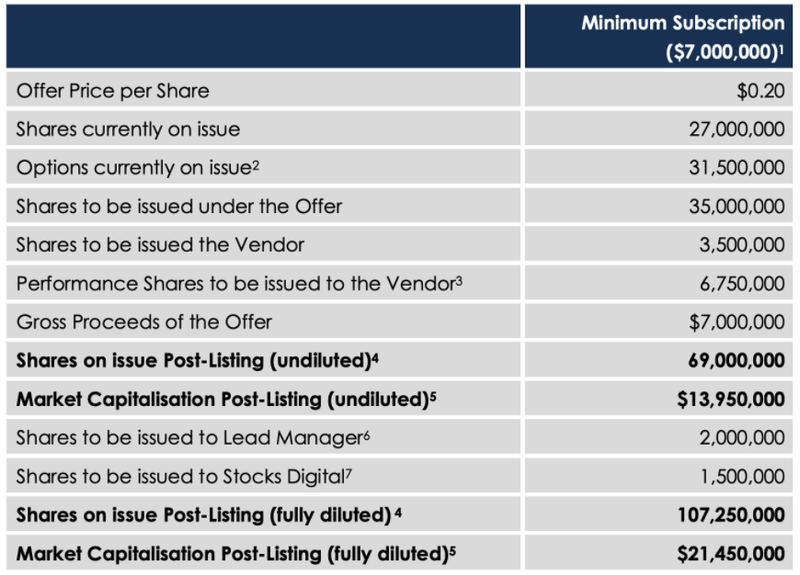

PFE just listed on the ASX this morning after raising $7.0M at 20c. PFE has a market cap of $13.95M (at 20c, undiluted), with an enterprise value of ~ $6.95M.

Quick take: Here are the 8 reasons we invested in PFE

Here is a quick summary - we will dive deeper into each point further down:

- First drilling in the next few months - could drive a re-rating in the stock

- High grade hematite (iron ore) - rock chip samples of 55% to 68% - these are good early signs. How much and how high grade will depend on upcoming drilling. High grades are good for beneficiation and direct shipping.

- Right next to export facilities - no stranded deposit. 5km from deep water port and $1BN capped producer Mt Gibson Iron.

- Takeover target? We think so, if PFE can successfully identify a high quality iron ore resource.

- Iron ore is trading around ten year highs - increased likelihood of mergers and acquisitions during commodity super cycle.

- Tight capital structure and low EV - Enterprise Value of $6.95M on ASX listing, with a big portion of stock in escrow (the majority of our holding is escrowed for 2 years).

- One of very few Indigenous CEOs on the ASX - PFE has a strong relationship with the traditional land owners and has ESG credentials.

- Ex Mt Gibson Exploration manager - he must know a good iron ore project when he sees one.

Initial comments on our investment in PFE

We invested in PFE because we like its barely explored, potential high-grade and high-tonnage iron ore exploration project in WA, located just kilometers from Mt Gibson Iron’s existing infrastructure on nearby Koolan Island.

Abundant hematite mineralisation (iron ore) has been confirmed at PFE’s project, rock chip sampling shows high grades of 55% to 68% (this is very good). Aeromag surveys have confirmed PFE’s first drill targets (colourful blobs).

PFE’s first drilling campaign is due to start in October so there isn’t too long to wait before things get interesting.

We expect the PFE price to open strongly today but settle over the next few weeks AFTER the IPO open excitement and day trading subsides - but BEFORE the drilling excitement kicks in later this year - similar to what happened with our other 2021 exploration pick BPM that we expect to march up again in anticipation of its drilling in late 2021.

We like the PFE team, we like the PFE project, the iron ore price is around 10 year highs and PFE is drilling in just a few months.

As an early stage explorer, PFE is high-risk, high-reward. Once PFE’s drilling starts there is immediate potential for a high value discovery ... OR no discovery at all (this is the risk in exploration investing).

