Los Cerros identifies new high grade gold targets at Miraflores

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Los Cerros Limited (ASX:LCL) has today provided an update on newly identified targets beyond the boundaries of the existing Miraflores gold deposit, part of the company’s Quinchia Gold Project in Colombia.

The newly targets identified have potential for high grade vein shoots and will be tested in the upcoming drill program.

Given recent improved understanding of regional geology, a recent review was of the foundations of the geological model was undertaken to better understand the distribution of gold bearing structures within the resource envelope and beyond.

Miraflores

Modern exploration at Miraflores commenced with 10 diamond holes drilled by AngloGold Ashanti and B2 Gold in 2006-2007, followed in 2010 by TSX-V listed explorer Seafield Resources.

Over the next four years, Seafield completed 63 diamond drill holes for ~22,000m defining low sulphidation epithermal mineralisation.

Seafield drill results included the following, encouraging intercepts:

- 23.95m @ 4.67g/t Au from 282.55m in QM-DH-03

- 6.0m @ 11.04 g/t Au from 343.1m within 194.9m @ 1.57g/t from 159.4m in QM-DH-32A

- 10.6m @ 11.97g/t Au from 233m within 1,145.7m @ 1.89g/t from 185.9m in QM-DH-33

- 60.0m @ 5.48 g/t Au from 225m within 161.15m @ 3.23g/t Au from 183m in QM-DH-34

- 59.2m @ 5.72 g/t Au from 182.8m within 238.15m @ 2.06g/t Au from 146m in QM-DH-50

Los Cerros believe that the considerable data set generated by Seafield Resources has not been fully interpreted and assimilated, and there is opportunity for a deeper understanding of the Miraflores structure and economic potential.

Recent modelling reveals potential high grade zones

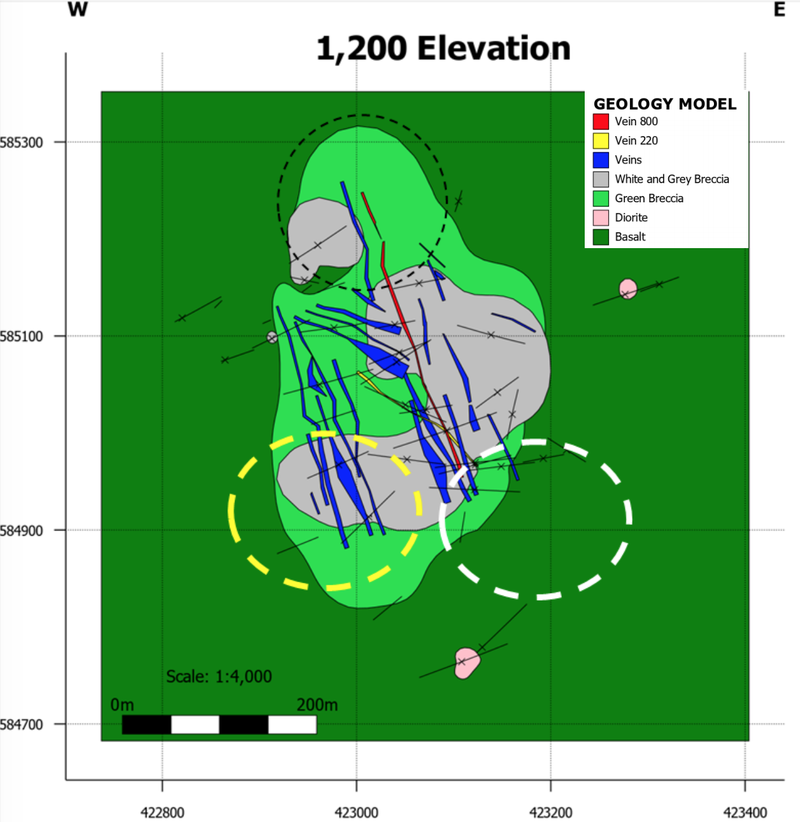

Recently completed drill core re-logging and 3-D modelling revealed several zones of interest both within the current resource model, but with sparse data, and also extending beyond the defined resource.

The highest gold grades occur within sheeted vein systems which cut white-grey breccia, which is believed to define a zone of hydrothermal boiling associated with deposition of gold mineralisation from the hydrothermal system.

Three zones of white-grey breccia are interpreted but none of these zones were specifically targeted by previous explorers, and the largest white-grey breccia zone remains open at depth.

It appears the 220/800 shoot remains open in both directions, creating two compelling targets for additional mineralisation. 3-D modelling also suggests the presence of other shoots parallel to the 220/800 vein set intersection. None of these vein intersections have been purposely targeted by previous drilling.

Los Cerros’ Managing Director Jason Stirbinskis commented: "Many impressive intercepts at Miraflores can be spatially attributed to the white-grey breccia and the 800 and 220 vein sets. Better understanding of these associations has given weight to the potential continuity of high grade zones, which is an important factor when considering the practicalities of mining the ore and also provides areas of investigation for potential extensions of high grade mineralisation.

“The Company remains focussed on the investigation of Tesorito and Chuscal, both of which have great potential and are less than 2kms from Miraflores. However, this recent work by our geologists has elevated our interest in Miraflores, especially given strong gold forecasts and the advanced nature of Miraflores’ engineering and approvals. To test the modelling, Miraflores targets will be added to the planned drilling program at Tesorito and Chuscal.”

