New geophys survey suggests TMR’s project is a monster.

With the Canadian drilling season having just restarted, we recently tripled our holding in gold explorer Tempus Resources (ASX:TMR) in anticipation, bringing our average entry price to 18.2¢.

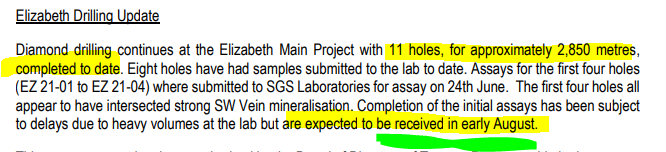

In what we hope could be a major catalyst, we are expecting TMR’s first drilling assay results to arrive any day now.

Further to upcoming drill results, TMR announced this morning that “geophysical surveys have revealed the potential for a much larger scale gold system”.

Today’s news comes from the first ever high resolution airborne magnetic and radiometric geophysical surveys completed over the entire Elizabeth Gold Project - and it revealed some pretty interesting results on TMR’s gold system.

This is off the back of their last announcement that metallurgy test work confirmed that gold can be very economically extracted from the specific rock/ore types on TMR’s project.

This is the kind of news that serious and institutional investors want to see — large mineral systems that can be economically extracted.

Now TMR just needs to drill it out and deliver some big results that prove what’s under the ground - first results expected any day now...

TMR says the geophys surveys “significantly increases the footprint and depth extensions of potential gold mineralisation”

The key increases reported this morning are:

- The same rock formations that host TMR’s high grade gold covers an area four times bigger than previously known.

- The gold system appears to extend at least 2km below surface - 10 times deeper than has been currently drilled.

- Two new anomalies (colourful blobs) have been identified - These two anomalies show strong continuity along strike and are also extensive at depth

So we now know that TMR’s gold system could be a lot bigger than we first thought AND that TMR’s gold is proven to be economically extractable.

Now TMR just needs to PROVE what’s under the ground with lots of drilling in the 6 months remaining in this year’s Canadian drilling season, before winter comes around again and drilling activities need to stop.

The survey shows geological similarities to the Bralorne - Pioneer mesothermal vein system (approximately 30km away), which was mined to a depth of approximately 2,000 metres and produced more than 4 million ounces of gold over a period of 50 years.

The TMR CEO seems pretty happy with the results, commenting that

“The results of the geophysical surveys show that the intrusive system that hosts the gold veins at Elizabeth is much larger and extends much deeper than previously thought. There are also two additional large-scale anomalies within the project licence. The results highlight the potential for Elizabeth to complement its high-grade nature with very large scale.”

We hope the next few months will deliver the drill results and share price appreciation we were hoping for in the 2020 drilling season that was disrupted by COVID and permit delays. We’ll soon find out as TMR’s first drill assay results should be any day now.

We are pretty excited about TMR and the many drill results expected over the next few months, certainly more exciting than the quiet news period that we just sat through for the last 6 months...

REMINDER: Our TMR investment and what coming next

We originally took a position in Canadian Gold explorer Tempus Resources (ASX:TMR) at 21c back in February 2020 because we liked its Canada and Ecuador Gold projects, active drilling campaign plans and sub 100 million shares on issue. We increased our position in November 2020 at 34c.

For a number of reasons, which we cover in this article the TMR share price has only moved sideways since we invested 12 months ago.

However, with the next drilling campaign now started after a few months’ pause due to winter weather, and the gold price looking like it wants to make a comeback, we recently tripled our holdings in TMR by participating in the last placement at 14.5c.

After the placement, our new average entry price on TMR is 18.2c. We haven’t sold a single TMR share since we first invested last year and are pleased that our first batch of TMR shares has now hit the 50% capital gains tax discount because we have held for 12 months.

Our goal with all our portfolio companies is a long term hold for hopefully a 1,000% plus gain, assuming the company executes on its plan (and has some exploration luck in TMR's case). We hope 2021 is TMR’s year and we get some positive drilling results over the next few months.

TMR is one of our biggest positions that is currently sitting around our average buy-in price of ~18c.

TMR was one of our very first investments back in early 2020 alongside VUL, WHK and EXR — all but TMR have so far been on a big run.

TMR’s Canadian gold project already has a resource of over 200,000 ounces at 12.26 g/tonne (inferred), plus permitted mine infrastructure that could fast track it into production.

TMR’s goals for the current Canada drilling season are to extend as much as possible the high grade veins that have already been discovered. The 2021 Canada drilling season is only a few weeks old and ends in December, so expect plenty of action to come over the next few months, especially now that the geophysical surveys have shown that the whole system is a lot larger than previously known.

