Diversified ASX Junior Next Door to Fortescue May Have a Major Australian Gold Asset

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Metals often run counter cyclical to each other. For example, a downturn in base metal prices is often accompanied by an uptick in gold prices. That’s because base metals are in higher demand when the economic outlook is robust as they are used in manufacturing. By contrast, gold has little in the way of industrial applications, but is viewed as a safe haven asset.

For this reason mining companies often adopt a strategy of diversification. With operations spanning multiple commodities they’re able to generate multiple revenue streams, which assists in insulating against cyclical movements — one of the most challenging and uncontrollable issues mining groups are faced with.

The need for diversification has been clearly underlined in recent years with the emergence of the metals required to manufacture new age technologies — a space that has seen a substantial degree of volatility. For example, as the rampaging prices of cobalt and lithium came off in 2018, vanadium emerged as ‘the next big thing’.

One ASX junior has diversification well and truly covered, with strategic exposure to gold, copper, and mineral sands, as well as a stake in some interesting proprietary technology.

Its gold project is in the prolific Mount Isa region of North Queensland, host to large copper-gold deposits such as Ernest Henry.

The highly prospective nature of this region is supported by the presence of Australia’s pre-eminent gold miner, $18.3 billion Newcrest Mining (ASX:NCM), which is targeting deposits at a depth of more than 500 metres.

Importantly, tenements held by the company we examine today have already delivered historic drill results such as 17 metres at 6.75 grams per tonne gold and 15 metres at 9.09 grams per tonne gold.

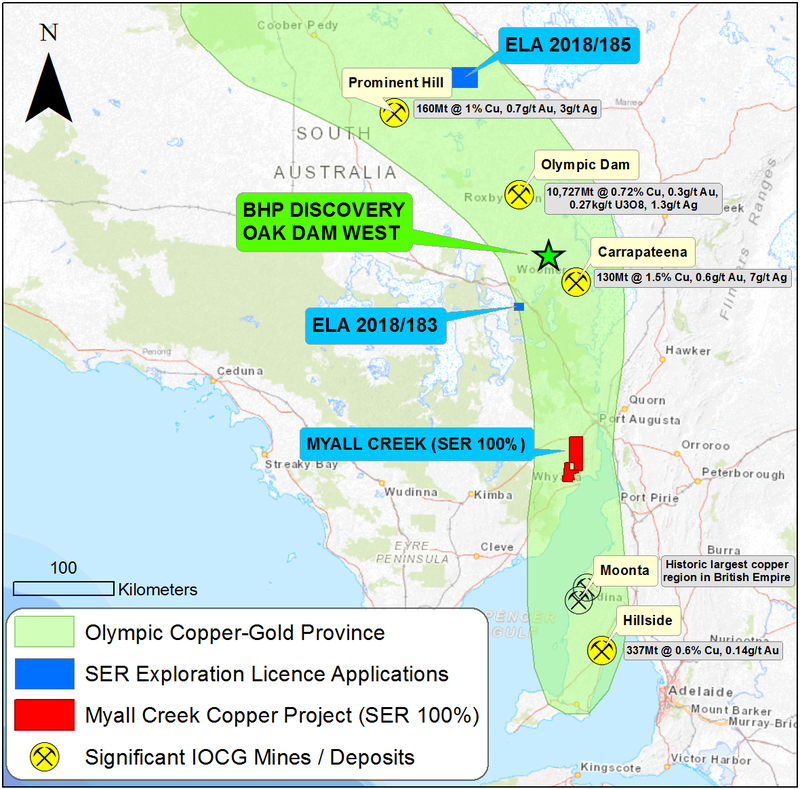

Management’s ability to target some of the most highly prospective areas in Australia extends to its South Australian assets which are located in the Iron Oxide Copper Gold (IOCG) corridor, home to the likes of Olympic Dam, Prominent Hill, Carrapateena and the stunning new discovery at Oak Dam West announced by BHP on 27 November 2018.

