Latin Resources outlines developments planned for 2021

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Latin Resources Limited (ASX:LRS) has released its annual report the year ended 31 December 2020, announcing that the company is debt free and in a very healthy financial position as it looks forward to progressing its projects in 2021 to the next level of development.

The highlights are outlined below:

- The consolidated profit after tax of the company for the year ended 31 December 2020 was $3.5 million (2019: loss of $5.5 million).

- The net assets of LRS have increased to $11 million (2019: net assets deficiency of $736,824).

- The company has a strong cash position of $4.5 million at 31 December 2020 (2019: $733,282) which subsequently has been further bolstered from the proceed of the exercise of LRSOC options by option holders to date.

Overview of Operations

Latin Resources’ principal activities during the year were the exploration and evaluation of mining projects in Australia, Peru, Argentina and Brazil.

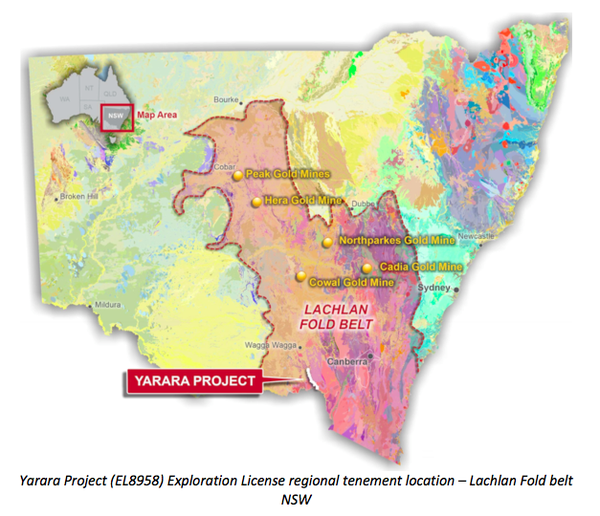

Australian projects include the Yarara gold project in the NSW Lachlan Fold belt, Noombenberry Halloysite Project near Merredin, WA, and the Big Grey Project in the Paterson region, WA.

The company is also actively progressing its Copper Porphyry MT03 project in the Ilo region, Peru, with joint venture partner First Quantum Minerals Ltd.

Additionally, during the year, LRS signed a joint venture agreement with the Argentinian company Integra Capital to fund the next phase of exploration on its lithium pegmatite projects in Catamarca, Argentina.

Some of the major developments in these projects are explained below.

Maiden drilling completed at Noombenberry Halloysite-Kaolin project

The company’s 100%-owned Noombenberry Project is east-southeast of Merredin, Western Australia.

As we reported in December 2020, LRS begun its maiden first pass and infill air-core drilling at the project, which the company advised had been completed in January 2021.

The company completed 197 drill holes to test the extent of a known Kaolinite-Halloysite occurrence.

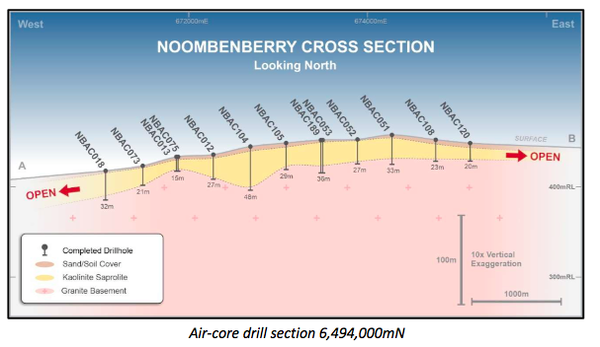

Logging of air-core drill cuttings confirmed significant intersections of bright white kaolinite across the area tested, with a maximum logged down hole intersection of 50m. This sequence of well-developed kaolinitic clay (saprolite) beneath a thin layer of soil cover is consistent across the area tested, as demonstrated in a simplified geological cross section 6,494,000mN which cuts through the center of area of drilling.

While not all results have been returned from the laboratory, the results received to date have confirmed that the Noombenberry project contains ultra-bright white Kaolinite (>80 ISO-B Brightness), and high grade halloysite with the highest individual result returned to date of 37% halloysite3.

On-ground exploration efforts continue for Yarara Gold Project

In June 2020, Latin announced it had signed a binding farm-in terms sheet with Mining and Energy Group Pty Ltd to earn up to a 75% interest in a gold project, Yarara, within the highly prospective Lachlan Fold gold belt of NSW.

The project area contains numerous old gold workings with at least four main historic high-grade gold mines that targeted high-grade quartz vein systems, including the Billabong Mine, Rangatira Mine, Perseverance Mine and Just-in-Time Mine. An initial structural interpretation based on the available regional datasets highlighted well over 30 target areas, including numerous priority areas, which Latin believes are highly prospective for a range of gold mineralisation styles.

During the December 2020 quarter, Latin continued its efforts to secure land access in priority target areas of the Yarara Project (EL8958), allowing the Company to plan on-ground reconnaissance mapping and prospecting for early January 2021.

The Company is expanding its NSW-based exploration team, including the recruitment of a Senior Geologist to be based in Orange, who will drive on-ground exploration efforts across the Yarara and Manildra Projects.

LRS secured major Manildra Gold project

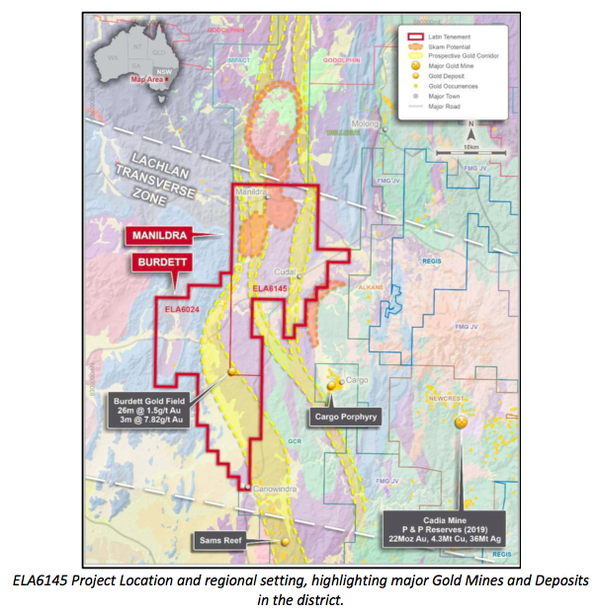

Latin secured a major new project in November 2020, within the east Lachlan Fold Belt of NSW, through the successful submission of a new tenement application, ELA6145.

Following the granting of the new tenement and securing land access and other statutory approvals, Latin proposes to complete regional and project scale first pass targeting exploration, which may include geophysical surveys and low-impact geochemical sampling, followed by RC drilling of any defined targets.

Burdett Project also acquired by LRS

Latin secured another major new project within the east Lachlan Fold Belt of NSW, through the acquisition of tenement application ELA6024, or Burdett Project, covering 252km2 of highly prospective Silurian age volcanic and sedimentary rocks.

The project area straddles the regional scale Canowindra Shear Zone, expanding Latin’s tenement holding to more than 530km2 in this highly prospective gold region; covering the north-west extension to the historic Lady Burdett Gold Mining centre, where previous drilling has returned significant gold intersections, including: 26m @ 1.5g/t Au and 3m @ 7.82 g/t Au8, close to surface.

LRS will undertake detailed prospect scale mapping and rock-chip sampling of the area to better understand the controls to mineralisation before undertaking further drill testing.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.