Aside from being named after one of our favourite bands, the other cool thing about PFE is that they are using a helicopter to fly the drill rig to site, which is much faster than trucking it through the hilly, remote terrain. PFE has promised to share a video when it happens which we will share with you.

Our strategy with PFE is to see them acquired by a larger player within a couple of years, assuming they get some good drill hits and quickly prove out a resource.

We aren’t expecting PFE to grow into a producer by itself and build all the expensive infrastructure needed to ship ore - that takes too much time and money to realistically squeeze it into the current hot commodity cycle window.

We believe the world has entered a multi year commodities super cycle. Mergers and acquisitions in the resource sector generally ramp up during this time and we are starting to see a few majors buy up junior companies that have drilled out decent assets.

The iron ore price is hovering around 10 year highs as every country is trying to spend its way out of COVID induced economic slowdown.

And if the first few holes don’t deliver a result (remember exploration is risky only invest what you are comfortable to lose), PFE does have some pretty interesting “side bet” projects in manganese and base metals to keep the investment going.

Side bets are good, but we are primarily invested in PFE for the iron ore exploration campaign starting in October. We’ll talk about PFE’s side bets in a later note.

Importantly - We like that PFE has strong relationships with the traditional land owners and is one of the only ASX listed companies with a local, indigenous CEO. PFE has committed to Environmental, Social and Corporate Governance (ESG) reporting which is rare for an early stage iron ore explorer and a big tick for us and many other investors.

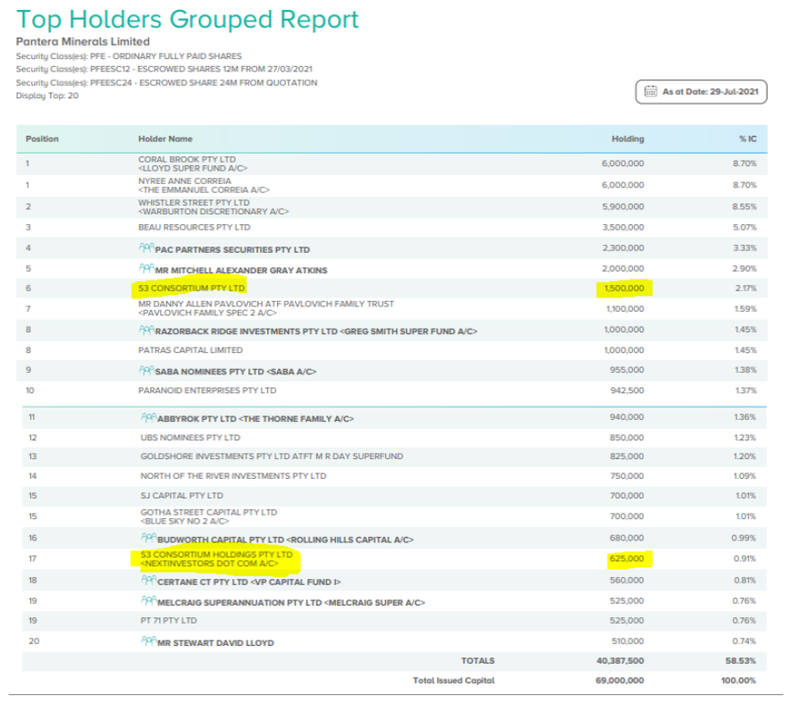

The PFE capital structure is tight, with a low number of shares on issue and the Top 20 shareholders hold a lot of the company. We understand about 40% of the shares on issue are escrowed for 2 years, so key shareholders are very motivated to make PFE work over the long term. There are however ~ 30M 25c options on issue which we arent happy with

We are in the Top 20 list and the majority of our holding is escrowed for 2 years, so we are locked in to PFE story.

We also have a smaller position that is not escrowed, that we will look to execute our usual investment plan for early stage explorers — to free carry and take some profit in the lead up to drilling result. As always, we will keep you updated on how this plan plays out for those interested to follow it’s progress.

