Emerging Australia’s gold mines by production, grades and costs Part 2

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Yesterday Finfeed provided a Who’s Who in the gold space, identifying companies that benefit from large deposits, robust grades, near surface mineralisation and other factors such as by-product credits that lower the costs of production.

We mentioned that most of these factors impacted what is termed in the mining industry as all in sustaining costs (AISC), which in layman’s terms simply refers to the costs of production as opposed to the upfront costs of establishing infrastructure prior to bringing a mine into production.

The AISC metric is just as important as a mine’s production profile, as even a large deposit can be uneconomical if the costs of production are too high.

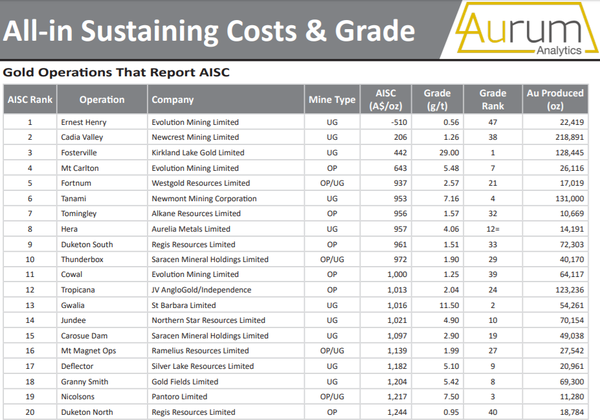

The following is a list of the top 20 mines in the March quarter, ranked in order from lowest to highest AISC with a listing of grades, production volumes and mine types (open cut/underground), which will provide some indication of the key factors contributing to their low cost profiles.

Yesterday we noted the wide variances between the AISC’s of prominent mines in the March quarter, even across a small sample of top echelon producers.

The best performer was Evolution Mining’s (ASX:EVN) Ernest Henry mine with AISC of negative $510 per ounce.

A negative figure was achieved because the revenue generated through the sale of by-products (copper) surpassed the costs of production.

Newcrest Mining’s (ASX:NCM) Cadia Valley mine which also has strong copper production was the second lowest cost producer with AISC of $206 per ounce, followed by Kirkland Lakes’ (ASX:KLA) extremely high grade Fosterville mine with costs of $442 per ounce.

The following chart shows the strong performances of these stocks measured against the S&P/ASX 200 index (XGD) with Kirkland Lakes the outstanding performer, up more than 90% over the last 12 months.

The index is represented by the orange line, and as you can see Newcrest Mining (blue) has outperformed the index while Evolution Mining is broadly in line.

It needs to be remembered that this is a comparison of individual mines, and in the case of Evolution Mining, the group has numerous projects, some of which aren’t as economical as its Ernest Henry operations.

By comparison, Kirkland has two mines, both of which are very low cost operations with the average AISC for the March quarter being US$560 per ounce, leaving a healthy margin of more than US$700 per ounce based on the spot gold price.

In search of the next Ernest Henry

Our goal today is to identify emerging companies that could be at the top of PCF’s list in the near to medium-term.

In keeping with the factors contributing to AISC’s we have examined the prospective/potential resource size, production volumes, grades and likely extraction costs of 10 companies.

Given that we highlighted the merits of ten potential up-and-coming gold prospects just last week we figured they were a good place to start given that their selection in most cases was based on one or more of the attributes we are looking for.

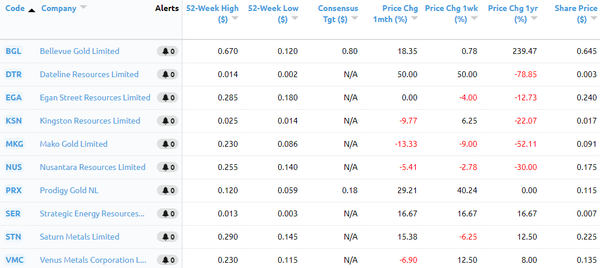

Prior to running the ruler across the stocks, we will quickly examine what has happened in the last week given the significant swings in the gold price that can mainly be attributed to the hot and cold geopolitical environment.

Looking at the ‘price change one-week %’ column, Dateline Resources has been the best performer, up 50% off a low base, perhaps suggesting that its Gold Links Project has gained attention.

Prodigy Gold NL has surged 40%, buoyed by a joint venture agreement with a subsidiary of Newmont Goldcorp Corporation.

This will see Newmont sole fund up to $12 million in exploration at the group’s Tobruk Project in the Tanami province of the Northern Territory.

Newmont Goldcorp has a long and successful history in the Tanami area including the development of the nearby Callie Gold Mine into a world-class gold project.

Strategic Energy Resources has also performed well, surging nearly 17%.

