KNI delivers multiple conductors on copper and cobalt - Drill targets next

Today our EU battery metals investment Kuniko (ASX:KNI) announced that it has received back positive early data from its geophysics program - unveiling multiple electro magnetic conductors across its projects.

Finding EM conductors is a big step toward KNI identifying its first drill targets.

KNI spun out from Vulcan Energy (Vulcan retains 23.34% of KNI) and is exploring for key metals for electric vehicles and the batteries that power them: Cobalt, Nickel and Copper.

KNI has a mandate to maintain Net Zero carbon footprint throughout exploration, development and production, in addition to being local in Europe - zero carbon and local supply are in high demand by European automakers switching to electric vehicles.

KNI’s copper, nickel and cobalt projects were historically producing mines, and have not had modern exploration techniques applied to them, meaning they could turn up new deposits if they look in the right places.

Two months ago we wrote that KNI’s modern EM survey techniques could return literally ANYTHING... including multiple EM conductor targets OR a big fat NOTHING. This is the nature of early stage metals exploration - any investment is risky, even when a company is working with historically producing mines.

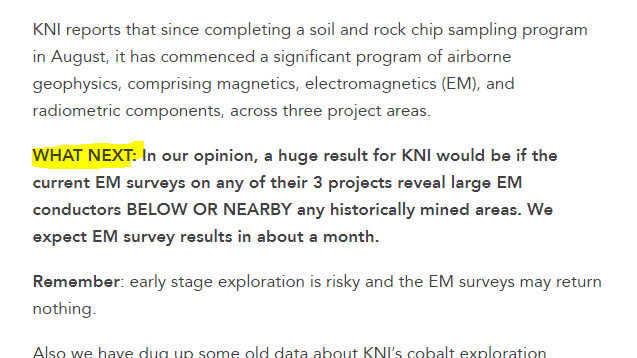

In September when KNI commenced their geophysics surveys we wrote we were hoping they would return multiple EM conductors.

Today KNI gave the market an early look into the progress of their geophysics work - and as we were hoping, KNI has delivered some very interesting geophysics and EM survey results, specifically:

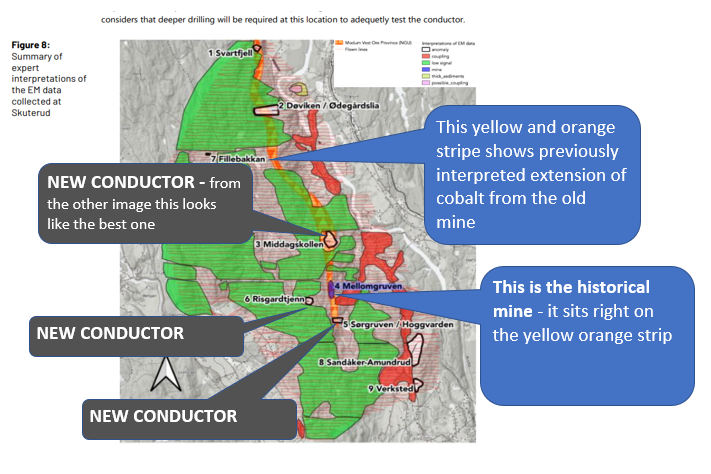

- Skuterud (cobalt project) - several EM conductors, including a big and deep one that is totally new and previously unknown, it is also along the previously interpreted “ore province” where the historical cobalt mine is located.

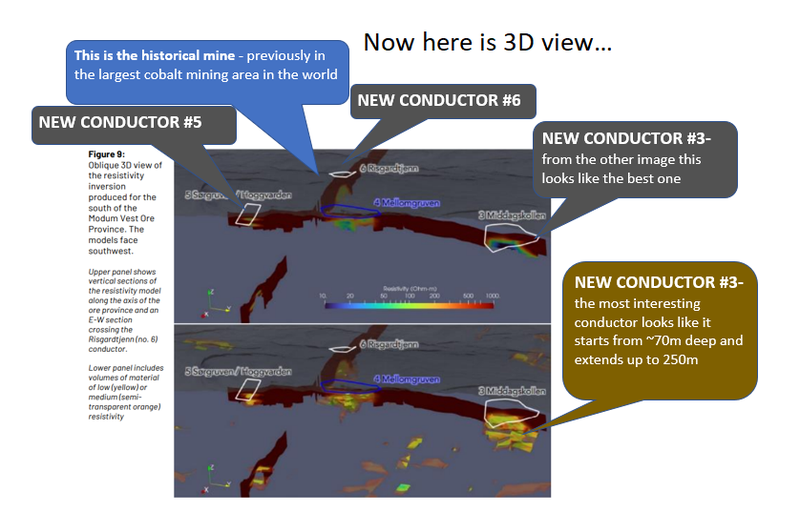

- Undal & Vangrofta (copper projects) - Magnetic and EM conductivity tests have thrown up several areas near historical mines for further investigation AND a new area that was previously unknown.

