GTR are Ready to Drill for Uranium in the Coming Weeks

GTi Resources (ASX:GTR) is an early stage uranium explorer with two projects based in the USA.

Yesterday GTR announced that they have secured two drill rigs for the upcoming drilling programme at its Wyoming uranium project next month.

The uranium price has been on a significant run, taking uranium stocks with it - so we think this is a great time for GTR to drill.

The drilling is targeting an area where there was previous uranium discovered in the 1970-80’s, which makes it more likely that GTR will find something than if this was a greenfields project.

What we are looking out for in this upcoming drilling is for GTR to confirm the historical uranium grades and give them a better understanding of what sits below.

Uranium is the feedstock for nuclear reactors and there is growing sentiment that more nuclear reactors are needed for the world to reduce its carbon dioxide emissions.

There are currently 441 nuclear reactors in operation around the world and further 56 reactors under construction.

In the wake of the current COP 26 global climate conference, we see uranium as a crucial element of the world’s decarbonisation strategy.

More reactors need more uranium, pure and simple.

Here’s where GTR comes in...

GTR’s ultimate goal is to define an economic uranium resource at their Wyoming Uranium Project - and success in the upcoming drilling would be a solid step towards this goal.

We made our initial investment in GTR in April-2020 at 1.2¢. With the uranium price now close to 9-year highs we believe it is the perfect time for GTR to commence their uranium drilling program.

GTR is now ready to get cracking on the drilling program at the newly acquired in-situ recovery (ISR) uranium projects in the USA.

What is ISR uranium?

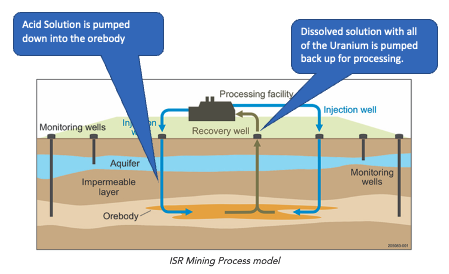

ISR uranium production is one of the two primary methods that are currently used to get uranium out of the ground. This method is used to recover uranium from low grade ores where other mining methods may be too expensive or environmentally disruptive.

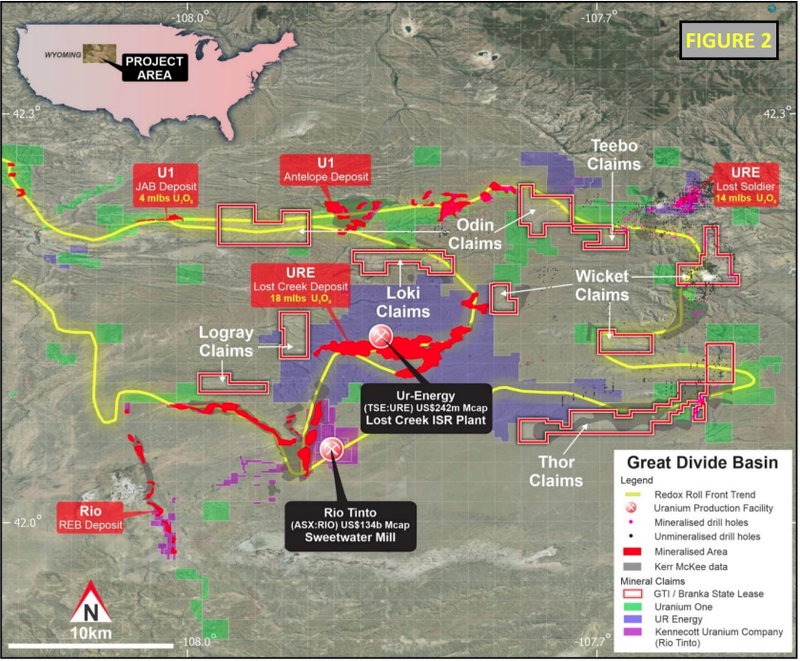

GTR’s project is surrounded by UR-Energy’s Lost-Creek ISR facility which UR-Energy claims is the lowest cost producing uranium project outside of Kazakhstan.

UR-Energy is listed on the Toronto Stock exchange and is capped at over CA$500M which gives some context to the potential upside for GTR on long term success. However it is early days for GTR, and plenty of work to do before GTR can even define a resource and build serious shareholder value.