Once again, there are majors that are either in close proximity to this company’s tenements, or abutting every boundary of the landholding, as is the case with $14.1 billion Fortescue Metals Group (ASX:FMG).

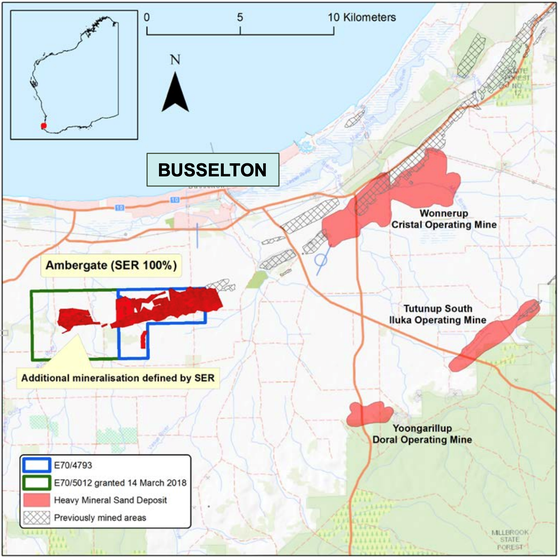

The group’s mineral sands tenements in Western Australia are also situated in areas where there are producing mines, and importantly the company defined an updated JORC 2012 Inferred Mineral Resource in April 2018 of 11.2.million tonnes, grading 5.1% heavy minerals for a total heavy mineral content of 569,000 tonnes.

As is the case with the company’s other projects, it would appear that its implied value isn’t captured in the share price. But this may not be the case for much longer if momentum continues following the stock’s three-fold rally in late November.

Introducing,

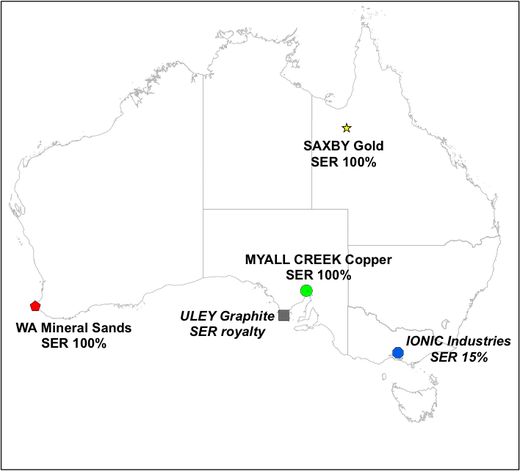

Strategic Energy Resources (ASX:SER) has a diversified portfolio of assets across Australia comprising exploration projects: WA Mineral Sands, Myall Creek Copper, Saxby Gold; and strategic investments: Ionic Industries and Uley Graphite Mine Royalty.

But it’s the company’s landholdings in the Iron Oxide Copper Gold (IOCG) corridor in South Australia that has put it under the spotlight — where it’s likely to stay after being granted exclusive first right to apply for a highly strategic licence, in exploration licence application (ELA) 2018/185.