Miraflores has a Reserve of 457,000 Au ounces at 3.29g/t Au based on a 2017 feasibility study.

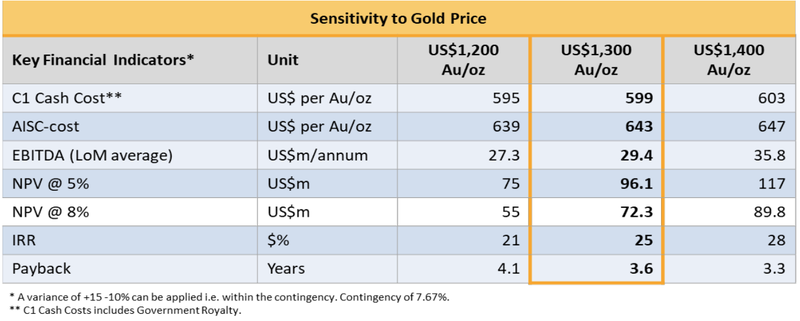

The study generated the following parameters based on a US$72M CapEx for a retreat long hole stope with backfill mining operation feeding a 1,300tpd conventional cyanide leaching facility, producing an average 4koz gold/month (48koz/year) over a 10 year operating life.

Note that current consensus gold price forecasts far exceed the upper limit of US$1,400/oz used in the 2017 sensitivity analysis.

A construction and operations plan (PTO) based on the parameters described in the Miraflores feasibility study has been approved and the final significant mine construction approval is Environmental Impact Assessment (EIA). Much of the work towards the EIA has been completed but will need to be updated closer to the submission date.

Quinchia Gold Project

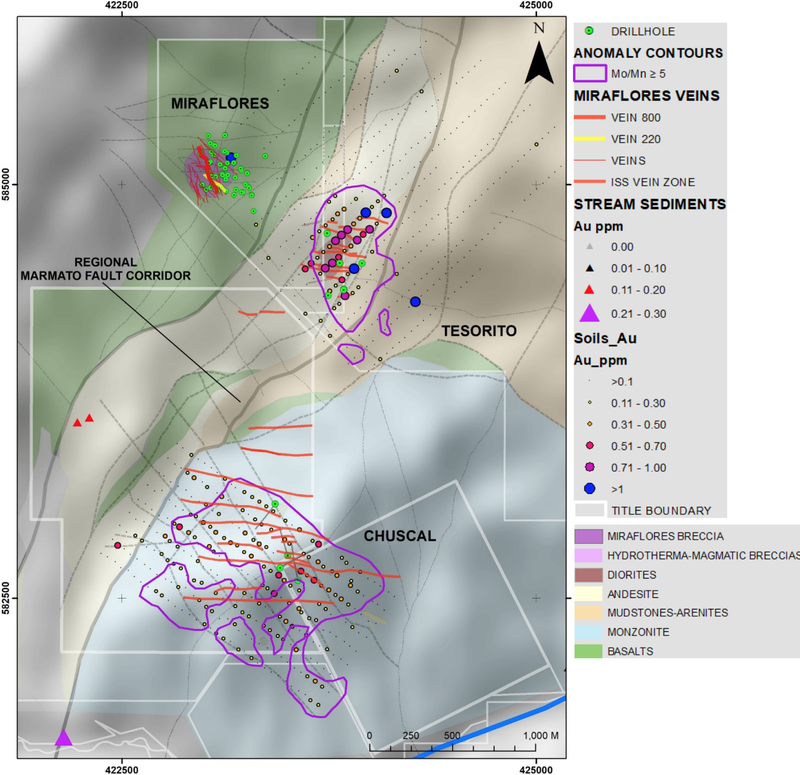

Miraflores is part of the 7,500ha Quinchia Gold Project which also includes Chuscal and Tesorito Prospects and the Dosquebradas Deposit which has an Inferred Resource of 459,000 Au ounces grading 0.71g/t Au.

There are also additional early stage exploration targets within a 3km radius of Miraflores. Los Cerros’ regional strategy is to advance the targets within the Quinchia Gold Project and re-enforce a production scenario leveraging Miraflores and using the proposed processing facility as a central hub.

The company is also committed to accelerated exploration for large scale gold-copper porphyry targets such as Tesorito and Chuscal. Quinchia sits within the Mid-Cauca Porphyry belt which hosts many multi-million-ounce porphyry discoveries.

2020 Drill Program

Los Cerros recently placed orders for a drill rig and supporting equipment as part of the Los Cerros / Hongkong Ausino Strategic Partnership Agreement (SPA). The SPA is a significant strategic initiative by Los Cerros to fund ~$2M of drilling and geophysics activity across the company’s extensive and highly prospective ~100kHa holding in Colombia and is expected to be the focus of on-ground activity for up to the next 18 months.

Through owning its own rig and similar assets, the company expects to realise material savings in its exploration programs in the long term whilst also driving a steady flow of drilling and geophysics activity.

As a priority, the company’s 2020 drilling program will focus on the Tesorito and Chuscal gold porphyry/epithermal targets and the Miraflores deposit, as mentioned above. The drilling is intended to start as soon as possible allowing for COVID-19 restrictions and shipping logistics.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.