88E Drill Rig Contracted - The Merlin-2 drilling event awaits…

Our oil exploration investment 88 Energy (ASX:88E) is getting closer to its “annual drilling event” - with its next oil well on track to be drilled in February 2022 on the North Slope of Alaska.

88E drills once a year for high risk high reward outcomes - these are basically big swings for the fence that IF successful can pay off handsomely for early investors - however it is risky. In previous years we have seen significant trading volatility in the lead up to drilling and whilst waiting for results.

We like to invest in 88E well before the wild speculation that can accompany each drilling season, and we have a position in 88E now, and are looking forward to Merlin-2.

88E has acreage across a number of projects in the North Slope of Alaska, home to some of the largest oil fields in the US, including Prudhoe Bay - the largest onshore oil field in North America, having produced over 12 billion barrels of oil since discovery.

Recently on the North Slope the “Brookian sequence” was discovered - unlocking the Pikka discovery - 1.4 billion barrels, and also Willow - a 750 million barrel discovery by oil major ConocoPhillips.

88E’s Project Peregrine is on trend to ConocoPhilip’s Willow discovery to the north, and is in the same play type.

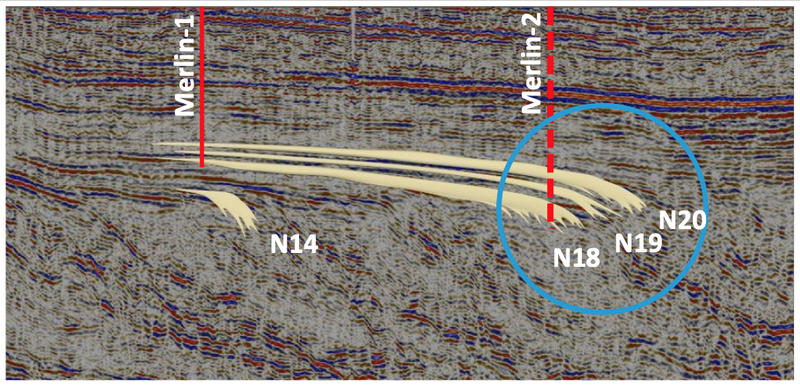

88E drilled Merin-1 on its Project Peregrine earlier this year, targeting an oil discovery of its own. Whilst there were some operational issues that prevented full sampling, Merlin-1 was a success, detecting light oil across three reservoir intervals.

88E’s “sequel well” Merlin-2 follows on from Merlin-1 - this recently released video gives a good background to the project, its potential, and the plan for Merlin-2 in glorious 3D animation.

88E’s Merlin-2 well is targeting 652 million barrels with a geological chance of success of 56%.

News last week was that 88E’s drill rig has been contracted - another step in the journey towards the spudding of the Merlin-2 well.

We have followed 88E every step of the way in its Alaskan exploration journey started in 2014 - and every year it manages to fund and drill an oil well with company making potential.

Generally each time 88E drills a well, there is significant market speculation on the outcome of the drilling. Earlier in the year we saw speculators spike 88E up from 0.9c to as high as 9.4c in the space of a few days, largely driven by a new US retail following in the stock. Prior to the well drill earlier this year, 88E started trading in the US under the ticker OTC: EEENF and caught their attention.

The trading volatility that we witnessed in the lead up to the Merlin-1 well result burnt a few traders and new investors chasing the spike - however long term investors who took a position prior to March 2021 would be very happy with 88E’s performance, as the price is still up about 450% higher than where it sat for most of 2020.

What’s different to last year?

88E has a better balance sheet ✅

88E is in a much better funding position than the Merlin-1 well last year, with A$36M in the bank and no debt. This comes after 88E recently raised $23.96M at 2.8c - which is around the same share price as 88E is trading at the moment.

The strong balance sheet means 88E has flexibility in how it pays for the Merlin-2 drilling - it can drill it alone and retain 100% of the working interest of the outcome, OR, if the right strategic partner comes along that wants to get exposure to the outcome of the drilling event, it could look to farm down a stake in exchange for the partner covering a share of the well costs. 88E didn’t have this financial flexibility last year.

88E already found oil in Merlin-1 ✅

Merlin-2 is an “appraisal” well - taking all of the valuable learnings of what was found at Merlin-1 and applying that information to select the best location for Merlin-2 to hopefully confirm an oil discovery.

The Merlin-1 well successfully demonstrated the presence of oil in the N20, N19, and N18 reservoir intervals.

Merlin-1 found 41 feet of net log pay across those three reservoir intervals, and geochemical analysis determined that the oil had an estimated API gravity between mid-30 and low-40 (light oil).

New well location for Merlin-2 - expecting thicker and higher quality reservoirs ✅

Armed with all the precious data gathered at Merlin-1, 88E is going to try and drill again through those three reservoir intervals hit on Merlin-1, but this time 88E is going to move the drilling location to the east - where the formation is proven to thicken and be of a better quality - so hopefully it can intersect greater net pay.

Three well locations have been prioritised - and final well location selection is expected to occur shortly.

What’s happening next?

Drill Planning and Permitting

With the rig now contracted, 88E is currently going through the process of planning and permitting its Merlin-2 well.

There is a window of time in Alaska over winter when wells of this nature can be drilled - this is when the ice roads allow for the transport of heavy machinery. Once the ice roads melt, the drilling season is over.

That’s why 88E are planning on drilling in February 2022 - just in time, and only a few months away now.

Strategic Farm in Partner?

This might happen - as we said above, 88E has some flexibility here and does not depend on securing a partner for the cost of the well.

BUT if the right strategic partner came along... one that perhaps could add technical value as well... and the price was right... we assume 88E management would consider a deal.

Precise Merlin-2 Well Location to be confirmed

As we pointed out above, 88E has three locations that are in the short list for the location of Merlin-2 - we expect this to be 100% locked in soon.

Project Peregrine (Main Bet #1)

Project Overview

✅ Acquired Project Peregrine

✅ Farmout Agreement Secured

✅ Buy back of 100% of Project Peregrine from APDC

🔲 Potential Farmout Peregrine to new partner

🔲 Planning for a possible in-fill 2D or 3D seismic

Merlin-2

✅ Drill Rig Contracted

🔄 Drilling Permits Secured

🔲 Drill Rig Mobilised to Site

🔲 Drilling Commenced [Q1 2022]

🔲 Drilling Complete

🔲 Lab Results 1

🔲 Lab Results 2

🔲 Lab Results 3

Investment Milestones

1st Key Drilling Event - Feb 2021

✅ Initial Investment: @0.5c (≈9 months before key drilling event)

✅ Increase Investment: @0.6c (≈6 months before key drilling event)

✅ Price increases 500% from initial entry

✅ Price increases 1000% from initial entry

🔲 Price increases 2000% from initial entry

✅ Free Carry (days before key drilling event)

✅ Take Some Profit (days before key drilling event)

✅ Hold position for key drilling event

✅ Decide New Investment Plan after results of key drilling event

2nd Key Drilling Event - Q1 2022

✅ Increase Investment: @2.5c (≈9 months before key drilling event)

🔲 Increase Investment

🔲 Increase Investment

🔲 Price increases 200% from investment

🔲 Price increases 400% from investment

🔲 Price increases 600% from initial entry

🔲 Free Carry (days before key drilling event)

🔲 Take Some Profit (days before key drilling event)

🔲 Hold position for key drilling event

🔲 Decide New Investment Plan after results of key drilling event

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 6,645,000 88E shares.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.