Today we will share our expected PFE milestones to re-rate the share price, our PFE investment strategy and a deep dive into why we invested in PFE.

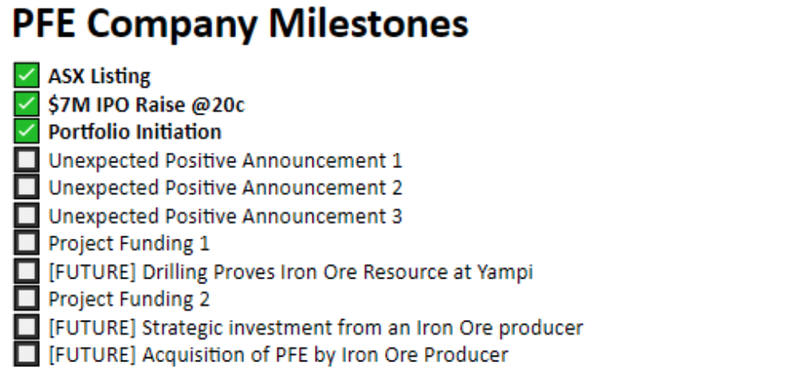

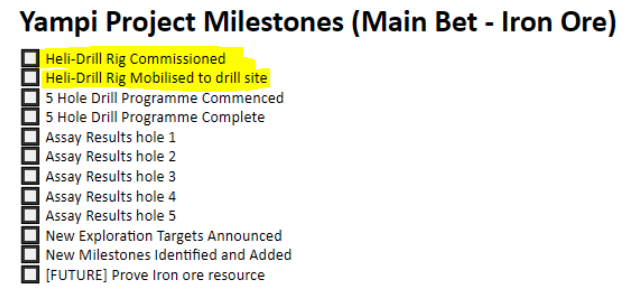

Before we get deeper into the 8 reasons we invested in PFE, here is the company milestones we will be ticking off as the PFE story progresses:

Our PFE Company Milestones

As mentioned above, the broad company milestones for our investment in PFE is an acquisition by a larger player after proving out an iron ore resources:

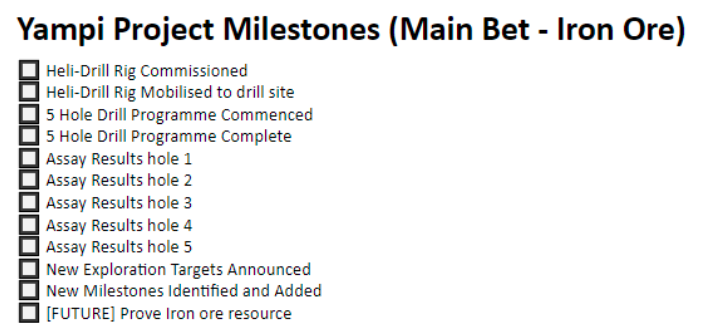

If we drill down (pun intended) into the initial steps that PFE have to take to deliver an iron ore resource, it all starts with the first drilling campaign in a few months time.

We have broken down the steps to get the first 5 planned holes completed and analysed and we will be providing our commentary every step of the way:

By the time the first round of drilling and assay results are completed later this year, we will know if we have had initial drilling success or not. We will then reassess the PFE investment and determine a new set of milestones depending on the initial drilling outcome (spoiler alert: it will likely be more drilling no matter what happens).

You can monitor the progress of the milestones on our company page. There you can also view the milestones for PFE’s other side bet projects - one manganese and the other ‘polymetallic’ - which we will talk about in a future note.