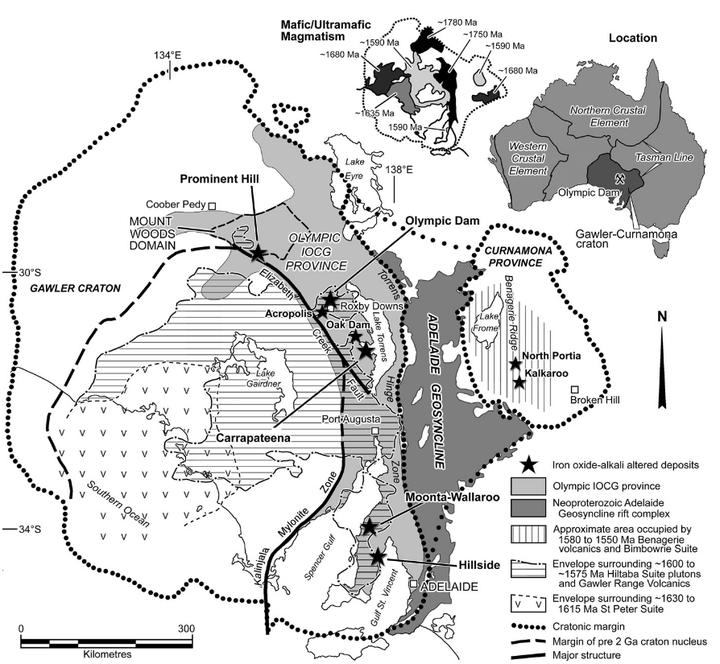

The application is in close proximity to Prominent Hill’s IOCG deposit being operated by Oz Minerals (ASX:OZL), which as illustrated below, lies to the north-west of Olympic Dam with OZL’s other key asset, Carrapateena to the south-east in the Olympic IOCG province.

The map of the regional setting is from Porter GeoConsultancy’s database, which in very concise terms sums the region up as follows:

“The Archaean to Palaeoproterozoic Gawler Craton, which extends over an area of around 700 km east-west by 800 km north-south in central South Australia, hosts the giant Mesoproterozoic Olympic Dam (Cu-U-Au-REE), Prominent Hill (Cu-Au), Cairn Hill (Fe and Cu-Au-Fe), Hillside (Cu-Au), and Carapateena and Khamsin (Cu-Au-U) deposits, all of which are IOCG systems, as well as gold occurrences and other deposits in the western part of the craton which are embraced by regional iron oxide alteration systems.”

Although SER’s ELA 2018/185 is situated within this corridor, it is more than just a nearology play in an area dominated by big names including BHP Group (ASX:BHP). The project area contains coincident and offset gravity and magnetic anomalies (a key IOCG indicator). The anomalies were drilled in the 1970s, however drilling failed to reach basement and test the targets. The source of the geophysical anomalies remains unknown.

The other licence applied for is ELA 2018/183 Island Lagoon, a 70 square kilometre area that covers a residual gravity anomaly, and lies approximately 50 kilometres south-west of BHP’s new discovery at Oak Dam West.

Equally important is SER’s Myall Creek project which lies to the south-west of Port Augusta within the IOCG province and roughly half way between Hillside to the south and Carrapateena/Olympic Dam to the north.

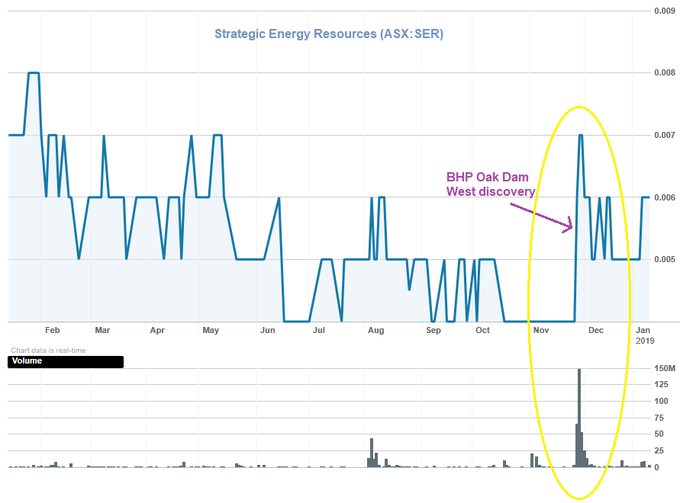

What really brought this area under the spotlight in recent times was an announcement by BHP that it had identified a potential new IOCG mineralised system on the eastern margin of the Gawler Craton in South Australia.

Excerpt from BHP announcement 27 November 2018:

“BHP today confirmed identification of a potential new iron oxide, copper, gold (IOCG) mineralised system, located 65 kilometres to the south east of BHP’s operations at Olympic Dam in South Australia.