We think GTR is drilling at the right time in the right place, with Wyoming being the capital of US uranium production (making up 80% of domestic production) and where Warren Buffet & Bill Gates will be building a $1B+ Natrium Nuclear Power Plant.

Here is a summary of the 8 reasons we like GTR:

- The uranium projects are in Wyoming. Wyoming is the capital for uranium production in the US accounting for 80% of domestic production.

- GTR is acquiring In Situ Recovery (ISR) uranium projects: ISR is commonly associated with the lowest cost production in the uranium industry.

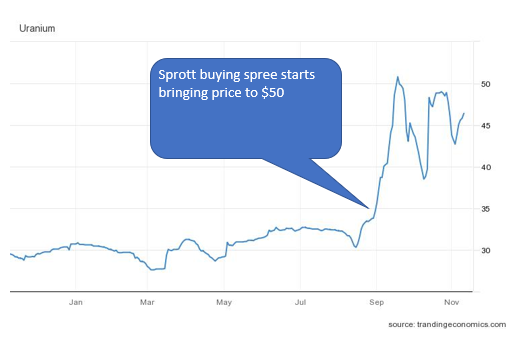

- Uranium price at 9 year highs - Uranium prices have moved from ~US$32/lb at the start of the calendar year to now trade at ~US$46/lb.

- The US is going to need a lot more uranium - The shift towards cleaner sources of energy generation as well as Uranium increasingly becoming a strategic mineral will mean the US need a lot more of it.

- GTR gains highly experienced US uranium team - Doug Beahm & James Baughman both in the US & have heaps of experience with ISR uranium projects in the US.

- GTR will be drilling by Christmas with funding in place ✅ Capital raise done & drilling will commence December.

- Sector consolidation moves underway already: is a takeover GTR’s destiny?

- Funded for upcoming drilling ✅- Capital raise was done at 1.5c and the share price has traded above this level ever since, showing good share price strength.

Our long-term investment thesis for GTR is to see it go onto prove out an economic uranium resource with ISR potential and for it to become the ideal takeover/merger target. You can read this article for a detailed explanation of our 8 key reasons on why we invested in GTR.

New readers should be aware that we have been invested in GTR for nearly 18 months and now that the uranium price is running hot, there could be increased volatility in the share price over the next few months. Also remember that exploration is a very risky investment.

Background on the In-situ recovery ISR project in Wyoming, USA

With the acquisition now completed for ~21,000 Acres of Ground in the Great Divide Basin, Wyoming in the US, is home to 80% of Domestic US uranium production, GTR is moving into the drilling phase across the projects.

We like that GTR’s Wyoming projects sit within transportation distance of 7 different ISR facilities that are already operating and two others that are currently licensed for construction. Activity in the area is crucial to be able to bring any ISR discovery onto the market quickly.

ISR mining - also called Insitu Leach (ISL) or Solution Mining is essentially the process of pumping liquid into an orebody to dissolve the mineralised deposit & then using what is called the “leach” process to pump the dissolved solution back to surface through a recovery well for processing.

We detailed the importance of an ISR deposit in a previous note on GTR, which you can view here.

GTR's projects surround the Lost-Creek ISR facility owned by UR-Energy which has a ~12m lbs resource @0.044% uranium. UR-Energy claims that this project is the lowest cost producer of uranium outside of Kazakhstan.

With ISR uranium mining usually having a lower cost of production due to the lower than required OPEX/CAPEX vs hard-rock mining, we think that any confirmation of an ISR discovery will get GTR’s neighbours attention.

Wyoming is already the capital for uranium Production in the US and with the likes of Bill Gates/Warren Buffet committing to construct the Natrium Nuclear Power plant in an investment tipped to be >$1B, Wyoming is the place to be as a uranium explorer in the US.

