AOW Swoops on Distressed Texan Oil Seller: Proven Oil Reserves Secured

Published 14-SEP-2017 09:25 A.M.

|

11 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

American Patriot (ASX:AOW) has embarked on an acquisition spree aimed at distressed assets that it hopes will net it a significant producing business, reaching 3,000 BOPD by 2019.

The goal is to pay just cents on the dollar for viable oil production resources that any oiler would want to summarily add to their production portfolio.

After so many years of cyclical change, AOW looks to have picked the right time to go bargain hunting with oil prices once again ticking higher...

..but with many oilers still locked into assets they cannot utilise or commercialise.

AOW is wading into oil assets currently locked in bankruptcy proceedings, which is proving to be an on point trend and a potentially lucrative enterprise for those that have the stones to make it happen:

AOW is actively cherry-picking the best assets across the US Texas and Gulf Coast regions, and has already amassed around 300boepd of active production.

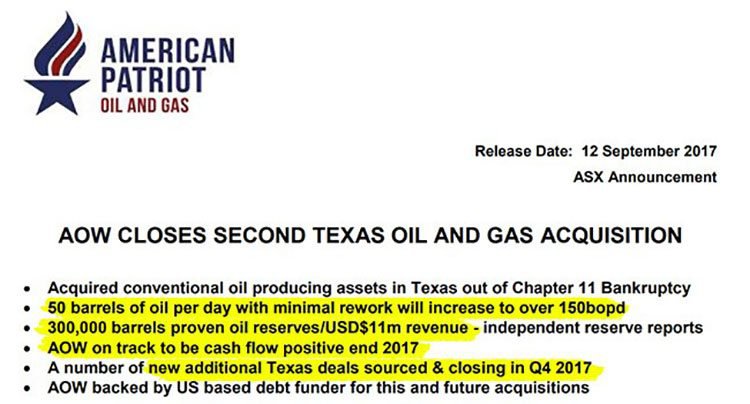

In its latest acquisition, AOW has acquired additional conventional oil and gas assets in Texas, the highlights of which are highly significant for the company:

- 50 barrels of oil per day with minimal rework that will increase to over 150bopd

- 300,000 barrels proven oil reserves/USD$11m revenue.

The good news is the assets have been acquired for just US$430,000 out of Chapter 11 Bankruptcy from major lender Solstice Capital LLC and the independent reserve reports suggest it is worth US$3 million

AOW remains on track to be cash flow positive by the end of 2017 and already has its eye on a number of new additional Texas deals that it is racing to close in the fourth quarter this year.

The company, however, is still an early stage play and as such investors should seek professional financial advice if considering this stock for their portfolio.

Over the longer-term, AOW intends to raise its production calibre to over 3,000bpd, therefore handing this micro-capped oiler the commercial arsenal it needs to raise its tiny $5,5 million valuation over the short to midterm.

We catch up with:

OTC QB:ANPOF:US

American Patriot (ASX:AOW) is a company on the lookout for a quick entry into profitable oil production and The Next Oil Rush is constantly looking out for undiscovered oil stocks that may be on the cusp of something big.

Did you see our coverage of SGC?

We recently wrote about Sacgasco (ASX: SGC) back in July and August .

Since that first article was released, SGC has climbed as high as 56%:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

AOW could be on the cusp of a similar run.

Rather than homing in on an oil prospect and doing all the necessary drilling and testing...

...AOW is opting for a more speedy and pragmatic approach.

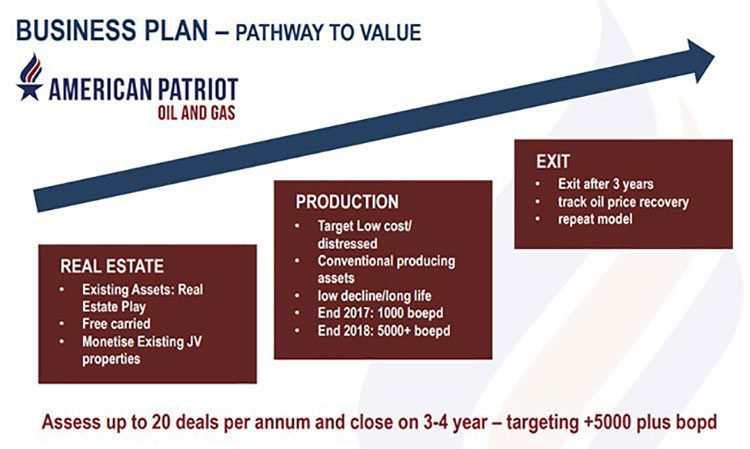

AOW is selectively picking up the most amenable oil wells scattered around the US, and folding them into a concerted oil productive strategy that is eventually aiming to achieve around 3,000 barrels per day once fully completed.

When we last updated you on AOW in the article AOW Acquires Producing Oil & Gas Reserves: More Acquisitions to Come , the company had picked up a game-changing acquisition for US$4.5 million, with low production costs set to translate into strong margins.

These assets are expected to generate more than US$2 million in annual net cash flow, at US$47 a barrel oil prices.