As part of BHP’s ongoing copper exploration program, four diamond drill holes, totalling 5346 metres, intersected copper, gold, uranium and silver mineralisation of IOCG style on BHP’s exploration licence 5941.

Laboratory assay results show downhole mineralisation intercepts ranging from 0.5% to 6% copper with associated gold, uranium and silver metals.”

The BHP drilling included one of the best high-grade copper intersections seen in a long time: 425.7m at 3.04% copper, 0.59g/t gold, 346ppm uranium and 6.03g/t silver. This intercept included 180m at a staggering 6.07% copper, 0.92g/t gold, 401ppm uranium and 12.77g/t silver.

BHP plans to conduct further drilling in early 2019, the results of which could further boost SER’s share price.

The news of BHP’s copper discovery was reported by Australian Mining:

While Finfeed.com considered the impact of the BHP discovery on SER:

Following BHP’s announcement SER’s share price rallied sharply, leading to the ASX issuing a speeding ticket and a please explain...

SER credited media reporting regarding the BHP discovery as a possible explanation for the rally.

Myall Creek has been a sleeper

SER has definitely flown under the radar for some time, no doubt partly attributable to its small market capitalisation.

However, it could be argued that the quality of the Myall Creek asset should have demanded attention earlier.

As a backdrop, the Department of Defence granted SER access to operate within the Cultana Training Area in September 2018, allowing the company to explore its Myall Creek Copper-Gold Project.

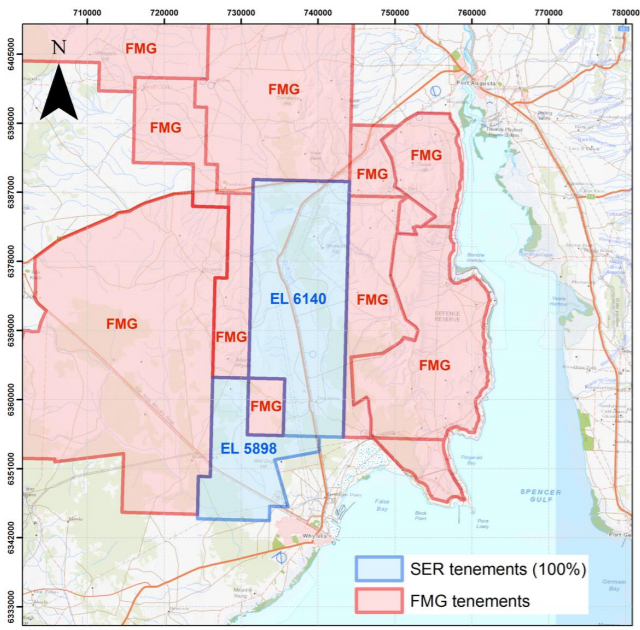

The group’s 100% held Myall Creek tenements (EL6140 and EL5898) lie within the expanded Cultana Training Area controlled by the Department of Defence. The highly prospective area would have been further explored a long time ago otherwise.

SER has established a good working relationship with the Department of Defence over many years and it is a credit to management that the company is one of the only groups to have been granted access to explore within the Cultana Training Area.

The fact that the market overlooked the group’s presence in that area is even more astounding given its tenements are surrounded by Fortescue’s landholdings, as indicated below.

From SER’s perspective, it’s in a prime position to target both IOCG mineralisation in the Proterozoic basement and sediment-hosted mineralisation in the overlying sediments at Myall Creek.

Key IOCG host rocks are present within the project area and overlying sediments include a 15 kilometre zone with anomalous copper in historic drilling.

Now that access has been granted, management is planning a detailed ground gravity survey within EL5898 to refine previously untested drill targets generated by former holder St Barbara (ASX:SBM).

