$5M ASX Micro Cap Launches Uranium Exploration - Near the Only US Processing Facility

Uranium appears to have some serious positive momentum right now, with investors scrambling to get exposure to further upward movement in the commodity price.

There are a number of factors at play here, however a key one is that the US government has recently announced substantial new support for domestic uranium producers.

The Trump Administration is seeking $1.5BN over 10 years to buy uranium from US mines and shore up a domestic stockpile.

We have just come across a $5M capped micro-cap ASX stock that appears highly leveraged to these macro forces – plus its own imminent exploration campaign.

This company is gearing up to undertake exploration in a region which historically provided the most important uranium resources in the USA – the prolific Colorado Plateau uranium province.

This tiny ASX stock has 1,500 hectares of ground within trucking distance to the White Mesa Mill, operated by Energy Fuels Inc (TSE: EFR) – which is the only conventional fully licensed and operational uranium / vanadium mill in the US.

Capped at $289M CAD, Energy Fuels is a well-established, leading US uranium producer with a proven track record.

Given the pent up US government demand for uranium, Energy Fuels is going to need to keep finding more local uranium and keep feeding its White Mesa mill.

That brings us back to our $5M capped ASX explorer – it needs to find “pounds in the ground” first, enough that would be of interest to the local mill owner.

To that end, this company appears well positioned.

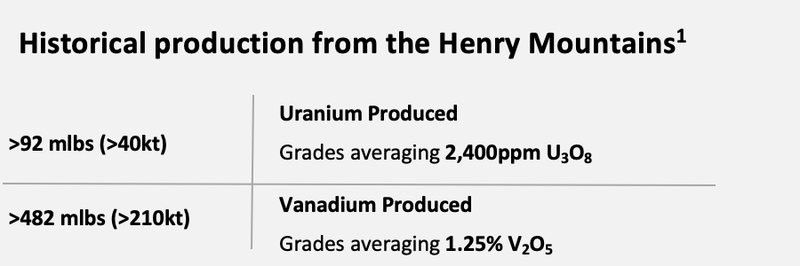

It is of course in the right region – which has historically produced in excess of 17.5 Mt of ore averaging 2,400 ppm (92 mlbs U3O8) and 12,500 pp, V2O5 (482 mlbs V2O5).

It has walk up drill ready targets in its possession, and the company will soon be running down hole logging of historical drill holes to help target new drilling.

This will follow up previous high grade assay results of 1.39% U3O8 and 2.46 V2O5 and 0.12% U3O8 and 3.89 V2O5. The ground has sandstone hosted mineralisation with a shallow ore horizon, which bodes well for further exploration.

It is very early days here, the stock is highly speculative – however it looks to be breaking out, and given its current low market cap and the potential of its ground we couldn’t ignore it.

With Bill Gates supporting nuclear as an efficient emission free energy source, and the US government pouring billions of dollars into the industry – the macro forces look right for uranium once again.

Alongside a number of high profile mining investors, we have just taken a position in this stock and intend to be long term holders – we are looking forward to seeing how this company’s strategy plays out.

Introducing ...

Share Price: $0.01

Market Capitalisation: $5M

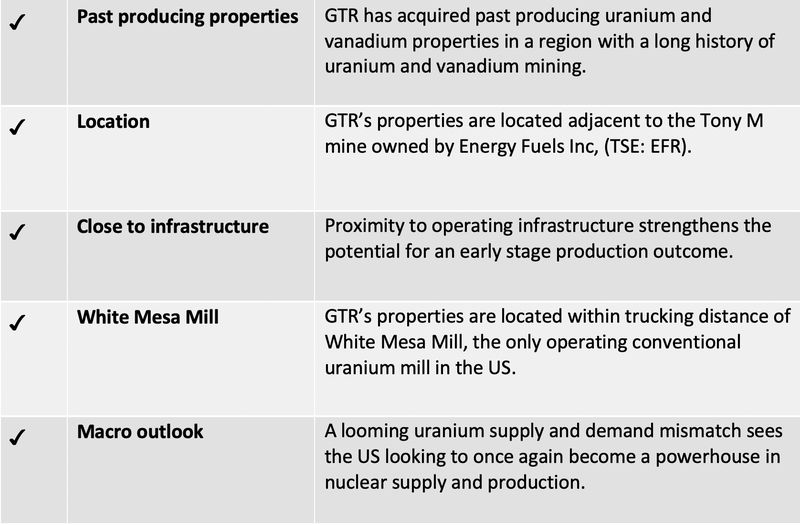

Here’s why I like GTR:

The lowdown on GTi Resources

The tightly held GTI Resources (ASX:GTR) has acquired a number of highly prospective uranium and vanadium properties located in Utah, USA.