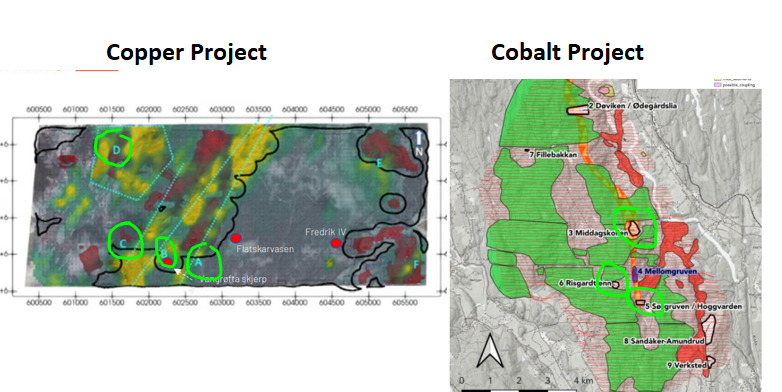

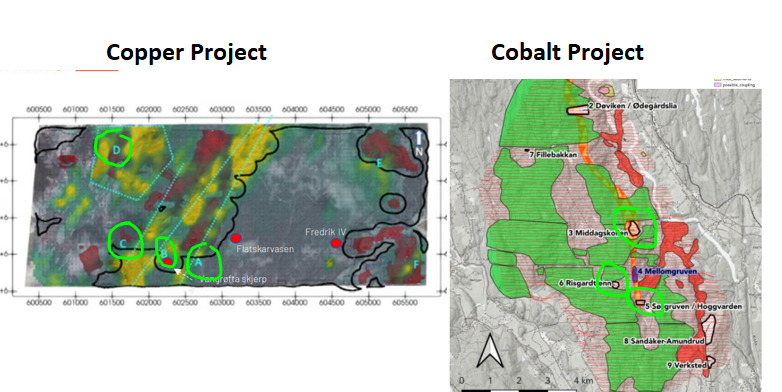

Here is our quick visual of the key anomalies and conductors returned by the KNI’s geophysics surveys that we’ll discuss today, we have circled them in green:

Today we will provide our commentary and our “armchair geologist” interpretation of the conductor data just released by KNI.

It's important to note that today's announcement gets KNI one step closer to identifying drilling targets. KNI’s geologists and technical team are going to go over the data shared with the market today, and will determine which of the multiple EM anomalies will be the most interesting to drill first, second, third etc.

By “most interesting ” we mean which target could have the most likely chance of delivering mineralisation when drilled, obviously that’s the one we want to drill first - the soil sample analysis we are still waiting on from the lab will help inform this decision.

Here is what we said we wanted to see two months ago from KNI from its geophysical survey work:

So we consider today’s news to be a very good result - KNI has returned EM conductors and anomalies in both expected areas AND a couple of new conductors in areas away from existing projects.

Regular readers will know that geophysics announcements can sometimes return little or no potential targets - some of our other exploration companies have not returned any interesting EM conductor data to warrant further investigation, so for KNI to have multiple EM conductors across several different projects is a great result.

Today KNI has given an early preview of the geophysics progress and the raw data to be further interpreted.

ALSO: KNI says it is still waiting for the geochemical results from the lab - this is important info from the soil samples taken from they surface above today’s conductors that will tell us if there are traces of the metals that we are looking for - a good indicator that the geophysical anomalies could also contain that metal. These results are due this month.

The next thing we want to see from KNI is selection of the highest potential drill targets based on analysis of the above conductors/anomalies.

Here is our mini-dive into each set of data for the cobalt project and copper projects:

What was announced today and why it matters

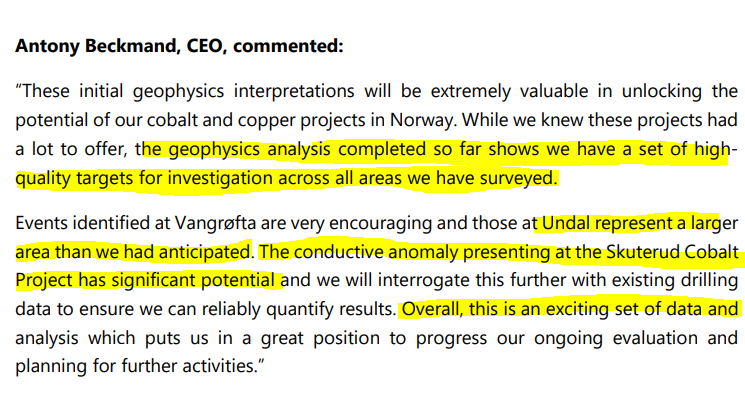

KNI’s CEO Antony Beckmand summed up today’s results:

Skuterud - (cobalt)

KNI’s Skuterud tenements are in a part of Norway called the Modum Vest Ore Province which was known for its historically important Co, Cu and Ni production — this mining district was previously the largest cobalt mining area in the world. Mining occurred from 1773 to 1898, with total estimated production of 1 million tonnes with 0.1–0.3 % Co, up to 2.0 % Cu and Au up to several parts per million locally.