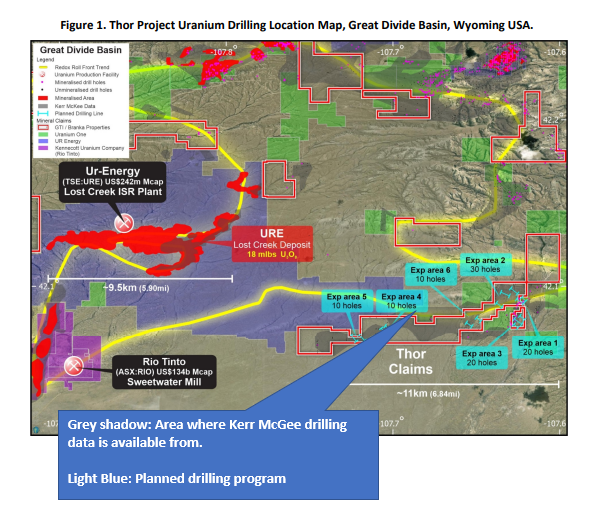

Where will GTR Drill?

GTR will initially be focussing on its Thor project where drill targets have been identified using previous drilling results. Permitting is already in place for ~15,000m in drilling down to ~110-20m depth. With the drill rigs secured we expect GTR to be drilling sometime in December.

This part of the Great Divide basin is specifically known for the deposits being ISR suitable which reduces OPEX/CAPEX significantly versus a traditional hard-rock deposit. We will be watching to see if the drill results are indicative of similar geological fundamentals to other ISR projects in the area.

Drilling has been designed to confirm the grade and size of uranium mineralisation that was previously identified by Kerr McGee in the 1970’s & 80’s and to ultimately support definition of a maiden uranium resource.

After Drilling the Thor prospect, GTR will move north to the Odin & Loki projects mid-next year.

GTR is fully funded for drilling

GTR is now fully funded to drill-out the Wyoming ISR project. We participated in the $2M placement at 1.5¢ where major shareholder Tolga Kumova topped up for another $234k. The rights issue was also completed and raised another $1.55M at 1.5¢.

GTR had ~$4.686M as at the end of the September quarter, with $600K raised from the vendor placement earlier this month GTR has plenty of cash to fund the 15,000m drilling programme.

With the share price holding firm well above the raise price of 1.5¢, we believe this bodes well for the long term prospects of GTR.

As with all early stage exploration companies, we aim to invest many months before a key drilling event and then take some profit as the share price rises on speculation of a positive drill result, holding the majority of our stake into the drilling results. We have been lucky with GTR after holding for well over a year, and the uranium price is up over 50%.

Why we like Uranium & why we think GTR is positioned:

The world's first and largest physical uranium exchange-traded fund, Sprott Physical Uranium Trust began trading in July, and has been accumulating uranium ever since. It now holds over 35.2M pounds of Uranium (~16,000 tonnes).

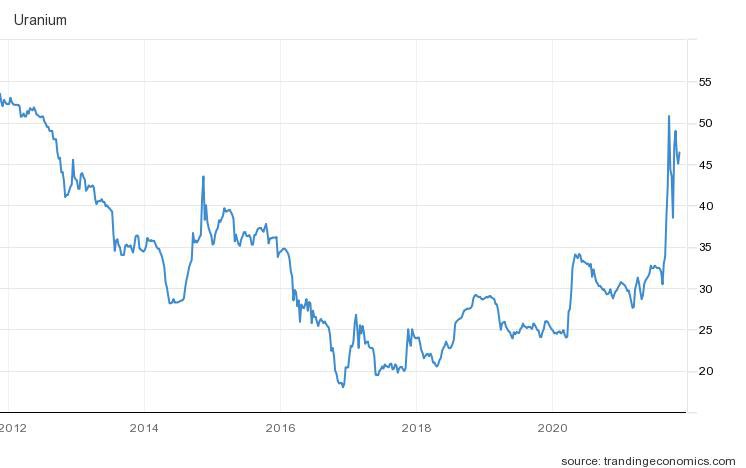

September was a big month for uranium after a long dormant period, in August and September Sprott’s buying spree drove a 64.5% increase to a nine-year high of $50/lb as of Sept. 16:

And in October Sprott made some more big moves, as per S&P Global Market Intelligence: ‘After taking a two-week break from buying, the Sprott Physical Uranium Trust purchased 400,000 pounds of uranium on Oct. 4 and 1.15 million pounds of material on Oct. 13. On the day of the second purchase, the uranium price assessed at 1 p.m. had risen to $46/lb, a 22% increase from $37.5/lb the previous day, according to S&P Global Platts data.’