Consequently, the company is very much a ‘watch this space’ story with the potential for its share price to gain momentum from developments within the company and/or important news flow from other big players in that area.

Indeed, there is also the prospect of corporate activity. Any drilling success that led to a more comprehensive exploration program requiring funding from a joint venture partner could easily see bigger players become involved.

Geologists highlight prospectivity of Myall Creek

A recent report from the Geological Survey of South Australia (GSSA) provides an interesting perspective in relation to Myall Creek.

In August 2018, the GSSA published, Roopena Basin: Sedimentary basin formation associated with Mesoproterozoic mineralising event in the Gawler Craton.

The report notes that both Olympic Dam and Prominent Hill are spatially associated with sedimentary rocks deposited synchronous with volcanism. This suggests an active sedimentary basin may be significant in the formation of IOCG mineralisation.

In the year ending December 2017, Prominent Hill produced 112,000 tonnes of copper and 126,700 ounces of gold.

Not only is this area renowned for hosting huge deposits, but another feature is the low cost of production. As an example, Prominent Hill’s bottom quartile all in sustaining costs in fiscal 2017 was US$1.20 per pound of copper.

This was in a period where copper traded in a mid-range between US$2.50 per pound and US$3.00 per pound, implying particularly healthy margins.

Oak Dam proximity makes ELA 2018/183 a prime address

Given its proximity to BHP’s discovery at Oak Dam West, the next share price catalyst could be news regarding SER’s efforts to secure the aforementioned ELA 2018/183.

There is only one drill hole within ELA 2018/183, “Vanguard 1” drilled in 1982 by CSR Ltd.

Vanguard 1 was designed to test the residual gravity anomaly and intersected Mesoproterozoic basement at 1067 metres, terminating 29 metres later in Gawler Range Volcanics.

The cause of the geophysical anomaly was not found.

ELA 2018/183 is in competition with two other parties who lodged applications on the same day, underlining the heightened interest in the area.

Saxby gold project represents additional value

Given the highly prospective nature of its projects it is hard to believe that SER’s market capitalisation is only $5.3 million, particularly given that the group has cash of $1.5 million.

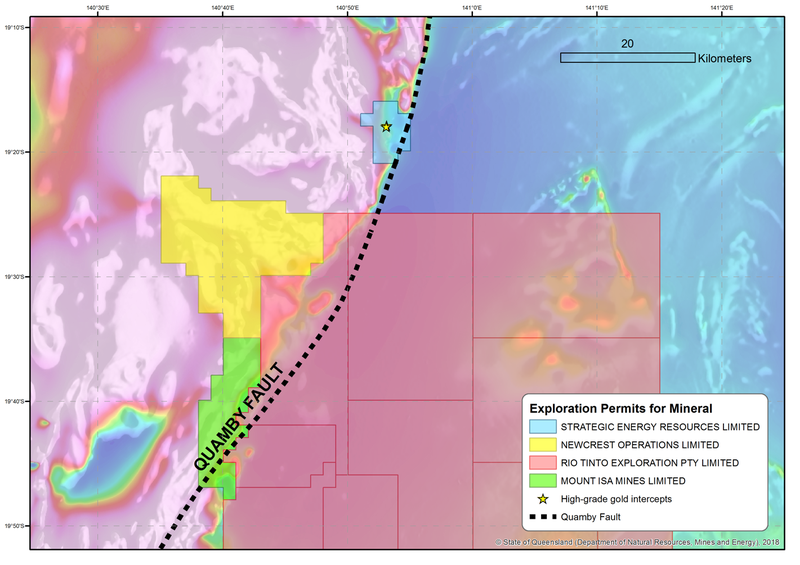

Adding further to the seemingly substantial divide between the value of the group’s assets and its enterprise value is the fact that it also owns the Saxby Gold Project in a prolific region of Queensland.

Such is the tenor of the area under exploration that several major mining companies have recently joined the hunt for high-grade gold near Saxby.