This is a speculative figure at this stage, so investors should approach any investment decision in this stock with caution and look at all publically available information before making an investment decision.

Now, take a look at AOW’s latest acquisition in Texas:

This second acquisition at a low cost entry point brings AOW an immediate increase of 50bpd, and a likely increase to 150bpd in the near term. This Texas-based asset also holds 300,000 of proven oil reserves worth $3 million at current oil prices of $45pb.

Combined with existing assets, AOW is now on track to achieve production of 300boepd by the end of 2017, with 1 million barrels of proven oil and gas reserves certified by independent reserve reports.

The assets are being acquired using existing AOW cash plus funding from a significant US based funder, with whom AOW will work to acquire this and future conventional assets.

The lay of the land

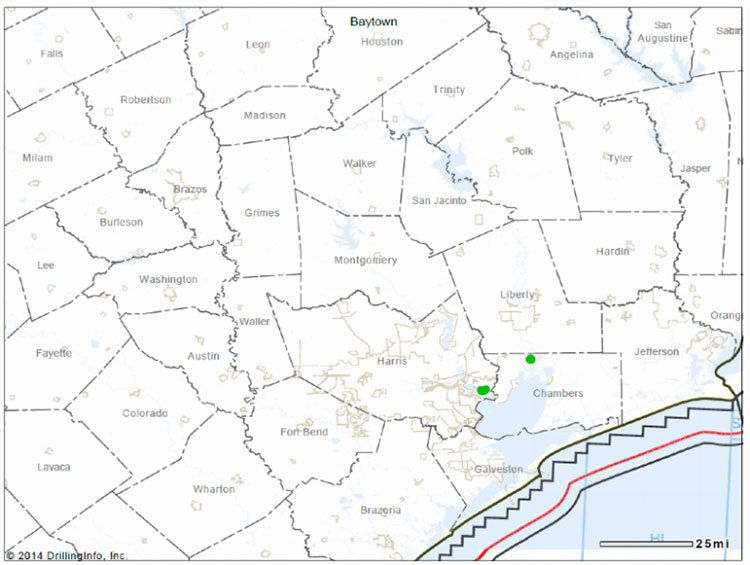

Through the acquisition, AOW will take hold of The Lost Lake and Goose Creek Oil fields located in Harris and Chambers Counties Texas as shown below:

Both fields are mature legacy assets with current daily production of 51bopd shut-in, with significant proven behind pipe pay that has not yet been exploited with the ability to grow production significantly for minimal capital expenditure.

There is also substantial workover and behind pipe potential on the existing wells and existing infrastructure is in place consisting of pump jacks, tanks, batteries and piping.

Minimal work and capital is required to bring these fields back to life, but importantly for AOW, the field consists of 37 recompletions and underdeveloped wells with significant upside potential.

AOW sees this as the second acquisition of many, with a number of attractive new target assets already sourced as it looks to deliver on the strategy of aggressively building a producing conventional oil business with well over 1000bopd production in 2018.

Lost Lake & Goose Creek Oil Field

Lost Lake/Goose Creek acquisition includes 50 bopd shut in and 1P proven reserves of 300 mboe. The assets have been acquired from the major lender Solstice Capital LLC at the Bankruptcy court in Houston.

The assets consist of 65 oil wells covering approximately 340 leasehold acres HBP at 100% GWI/average 75-81% NRI in Harris and Chambers counties Texas.

The Lost Lake field is located in Chambers County and encompassed the entire Lost Lake Salt dome. Wells produce from the shallow Miocene zones with cumulative production of 1.37 million barrels of oil and 230 million cubic feet of gas since first production in the 1970s. Existing 2D seismic has identified 8-10 additional infill-drilling sites upon the leases. The primary objective is to return the shut-in wells to production and rework behind pipe zones.

The Goose Creek Field is located in Baytown Texas. The wells produce from the shallow Miocene at depths from 1200 to 3860 feet. Cumulative production of 1.8millions barrels of oil has been recovered since the first production in the 1950s. Rework of the shut-in wells should result in daily production increases in the range of 25-30bopd per well at minimal capex to rework the wells. In addition there are numerous additional locations for infill drilling targeting 50 to 100bopd per well targeting additional reserves of 300,000 barrels of oil. The producing wells are fully equipped while many of the shut-in wells have tubing and or rods in them.

Why conventional?

Conventional oil exploration is whole lot cheaper than shale and can remain profitable despite oil prices languishing below $40pb. This premise underpins AOW’s overarching strategy and could likely see AOW achieve cash-flow positive status as early as this year.

Not a bad sight for an ASX-listed oiler, worth merely AU$5.5 million. Clearly, there is some upside revaluation potential here.

Here’s how oil prices have been tracking over the past few years:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Having taken a swan dive from their lofty $150+ peaks in 2014, oil prices have remained in a stable $40-60 range for over 2 years. This is a good backdrop to be picking up distressed assets for cents on the dollar.

If oil prices do make a significant recovery, this bodes well for AOW. If oil prices remain in their recent range, AOW can sustain its existing strategy. And worst case, if oil prices suffer again, AOW can maintain viability down to as low as $22pb, given the cost-base conditions in the US.