The success of the Sprott Trust has also prompted Kazatomprom which is the world largest uranium miner to announce that it would also be setting up a physical uranium fund similar to Sprott. The fund will hold physical uranium as a long-term investment, with its initial USD50 million of purchases financed by its founders and plans to raise USD500 million for additional uranium purchases in a second development stage.

Which brings the uranium spot price to a price not seen for 9 years:

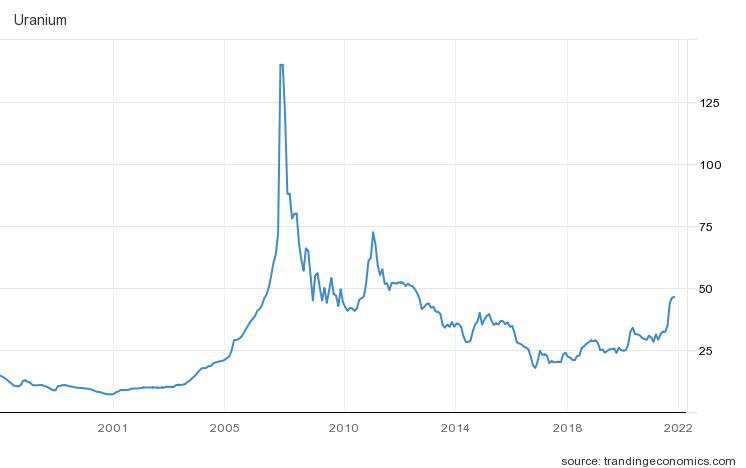

That may look like a sharp increase, but here’s where the uranium story comes into its own.

We know this active buying in the physical markets & increased demand from investors in exposure to physical uranium is having an effect on the spot-price. We expect this to continue & think that with a change in the demand-side in the long-run the uranium price will just continue higher.

Check out the headroom on the uranium chart going back 25 years:

The 2006/2007 bull run took it to $140USD/lb.

Combined with a broad-based commodities ‘supercycle’ in an inflationary environment and what we think is a crucial role in a green energy future, you can start to see the macro picture surrounding GTR a bit better.

Uranium Importance in the Green Energy Future:

The Intergovernmental Panel on Climate Change has said that over 80% of the world’s electricity will have to go “low carbon”. That is if global warming is to be kept below the 2°C Paris agreement target, set in 2018.

The world is desperate for emissions-free sources of alternative energy that will power the future of electricity grids globally. Although wind/solar are both viable options the common issue with these are that they are intermittent.

When the wind isn't blowing or the sun isn't shining an alternative energy source is required to provide baseload energy generation to the grid. Currently this is provided by coal and oil, which is harmful to the environment.

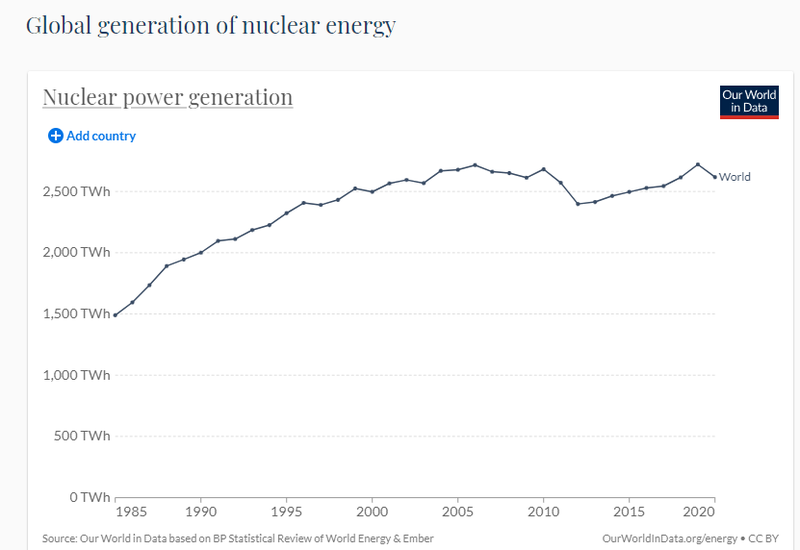

Enter uranium & nuclear power. Nuclear power currently makes up ~10% of the global energy mix and has historically had very little investment.

Nuclear power for over 20-years has seen very little growth in generation levels, and they are around the same level as they were in 2000-2001.