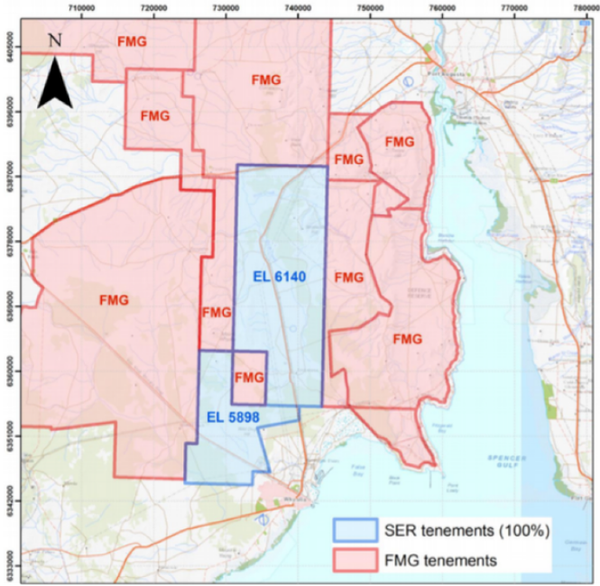

However, that may be the start of a much larger rerating as the group prepares to commence drilling at its high grade Saxby Gold Project in Queensland and takes advantage of a potentially valuable multi-commodity venture in the renowned Olympic Dam IOCG (iron oxide copper-gold) corridor in South Australia where the group has two highly prospective landholdings.

Regards the latter, there is a strong likelihood that Fortescue Metals Group (ASX:FMG) could be interested in farming into the group’s Myall Creek Copper-Gold project to the south of Olympic Dam and a more recent discovery by BHP (Oak Dam West) given FMG’s tenements abut nearly every boundary of the Myall Creek tenements as indicated below.

More on Strategic Energy Resources later - we will now examine the first five stocks in our 10 stock series.

Bellevue Gold

Bellevue Gold Ltd (ASX:BGL) is advancing the historic Bellevue Gold Mine in Western Australia which was in its day one of Australia’s highest-grade gold mines, producing 800,000 ounces at 15 grams per tonne (g/t) gold.

The Bellevue Project is located in the northern part of the Norseman-Wiluna Greenstone belt in the Yilgarn Craton, host to many large discoveries and relatively close to Goldfields Ltd’s dual operations which have produced 6.5 million ounces of gold.

The company started 2019 on a high note, increasing the inferred resource to 1.5 million ounces at a very high grade of 11.8 g/t gold.

Following the resource upgrade, drilling at the Viago and Tribune lodes has yielded further high grade results including 6 metres at 24.9 g/t gold and 6.2 metres at 22.2 g/t gold.

Just this week, the company confirmed two new major drill targets with visible gold.

High-grade gold mineralisation in the Tribune Lode has now been extended a further 300 metres, and the following drill results have come to hand recently:

It is worth noting the particularly high grades that have been identified around depths of 200 metres, including 218.5 grams per tonne, and 17.2 grams per tonne.

This could indicate the likelihood of identifying further high-grade gold at lower depths, but importantly 200 metres would still be amenable to open pit mining, suggesting that Bellevue could emerge as a low-cost producer.

From a resource size perspective, the company already has a significant base to build on, and with its drilling targets open along strike and at depth it may be able to transition to a low AISC producer, particularly given the potential for open pit mining.

Dateline Resources

Dateline Resources Ltd (ASX:DTR) is well-positioned to achieve its goal of establishing a maiden JORC Resource at its Gold Links Project in Colorado in 2019 after raising $14.5 million.

When management reaffirmed this outlook in delivering its quarterly activities report on April 30 the company’s shares spiked 50%, and as exploration news comes to hand in the ensuing months further share price momentum is on the cards.

The funds will be used to examine an exploration target ranging in size between 520,000 tonnes and 650,000 tonnes.

However, in terms of determining Dateline’s prospects of being a low AISC producer, the key factor is its shallow high-grade mineralisation, once again providing the potential for open pit mining.

The deposit contains particularly high grades, potentially ranging between 13 g/t gold and 17 g/t gold, equating to a prospective resource of between 250,000 ounces and 300,000 ounces.

The proposed project has been the subject of previous mining and exploration which has established the presence of shallow high grade mineralisation, yet Dateline’s exploration program will be the first time that the targeted area has been exposed to a widespread systematic exploration campaign using modern techniques.

EganStreet Resources

EganStreet Resources Ltd (ASX:EGA) is an emerging Western Australian gold company which is focused on the exploration and development of its Rothsay Gold Project, 300 kilometres north-east of Perth in Western Australia’s mid-west region.

Management’s longer-term growth aspirations are based on a strategy of utilising cash flow generated by an initial mining operation at Rothsay to target extensions of the main deposit, facilitating exploration of the surrounding tenements, which include an 18 kilometre strike length of highly prospective and virtually unexplored stratigraphy.

The Rothsay Gold Project currently hosts high-grade Mineral Resources of 454,000 ounces at an average grade of 9.2 g/t gold.

A definitive feasibility study (DFS) has pointed to a production target of 2.3 million tonnes mined at 4.4 g/t gold for 329,000 ounces of gold.

However, management’s strategy is to grow the size of the resource and pursue further high-grade mineralisation, factors that would effectively drive down AISCs.