COVID delays in the 2020 season meant TMR could only deliver a fraction of the drilling they wanted to, especially at Elizabeth. But we think the 2021 season is going to be full steam ahead.

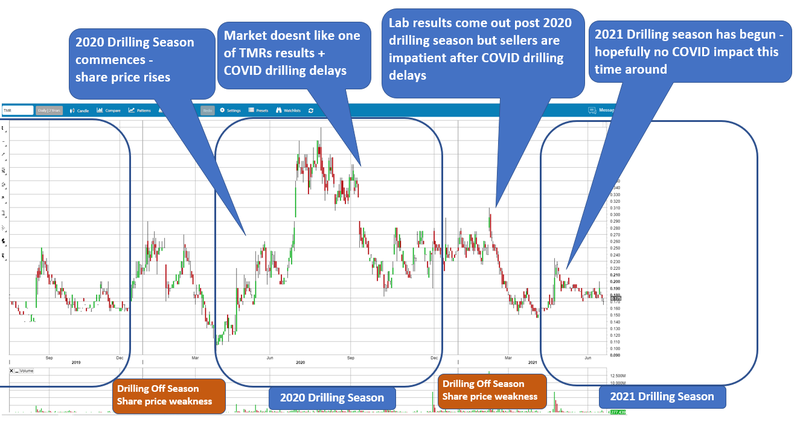

TMR is one of those exploration stocks that has a finite window to drill each year (thanks to the Canadian winter), so all the share price activity is concentrated into those drilling season windows. The share price runs up in anticipation of a positive drilling campaign and if the results beat what the market is expecting, then we think there will be a share price re-rate (hopefully more than the last highs of around 40c). In this case, we will look to free carry.

When TMR is expecting drilling and results within a drilling season window, the share price should run up in anticipation like it did early in the 2020 season.

If the drilling delivers above expected results we should see a rerate in the TMR share price - TMR only has ~113 million shares on issue so its share price can move quickly (up OR down).

So why didn’t we sell some last year when the price was trading at above 40c?

We invest for 1,000% price increases over the long term and, in our opinion, TMR didn’t get a chance to really get going in 2020 due to COVID. They only managed to do 2,000 metres of drilling out of a planned 6,000 metres at Elizabeth and the market didn’t like the slow progress.

If we are going to take the risk on a small cap explorer then we want to see it reach its full potential. We also saw the opportunity to secure the 12 months capital gains discount on our initial batch of TMR shares into the 2021 drilling season (the 50% CGT discount is very valuable against the tax that can come with investing for 1,000% plus returns).

With only 100 million shares on issue (113.8 million fully diluted) we think TMR has a lot more to offer than 40c on the back of a better than expected drilling result, so we held on at the 40c mark. But unfortunately a result came in that the market didn’t like AND drilling was impacted by COVID ... and then the drilling season finished.

We didn't mind and were happy to hold and wait for the 2021 drilling season, which is now upon us.

We are hoping that drilling season 2021 will deliver what we hoped TMR would do during the 2020 drilling season before COVID struck.

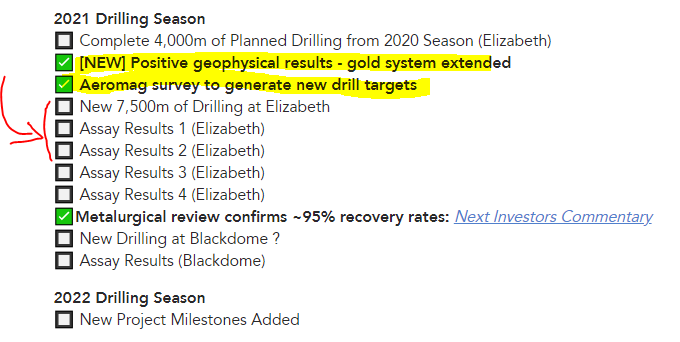

What we are watching out for next

Drill results from the assay lab!

Our main interest for TMR over the next 6 months is the drilling out of the Elizabeth project (shown with red arrow), which was heavily impacted by COVID in the 2020 season and is why we think the TMR share price has stagnated. Today we added a new milestone for the positive geophysical survey and ticked it off:

Here is our investment strategy for TMR

TMR is a little different to our other early stage explorers in that its Canadian gold project already has a resource of over 200,000 ounces at 12.26 g/tonne (inferred), plus permitted mine infrastructure that could fast track it into production. For this reason, we haven’t been doing any selling yet to free carry in the run up to drilling results, we want to see it drill out a few holes and deliver some results first - there is plenty of results incoming:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.