Newcrest and Rio Tinto have made applications for mineral exploration permits just to the south and Mount Isa Mines already holds granted exploration permits in the area.

Two historic drill holes at Saxby spaced 200 metres apart returned hits of 17 metres at 6.75 grams per tonne gold and 15 metres at 9.09 grams per tonne gold.

Management has developed a drilling program for Saxby and is considering joint venture options to fund the program.

With several big players looking to acquire tenements in the area, the emergence of a joint venture partner may not be far away, and such a development could see the value of the asset reflected in the company’s share price.

On this note, management recently confirmed that it is in discussions with multiple potential partners.

Mineral sands is another string to the bow

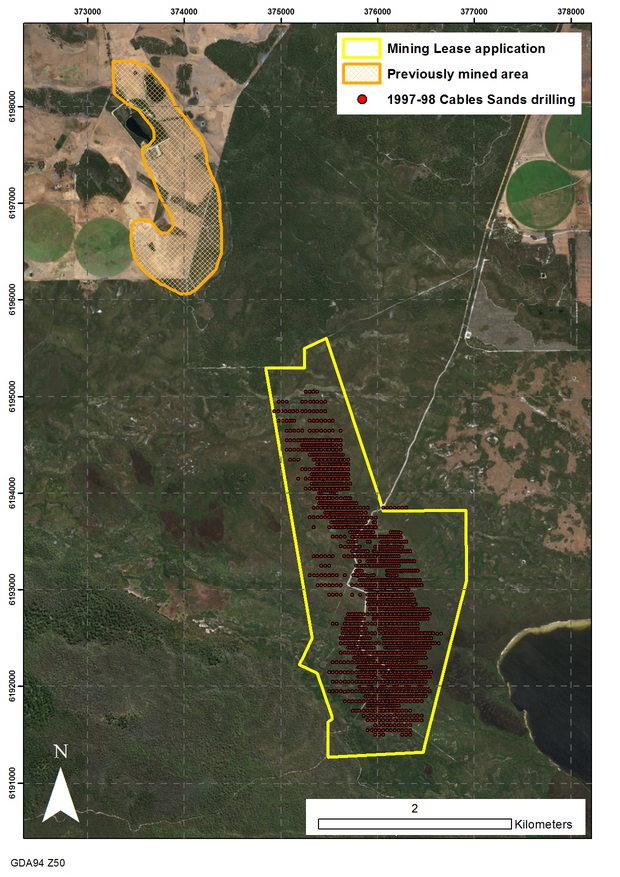

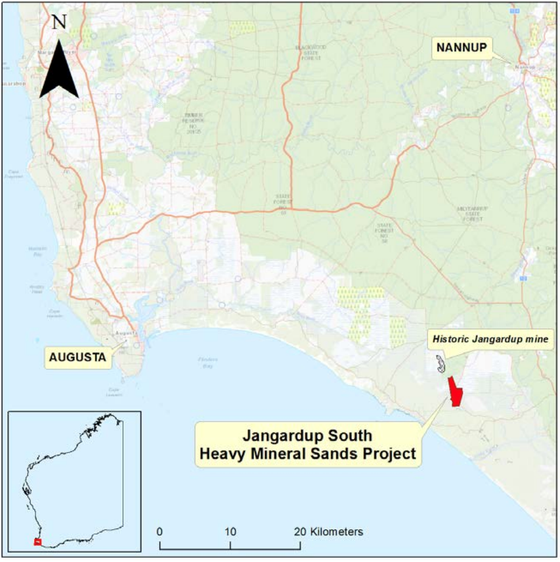

In August 2018, SER lodged Mining Lease application M70/1385 over the Jangardup South heavy mineral sands deposit in the south-west corner of Western Australia.

The application was the result of over a year of research and preparation by the company.

The 500 hectares area lies four kilometres south of the historic Jangardup deposit which was mined from 1994-2003 by Cable Sands.