GTI acquired 100% of the assets from Voyager Energy Pty Ltd, following a fully underwritten placement & non-renounceable rights entitlement offer that raised ~$2 million.

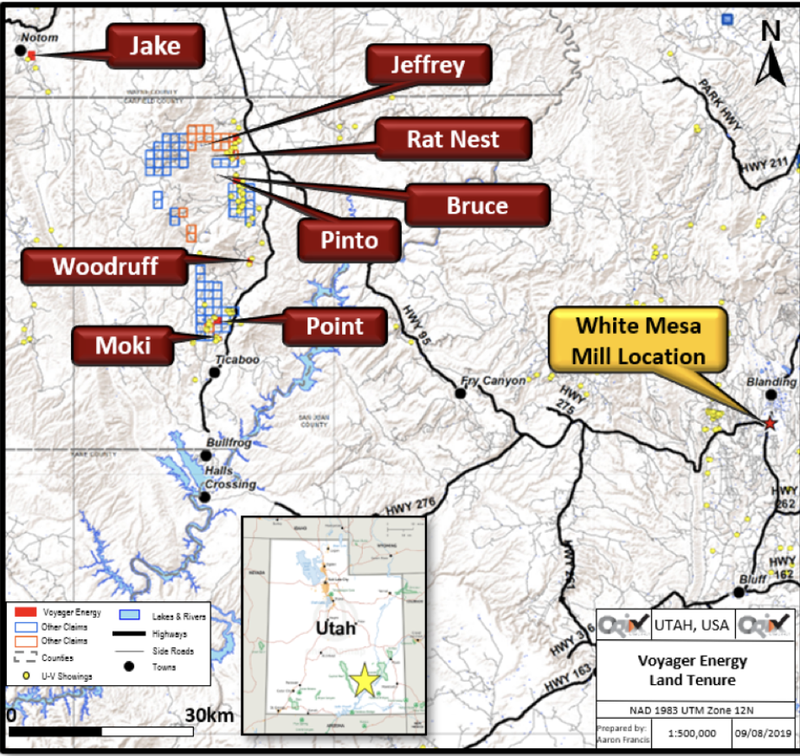

The Properties cover ~1,500 hectares of the Henry Mountains region, within Garfield and Wayne Counties near Hanksville, Utah.

This region is historically highly prolific and has, in the past, provided the most important uranium resources in the USA. It forms part of the prolific Colorado Plateau uranium province as seen below:

Ores have been mined in the region since 1904 and the mining region has historically produced in excess of 17.5Mt@2,400ppmU3O8 (92mlbs U3O8) and 12,500ppm V2O5c(482mlbsV2O5).

Recent sampling at GTR’s properties confirms mineralisation in old workings grading up to 81,558ppm U3O8 & 8.39% V2O5, which could prove significant when determining how quickly the company can progress its exploration program.

Along with its high grades, the properties are located, not only close to a major highway, grid power and local skilled workforce, but also within trucking distance to a fully permitted and operational uranium/vanadium processing mill owned and operated by the ~ CA$250m market capped Energy Fuels (TSE: EFR).

The main project is the Jeffrey Project, where GTR has identified drill targets selected for its initial drilling program to be undertaken shortly. The Jeffrey Project features a thick mineralised lens exposed in the underground workings.

The company is now getting ready to commence its drilling programs with results to follow shortly after completion.

GTR will initially undertake down hole logging of historical drill holes at the Jeffrey project to help target the new drilling.

GTR commences uranium and vanadium testing

As stated above, GTR is set to commence its Spring exploration program next week.

The program follows positive recent sampling results, improved ground conditions in Utah, and recently announced substantial new US government support for domestic uranium producers, which we will discuss shortly.

A sustained improvement in the uranium spot market price, also has the industry poised for a revival.

GTR will commence its spring exploration program at the Jeffrey Project, where it has confirmed the presence of high-grade uranium and vanadium potential.

Having successfully navigated COVID-19 restrictions, GTR is able to safely deploy contractors in the field with the necessary PPE and procedures.

GTi Resources has a great deal of confidence moving into this current program, following a November 2018 field program that identified high-grade in-situ uranium/vanadium mineralisation from within the workings on the Jeffrey Claim.

Results included a sample that returned 13,932 ppm (1.39%) U3O8 and 2.46% V2O5 from geochemical analysis.

Historical results, combined with more recent assay results confirm the presence of high-grade uranium and vanadium mineralisation.

Due to past work, GTR has identified over 20 open historical drill holes, with the number split between each end of the in excess of 1 kilometre high grade mineralised prospective trend.

Starting next week, GTI is conducting a down-hole geophysical logging program in these holes in a high-value effort to refine drill targets prior to commencing with the permitted exploration drill program.