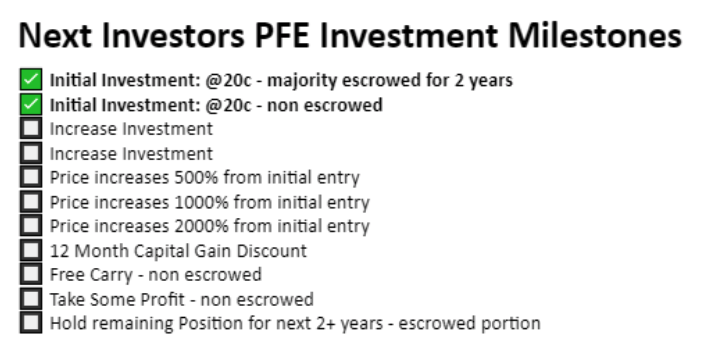

Our PFE investment strategy:

As mentioned above, we have two tranches of shareholding in PFE. The larger portion of our stock is escrowed and the small portion is not escrowed.

We are holding the large portion for 2+ years, and the smaller portion we will look to free carry prior to the first drill assays in late 2021 as per our usual investment strategy for early stage explorers.

So that’s our plan. Check out our PFE company page at any time where we monitor the progress of this investment.

Here are the 8 reasons we have invested in PFE:

1. First drilling set for October...

PFE expects to begin first drilling at the Yampi Iron Ore Project around the third week of September, after the drill rig is mobilised to site in mid-September.

Assuming the usual drilling delays that happen we are calling it for October.

There are currently five drill holes planned — already signed off by the land’s traditional owners — that are designed to provide the maximum amount of information, in the smallest amount of time.

This initial drilling is expected to take four to five weeks to complete, with progress updates expected along the way. Once completed, first assays are expected to arrive around four to five weeks later, beginning the late-October or November.

2. Yampi project - High grade hematite “everywhere”

PFE’s initial focus is on exploring the Yampi Iron Ore Project in Western Australia’s Kimberley region - which already has millions of tonnes of high grade iron ore identified.

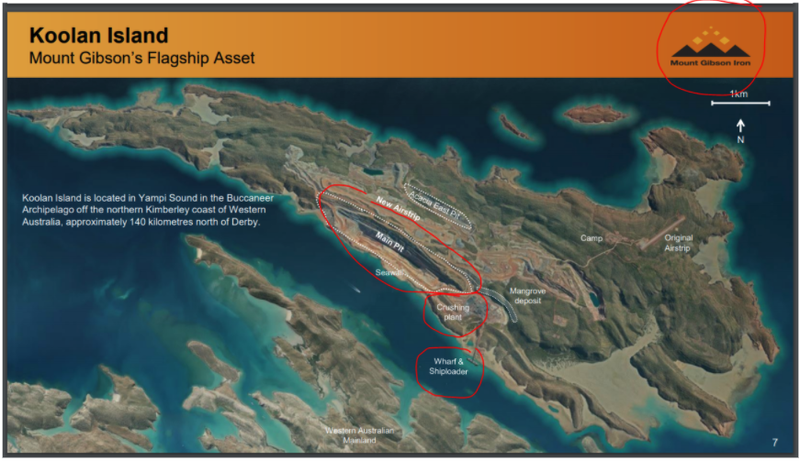

The Yampi Project is adjacent to Mount Gibson Iron’s (ASX:MGX) Koolan Island Iron Ore Project — Australia’s highest grade (18.7Mt, grading 65.5% Fe) direct shipping ore hematite ore mine.

Mt Gibson Iron is a billion dollar iron ore producer and its Koolan Island Project sits just 25km from PFE’s Yampi Project.

The Koolan Island project has a 68 million tonne resource at 63% Fe with 30 million tonnes 64% Fe in reserve. Approximately 70 million tonnes has been mined so far.

Also nearby to PFE is Cockatoo Island - which has a 12 million tonne resource at 67% Fe.

PFE’s project is on the mainland. Early indications are that PFE’s Yampi project could host the premium priced, and difficult to find, hematite ore that Koolan Island is well known for. Given that the territory is relatively unexplored, this makes the drilling quite exciting in our view (and also risky).

Our opinion is that a stake in the Yampi Project could be worth far more than PFE’s implied enterprise value of $6.95M at today’s ASX listing if drilling can deliver.

