Kairos all revved up to find the next Hemi-style gold deposit

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Kairos Minerals Ltd (ASX:KAI) were up by approximately 20% on Monday after the company announced positive exploration news from the Skywell Project, part of the group’s broader Pilbara Gold Project in Western Australia.

This substantial spike in the company’s share price occurred under some of the highest daily traded volumes recorded in the last two years.

Initial rock sampling at Skywell returned high-grade assay results including 12.9 g/t gold from a quartz vein in a gabbro unit of the Sisters Supersuite intrusion.

While this is definitely good news, it is just part of what has been a much bigger story over the last three months particularly as the group’s share price has increased eight-fold.

The company’s shares have more than doubled since June 23 when Kairos announced that it was undertaking a non-renounceable pro-rata entitlement offer to eligible shareholders of ordinary fully paid shares at an issue price of $0.011 per share.

This offer was on the basis of 1 new share for every 8 shares held at the record date on June 25, 2020 (Record Date), with one free attaching option for every two shares subscribed.

This has allowed the company to raise up to approximately $1.7 million before costs which will be used to fund exploration work programs at various areas across the group’s highly prospective projects.

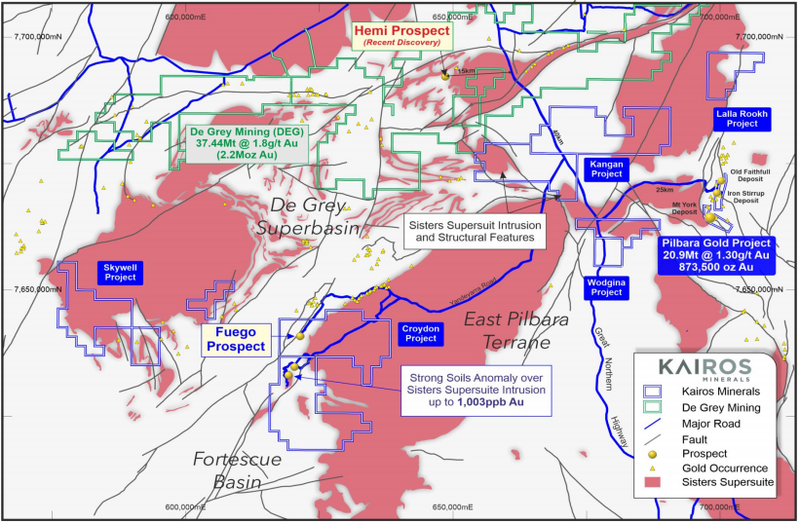

Broadly speaking, funding will be put towards the company’s Pilbara Gold Project, geochemistry programs and drilling programs across priority intrusive-related gold targets at the Kangan and Skywell Projects, drilling and mining studies at the Pilbara Gold Project, reverse circulation drilling at the large Fuego gold anomaly, as well as being used for working and other capital requirements.

Resource update provides foundation for share price rerating

In early March, Kairos released an updated global mineral resource inventory that increased the size and quality of the resource as well as providing greater confidence in its ability to progress the Pilbara Gold Project.

This followed an extensive review of existing data, including the results from the latest drilling program over the Mt York Deposit and with the application of new parameters, the new global Indicated and Inferred Mineral Resource for the centrally located Mt York, Iron Stirrup and Old Faithful deposits.

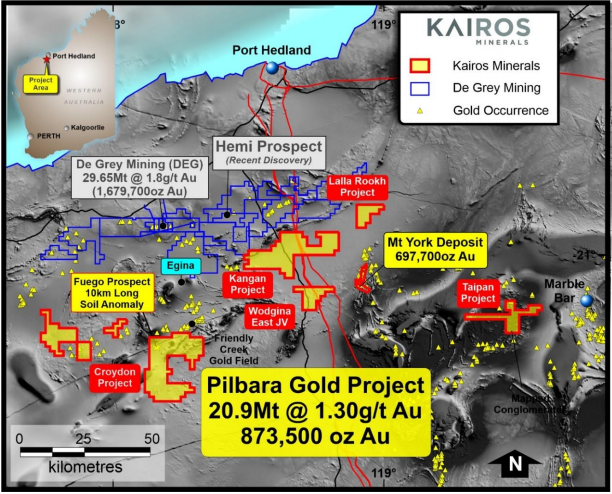

The Pilbara Gold Project resource currently stands at 20.9 million tonnes at 1.3 g/t for 873,500 ounces of gold.

Three deposits have now been brought under the Mt York gold deposit banner which has 17.2 million tonnes at 1.26 g/t for 697,700 ounces of contained gold.

The significant increase in the Indicated Mineral Resource for the Mt York Deposit stemmed largely from the results of the late-2018 reverse circulation drilling campaign, comprising 51 holes for 6,710 metres.

While the above map focuses on the broad range of prospects, including those further west of where the established resource has been delineated, the following narrows in on the key Pilbara Gold Project Area, in particular the Mt York deposit.

This also highlights the proximity to De Grey Mining’s gold resource of nearly 1.7 million ounces, as well as the Hemi Prospect which De Grey believes will be a game-changer.

Certainly, assay results suggest they could be on the mark with near-surface returns including 44 metres at 5.1 g/t gold and 46 metres at 6.6 g/t gold.

As can be seen above, Kairos has a number of projects in close proximity to Hemi, and in commenting on the potential relationship between the outstanding grades returned at Skywell and the results at Hemi, executive chairman Terry Topping said, ‘’The presence of gold grades at these levels has defined a significant high-grade gold anomaly which clearly warrants follow-up.

‘’Gold can often occur in quartz veins on the margins of the sort of big intrusive-features we are targeting for potential Hemi-style discoveries, so this increases our confidence in the scale and potential of the opportunity here.

“We are currently about halfway through an ultrafine soil sampling program at the Kangan Project and, once the team is finished there, we will relocate them to Skywell to undertake systematic soil sampling to help define drill targets.

‘’Our multi-pronged exploration program is also advancing on other fronts, with the extensive airborne magnetic and radiometric survey over the broader Pilbara Gold Project now complete and data processing underway.

‘’We have also appointed a contractor to upgrade access to the Fuego gold target and we are in the process of finalising contractor selection for the upcoming drill program at Mt York and, following that, Fuego.”

Kairos increases exposure to Hemi style deposits

In mid-June, Kairos expanded its Pilbara Gold Project by securing a strategic tenement package located immediately to the south-east and adjacent to its Croydon project.

This doubled the size of the company’s landholding at Croydon, giving coverage of a highly prospective suite of rocks including the regionally significant Sisters Supersuite intrusions.

Explaining the strategic significance of this acquisition, Topping said, “Evidence from the recent Hemi gold discovery suggests that the margins of these large intrusive features where they intrude granites is now highly prospective for new gold discoveries.

‘’The land package also includes prospective granite-greenstone rock units that are prospective for more conventional structurally-hosted gold deposits.

‘’This further strengthens our extensive pipeline of exploration opportunities across the Pilbara gold district.”

With the gold price hovering in the vicinity of A$2500 per ounce, companies in that space are likely to continue to receive robust support.

However, there will be a particular focus on those that are approaching the transition point from exploration to production especially where near-surface mineralisation can be accessed relatively quickly.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.