The logging program will generate down-hole eU3O8 assay values which will aid in determining the geometry of the mineralisation as the trend moves away from outcrop and underground exposure.

There should be plenty of newsflow to come for GTR as it looks to stake a claim in uranium supply in a region that will be looking closely at quality suppliers.

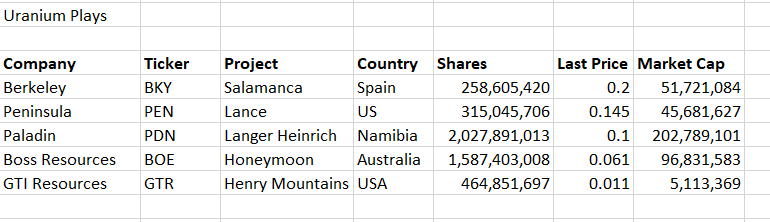

We should note here that GTR offers investors a chance to buy into one of the few uranium stocks on the ASX:

Comparing GTR with its peers and factoring in its current share price, GTR looks to be seriously undervalued. The potential of its project shouldn’t be underestimated and the fact it is one of only two ASX-listed companies operating in the US, puts it in a strong position to feed into the market.

This is a small-end operation, mining a high grade product that could feed into growing demand.

So let’s have a look at the demand supply dynamics.

Demand for uranium set to spike

Back in 2018, GTR saw a trend emerging.

It has taken two years for its foresight to come to fruition, but the company’s patience could pay off pretty quickly.

GTR picked its uranium/vanadium ground next to a producing mill fully aware that the US market has strong demand and no supply.

It was inevitable the country would have to act on this imbalance and recently the US sounded its intention to once again become a world power in nuclear energy.

This comes at a time when the uranium spot price is also on the rise.

You’d be surprised to know that 20 new nuclear reactors are scheduled to come online and over ten reactors are expected to be constructed per year between 2020 and 2030.

The uranium sector is back in a big way and several analysts predict we are entering a bull market:

Indeed, the long term fundamentals are bullish.

The spot price is currently sitting at US$32.75.

Here’s how it has been trending over the last six months.

Looking at that chart it is little wonder, the world is starting to take notice again. Of course, there are important reasons for the rise.

Uranium as a clean energy alternative

The Intergovernmental Panel on Climate Change has said that over 80% of the world’s electricity will have to go “low carbon”. That is if global warming is to be kept below the 2°C Paris agreement target, set in 2018.

The uranium industry is ready to fill this need.

The tsunami that triggered the Fukushima nuclear disaster was a tragic accident, but technology has made uranium production safer.

When you consider that Fukushima accounted for about 13% of uranium demand before this disaster, this has to be considered a viable alternative.

Bill Gates certainly thinks so. Now, Mr Gates has an economic interest however his call for a return to nuclear energy to combat climate change doesn’t come lightly.

Of course Gates isn’t the only one spruiking nuclear. This is a rising movement.

“Nuclear power is a clean, efficient, and essential source of electricity used to meet the world’s growing energy demands,” said Global X analyst Chelsea Rodstrom in a recent note. “Nuclear power can produce electricity at a greater scale while minimising greenhouse gas emissions.”

As reported by ETF Trends, ‘the uranium market has been supported by significant production cuts, reductions in producer inventories and an increase in demand. Investors may be looking at the battered uranium miner space as a value play, given the improved strength in the sector.’

Rodstrom backs up this assertion: “According to the International Atomic Energy Agency (IAEA), roughly 10% of the world’s electricity was generated from nuclear power in 2019. This is approximately one-third of the world’s low-carbon electricity. There was an increase of 2.5 GW(e) in net installed capacity since the end of 2018 and it is projected to increase by 25% over current levels to 496 GW(e) by 2030, and by 80% to 715 GW(e) by 2050.”

The world is thirsting for clean, 24×7, emissions-free sources of alternative energy.

Nuclear power is emerging as a viable alternative.

Enter the US

President Trump has stated his uranium intentions by adding $150 million p.a. for 10 years to the 2021 budget to create a US$1.5BN strategic uranium reserve.

The money will be used to buy domestic uranium to create a national stockpile, to "pull America's nuclear industrial base back from the brink of collapse".

This US$150m p.a. program indicates a purchasing requirement for circa 3.75 mlbs of annual domestic production based on a weighted average price of US$40 per pound.

On the back of this, the US Department of Energy recently released a report (24th April 2020) titled Restoring America's Competitive Nuclear Energy Advantage: A strategy to assure US national security revealing that further congressional approval will be sought to expand this initiative to acquire a total of 17-19 mlbs of U3O8 over 10 years.