Aside from its excellent location plus high grade rock chip samples, there is some solid early exploration data that points to the prospect of PFE delineating high-grade mineralisation.

Most notably, aeromagnetic, radiometric and satellite data has identified Fe and base metal targets.

High-grade, low impurities, clean ore grab samples have been assayed over an area of 50 square kilometres.

PFE has undertaken preliminary beneficiation test work, confirming the potential to convert lower grade ore to a saleable product, a strategy that Mount Gibson has successfully employed over the years.

The ore has low alumina, phosphorus and calcium, a factor that could work in PFE’s favour in terms of producing a saleable 60% Fe product from lower grade material in a range between 40% and 50% Fe.

PFE has completed much of its pre-drilling preparations and has secured a heli-portable diamond drill rig. We are looking forward to initial drilling to begin by October.

3. Right next to export facilities

Located just 5kms from the coastline and deep water port channel, PFE has a clear pathway to market from the Yampi Project.

The project is adjacent to Australia’s highest-grade direct shipping ore (DSO) Hematite Ore Mine, the $1BN Mount Gibson Iron’s Koolan Island Mine (18.7 Mt grading 65.5% Fe).

4. Takeover target?

We think PFE can become a takeover target if they can successfully identify a high quality iron ore resource quickly, while the world is still in a hot commodities cycle.

During commodities down cycles like the last decade, big resource companies cut production costs as much as possible, savagely cutting down on exploration costs.

So when the cycle turns and commodities get hot again, and mining giant’s balance sheets get strong from high sales revenues, it's easier to make acquisitions of smaller players to grow their available resource base.

That’s when early stage risk capital investors like us can get a good win.

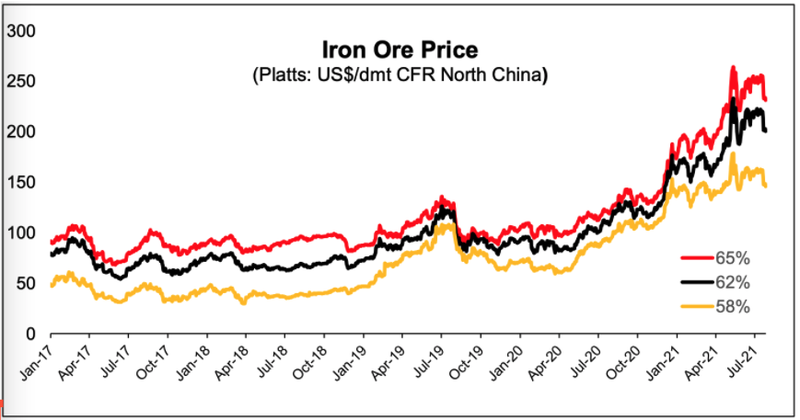

5. Iron ore is trading around ten year highs

While iron ore price has come off a bit in the last few days, it’s still trading at nearly 10 year highs as demand soars and supply is constrained by COVID impact on major exporters like Brazil.

The commodity has been making the news this week, with headlines including “Iron ore price slumps” and “Iron ore plunges into bear market”. To us this is a bit overblown - The reality is that while the iron ore price has pulled back in recent times, it is coming off its highest price ever.

Back in December 2020, iron ore prices increased by ~20% over the month and averaged US$134/t for the quarter. Since then, prices have continued to rise, peaking at more than US$237/t in May and have remained high through July, averaging ~US$216/t.

This week’s headlines come as iron ore pulled back to $US181.57/t last Friday — down from its recent highs, but still well above historical levels.

Given PFE is close to infrastructure and a port, and we are seeing early high grades, we suspect costs would be relatively low to get its project off the ground - so that means even in a lower price environment, PFE’s project could still be economical.

The following chart shows the premium price that 65% Fe has fetched since 2017:

6. Tight capital structure and low EV

PFE has an Enterprise Value of $6.95M on listing, with a big portion of stock in escrow (as mentioned the majority of our holding is escrowed for 2 years).