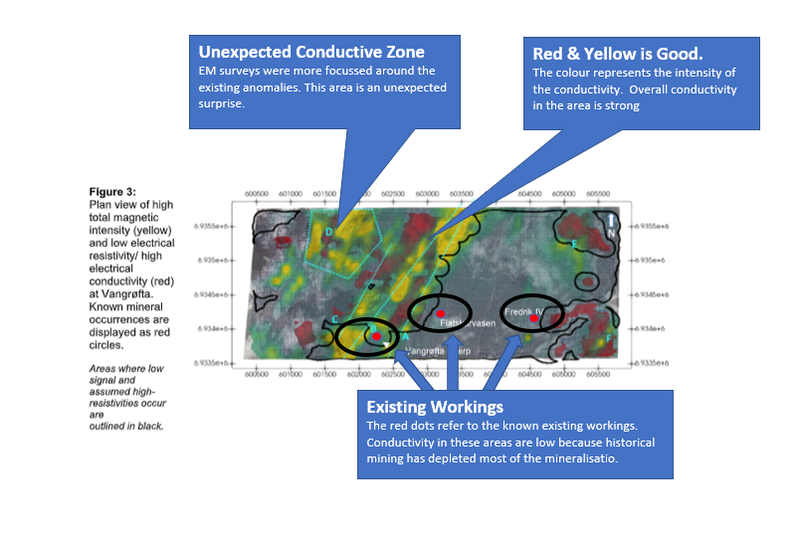

Here are the three key new conductors revealed for the Skuterud cobalt project in today’s KNI announcement:

This is the key element of today’s announcement:

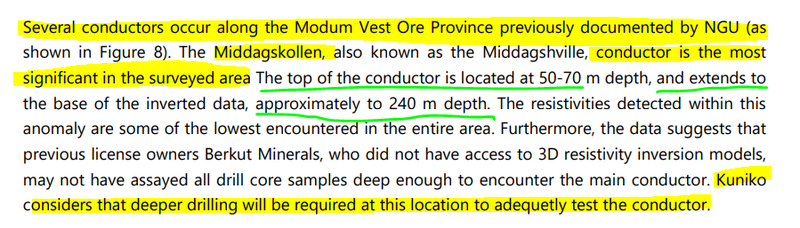

To best understand what KNI is working with, and why they need to drill these new conductors starting with Middagskollen (conductor #3) - check out this 3D map:

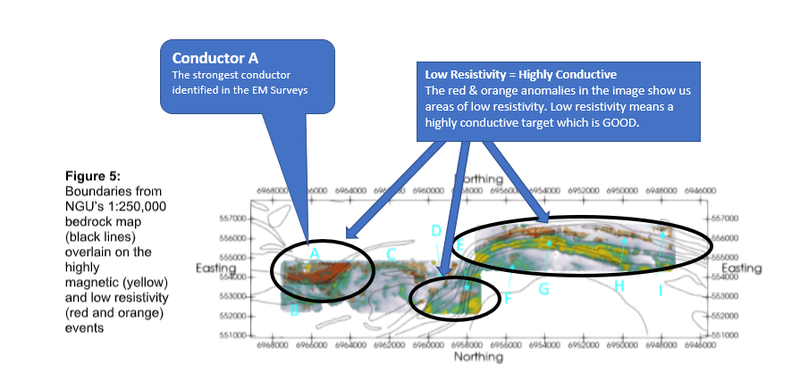

An area of low resistivity is the equivalent of high conductivity. Resistivity is the opposite of conductivity. This is down to European geophysics language as opposed to some of the geophysics language you encounter in Australian mining announcements - in the end it's all just conductive “colourful blobs” that we want to see, no matter the language used.

So the paragraph we highlighted above, combined with the commentary on the maps we provided, outlines what we think is some good potential for KNI’s Skuterud project.

It’s also important to know that the previous project owner, Berkut Minerals didn’t have access to the technology that KNI has, and as a result KNI can build a better model of the Modum Vest Ore Province. Here is where we cover more about KNI’s cobalt project and the historical data.

Better exploration technology could advance a more economically valuable project, quicker.

Skuterud - Here’s what to expect next...