On this note, the company has also had recent success with the drill bit, with particularly encouraging results from its Orient Shear reverse circulation (RC) programme which was completed during the December 2018 quarter.

Results indicate that the mineralisation on the Orient Shear is more extensive than previously thought with grades of up to 34.6 g/t gold intersected along 800 metres of strike on the Orient Shear, less than 200 metres west of the main Woodley’s Resource.

High grade mineralisation could be the main factor that plays a significant role in driving down AISCs.

Consequently, this is likely to be a news flow driven story in 2019, particularly with management moving towards a Final Investment Decision (FID) at Rothsay.

Kingston Resources

Kingston Resources Ltd (ASX:KSN), is progressing a prospective high grade opportunity in Australia and a 70% stake in the well-advanced Misima Gold Project in a proven area of Papua New Guinea (PNG).

The latter has a history of 130 years of successful and profitable gold mining, and the area is still the subject of active artisinal mining today.

The mine has an existing resource of 82.3 million tonnes at 1.1 g/t gold and 5.3 g/t silver for 2.8 million ounces.

Consequently, on the face of things Misima’s prospects for a low AISC development lie in the size of its resource and the benefits it will receive from silver credits.

However, as we will discuss later, recent exploration suggests that such a project could also benefit from shallow high-grade mineralisation that has been unveiled in relatively quick time by Kingston.

It is also worth noting that the mine has a history of robust production.

Between 1989 and 2004 the average production was 230,000 ounces per annum, with a high of 370,000 ounces in 1992.

Such were the robust economics of the project that the mine only closed when the gold price fell below US$300 per ounce, about US$1000 per ounce below where the precious metal is currently trading.

After funding further exploration in the March quarter, Kingston’s stake in the project is expected to increase to 75% with the group’s joint venture partner Pan Pacific Copper owning the remaining 25%.

Kingston Resources should be in a position to move relatively quickly in 2020, given it is developing a project that was previously in production.

Not only has Kingston been successful in delineating much higher grade mineralisation than that indicated by the current resource, it has also extended the size of the resource.

Misima field work commenced in December 2017, delivering immediate success with the discovery of a new prospect, Ginamwamwa, located adjacent to the former mill site.

Channel samples at surface included 14 metres at 12.2 g/t gold and 35.5 g/t silver, as well as thicker intersections such as 34 metres at 3.2 g/t gold.

It was further exploration work at east Ginamwamwa that extended a large area of high-grade near surface gold mineralisation including 14 metres at 17 g/t gold which featured fine visible gold.

There was also a relatively narrow intersection of 2 metres grading 140 g/t gold.

Commenting on this development, Kingston Resources’ managing director, Andrew Corbett said, “Ginamwamwa is continuing to deliver some amazing gold grades near surface.

“We are seeing bonanza gold grades immediately west of some artisanal workings where we identified gold in veins in September, and 100 metres further east of that, on the other side of the creek we are seeing more high grades in an intersection of 8 metres at 14.2 g/t with individual samples up to 39 g/t.”

With multiple targets across untested ground over eight kilometres of prospective strike there is enormous upside potential from exploration, and there is a school of thought that this could provide feed for a starter pit which would be processing new surface high grade ore, providing early cashflow for further exploration and potentially the development of a larger scale plant.

Kingston has another iron in the fire with its Livingstone Gold Project in Western Australia which holds a 50,000 ounce resource and is the site of a number of high grade historic intersections, but it is likely to be Misima that dominates the headlines in the near-term.

Mako Gold

Mako Gold Ltd (ASX:MKG) is an Australian based exploration company with gold projects in Côte d’Ivoire and Burkina Faso in the gold-bearing West African Birimian Greenstone Belts which host more than sixty gold deposits of more than 1 million ounces.

The company’s focus is to explore its portfolio of highly prospective projects with the aim of making a significant high-grade gold discovery, and its experienced management has a proven track record of delivering such results in West Africa.

Mako has plenty going for it having recently completed its maiden drilling program at the Napié Project in Côte d’Ivoire.

This is the group’s flagship project and Mako is earning up to a 75% interest in Napié under a farm-in and joint venture agreement with Occidental Gold SARL, a subsidiary of West African gold miner Perseus Mining Ltd (ASX/TSX:PRU).

Drilling at Napié intersected multiple zones with significant widths and grades of gold mineralisation with individual 1 metre assays up to 29.89 g/t gold, and separately, widths up to 28 metres at 4.86 g/t gold.

Mako has also had exploration success at its Niou Project in Burkina Faso, announcing a new gold discovery in January following its maiden drilling program.

Drilling intersected multiple zones with significant widths and grades of gold mineralisation with individual 1 metre assays up to 53.80 g/t gold and separately widths up to 24 metres at 2.73 g/t gold.

Further drilling at both Napié and Niou will be undertaken in the June quarter, and given the calibre of exploration results to date the return of high-grade assays could be a share price catalyst, particularly if they point to the potential of establishing a mine with low AISC’s.

Tomorrow we will be looking at five other emerging stocks that have the potential to transition to low-cost miners.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.