Final assays from Kingsley bode well for Kingston’s Livingstone project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

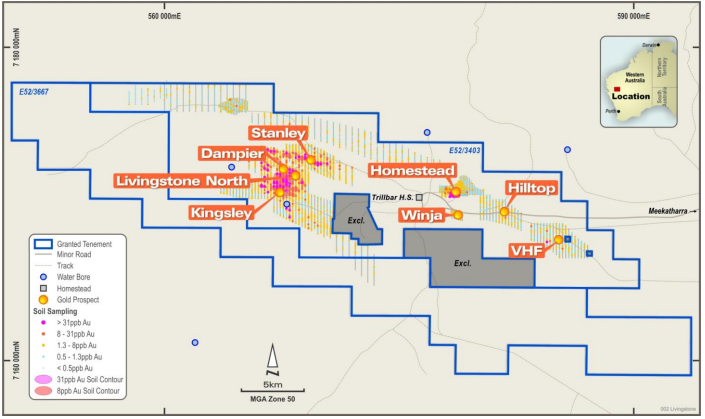

Kingston Resources Limited (ASX:KSN) has received the final batch of assay results from the remaining holes at the Kingsley prospect, part of the group’s Livingstone Gold Project in Western Australia.

The latest results are from 1577 metres of drilling which formed part of the 50-hole/4,390 metre reverse circulation (RC) drilling program completed in July.

The final batch of assays included numerous strong results, including wide zones of shallow mineralisation containing higher grade intercepts that correlate well with previously reported results released in August and mid-September.

The drilling was designed to define shallow oxide mineralisation and test the current geological model developed from the structural review conducted over the wider Livingstone Project, including Kingsley, in late 2019.

Highlights from recent results include 15 metres at 1.5 g/t gold from 2 metres, and 6 metres at 1.7 g/t gold from 11 metres.

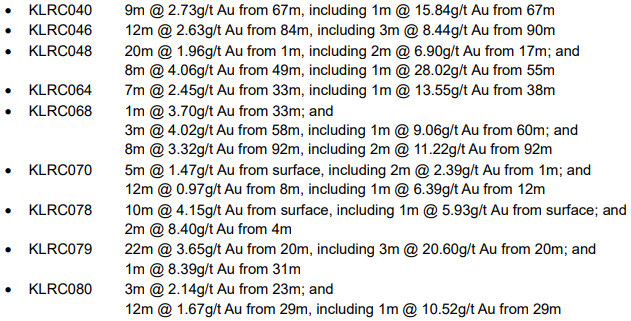

These built on impressive results received in August and September which included 9 metres at 2.7 g/t gold from 67 metres and 22 metres at 3.7 g/t gold from 20 metres, including 3 metres at 20.6 g/t gold from 20 metres.

Kingston working towards maiden MRE at Kingsley

The final results, together with previously reported results and data from the favourable preliminary metallurgical test work and structural geological review, will underpin work on the maiden Mineral Resource Estimate (MRE) for the Kingsley Prospect, which is expected to commence during the December 2020 quarter.

Commenting on the significance of these developments in terms of the broader Livingstone Project, Kingston’s managing director Andrew Corbett said, “We are very pleased with the success of the drilling program at the Kingsley Prospect, which has confirmed the continuity of shallow, high-grade mineralisation over a 1 kilometre strike length.

“These final assay results once again include high-grade intercepts within broader widths of significant mineralisation, correlating well with the previously reported results and confirming our understanding of the geological model.

“With all the results now in, work is set to begin on the maiden JORC compliant MRE at Kingsley, which we expect will add significant value to this strategically located WA gold project.

“It is also great to have the drill rig back on site at Livingstone, conducting co-funded drilling at the Stanley target and undertaking further drilling at the Homestead Deposit that hosts an historic shallow 49,900 ounces gold (JORC 2004) Inferred Resource, as well as at the high-grade Winja prospect.’’

Kingston’s exploration program at Livingstone will run concurrently with ongoing mining studies at its flagship 3.2 million ounce Misima Gold Project in Papua New Guinea where excellent progress is being made.

As a result of Covid-19 related travel restrictions, management suspended drilling at Misima in late March, but Kingston is now well advanced with plans to re-commence drilling.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.