The most common forms of energy consumption at the moment is Oil which makes up ~31.2% & Coal which makes up ~27.1% of energy consumption. The recent energy shortages and reliance on coal-powered generation in China has highlighted that something needs to replace fossil fuels and we see Nuclear power emerging as the viable alternative.

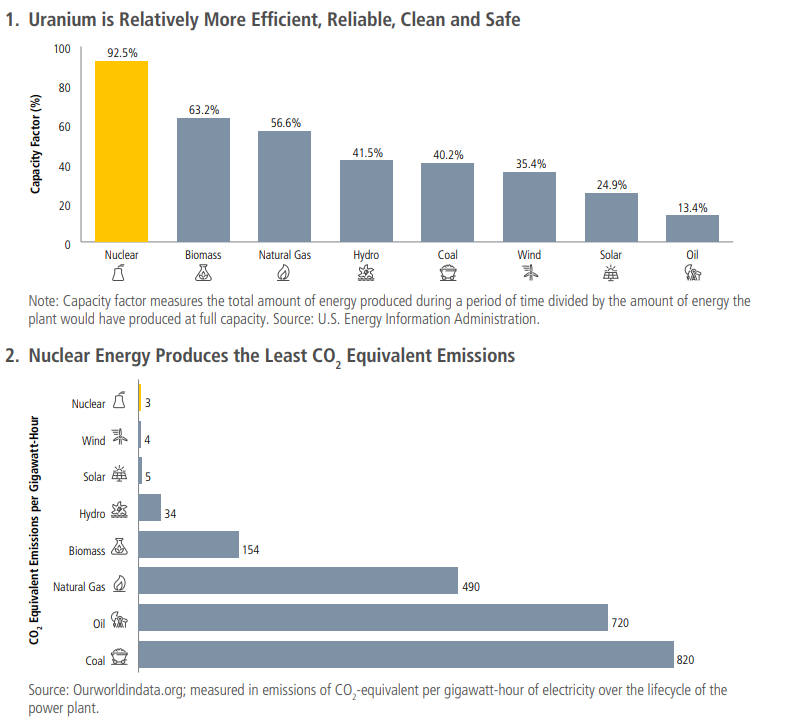

The difference between current energy generation technologies and uranium is just too big to ignore, according to the US Department of Energy nuclear power has the best uptime of any energy source, with reactor working 92.5% of the time compared to its peers like coal solar, wind and even geothermal.

You can see how uranium stacks up against other energy sources below:

Nuclear power has struggled with a bad image from perceived safety issues surrounding nuclear disasters such as Fukushima. But with the world looking to decarbonise by 2050, global leaders are beginning to realise that nuclear power is the best option for base load energy generation. In a symbolic moment for proponents of Nuclear Power, Japan announced last month that it would restart 30 nuclear reactors to reduce its carbon emissions.

We see this becoming a common theme in the future and expect other countries to follow.

Our GTR investment strategy:

We initially made our investment in GTR in late-April 2020 when the share price was at around the 1.2c price level. At the time the Uranium price had just started moving higher reaching a ~US$34/lb spot price before it retraced and started to consolidate around the US$30/lb. We then invested again at 3.3c and then most recently at 1.5c.

We like to make our investments in company’s during quiet periods where the share price or the commodity price is either moving lower or is consolidating. We make our investments and trust that the management teams running our portfolio company’s use these periods to set the company up for future success.

After patiently holding onto our GTR shares in the hope that the uranium price would continue its rise, it finally has, and with GTR completing the acquisition of the Wyoming ISR projects during a period of weakness for the Uranium price can now reap the benefits of drilling it with the Uranium Spot-price up by almost 50% from 12-months ago.

This is a good example of the importance of having patience when investing, to hold and wait for a sector to fire up. Another example of this is our investment in lithium (via Vulcan) back when the lithium price was in the doldrums and no one was interested in lithium stocks.

Another example of this was our 88E investment which we made briefly after Oil prices went negative in 2020 during the COVID panic.

Utah Uranium/Vanadium Project:

Yesterday's announcement has also confirmed that GTR have been busy at the Henry Mountains project, Utah in the background.

