Elixir Energy grows prospective resource at Nomgon IX

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

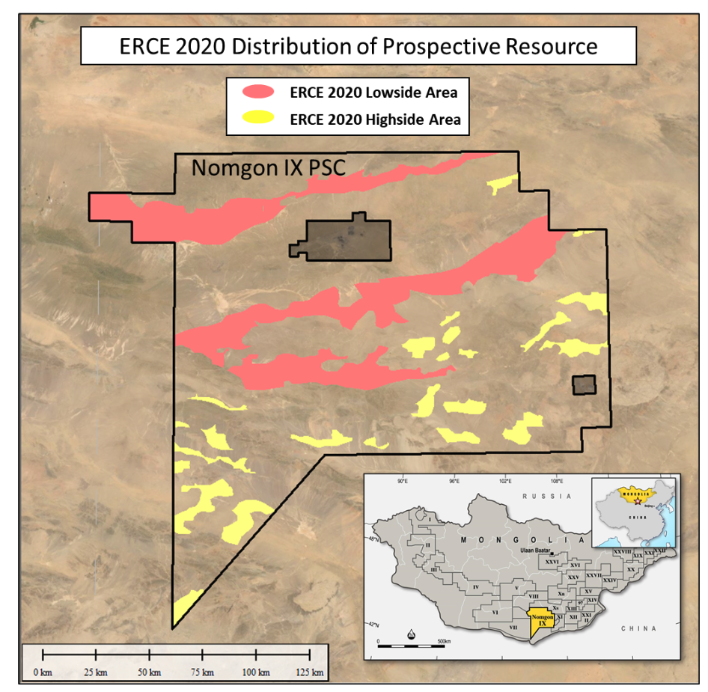

Elixir Energy Limited (ASX:EXR) has updated the Nomgon IX prospective resource prepared by independent reserve auditor ERCE Equipoise (ERCE).

The updating of the prospective resources for Elixir’s 100% owned Nomgon IX CBM PSC follows the successful 2020 drilling campaign where seven CBM (coalbed methane) exploration and appraisal wells spanning a distance of 62 kilometres all intersected coal.

An initial contingent resource estimate for the Nomgon sub-basin discovery area will be prepared and issued once all of the data from the appraisal drilling program has been compiled, modelled and analysed.

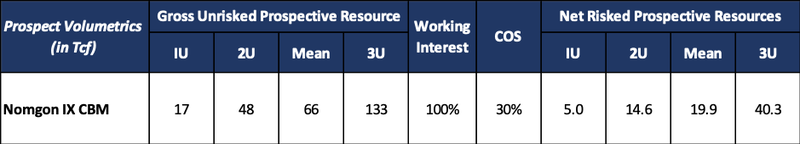

In the interim, a summary of the prospective resource range is outlined below:

It is important to note that the estimated quantities of petroleum that may be potentially recovered by the application of a future development project relate to undiscovered accumulations.

These estimates have both an associated risk of discovery and a risk of development.

Further exploration, appraisal and evaluation are required to determine the existence of a significant quantity of potentially movable hydrocarbons.

Substantial increase in prospective resource achieved quickly and cheaply

Management was encouraged by the resource update given that it is a significant increase at all levels compared with the 2018 report.

The overall Risked Mean Prospective Resource for the Nomgon IX CBM PSC is now 19.9 trillion cubic feet (Tcf).

Importantly, the geological chance of success (COS) as estimated in the ERCE report has increased from 19% to 30%.

In commenting on these developments and casting an eye to 2021, Elixir’s managing director Neil Young said, “We are naturally delighted to see that our work over the last 18 months has delivered such a substantial increase in our prospective resources with the best case nearly doubling.

‘’To achieve this level of de-risking of the asset with what in oil and gas terms has been a very modest outlay over a short period of time makes a real statement about how readily the enormous potential of the PSC can be realised.

‘’Next year’s program will be multi-faceted with exploration and appraisal elements, but ultimately it is all about continuing to reduce risks in a very economic and demonstrable fashion.”

Strong incentives to continue to grow resource

With its extensive PSC landholding providing ready access to high demand markets in China, Elixir represents a compelling investment play for Australian investors in that it is one of only a few ASX- listed companies that offers exposure to the globally significant thematic of a de-carbonising and increasingly energy security-conscious China.

China’s new “5 year plan” dramatically reduces its reliance on other global powers for key resources, especially its energy supply with the added advantage of transitioning from burning dirty coal to cleaner forms of energy.

Commenting on results received last week, Elixir’s managing director Neil Young noted that the consistent adsorption result from Nomgon-2 indicated that earlier high gas saturation levels from Nomgon-1 were not a one-off, highlighting that they were already feeding into production testing plans for next year.

Despite volatility in the energy sector, Elixir’s shares are still up some 400% since January, a reflection of management’s astute handling of costs and the operational expertise demonstrated across all of the wells drilled.

The company has a robust platform to build on in 2021, and it will also benefit from gaining a better understanding of the region’s broader geological characteristics in 2020.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.