KNI indicated that to really wrap their head around the Middagskollen conductor (number #3), the big colourful blob on the right figure 9, deeper drilling is required.

We think these initial drill results could really unlock the potential at Skuterud and Middagskollen is one of the primary places they intend to go looking for more cobalt.

From our observations, there's clearly something significant at these conductors, especially Middagskollen, however KNI needs to do more drilling in key areas in order to prove something up.

KNI CEO Antony Beckmand said in the announcement that the ‘events’ or anomalies require further analysis as KNI triangulates all the data and results they are working with and that these targets are high quality.

EM surveys and geophysics will often return no conductors or anomalies, after today’s results we feel more confident in Skuterud and it is shaping up nicely.

Copper projects (Vangrøfta, Undal, and Nyberget)

KNI’s copper projects sit on ~50km^2 of ground and make up KNI’s “South-central targets”.

The project area has a long history of production dating back to the 1600’s. Specifically in the Undal project area where historical production was completed for 289kt at average mined grades of 1.15% Copper & 1.86% Zinc.

The EM Surveys have now been completed over the Undal & Vangrøfta projects where sampling by KNI at Vangrøfta yielded up to 16.75% Copper, 3.33g/t gold and anomalous concentrations of cobalt.

Encouragingly today’s EM data shows us that surrounding Vangrøfta are large areas of conductivity highlighted in Red & Yellow. The better the conductivity the more likely KNI are to hit an ore-body. This is exactly what we wanted to see and indicates to us that KNI are looking in the right area.

What to expect next at Vangrøfta?

The last piece of the puzzle is to overlay the geochemical results with all of this existing data. Going into this part of the exploration program we will be looking out for confirmation in the geochemical results that the zones highlighted in light blue as A/B/C/D are Priority areas & that the highest priority drill targets are located in these zones.

What about Undal/Nyberget?

Importantly the Undal project also returned strong conductors which correlated well with the stratigraphy mapping in the area. This is particularly encouraging to us, as mineralisation in this area is generally stratigraphically hosted. “Stratigraphic mapping” studies the different layers of the host-rock & the mineralisation links between them. This correlation basically confirms to KNI what they hoped their geological models were telling them.

The strongest conductor – Conductor A – occurs in the northernmost part of the survey area.

Geochemical results are due by the end of November and will need to be overlaid with the existing EM Data to better make sense of the conductivity.

Ideally we want to see Geochemical results indicating that Conductor A is a priority drill target and will be included in the upcoming drilling programme.

What we are watching out for next

So we have the #5, #6 and #3 conductors/anomalies for cobalt at Skuterud. #3 being the best looking one in our opinion so far.

And A, B, C, D conductors / anomalies for copper.

KNI says the geochemical work is still in the lab, and once this comes back, it will help inform the most prospective places to drill first. These results are due in November.

Basically all the colourful blobs returned in the images above are just one piece of the puzzle, the geochemical testing will confirm if there is presence of the metal KNI is looking for in the surface soil, which will help choose which colourful blobs are the most likely to deliver a result when drilled

WHAT NEXT: we want to see the geochemical results (due this month), probably combined with KNI’s most high priority drill targets announced (including an explanation of why they were chosen) AND a time frame for when the first drilling will happen.

With $7.17 million in cash as at 30 September 2021, KNI has a decent war chest to get the ball rolling here. And today’s conductors are just the beginning, we think.

Investment milestones

Skuterud Project - Cobalt

✅ Field Studies - Geochemical Sampling

🔄 Assay Results (Geochemical Sampling)

🔄 Geophysical Program

🔄 Drill Targets Identified

🔲 New Milestones Added

Feøy Project - Ni-Cu-PGE

🔄 Field studies - mapping/sampling

🔲 Geophysical Program

🔲 Geochemical Surveys

🔲 Drill Targets Identified

🔲 New Milestones Added

Copper Projects

Romsas, Undal and Vangrofta

✅ Field studies - mapping/sampling (Vangrøfta)

🔄 Geophysical Program (Vangrøfta, Undal)

🔄 Geochemical Surveys

🔄 Drill Targets Identified

🔲 New Milestones Added

Investment Milestones in KNI

In line with our general investment strategy for early stage explorers, we have sold 8.04% of our KNI position, and we are moving towards achieving free carry prior to the initial drilling results, which we expect to complete in the first half of 2022.

✅ Initial Investment: @20¢ (Majority Escrowed for 2 Years)

🔲 Increase Position

🔲 Increase Position

✅ Price increases 500% from initial entry

✅ Price increases 1000% from initial entry

🔲 Price increase 2000% from initial entry

🔲 12 Month Capital Gain Discount

🔲 Free Carry

🔲 Take Profit

🔲 Hold remaining Position for next 2+ years

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities (including staff), own 2,881,667 KNI shares.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.