All commodity-based investments are inherently risk propositions, but when so many factors have been accounted for and mitigated — we think AOW represents a worthy entry into small-cap Resources investing.

So, let’s move into the nitty-gritty of AOW’s potential...

Locate, acquire, squeeze and release — sifting through AOW’s asset arsenal

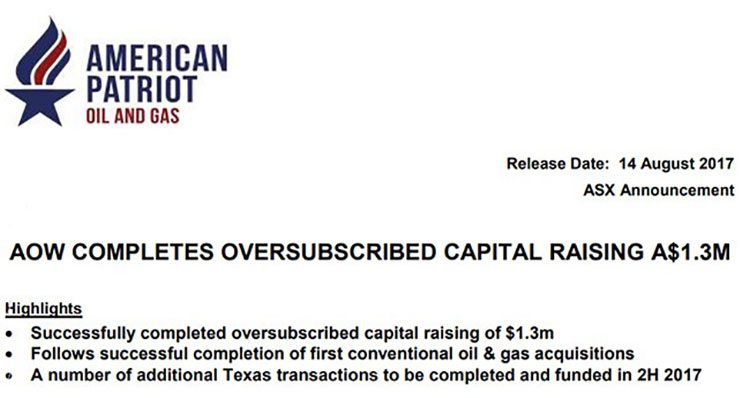

With over $1.3 million in the kitty from a recently oversubscribed capital raising, AOW intends to invest every penny in securing oil productive assets.

Take a look at AOW’s overarching business plan:

Targeting distressed assets is a priority and AOW is certainly now meeting its targets.

A word about funding...

Any oiler needs ample funding regardless of flow rates, oil prices or location.

On this front, AOW now has some heavy-hitting financing to ensure its cherry-picking strategy pays off. Just recently, AOW announced an oversubscribed $1.3 million capital raising, which is a great sign at this early stage. From a fundamental perspective, institutional money seems to be backing AOW and its intentions — which can often be an early-warning sign for future revaluation. In addition AOW has the benefit of a big brother US funder supporting and funding its US acquisitions.

AOW will use the funds from this cap raise to fund further acquisitions of conventional oil and gas projects in Texas.

Such acquisitions are likely to be purely value accretive and self-financing; which means AOW is advised to do as many as it can and as quickly as possible. From a sentiment perspective, the fact that AOW’s cap raise was oversubscribed, is a likely indication that both institutional and retail investors are fully on-board with AOW’s ‘acquisition-led’ growth strategy.

Changing sentiment in oil, leads to lucrative opportunities for minnows like AOW

Lethargic oil prices needn’t be a source of fear and anxiety for oilers — or should we say, well-run oilers.

What the past few years have shown is that oil production is fraught with obstacles and risks, but, there is a definitive way of making a buck in oil regardless of the oil price.

In amongst the changing economics within the oil market, and under the cover of the US-sourced shale gale that’s swept the globe and changed oil production methods forever...

...AOW wants to go back to basics and kick-start a simple, no-frills strategy built on pragmatism.

AOW is blessed with 28,256 net mineral acres under lease across 5 key projects, scatted across the US Midwest.

Since its establishment, AOW has assembled a portfolio of prospective oil and gas exploration assets in the US and has completed joint venture agreements on its key Northern Star asset in Montana with US based partners...

...and the good news is, there’s more to come.

We’re already on the lookout for more acquisition deals as part of AOW’s spending spree, and therefore, a fistful of catalyst opportunities coming down the track. AOW is targeting a number of acquisitions later this year and in 2018, which will all likely add confirmed oil assets onto its balance sheet.

According to AOW , it has now “entered into multiple Letters of Intent (LOI) and paid refundable deposits on a number of potential oil and gas producing property acquisitions”, and “currently negotiating Purchase and Sale Agreements and Asset Assignment documentation with our preferred transactions”.

Yet this remains a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

AOW remains in a strong cash position and by using a combination of external funding as well as existing cash reserves, to acquire its production assets — will likely mean AOW remains in a solid position financially, and therefore, could deliver on its ambitious land-grab across the US.

Shooting undervalued fish in a star-studded barrel

In the next 12-18 months, AOW intends to expand its reserve/resource base and progress its aggressive acquisition strategy by restarting production at shut wells, rather than starting new ones.

The focus is on cost efficiency, cash flow metrics and tight capital discipline. In oil, dividends remain sacrosanct for the Majors; but for smaller juniors, the operative word is ‘efficiency’.

So many US-based oil companies have been carried out feet first over the past few years, but those that have remained have one thing in common — they are all efficient enough to endure an oil market downturn.

AOW is pitching to become one oil company that has efficiency as its core principle. Shale exploration can be highly lucrative, but it’s also highly risky and highly expensive. In today’s oil market, capital expenditure is better targeted at low risk opportunities while companies looking for ‘growth’ are likely to falter at the expense of those looking for efficient production at all stages.

The implications are that production profiles may decline and companies may get smaller — but returns should improve. This is what AOW is banking on, and going out there to make it all happen.

This could be a good time to jump on and ride AOW’s coattails, all the way to the pump.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.