The Report states “the US Government will take bold action to revive and strengthen the uranium mining industry”.

Trump’s announcement also led to Energy Fuels Inc. (NYSE American: UUUU; TSX: EFR), owner of the White Mesa uranium and vanadium processing plant in Utah, to raise US$16.6 million to underpin activities to increase uranium &/or vanadium production at the Company's properties.

Remember, GTR is, strategically, just a truck drive away from Energy Fuels at White Mesa, which currently has no supply contract in place and not enough pounds in the ground to fill its mill capacity.

One final thing to take into account here is that in addition to the current COVID 19 related shutdowns of Cigar Lake among other uranium operations, global production is tipped to take a dive between 2035 and 2040 as a quarter of all mines in the World Nuclear Association’s modelling come offline.

This means long-term supply will dwindle without being replaced.

There is a gap to be filled through the development of new projects, the ramping back up mothballed mines and the scrounging of old stockpiles.

According to GTI, it is “encouraged by this news of significant US government support for US domestic uranium producers and sees it as potentially “game changing” for GTI and the US industry and supportive of the Company’s US strategy to develop its uranium and vanadium properties in Utah.

“GTI is moving to rapidly advance its projects in Utah given the obvious potential to supply high-grade uranium ore to help fill existing mill processing capacity. GTI is also looking for value accretive opportunities to expand its US project portfolio in this space.”

Let’s not forget about vanadium

Whilst there is a focus on uranium (for good reason), vanadium is also looking strong.

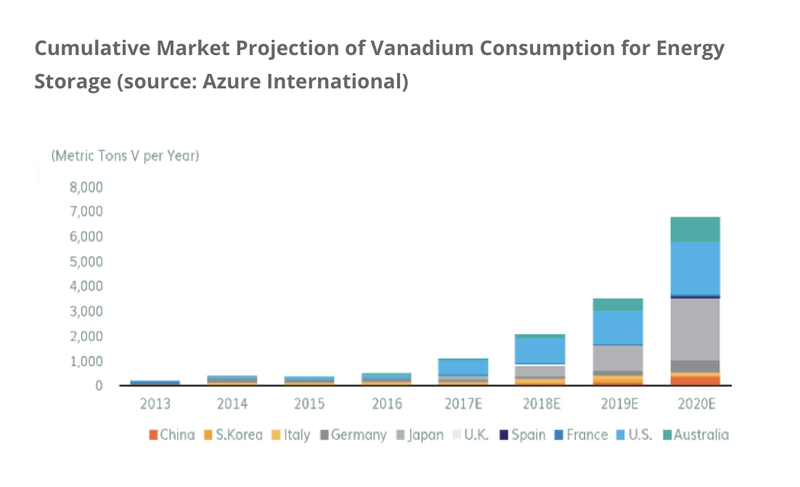

With steel production expected to grow, from global infrastructure plans along with the need for Vanadium Redox Flow Batteries (VRFB), demand for vanadium, like uranium, is expected to rise exponentially.

VRFB growth will support non-baseload energy sources (renewables), so it too fits into the clean energy equation.

Roskill Director Jack Bedder says, “There are various forces that could push prices up. All eyes will be on China, where higher demand or lower supply could make things interesting.”

SP Angel Analyst John Meyer says that the new Chinese regulations require substantially more vanadium in the steel, which was expected to drive demand higher.

Meyer says, “Prices are expected to recover sharply in the next few months as buying returns to the market.”

Vanadium is scheduled for evaluation in 2020 by the US government under its critical minerals initiative.

This is another factor that could work in GTR’s favour.

The final word

“Both uranium and vanadium are minerals that have been deemed critical to US national security, according to the US government,” Energy Fuels’ VP of Marketing and Corporate Development Curtis Moore said. “Therefore, by providing support for the US uranium industry, the government would also support domestic vanadium production.”

Energy Fuels owns the White Mesa mill, the only conventional uranium mill operating in the US today that also has the ability to produce vanadium when market conditions warrant.

Energy Fuels is well placed to meet the coming need, as is GTi Resources, which lies adjacent to Energy Fuel’s Tony M mine.

GTR’s strategic decision to put itself in this location could pay off quickly, with macro events all working in the company’s favour.

Just to reiterate, GTR has acquired past producing uranium and vanadium properties in a region with a long history of uranium and vanadium mining, located within trucking distance of White Mesa Mill, the only operating conventional uranium mill in the US.

And, with a looming uranium supply and demand mismatch which has seen the US looking to once again become a powerhouse in nuclear supply and production, the company is ramping up operations at just the right time.

Work starts next week at GTR’s Jeffrey Project, so we expect a stream of news to potentially prove that the company’s current value should be reconsidered.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.