We like that 40% of the cap table is escrowed and we also like the low number of shares on issue. We are not fans of the 31.5 million 25c options on issue, while they do guarantee the next tranche of funding for the company if the share price surges, we would prefer it if they weren’t there.

PFE’s Fully diluted cap table:

7. One of the few indigenous CEO’s on the ASX

Strong relationships with traditional owners and ESG credentials are critical when we make an investment.

PFE CEO Matthew Hansen has been instrumental in the progress of large companies across multiple commodities, including Australia’s largest gold producer in Northern Star Resources as well as nickel miner Western Areas.

As a lawyer who has completed in-house roles with Newmont and Rio Tinto, Hansen has vast experience in areas such as indigenous affairs and native title, as well as broader regulatory requirements. He has worked on both sides of the table, negotiating on behalf of traditional owners and representing mining companies.

On that note, we liked hearing from the team that a good relationship with the land’s traditional owners, the Dambimangari People, has already been established.

8. Ex Mt Gibson Exploration manager

Nick Payne is Head of Exploration at PFE, brings over 20 years experience in the exploration for and development of iron ore deposits globally and has conducted iron ore and copper exploration programs throughout the Kimberley.

While he has spent time working for large multinationals, such as BHP and AngloGold, arguably, of most significance for PFE is Payne’s role as Senior Exploration Geologist and Exploration Manager for Mount Gibson Iron Ltd. There, he was responsible for exploration at the Koolan Island Iron Ore Project. Yes, that’s the same iron ore project that’s located just 25km from PFE’s Yampi Project.

We’re confident that he knows a good iron ore project in this region when he sees one.

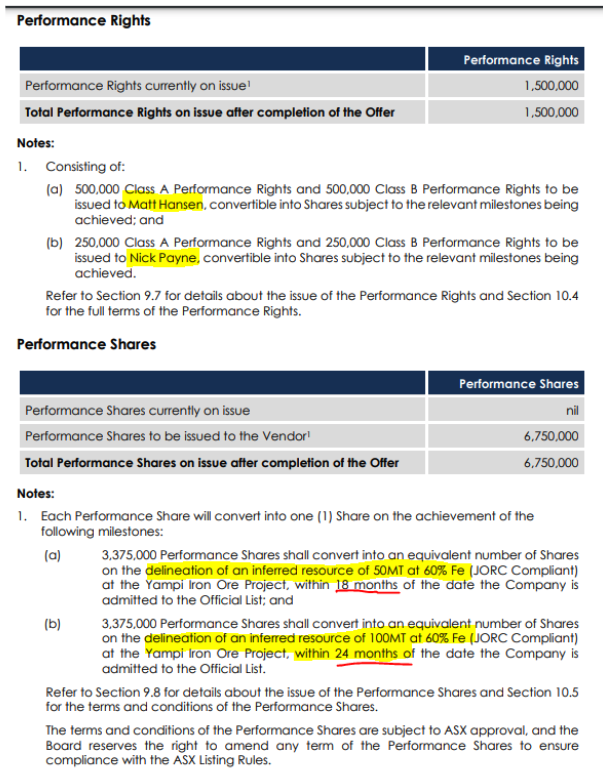

CEO Matt Hansen and Exploration manager Nick Payne are both handsomely incentivised with performance shares that they get IF they manage to prove an iron ore resource within a certain time frame.

In summary, the performance hurdles are:

- 50Mt at 60% Fe within 18 months

- 100Mt at 60% Fe within 24 months

...right within our 2 year time frame. We like these targets for the PFE management team.

Here are the details as in the prospectus.

Summary and what to watch out for next

We are excited to be invested in PFE and look forward to watching the story unfold over the next few months and into drilling.

The next news to watch out for from PFE is anything on the contracting or mobilisation of the helicopter to deliver the drill rig to site.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.