However, the more advanced project is Ambergate which has a JORC 2012 Inferred Resource of 11.2 million tonnes grading 5.1% Heavy Minerals for a total Heavy Mineral content of 569,000 tonnes.

Once again, it is evident that SER has targeted a highly prospective region with the $3.5 billion mineral sands group, Iluka Resources (ASX:ILU), operating the Tutunup South mine, approximately 15 kilometres to the south-west.

Similar to Myall Creek, the address is excellent in terms of pursuing such a project as it is home to a well-established mineral sands mining industry with multiple operating mines, world-class expertise and existing infrastructure.

The ilmenite titanium dioxide content averages 58.7%, and with a high zircon content of 12% this makes for a highly valuable mineral assemblage.

Analysts at Citi recently provided their take on zircon pricing in a supply constrained environment.

The broker forecast a US$70 per tonne increase to US$1650 per tonne in the second quarter of 2019.

More importantly though for an emerging player such as SER, the broker sees structural factors emerging in terms of projecting where zircon will come from to replace the depletion of current production towards the end of the next decade.

While the broker’s long-term reference price is US$1300 per tonne with potential price movements most likely to trend upwards. Of course any broker projection is speculative.

Providing confidence in SER’s ability to bring a new project into production in the medium term is the fact that an independent report from SRK Consulting said, “Ambergate appears to have reasonable potential for economic extraction by way of small open pit surface mining.”

Titanium dioxide has diversified uses including whitening pigments in paints, plastics and paper products, while zircon is used extensively in ceramics, once again providing vital diversification aside from base and precious metals.

The annual global market is estimated to be worth US$18 billion.

But wait, there’s more

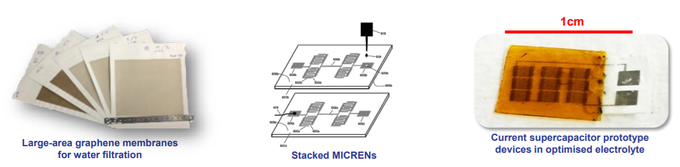

SER also has a 15% stake in Ionic Industries who recently concluded an agreement with the $300 million Clean TeQ Holdings (ASX:CLQ) to commercialise a graphene-based water treatment technology.

The formation of the Clean TeQ joint venture (JV) is a significant milestone, demonstrating that Ionic’s graphene technology is attracting the attention of major industry players.

The JV, owned 75% by Clean TeQ and 25% by Ionic, will focus on achieving commercial scale production of Graphene Oxide Membranes, as well as water purification modules targeted at wholesale and retail customers.

Ionic will grant the JV a sub-licence for Graphene Oxide (GO) technologies in the field of water purification.

Importantly, the JV has a head start in terms of progressing the project having entered into a partnership in 2017.

This required Clean TeQ to fund a $200,000 program to develop, manufacture and apply GO-Membranes to water filtration applications.

Following 18 months of testing, a process to manufacture high-purity GO that can be applied to membrane support to create a highly efficient graphene nanofiltration membrane was successfully developed.

The GO-Membrane manufacturing process has now been demonstrated on commercial scale industrial equipment, indicating that GO-Membranes have the potential to deliver significant benefits due to their high water flux, tunability and non-fouling properties.

SER also holds a 1.5% Gross Revenue Royalty on any production from the Uley Graphite Mine, Australia’s only ever producing graphite mine which Quantum Graphite Limited (ASX:QGL) is now seeking to bring back into production.

Consequently, SER also provides exposure to water — one of our most valuable resources, and one that is becoming increasingly threatened by a number of factors including pollutants.

The final word

Offering geographical and commodity diversification, SER has all the pieces in place to potentially propel its share price above the current level of less than one cent, and corresponding $5.4 million market cap.

The sharp rally in SER shares following news of the BHP discovery certainty suggests that there are buyers waiting in the wings that may emerge given further catalysts.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.