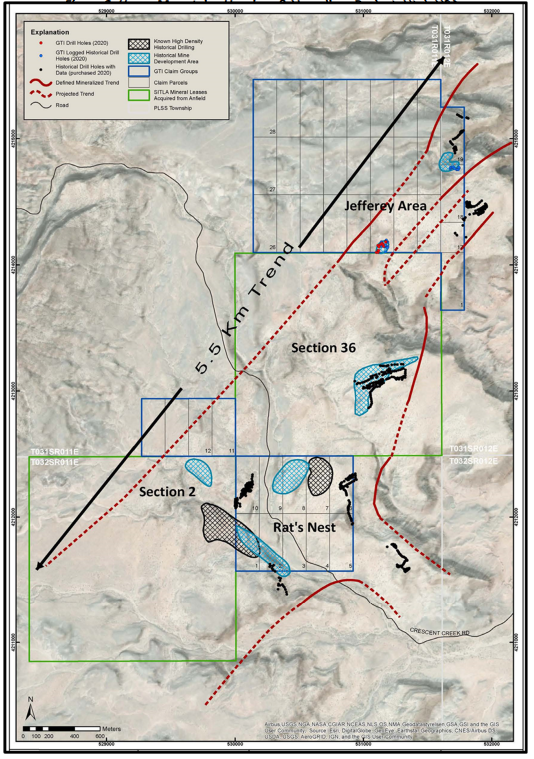

The field reconnaissance exploration program completed was largely being done to enhance GTR’s understanding of the 5.5km mineralised strike between Section 36, Jeffery & Rat’s nest prospects. Data from this program will dictate the next round of drilling at the Utah assets.

We don't expect any significant news from the Utah assets but it’s good to see GTR are trying to better understand the project area & will be prepared for any future drilling programmes here.

There is still a lot of Geological mapping + Downhole logging works to do & with this program due to start by the end of November we don't anticipate any results from this program until mid-late Q1-2022.

What to expect next

Drilling to commence at the Thor prospects targeting an ISR suited deposit.

We look forward to drilling commencing & we would be happy if drilling results confirm historical grades previously identified in the 1970s and 80s.

An excellent outcome would be if GTR can find better grades and more mineralisation that leads it to an expanded drilling programme.

If drilling is successful we would expect GTR to quickly move into follow-up drilling over the same target whilst preparing for drilling at both the Odin & Loki prospects.

A great result for us would be grades similar to the nearby UR-Energy project above 0.04% uranium.

A disappointing outcome for us would be if drilling returned no uranium mineralisation or if the drilling showed that there is no ISR potential over the project area.

In the background we would also like to see GTR make some progress with the upcoming Fieldwork planned to commence by the end of this month at the Utah uranium projects. We expect to see the results of Geological mapping & Down-hole logging of existing drill holes in Q1-2022 before a drilling program starts being prepared.

Company Milestones

✅ Next Investors Portfolio Launch

🌎 Support for Domestic Uranium Produces in the US

✅ $1.8M Cap Raise @ 3¢

✅$4M Cap Raise @1.5¢ ($2.6M Placement + $1.548m Rights issue)

🔲 Unexpected Announcement 1

🔲 Unexpected Announcement 2

🔲 Funding 1

🔲 Funding 2

Wyoming Projects: Uranium, U.S.A

✅ Project Acquisition Announced

✅ Project Acquisition Complete

✅ Drilling Permits Secured (Q4 2021)

🔄 Initial Drilling (Thor, Q4 2021)

🔲 Drilling Results (Thor, H1 2022)

🔲 Initial Drilling (Odin & Loki, H1 2022)

GTR Investment Milestones

We have been holding GTR for 16 months and increased investment twice. As with all our early stage exploration companies we invest in our strategy is to achieve free carry - with GTR we have partially achieved free carry and are going into this drilling program holding 70% of our total investment.

✅ Initial Investment: @ 1.2¢

✅ Increase Investment: @ 3.3¢

✅ Increase Investment: @ 1.5¢

🔲 Price increases 500% from initial entry

🔲 Price increases 1000% from initial entry

🔲 Price increases 2000% from initial entry

✅ 12 Month Capital Gain Discount

🔲 Free Carry

🔲 Take Some Profit

🔲 Hold remaining Position for next 2+ years

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities (including staff), own 21,391,459 GTR shares and 746,615 GTR options.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.